Introduction

Effective management of a Limited Liability Company (LLC) is essential for e-commerce businesses operating in today’s dynamic marketplace. Understanding the distinctions between member-managed and manager-managed structures can greatly influence operational efficiency and decision-making agility. The challenge, however, lies in balancing compliance with state regulations while fostering clear communication among members. E-commerce entrepreneurs must consider how to ensure compliance and position themselves for growth in this competitive landscape.

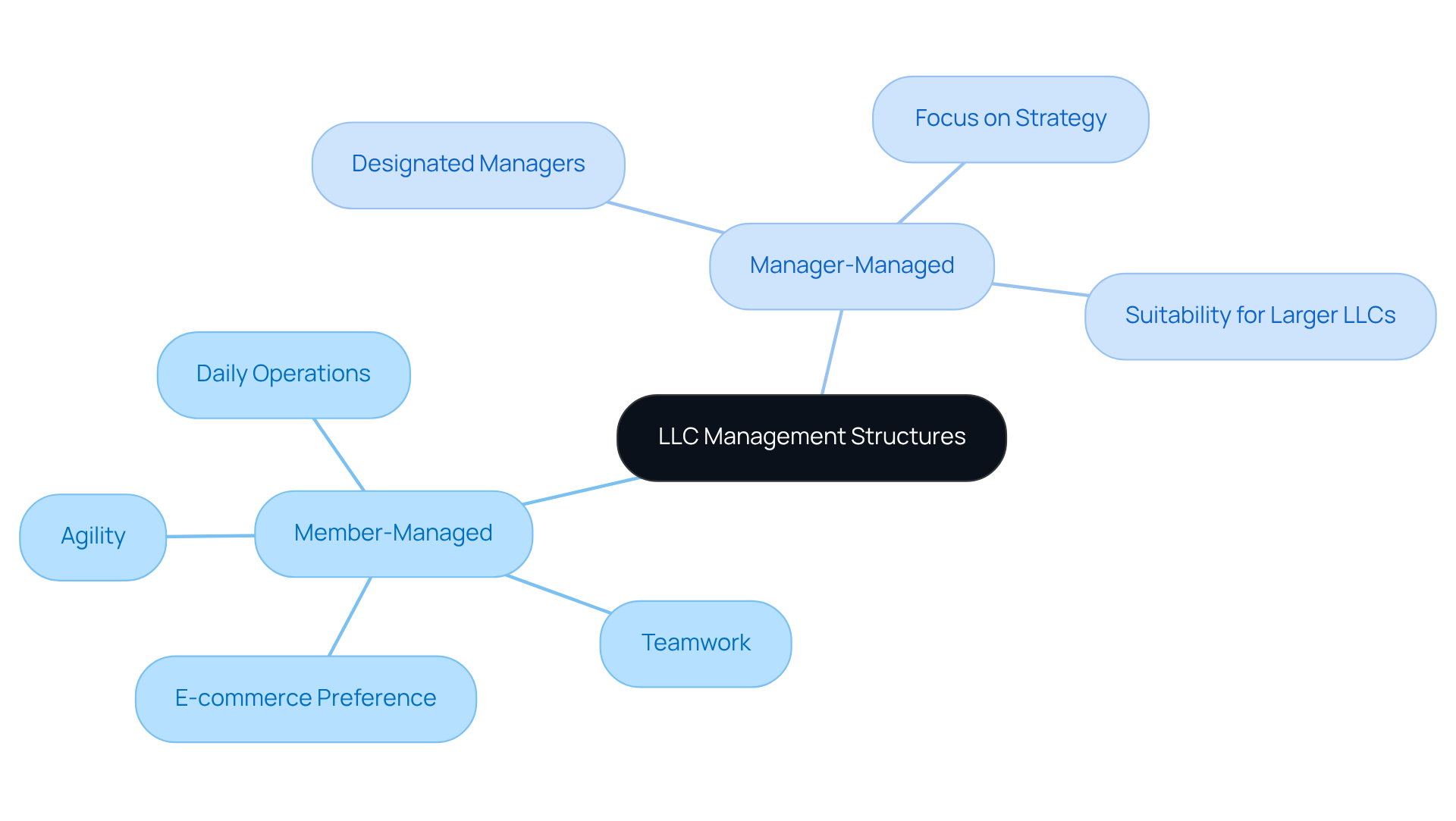

Understand LLC Management Structures: Member-Managed vs. Manager-Managed

When establishing an LLC, a critical decision involves choosing between a member-managed structure or an LLC management structure. A member-managed LLC allows all members to engage in daily operations and decision-making, making it a straightforward choice for smaller enterprises where active involvement is common. This approach is particularly advantageous for online business initiatives, as it fosters teamwork and facilitates rapid decision-making-essential in a fast-paced market. Notably, a significant percentage of e-commerce businesses prefer member-managed LLCs, reflecting their inclination for hands-on involvement.

Conversely, LLC management involves designating one or more managers to oversee daily operations, allowing members to focus on strategic roles. This structure is well-suited for larger LLCs or when members prefer to concentrate on high-level planning rather than routine tasks. As online commerce continues to evolve, understanding these LLC management distinctions is vital for aligning the LLC structure with operational needs and growth objectives. Successful case studies indicate that businesses utilizing member-managed structures often experience enhanced agility and responsiveness-critical traits in today’s competitive landscape.

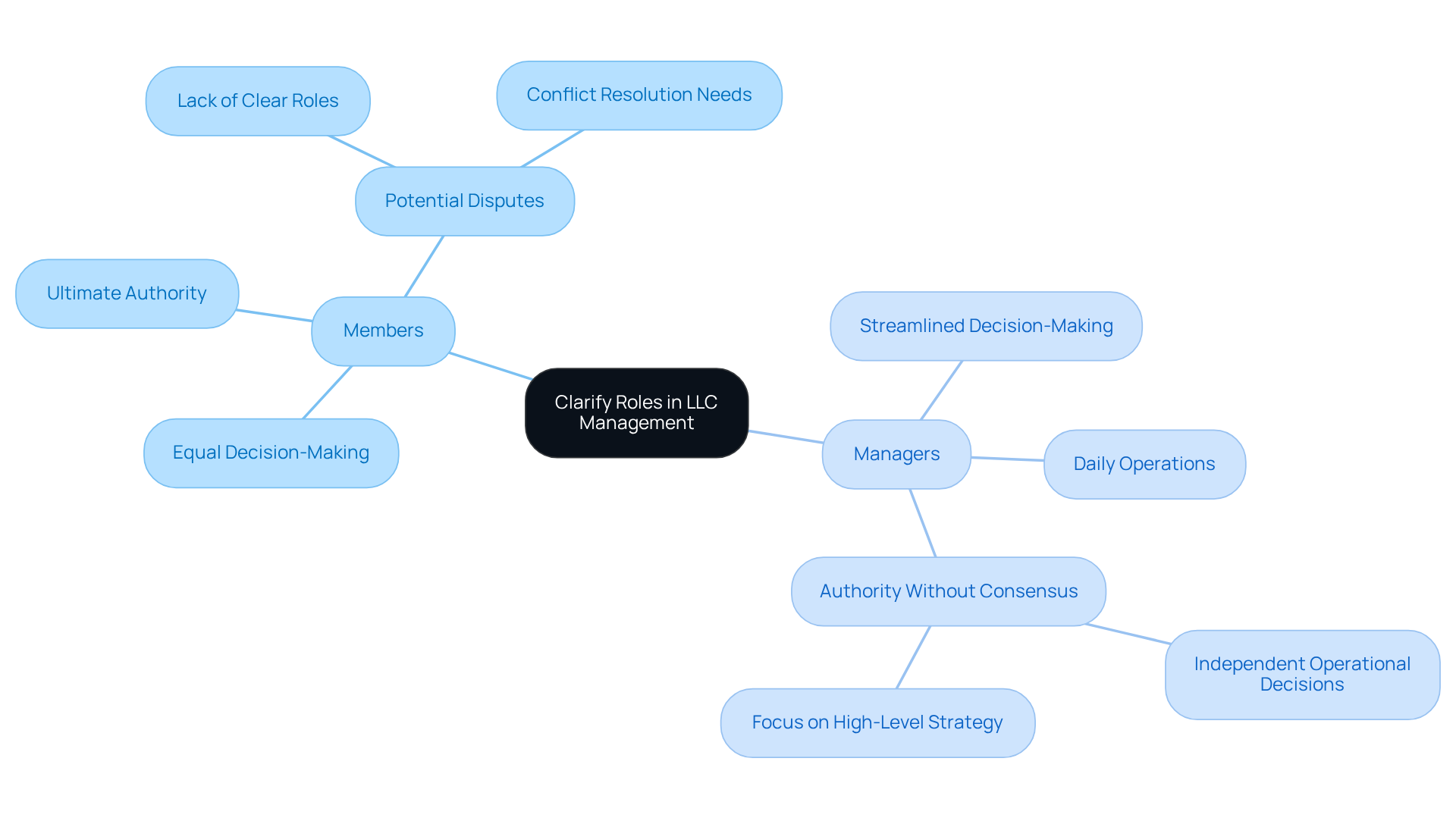

Clarify Roles: Distinguish Between LLC Members and Managers

Defining the roles of participants and managers is crucial for the effective operation of LLC management, especially for international e-commerce entrepreneurs. Members, as owners, possess ultimate authority, while managers are appointed to oversee daily operations. In a member-operated LLC, all participants share equal decision-making authority, which can lead to disputes if roles are not clearly defined. Conversely, in the context of LLC management, a manager-managed LLC streamlines decision-making by granting power exclusively to appointed managers, allowing them to act on behalf of the LLC without needing consensus from all participants.

Establishing clear roles and responsibilities in the operating agreement is essential; it prevents misunderstandings and ensures that everyone comprehends their duties. This clarity not only fosters a more efficient operation but also enhances collaboration and trust among members, ultimately supporting the organization’s growth and adaptability in the competitive online marketplace.

Moreover, it is vital to understand the distinctions between LLCs and Corporations, particularly in terms of taxation. Corporations face double taxation, requiring both corporate tax and individual tax returns, whereas LLCs are subject only to individual taxation. Therefore, obtaining expert advice before deciding on the company structure is imperative.

As highlighted by Checketts Law, PLC, creating a comprehensive operating agreement is fundamental to effective LLC management, delineating roles, responsibilities, and decision-making processes. Additionally, statistics suggest that member-managed LLCs may incur lower administrative costs due to the absence of outside managers, underscoring the importance of clearly defining roles to prevent potential conflicts and inefficiencies. Opting for an LLC structure provides significant advantages, including tax flexibility and personal liability protection, which are particularly advantageous for fintech entrepreneurs navigating state-specific regulations.

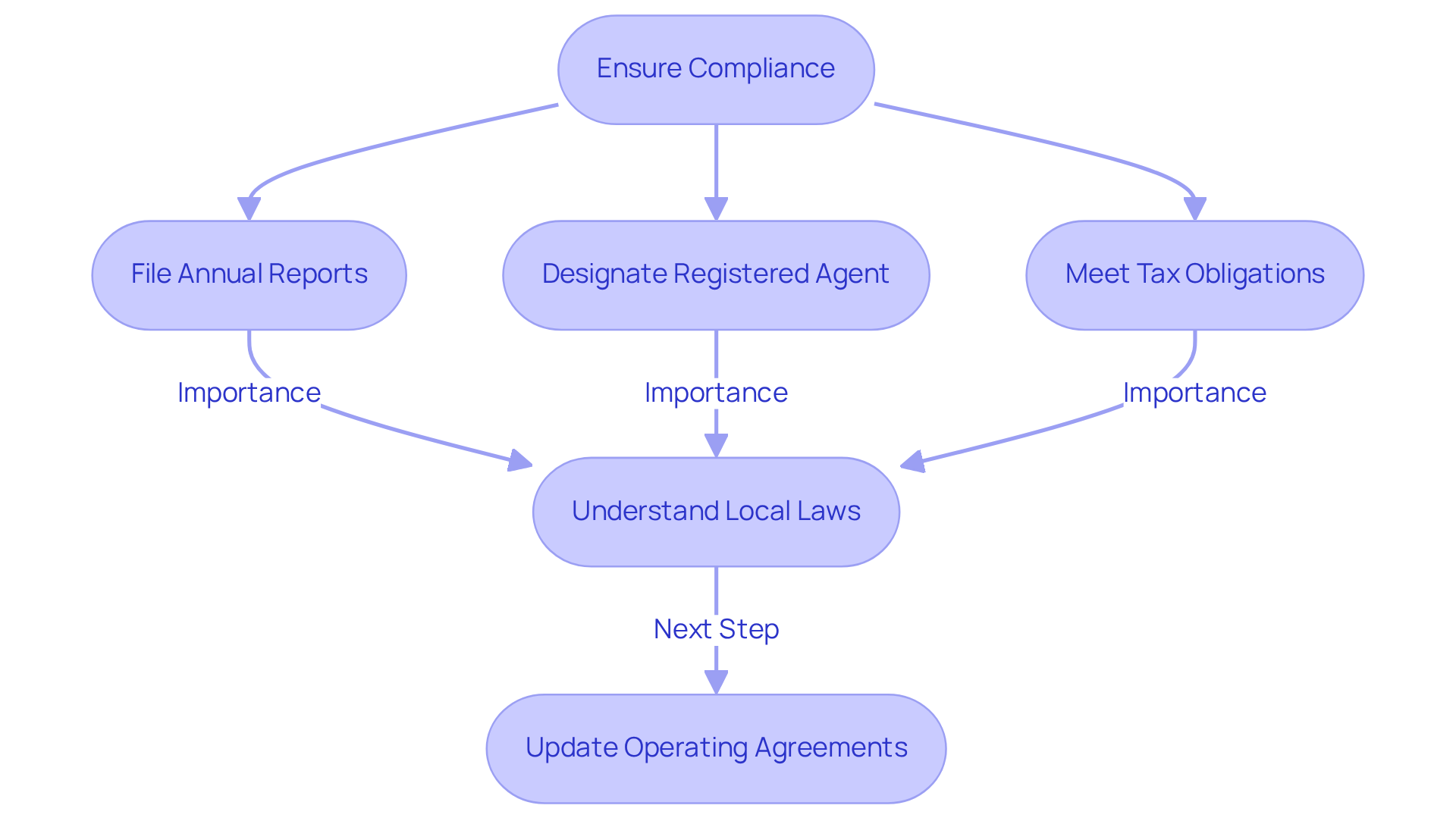

Ensure Compliance: Adhere to State Regulations and Operating Agreements

E-commerce LLC management must navigate a complex landscape of state regulations that necessitate diligent compliance with operating agreements. This includes critical tasks such as:

- Filing annual reports

- Designating a registered agent

- Meeting tax obligations

Each state imposes distinct requirements, making it essential for LLC owners to thoroughly understand local laws. For example, nearly 20 states have enacted their own privacy regulations, resulting in a fragmented legal environment that complicates compliance efforts.

Consistently reviewing and updating the operating agreement is equally vital, as it must accurately reflect any changes in organizational structure or operations. By proactively ensuring compliance, online retail businesses can mitigate legal risks and maintain their good standing, which is crucial for sustainable growth.

Successful online retail LLC management, especially those that utilize robust operating agreements, shows that adherence to state regulations not only prevents legal issues but also enhances operational efficiency and credibility in the marketplace.

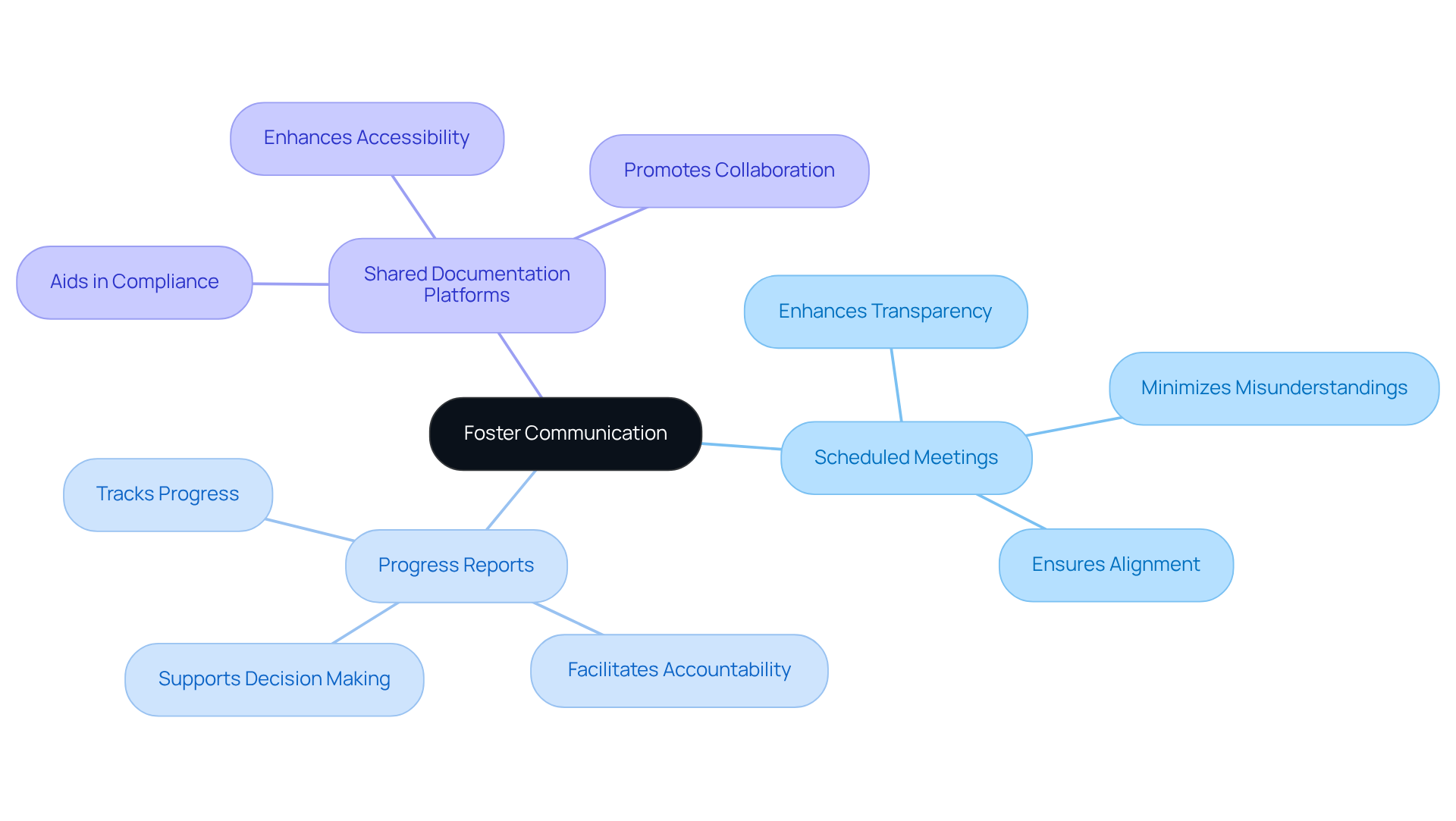

Foster Communication: Implement Regular Updates and Documentation Practices

Effective communication is essential for successful LLC management, particularly in the fast-paced world of e-commerce. Regular updates and robust documentation practices are essential for keeping all members and managers informed about organizational operations and strategic decisions. This includes:

- Scheduled meetings

- Progress reports

- The use of shared documentation platforms that enhance transparency and accessibility

By cultivating a culture of open dialogue, LLCs can significantly enhance collaboration, minimize misunderstandings, and ensure alignment with the organization’s objectives. For example, successful e-commerce LLCs have shown that consistent documentation of decisions and communications not only aids in compliance but also serves as a valuable resource for operational reviews.

Furthermore, organizational leaders stress the importance of regular updates in LLC management operations. As one leader remarked, “Staying informed through regular updates is crucial for navigating the complexities of business management and ensuring that all team members are on the same page.” This proactive approach to communication and documentation ultimately bolsters the stability and growth of the LLC, enabling it to adapt swiftly to market changes and customer needs.

Conclusion

Establishing a successful e-commerce LLC relies on effective management practices tailored to the unique demands of the online marketplace. Understanding the distinctions between member-managed and manager-managed structures enables entrepreneurs to make informed decisions that enhance agility and responsiveness. Moreover, clarifying roles and responsibilities within the LLC promotes collaboration and minimizes conflicts, thereby laying a solid foundation for growth.

This article outlines critical best practices, emphasizing the importance of compliance with state regulations and the maintenance of a comprehensive operating agreement. By adhering to local laws and regularly updating internal documents, LLCs can mitigate legal risks and enhance operational efficiency. Furthermore, fostering communication through regular updates and documentation practices is essential for ensuring that all team members remain informed and aligned with organizational goals.

Ultimately, implementing these best practices positions e-commerce LLCs for sustainable growth and empowers them to navigate the complexities of an ever-evolving market landscape. Embracing these strategies can lead to greater operational success and a competitive edge, making it imperative for online entrepreneurs to prioritize effective LLC management.

Frequently Asked Questions

What are the two main management structures for an LLC?

The two main management structures for an LLC are member-managed and manager-managed.

What is a member-managed LLC?

A member-managed LLC allows all members to participate in daily operations and decision-making, making it ideal for smaller enterprises where active involvement is common.

What are the advantages of a member-managed LLC?

The advantages of a member-managed LLC include fostering teamwork, facilitating rapid decision-making, and being particularly beneficial for online business initiatives.

Which type of businesses prefer member-managed LLCs?

A significant percentage of e-commerce businesses prefer member-managed LLCs due to their inclination for hands-on involvement.

What is a manager-managed LLC?

A manager-managed LLC designates one or more managers to oversee daily operations, allowing members to focus on strategic roles and high-level planning.

When is a manager-managed LLC structure preferable?

A manager-managed LLC structure is preferable for larger LLCs or when members want to concentrate on high-level planning rather than routine tasks.

Why is it important to understand the distinctions between LLC management structures?

Understanding the distinctions between LLC management structures is vital for aligning the LLC structure with operational needs and growth objectives, especially as online commerce evolves.

What traits do businesses with member-managed structures often experience?

Businesses utilizing member-managed structures often experience enhanced agility and responsiveness, which are critical traits in today’s competitive landscape.