Introduction

In the rapidly evolving landscape of e-commerce, the structure and roles within a multi-member LLC play a crucial role in determining a business’s success. As entrepreneurs increasingly pursue collaborative models to navigate the complexities of online trade, it becomes essential to understand the key titles and responsibilities associated with multi-member LLCs. These roles face significant challenges in a competitive marketplace, yet they also present opportunities to drive growth and innovation. This article explores ten critical multi-member LLC titles that not only define ownership and management but also lay the groundwork for e-commerce success.

Social Enterprises LLC: Your Partner in Multi-Member LLC Formation

Social Enterprises LLC has established itself as a trusted partner for over 7,500 organizations globally, with a particular emphasis on the formation of multi member LLC titles. The firm specifically caters to Turkish-speaking clients, offering customized services that simplify the process of creating a legal entity in the United States. Their comprehensive approach encompasses assistance with obtaining Employer Identification Numbers (EINs), ensuring compliance with regulations, and providing post-incorporation services. This enables enterprises to operate smoothly from the very beginning.

In 2026, a significant number of new businesses are projected to be formed under multi member LLC titles, reflecting a trend that resonates with the collaborative nature of online trade ventures. By partnering with Social Enterprises LLC, e-commerce entrepreneurs can benefit from expert guidance to effectively navigate the complexities of U.S. regulations, thereby positioning themselves for success in a competitive marketplace.

Managing Member: The Operational Leader of Your LLC

The Managing Member, holding one of the multi member LLC titles, serves as the pivotal decision-maker, overseeing daily operations and steering the strategic direction of the organization. This role encompasses financial oversight, critical business decision-making, and ensuring compliance with legal obligations, including a thorough understanding of complex tax responsibilities. In the fast-evolving landscape of e-commerce, particularly for international entrepreneurs, the effectiveness of a Managing Member is vital for adeptly navigating the rapid online market and adapting to changes in consumer behavior.

Misunderstandings surrounding income tax versus sales tax, particularly the implications of the FBA Trap, can result in significant compliance challenges. Therefore, it is essential for the Managing Member to possess a clear understanding of these distinctions to mitigate audit risks. Their leadership not only influences operational efficiency but also plays a crucial role in shaping the growth trajectory of multi member LLC titles.

In a member-managed LLC, fostering clear communication and delineating responsibilities among members can enhance collaboration and streamline decision-making processes regarding multi member LLC titles. Industry leaders emphasize that strong leadership cultivates a culture of innovation and responsiveness, which is critical for success in e-commerce. The ability to swiftly adapt to market fluctuations and customer demands, while ensuring compliance with sales tax regulations post-Wayfair, can set an enterprise apart in a competitive landscape, underscoring the Managing Member’s role as essential for achieving long-term success.

Transitioning from a member-managed to a manager-managed LLC may present challenges, necessitating a reassessment of authority and decision-making frameworks, further highlighting the importance of effective leadership.

Member: The Core Owners of Your Multi-Member LLC

Members serve as the foundational owners of a multi-member LLC, and their roles are often defined by multi-member LLC titles, with each possessing a stake in the enterprise that may include capital investment, industry expertise, or operational management. Their contributions are crucial, as they share in both the profits and losses of the LLC, highlighting the necessity of understanding their rights and responsibilities as outlined in the operating agreement. In the realm of online commerce, clearly defined responsibilities among members foster cooperation, enabling the business to pursue its goals efficiently.

For example, a group of founders successfully established a dropshipping brand by forming a multi-member LLC, which included multi-member LLC titles in a customized operating agreement that specified capital contributions and profit-sharing arrangements. This strategic clarity not only reduced potential conflicts but also improved operational efficiency. As noted by successful entrepreneurs, effective collaboration among LLC members can significantly influence performance, driving innovation and growth. The synergy created through shared objectives and responsibilities is essential for navigating the competitive online marketplace, ultimately leading to greater success for the LLC.

Secretary: The Compliance and Record-Keeping Officer

The role of the Secretary is vital in ensuring that a multi-member LLC, including its multi member LLC titles, adheres to all legal obligations, especially in the fast-evolving online business landscape. This position is tasked with maintaining detailed records of meetings, decisions, and financial transactions, which are crucial for tax compliance and legal accountability. Effective record-keeping not only supports regulatory requirements but also reduces the likelihood of disputes among Members, thereby promoting a cooperative operational environment.

As we approach 2026, e-commerce companies are likely to encounter heightened scrutiny from regulatory bodies. In this context, the Secretary’s commitment to maintaining accurate records will be increasingly essential. On average, LLC Secretaries invest considerable time in these responsibilities, underscoring the significance of their role in the governance and success of the enterprise.

Treasurer: The Financial Steward of Your LLC

The Treasurer plays a crucial role in managing the financial assets associated with multi member LLC titles, overseeing budgeting, financial reporting, and cash flow management. This position is particularly vital for online retail businesses, where financial agility significantly impacts success. By ensuring that the LLC meets its financial obligations and optimizes its resources, the Treasurer establishes a solid foundation for growth and investment.

Effective financial management practices, such as maintaining a clear budget and monitoring cash flow, are essential for navigating the dynamic online retail landscape. As financial expert Suze Orman notes, “Saving money can help you deal with the stress of unexpected expenses,” highlighting the importance of proactive financial strategies. In 2026, online retail LLCs are prioritizing these practices to enhance their financial resilience and capitalize on emerging opportunities.

Moreover, January serves as a critical reset point for online retail accounting and tax planning, enabling companies to evaluate their financial strategies and prepare for the upcoming year.

Member-Manager: Balancing Ownership and Management

A Member-Manager serves a dual role as both an owner and a manager of the LLC, engaging directly in daily operations while also holding an ownership stake. This integrated management approach facilitates decisions that reflect both ownership interests and operational realities. In the context of online retail enterprises, the presence of Member-Managers significantly enhances responsiveness to market dynamics, allowing for quicker adaptations to consumer demands and trends. This collaborative environment fosters stronger cooperation among Members, which is essential in the fast-paced online retail landscape.

Research indicates that companies with balanced leadership structures exhibit a 20% increase in efficiency, as highlighted by studies from the University of Bergen. This underscores the advantages of the Member-Manager model. Additionally, e-commerce ventures utilizing Member-Managers have reported notable performance improvements, including a 30% revenue increase within the first year, as evidenced by a successful tech startup operating under a Member-Managed LLC.

Moreover, establishing a clearly defined operating agreement is crucial for delineating duties and responsibilities, further enhancing the effectiveness of this management structure.

Non-Managing Member: The Passive Owner in Your LLC

Non-Managing Members are owners who do not engage in the daily management of the LLC. Although they have a vested interest in the enterprise and share in its profits, their role is more passive compared to that of Managing Members. It is crucial to understand the rights and responsibilities of Non-Managing Members to ensure that all Members are aligned and aware of their contributions. For online retail companies, this structure facilitates investment without the burden of daily operational responsibilities.

As the e-commerce landscape evolves in 2026, the role of Non-Managing Members remains essential, providing vital capital and support while allowing for a streamlined operational approach. Notably, statistics reveal that 40% of LLCs generate less than $50,000 in annual revenue, underscoring the significance of effective ownership structures in enhancing performance. Entrepreneurs like Tony Hsieh advocate for pursuing a vision rather than focusing solely on profits, which can lead to sustainable success, thereby reinforcing the value of Non-Managing Members in fostering growth.

Registered Agent: The Legal Liaison for Your LLC

The Registered Agent acts as the official point of contact for legal documents and government correspondence, a role essential for ensuring that LLCs comply with state regulations and receive important notifications promptly. Most states in the U.S. mandate that companies designate a Registered Agent to handle official government correspondence, highlighting their critical role in compliance. For online retail businesses, having a reliable Registered Agent can prevent legal complications and facilitate smooth operations.

As the landscape of online commerce evolves in 2026, current trends in legal requirements for LLCs underscore the growing importance of Registered Agents. Legal experts assert that employing a professional Registered Agent can protect businesses from missing crucial deadlines and incurring penalties, ultimately leading to more efficient operations and enhanced credibility in the marketplace.

In the realm of global online trade, compliance transcends mere regulatory obligation; it represents a strategic investment that secures access to the U.S. market. Neglecting tax laws and compliance requirements can jeopardize this access, resulting in costly penalties and operational disruptions. Therefore, it is imperative for entrepreneurs to prioritize these critical aspects.

Operating Agreement Signatory: The Formalizer of Your LLC’s Structure

The Operating Agreement Signatory plays a vital role in formalizing the LLC’s structure by signing the operating agreement, which delineates the duties, responsibilities, and rights of all members. This document is essential for mitigating disputes and ensuring that each member comprehends their obligations. In the realm of online commerce, a well-crafted operating agreement not only provides clarity but also fosters a collaborative atmosphere among members, thereby enhancing operational efficiency.

As online commerce evolves, current trends indicate a shift towards more adaptable and inclusive operational agreement frameworks, allowing for flexibility in duties and responsibilities that reflect the dynamic nature of the sector. Business leaders emphasize that a clear delineation of responsibilities within the operating agreement is crucial for promoting accountability and achieving success in e-commerce ventures.

Furthermore, utilizing user manuals can aid in navigating the complexities of establishing a business in the U.S. With Social Enterprises, you can set up your LLC, corporation, or nonprofit in as little as 1-3 business days, ensuring that you have the appropriate structure in place to support your business objectives and navigate the intricacies of tax implications and operational considerations.

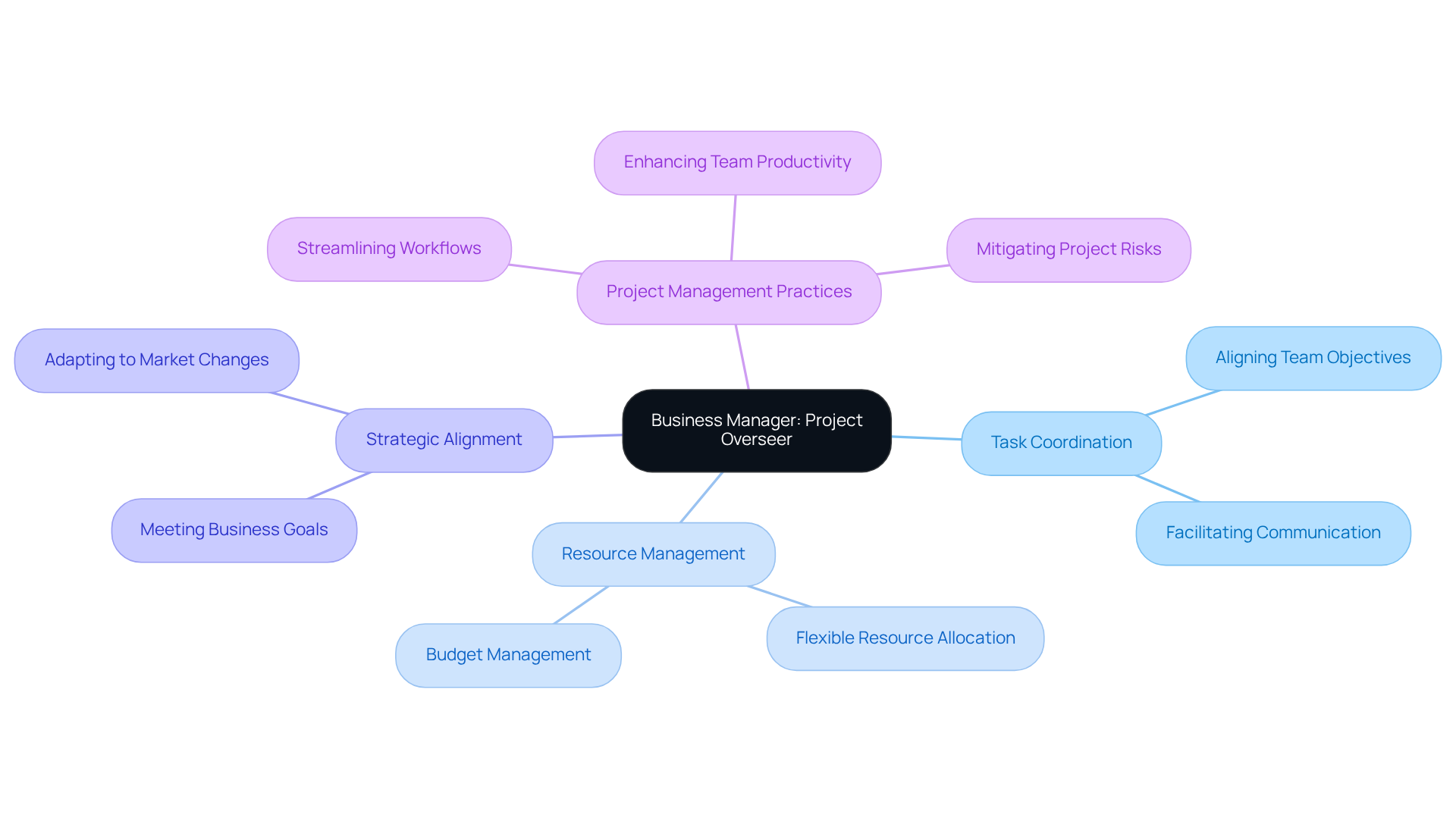

Business Manager: The Project Overseer in Your LLC

The Business Manager is essential in overseeing projects and ensuring that the LLC operates at peak efficiency. This role encompasses the coordination of tasks, management of resources, and alignment of projects with the LLC’s strategic goals. In the dynamic environment of online commerce, a dedicated Business Manager significantly boosts productivity and fosters growth by keeping all team members focused on shared objectives.

Effective project management practices are crucial; they streamline workflows, minimize bottlenecks, and enhance communication among team members. This ultimately leads to improved operational outcomes. Successful entrepreneurs often highlight the importance of robust project oversight, asserting that a well-managed team is more likely to meet deadlines and achieve business targets.

As e-commerce continues to evolve in 2026, the influence of Business Managers on productivity will become increasingly significant. They will need to adapt to new challenges and leverage innovative strategies to drive success.

Conclusion

The exploration of multi-member LLC titles underscores their critical role in fostering successful e-commerce ventures. By comprehending the distinct roles – such as Managing Member, Member-Manager, and Treasurer – entrepreneurs can strategically position their businesses for growth and sustainability. Each title encompasses specific responsibilities that enhance the overall efficiency and compliance of the LLC, emphasizing the necessity of well-defined roles in navigating the complexities of online commerce.

Key insights from the article highlight the value of effective leadership and collaboration among members. The Managing Member’s operational oversight, the Treasurer’s financial stewardship, and the Secretary’s compliance management are integral to maintaining a robust organizational structure. Furthermore, the distinctions between Managing and Non-Managing Members illustrate the importance of aligning interests and responsibilities to drive innovation and performance within the LLC.

As the e-commerce landscape continues to evolve, embracing these multi-member LLC titles is essential for entrepreneurs aiming to thrive. By prioritizing clear communication, defined roles, and strategic planning, businesses can enhance their operational effectiveness. The call to action is evident: take the necessary steps to establish a well-structured LLC that not only meets regulatory requirements but also positions the enterprise for long-term success in a competitive market.

Frequently Asked Questions

What services does Social Enterprises LLC provide for multi-member LLC formation?

Social Enterprises LLC offers customized services for forming multi-member LLCs, including assistance with obtaining Employer Identification Numbers (EINs), ensuring regulatory compliance, and providing post-incorporation services.

Who is the target audience for Social Enterprises LLC?

The firm specifically caters to Turkish-speaking clients, helping them navigate the process of creating a legal entity in the United States.

What is the projected trend for new businesses in 2026 regarding multi-member LLCs?

A significant number of new businesses are expected to be formed under multi-member LLC titles in 2026, reflecting the collaborative nature of online trade ventures.

What role does the Managing Member play in a multi-member LLC?

The Managing Member serves as the pivotal decision-maker, overseeing daily operations, financial oversight, and ensuring compliance with legal obligations and tax responsibilities.

Why is understanding tax implications important for the Managing Member?

Misunderstandings regarding income tax versus sales tax can lead to compliance challenges, making it essential for the Managing Member to understand these distinctions to mitigate audit risks.

How can effective leadership impact a multi-member LLC’s success?

Strong leadership fosters a culture of innovation and responsiveness, which is critical for adapting to market fluctuations and ensuring compliance with sales tax regulations, ultimately influencing the LLC’s growth trajectory.

What are the core roles of members in a multi-member LLC?

Members are the foundational owners of a multi-member LLC, contributing capital investment, industry expertise, or operational management, and sharing in both the profits and losses of the LLC.

How can clearly defined responsibilities among members benefit an LLC?

Clearly defined responsibilities foster cooperation among members, enabling efficient pursuit of business goals and reducing potential conflicts, which enhances operational efficiency.

Can you provide an example of successful collaboration among LLC members?

A group of founders established a dropshipping brand by forming a multi-member LLC with a customized operating agreement that specified capital contributions and profit-sharing arrangements, leading to improved operational efficiency and reduced conflicts.