Introduction

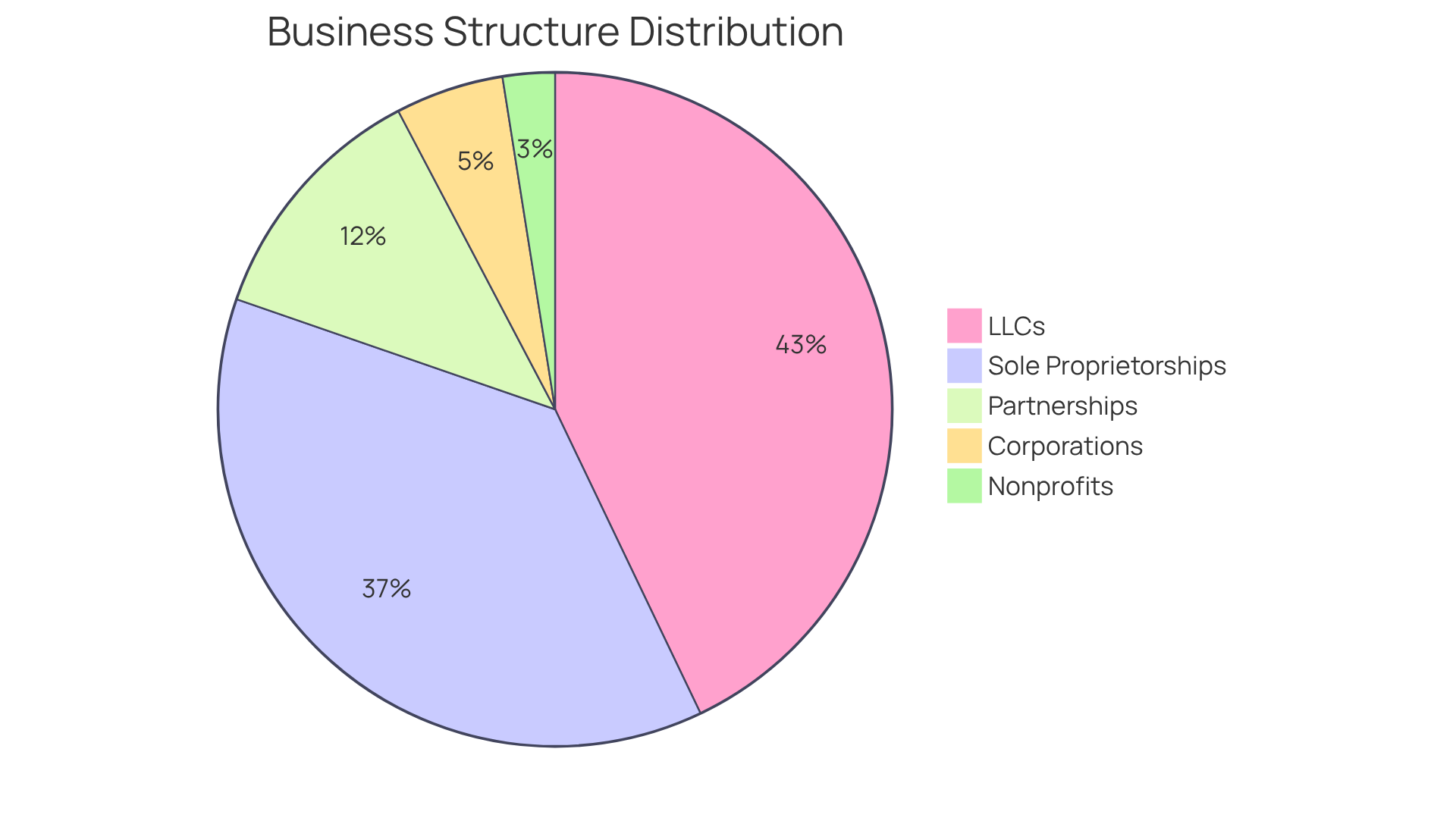

The acronym LLC, which stands for Limited Liability Companies, has emerged as a fundamental element of the American entrepreneurial landscape, representing nearly 43% of small businesses. This statistic underscores the necessity of grasping the intricacies of LLCs, including their inherent flexibility in management structures and the substantial tax advantages they provide. However, with significant opportunities come complexities – what are the essential facts that every entrepreneur must understand to navigate the LLC landscape effectively? This article explores ten critical insights about LLCs that can empower business owners to make informed decisions and optimize their ventures in an increasingly competitive market.

Social Enterprises LLC: Your Partner in LLC Formation

Since its founding in 2015, Social Enterprises LLC has established itself as a leader in assisting companies with their entry into the U.S. market. The firm has successfully facilitated the formation of over 7,500 limited liability companies, corporations, and nonprofits. Notably, it is recognized for its specialized services tailored to Turkish-speaking clients, which streamline the often complex formation process while ensuring compliance with U.S. regulations. This support is crucial for international entrepreneurs who face unique challenges when launching a venture abroad.

The LLC acronym represents limited liability companies, which have emerged as the most prevalent organizational structure in the U.S., accounting for approximately 42.9% of all small enterprises. This statistic underscores their significance in the entrepreneurial landscape. Social Enterprises LLC’s commitment to client satisfaction is evident through its tailored solutions and expert guidance, which empower entrepreneurs to navigate the complexities of U.S. company formation effectively.

To further assist potential clients, Social Enterprises LLC offers a complimentary 15-minute consultation to discuss company formation and taxation. As online filing platforms and consulting services continue to rise, the demand for professional assistance in LLC formation, often referred to with the LLC acronym, is growing. This trend makes it a prudent choice for those seeking to establish a credible and compliant business presence in the United States.

Contact Social Enterprises LLC today to customize your company plan according to your needs and leverage the vast market potential and collaboration opportunities available for game companies in the U.S.

Flexibility of LLCs: Tailoring Business Structures to Your Needs

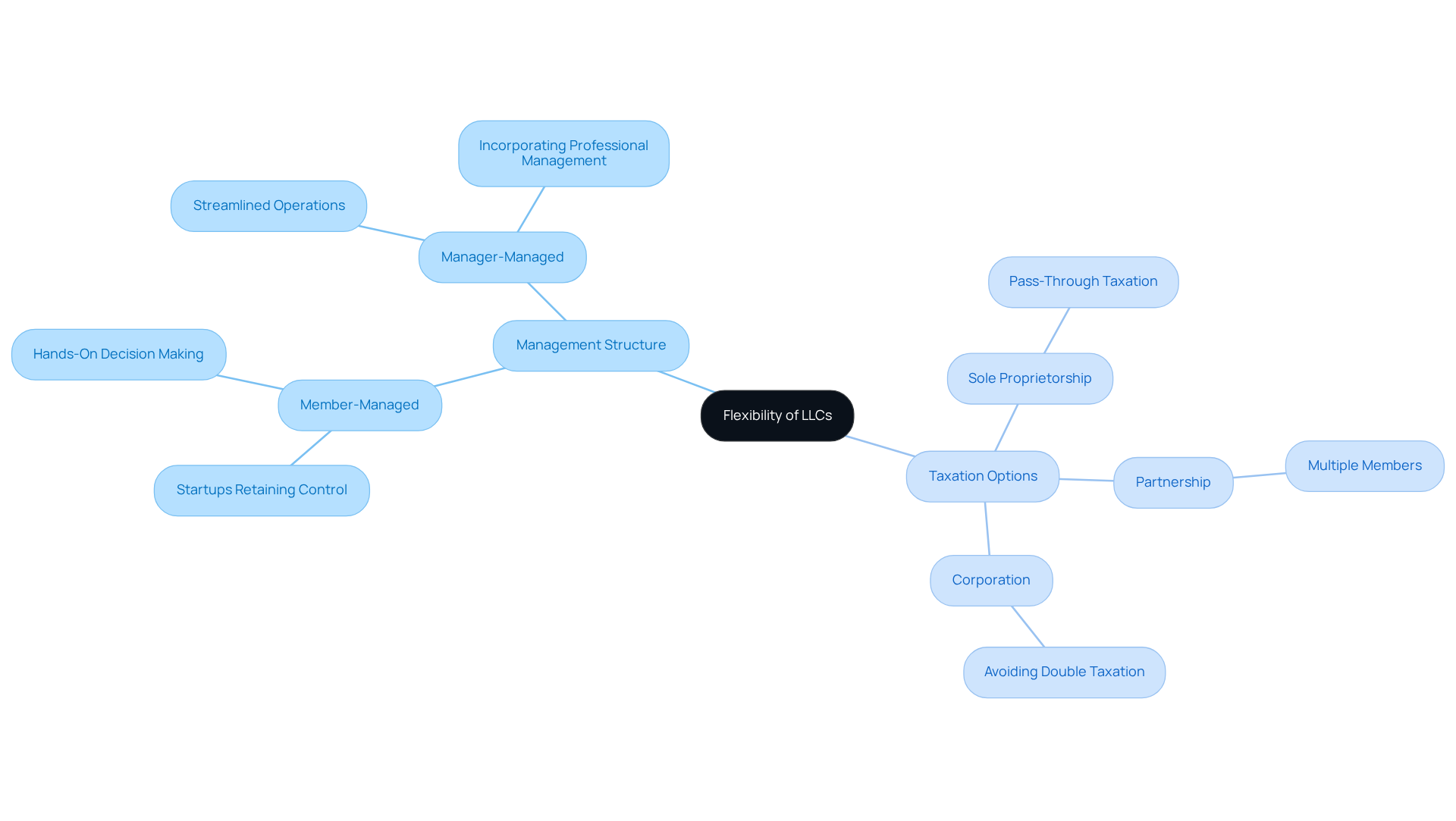

The llc acronym refers to Limited Liability Companies, which offer remarkable flexibility in management structure and taxation, making them an optimal choice for entrepreneurs, especially in the context of U.S. company formation. Business owners can select a member-managed format, where all members participate in decision-making, or a manager-managed arrangement, which allows appointed managers to oversee operations. This adaptability enables businesses to align their management strategies with specific needs and growth objectives.

For example, startups often initiate with a member-managed structure to retain hands-on control. However, as they expand, they may transition to a manager-managed model to streamline operations and incorporate professional management. This transition not only enhances operational efficiency but also allows founders to concentrate on strategic growth.

Regarding taxation, limited liability companies present significant advantages. They can choose to be taxed as a sole proprietorship, partnership, or corporation, offering flexibility that can result in substantial tax savings. For instance, LLCs benefit from pass-through taxation, meaning profits and losses are reported on the owners’ personal tax returns, thereby avoiding the double taxation that corporations encounter. This is particularly beneficial for startups with limited capital, as it alleviates initial financial burdens.

Current trends indicate that many entrepreneurs, including those in the e-commerce and fintech sectors, are increasingly selecting limited liability companies, commonly known by the llc acronym, for their ventures due to these advantages. Furthermore, gaming companies can capitalize on the unique benefits of LLCs, such as flexible management and favorable tax treatment, to enhance their operational strategies. As enterprises evolve, the ability to adjust their management framework and taxation options ensures they remain competitive and financially sustainable in a dynamic market. By leveraging the inherent adaptability of limited liability companies and consulting with experts from Social Enterprises, entrepreneurs can tailor their organizational structures to meet their specific operational needs and growth aspirations. For personalized guidance, consider reaching out to Social Enterprises to navigate the complexities of company formation.

Tax Benefits of LLCs: Understanding Your Financial Advantages

One of the most compelling reasons to form a Limited Liability Company (the LLC acronym) is the tax flexibility it offers. The LLC acronym stands for Limited Liability Companies, which are typically classified as pass-through entities, meaning that profits and losses can be reported on the owners’ personal tax returns, thereby avoiding double taxation. This structure allows for the LLC acronym to deduct operational expenses, which can significantly lower taxable income. Consequently, entrepreneurs can retain a larger portion of their earnings, making the LLC acronym an attractive option for individuals seeking to enhance their financial benefits.

Moreover, Social Enterprises provides a comprehensive tax service package that includes:

- Federal income tax returns

- State income tax returns

- Audit support for three years

- Monthly accounting services

This ensures that LLC owners are well-equipped to effectively manage their tax obligations.

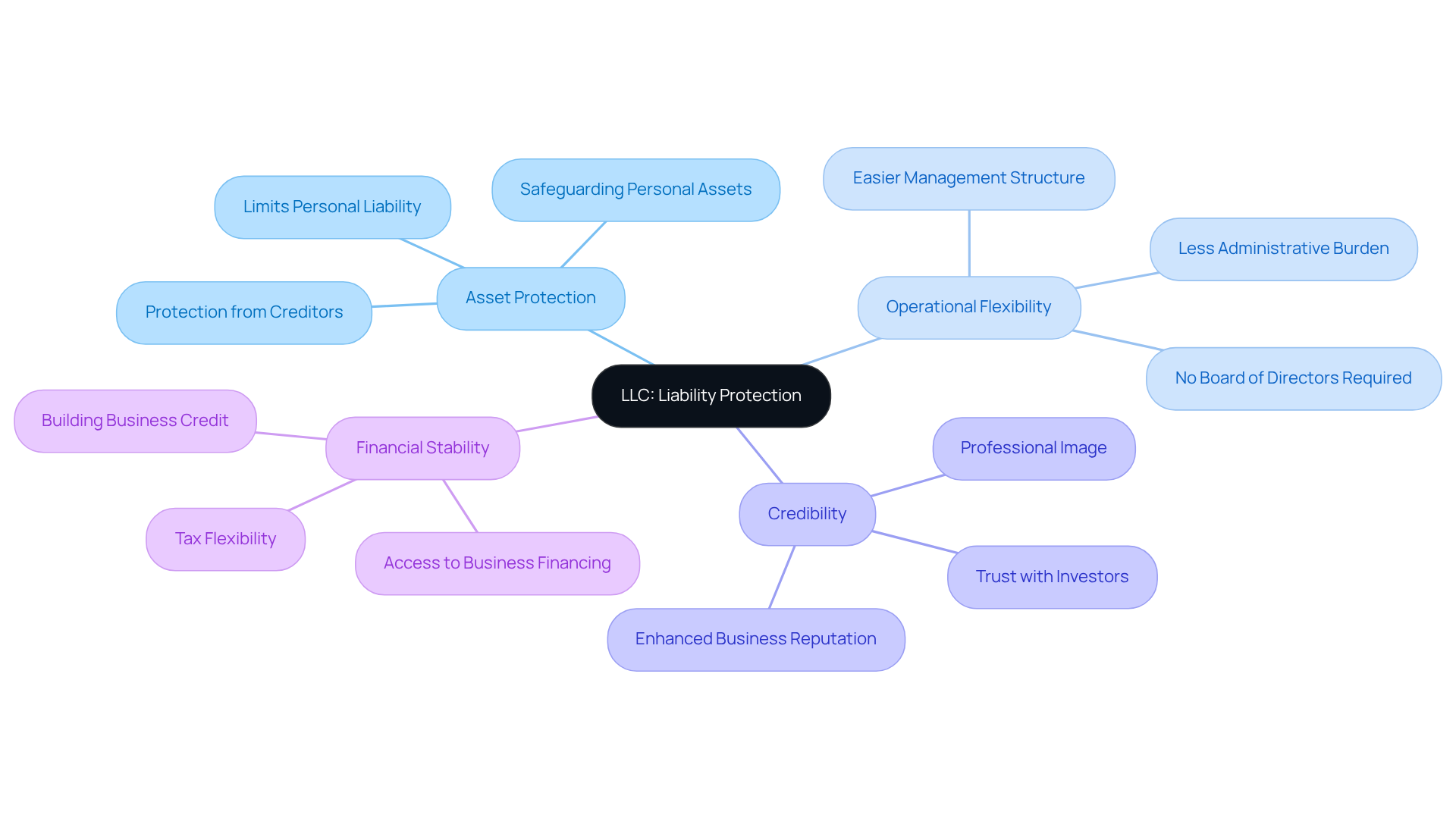

Liability Protection: Safeguarding Personal Assets with an LLC

Establishing an LLC acronym represents a strategic decision for entrepreneurs who aim to safeguard their personal assets. The LLC acronym represents a business structure that creates a clear distinction between personal and professional liabilities, ensuring that, in the event of debts or legal actions, owners’ personal assets – such as homes, cars, and savings – are generally protected from creditors. This layer of protection is particularly vital, as over 70% of small businesses opt for LLCs, which is the LLC acronym for limited liability companies, due to their operational flexibility and robust asset protection benefits.

For example, in situations where a business encounters lawsuits, having an LLC acronym can help avert personal financial disaster. Legal experts emphasize that without sufficient asset protection, individuals risk losing their homes and savings if a court determines that their personal and business finances, represented by the LLC acronym, are intertwined. This underscores the necessity of maintaining clear boundaries between personal and professional finances, especially in the context of an LLC acronym, as failing to do so can lead to personal liability.

Furthermore, the structure referred to by the LLC acronym is crafted to bolster credibility with customers and investors, which is essential for securing financing and fostering trust. Industry experts note that the rapid growth of businesses, often referred to by the LLC acronym, illustrates their effectiveness in protecting entrepreneurs’ personal wealth while allowing them to focus on expansion. Understanding these protections related to the LLC acronym is crucial for anyone considering starting a business, as it lays the foundation for long-term success and financial stability.

Forming an LLC: Step-by-Step Guide for Entrepreneurs

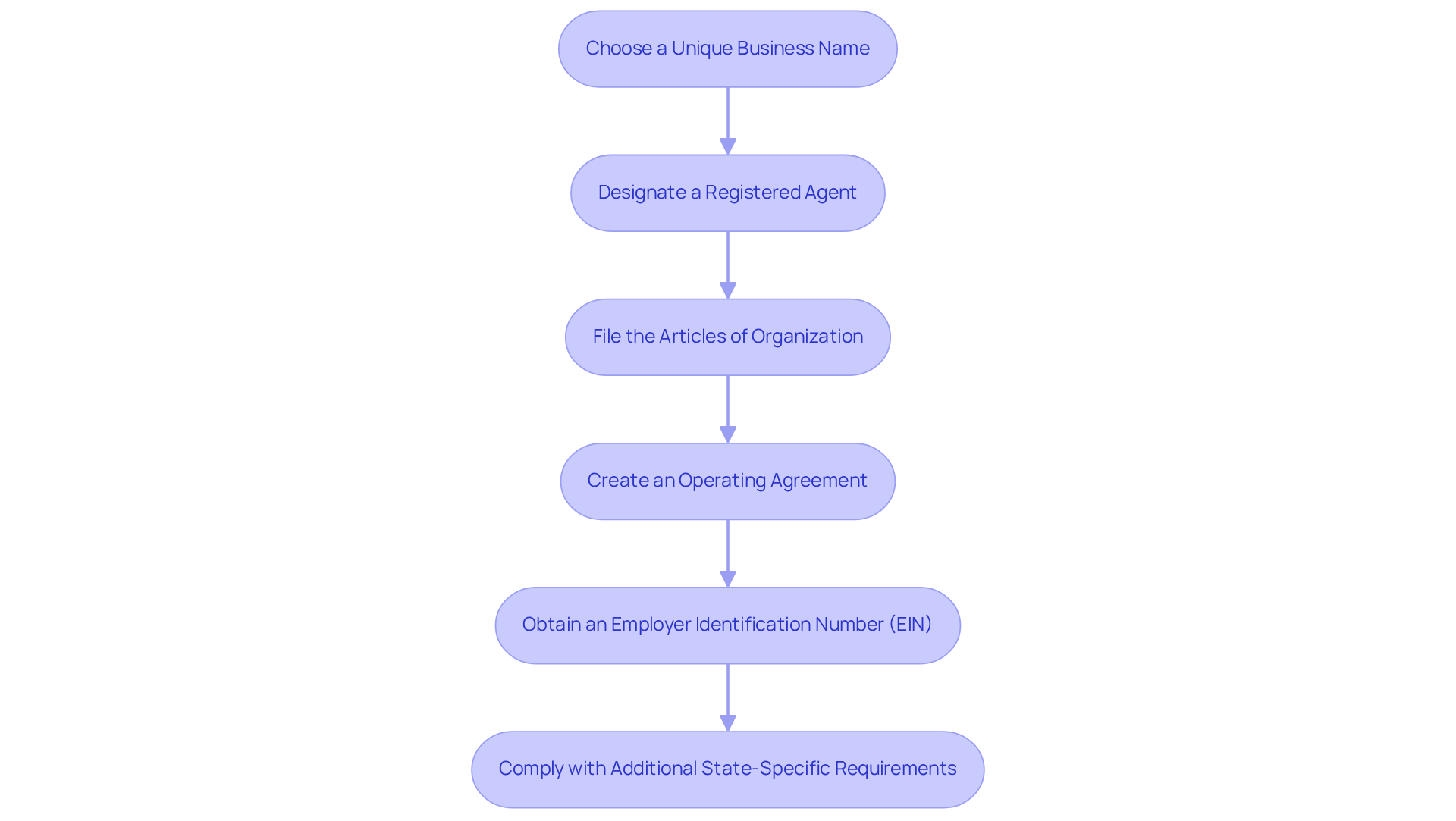

Creating an LLC acronym involves several essential steps to ensure compliance and establish a solid foundation for your business. Here’s a structured guide for entrepreneurs, enhanced by the efficient services provided by Social Enterprises:

- Choose a Unique Business Name: Ensure your name adheres to state regulations and is distinguishable from existing entities. This name often serves as the first impression potential customers will have of your business.

- Designate a Registered Agent: Appoint a registered agent to receive legal documents on behalf of your LLC. This agent must be a state resident or an authorized company, ensuring compliance with state requirements. Having a registered agent is crucial for maintaining compliance and protecting your privacy.

- File the Articles of Organization: Submit this essential document to your state, which includes your LLC’s name, address, and management structure. This filing officially establishes your LLC as a legal entity.

- Create an Operating Agreement: Although not always legally required, this internal document outlines the management structure and operational procedures, helping to prevent disputes among members.

- Obtain an Employer Identification Number (EIN): This number is necessary for tax purposes and to open a commercial bank account, safeguarding your personal information and facilitating financial operations. Social Enterprises can assist you through the EIN application process, ensuring compliance with all requirements.

- Comply with Additional State-Specific Requirements: Each state may have unique regulations, including annual reports and fees, which are crucial for maintaining good standing. State filing fees for starting an LLC typically range from $50 to $200.

As of 2026, the average duration to establish an LLC has significantly decreased, with many entrepreneurs receiving their official documents within just a few working days. This year has seen a record number of small enterprises being established, primarily limited liability companies, which are often referred to by the LLC acronym, due to the reduced complexity and time required for formation. By following these steps and leveraging the expertise of Social Enterprises, you can effectively navigate the LLC formation process and prepare your business for success, benefiting from the tax advantages and flexible management structures that such entities offer.

Drawbacks of LLCs: What Entrepreneurs Should Consider

While limited liability companies (LLCs), commonly known by the llc acronym, provide various advantages, they also present notable drawbacks that entrepreneurs must carefully evaluate. A primary concern is the self-employment tax, which applies to LLC profits and can surpass corporate tax rates. For example, LLC members are subject to a 12.4% Social Security tax and a 2.9% Medicare tax on their earnings, potentially resulting in higher tax liabilities compared to traditional corporations. In 2021, over 2.2 million tax returns were filed for limited liability companies, underscoring their increasing popularity; however, many owners grapple with the burden of self-employment taxes on their entire net earnings.

Moreover, annual fees and reporting requirements differ significantly by state. Some states impose no fees, while others, such as California, charge up to $800 annually. This variability can increase the administrative burden for LLC owners, who must ensure compliance to avoid penalties or dissolution. For instance, Massachusetts has the highest filing fee at $520, whereas states like Arizona and Arkansas offer lower fees of $50.

Additionally, securing funding can pose challenges for limited liability companies, as investors often prefer the structure and familiarity of corporations, which can issue shares for capital. This limitation may restrict growth opportunities for companies, often referred to by the LLC acronym, seeking substantial investment. Understanding these constraints is crucial for entrepreneurs to make informed decisions regarding their organizational framework.

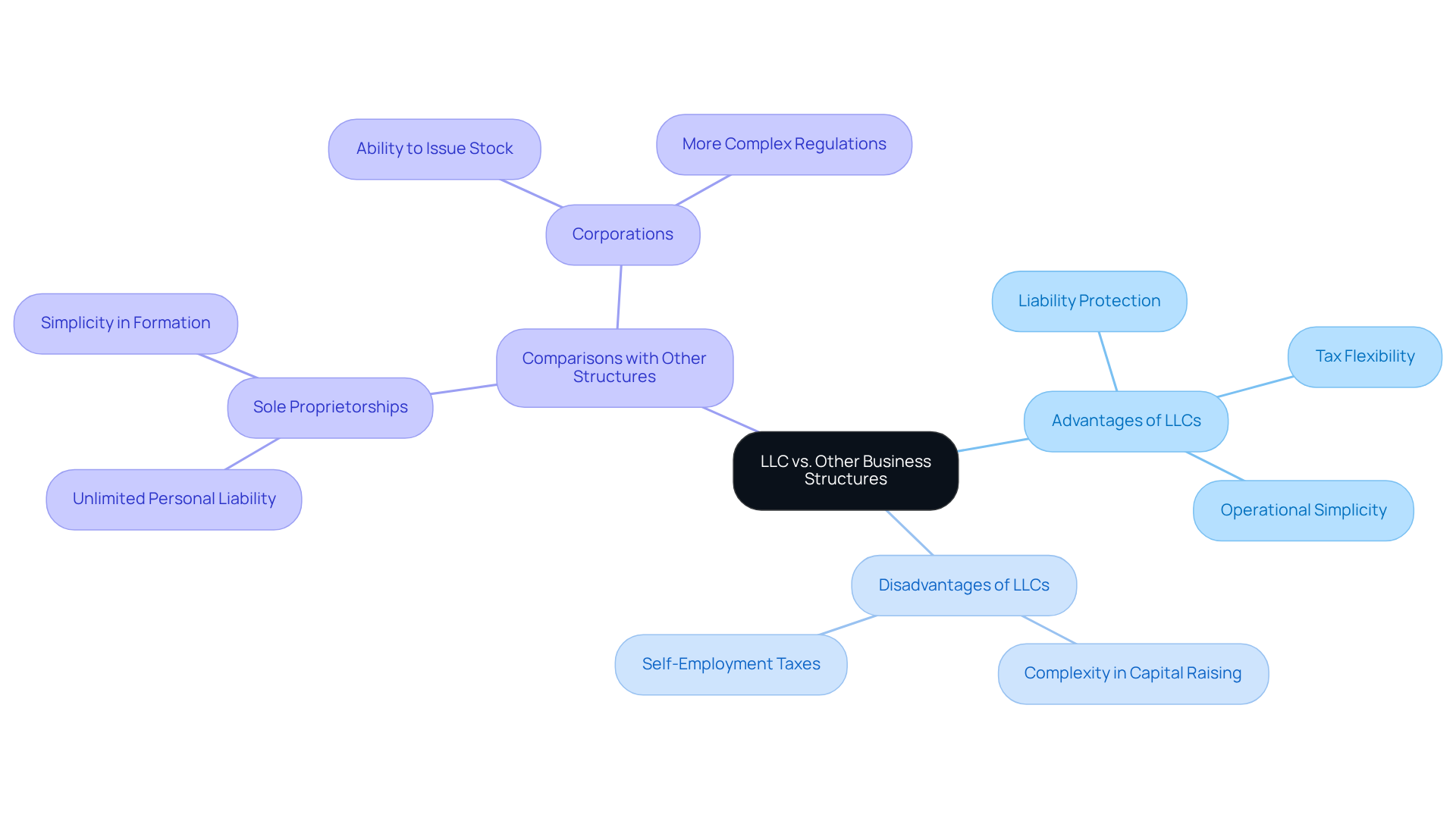

LLC vs. Other Business Structures: Making the Right Choice

When assessing organizational frameworks, the LLC acronym stands for Limited Liability Corporations, which emerge as a preferred choice due to their unique blend of liability protection and tax flexibility. Unlike sole proprietorships, where owners face unlimited personal liability for business debts, LLCs safeguard personal assets from liabilities tied to their operations. This protection is crucial, especially considering that 38% of businesses fail due to cash flow issues, underscoring the importance of financial security for entrepreneurs.

In contrast to corporations, which often involve more complex regulations and formalities, the LLC acronym signifies a simpler management structure that is attractive to many small business owners. While corporations may offer benefits in capital raising – such as the ability to issue stock – LLCs provide operational ease and flexibility that can be more advantageous for startups and small businesses.

Current trends reveal a rising preference for the LLC acronym among entrepreneurs, especially in sectors like e-commerce and consulting, where agility and personal asset protection are essential. As of 2026, with over 33.2 million small businesses in the U.S., many entrepreneurs are opting for LLCs, which is represented by the LLC acronym, to achieve a balance between liability protection and the operational simplicity they require.

Ultimately, the decision between an LLC and other organizational structures should be informed by individual goals, liability considerations, and tax implications. Entrepreneurs are advised to conduct thorough research and evaluate their specific circumstances to make an informed decision that aligns with their long-term vision.

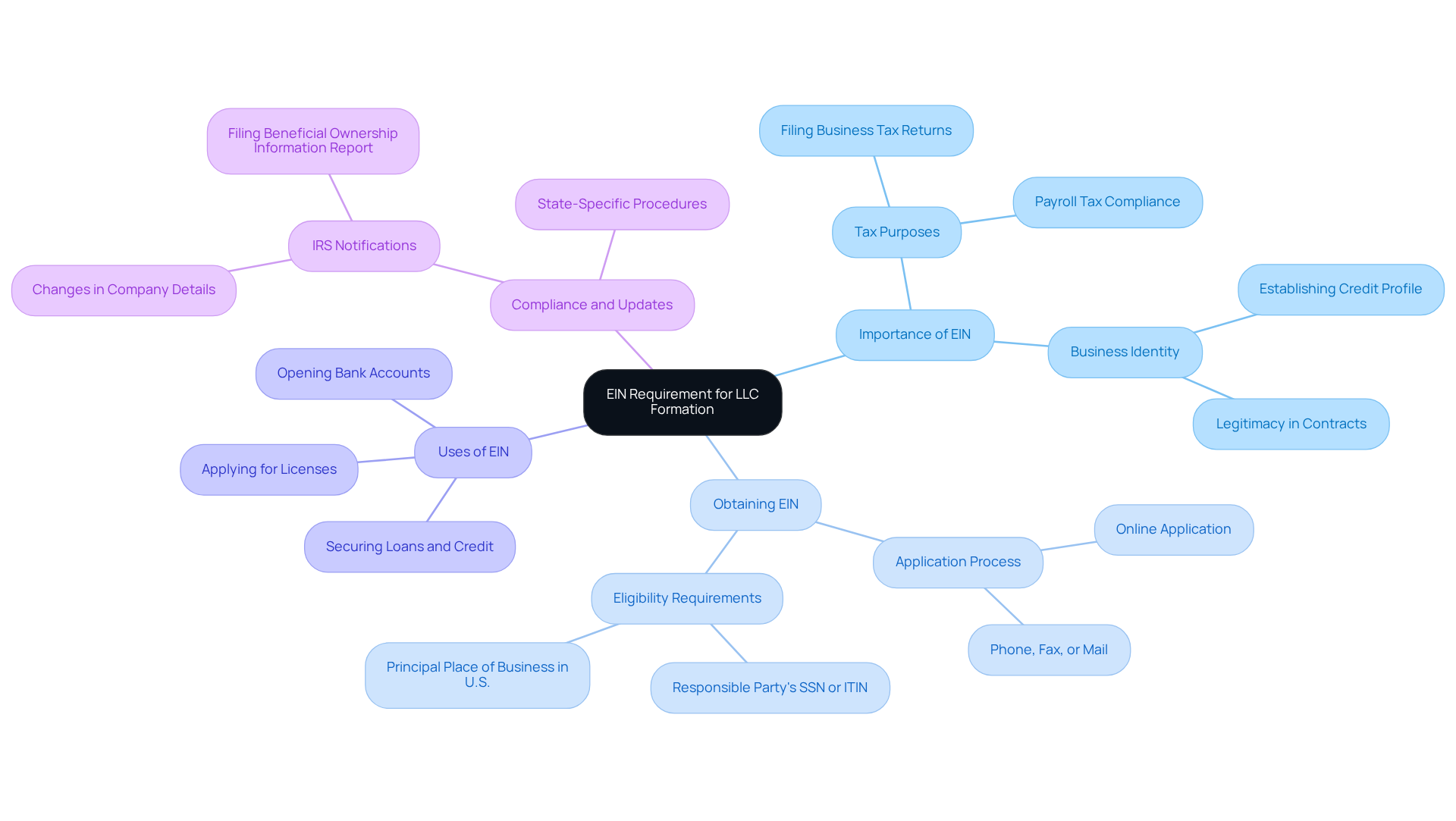

EIN Requirement: Essential for Your LLC Formation

An Employer Identification Number (EIN) is essential for limited liability companies (LLCs), commonly known by the LLC acronym, serving as a unique identifier for tax purposes. Approximately 96% of small businesses in the U.S. are classified as LLCs, which is the LLC acronym, and most of these entities must obtain an EIN from the IRS, particularly if they have employees or intend to file specific tax documents. While single-member LLCs or sole proprietorships may use an Individual Taxpayer Identification Number (ITIN), acquiring an EIN is crucial for more complex business structures.

The EIN plays a vital role in facilitating key operations for businesses, allowing the LLC acronym to open bank accounts, apply for licenses, and accurately file taxes. Entrepreneurs should prioritize applying for their EIN promptly after establishing their LLC acronym to ensure compliance with federal regulations and to take advantage of the benefits associated with having a distinct corporate identity. Furthermore, if there are changes to company details, such as address or partners, it is imperative to notify the IRS and adhere to the state-specific procedures for updating this information.

For instance, a small café owner successfully opened a merchant services account under her business name using her EIN, which streamlined transactions and improved cash flow management. If you have inquiries about obtaining your EIN or require assistance with U.S. company formation, consider scheduling a free consultation with Social Enterprises LLC today!

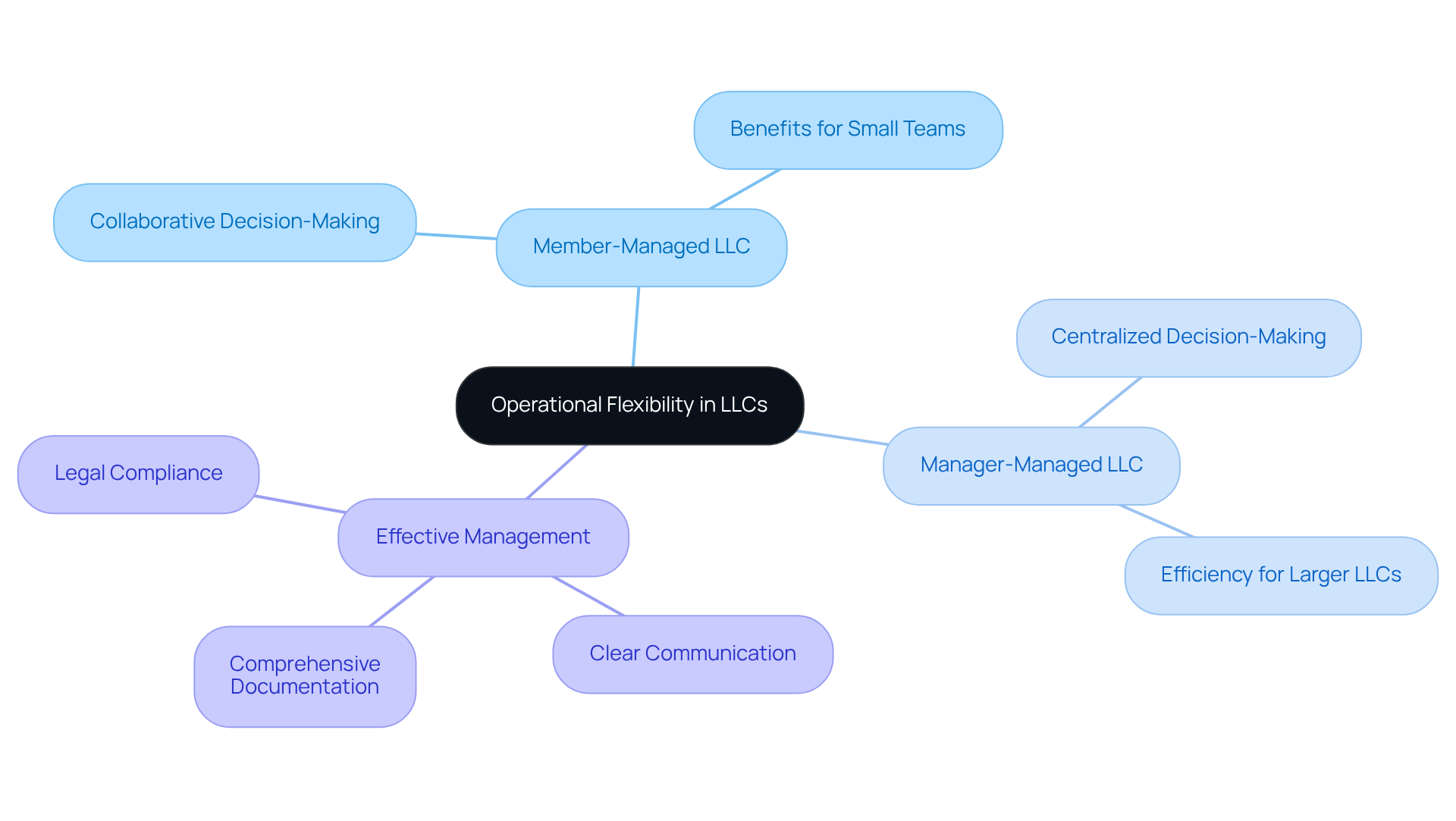

Operational Flexibility: Managing Your LLC Effectively

The LLC acronym refers to limited liability companies, which provide remarkable operational flexibility, allowing members to tailor their management structure to meet specific organizational needs. In a member-managed LLC, all members engage in decision-making, which cultivates a collaborative atmosphere. This setup is particularly beneficial for small teams where members are familiar with the business operations. In contrast, a manager-managed LLC appoints designated individuals to oversee daily operations, streamlining decision-making and appealing to passive investors who prefer not to engage in everyday management. This centralized approach can enhance efficiency, especially in larger LLCs where prompt decisions are essential.

Effective management within any framework hinges on clear communication and comprehensive documentation. It is imperative for members to ensure that their operating agreement delineates roles, responsibilities, and voting rights to avert potential disputes. Notably, 96% of LLCs, as referenced by the LLC acronym, are classified as small businesses, indicating that many entrepreneurs opt for these flexible structures to navigate the complexities of business operations. As LLCs grow, they may encounter additional legal obligations, necessitating adjustments to their management strategies. By leveraging the benefits of their chosen structure, LLCs can position themselves for sustainable growth and success. Furthermore, adherence to U.S. tax laws is vital. A transparent and compliant business framework not only reduces the risks associated with penalties but also improves access to the U.S. market, making it a strategic investment for long-term success.

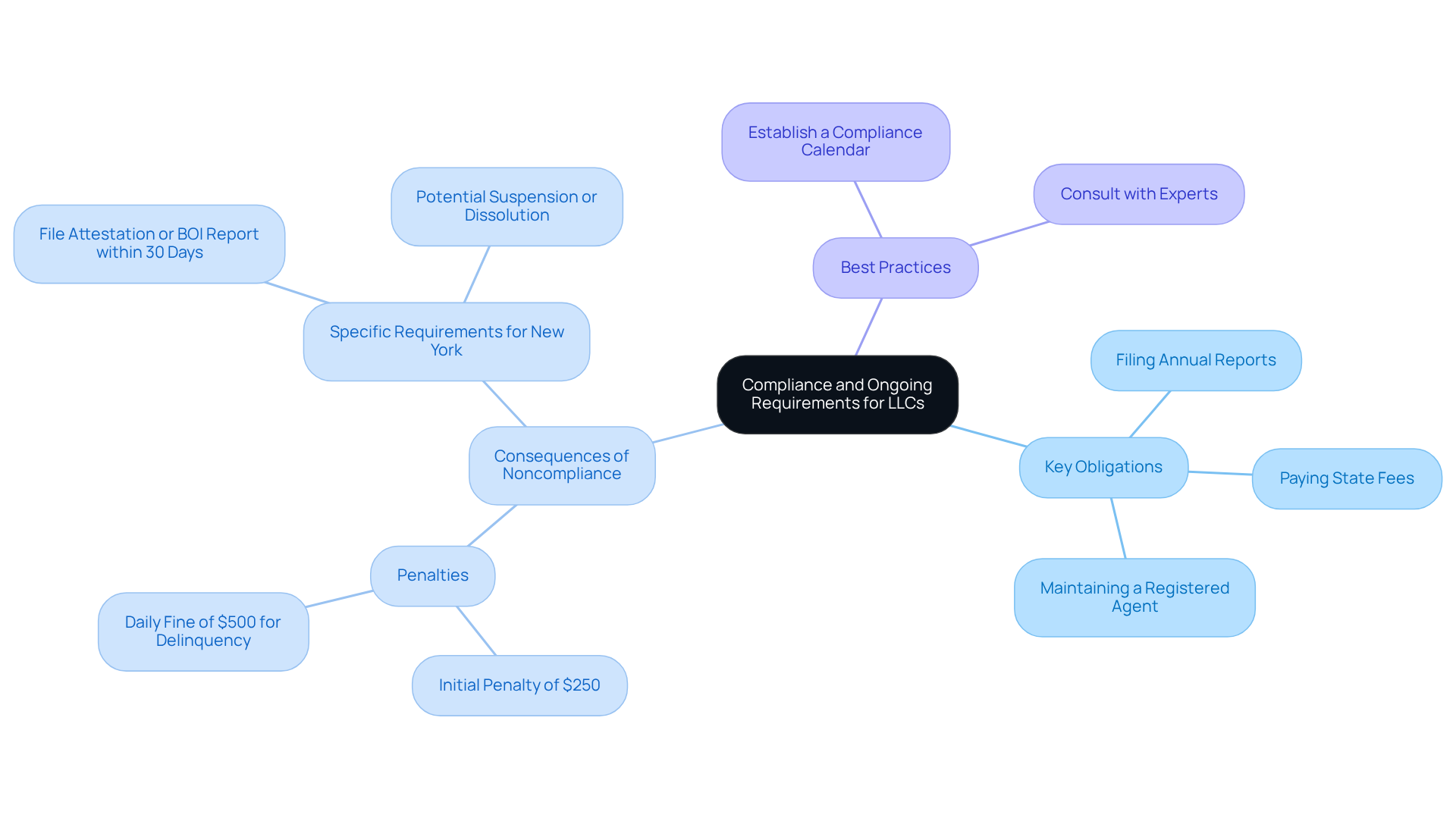

Compliance and Ongoing Requirements: Keeping Your LLC in Good Standing

To maintain good standing, limited liability companies (LLCs), known by the llc acronym, must adhere to various ongoing requirements that can differ by state. Key obligations typically include:

- Filing annual reports

- Paying state fees

- Maintaining a registered agent

Noncompliance with these requirements can lead to penalties or even the dissolution of the llc acronym. For example, LLCs that fail to submit their beneficial ownership disclosures or attestations on time may face initial penalties of $250 for each failure to file, along with additional fines of $500 for each day the company remains past due or delinquent, as noted by Barry J. Bendes.

Moreover, LLCs formed or registered to conduct business in New York on or after January 1, 2026, are required to file a signed attestation of exemption or a beneficial ownership information report within 30 days of their formation or registration. The New York attorney general may also take action against companies that do not comply, highlighting the critical nature of adhering to these requirements.

Entrepreneurs should establish a compliance calendar to monitor deadlines and ensure that all necessary filings are completed punctually. Staying organized and proactive in compliance efforts is essential for safeguarding the limited liability status that the llc acronym denotes. Consulting with experts, such as the team at Social Enterprises, can offer valuable guidance in effectively navigating these requirements.

Conclusion

Understanding the acronym LLC – Limited Liability Company – highlights its vital role in the entrepreneurial landscape. This business structure not only provides liability protection but also offers entrepreneurs the necessary flexibility to navigate the complexities of business operations. As a preferred choice among small businesses, LLCs are essential for those seeking to establish a compliant and credible presence in the U.S. market.

Key insights reveal:

- The operational flexibility of LLCs

- The significant tax benefits they provide

- The crucial protection they offer for personal assets

Furthermore, the step-by-step guide for forming an LLC emphasizes the importance of proper compliance and ongoing obligations to maintain good standing. Entrepreneurs are encouraged to utilize the expertise of firms like Social Enterprises LLC, which can streamline the formation process and offer tailored support.

In conclusion, the advantages of forming an LLC are evident, making it a strategic choice for entrepreneurs focused on growth and sustainability. By grasping the nuances of LLCs and seeking professional guidance, business owners can position themselves for long-term success and capitalize on opportunities within the dynamic U.S. market. Embracing this knowledge empowers entrepreneurs to make informed decisions that align with their business goals and aspirations.

Frequently Asked Questions

What is Social Enterprises LLC and what services do they offer?

Social Enterprises LLC is a firm established in 2015 that assists companies with their entry into the U.S. market, having facilitated the formation of over 7,500 limited liability companies, corporations, and nonprofits. They specialize in services tailored to Turkish-speaking clients to streamline the company formation process and ensure compliance with U.S. regulations.

Why are limited liability companies (LLCs) significant in the U.S.?

LLCs are the most prevalent organizational structure in the U.S., accounting for approximately 42.9% of all small enterprises. Their popularity underscores their importance in the entrepreneurial landscape, offering flexibility in management and taxation.

What is the benefit of the complimentary consultation offered by Social Enterprises LLC?

Social Enterprises LLC offers a complimentary 15-minute consultation to discuss company formation and taxation, providing potential clients with expert guidance tailored to their specific needs.

What management structures can LLCs adopt?

LLCs can adopt either a member-managed format, where all members participate in decision-making, or a manager-managed arrangement, where appointed managers oversee operations. This flexibility allows businesses to align their management strategies with their specific needs and growth objectives.

How does the taxation of LLCs work?

LLCs can choose to be taxed as a sole proprietorship, partnership, or corporation, which provides significant tax flexibility. They benefit from pass-through taxation, meaning profits and losses are reported on the owners’ personal tax returns, avoiding double taxation.

What are the financial advantages of forming an LLC?

Forming an LLC allows entrepreneurs to deduct operational expenses, significantly lowering taxable income and enabling them to retain a larger portion of their earnings. This makes LLCs an attractive option for enhancing financial benefits.

What tax services does Social Enterprises LLC provide?

Social Enterprises LLC offers a comprehensive tax service package that includes federal income tax returns, state income tax returns, audit support for three years, and monthly accounting services to help LLC owners manage their tax obligations effectively.

Why are LLCs popular among entrepreneurs in sectors like e-commerce and fintech?

Entrepreneurs in sectors like e-commerce and fintech are increasingly selecting LLCs due to their advantages in flexible management structures and favorable tax treatment, which enhance operational strategies and support competitiveness in a dynamic market.