Introduction

Forming a Delaware LLC represents a strategic opportunity for international entrepreneurs aiming to enter the U.S. market. Delaware’s business-friendly laws, favorable tax structure, and strong privacy protections make it an ideal jurisdiction for establishing a limited liability company.

However, the process of successfully forming an LLC can present various challenges, including navigating complex legal requirements and overcoming language barriers. Entrepreneurs must consider how to effectively manage this process while leveraging the benefits that Delaware offers.

This guide outlines a comprehensive, step-by-step approach to forming a Delaware LLC, equipping aspiring business owners with the necessary tools to embark on their entrepreneurial journey.

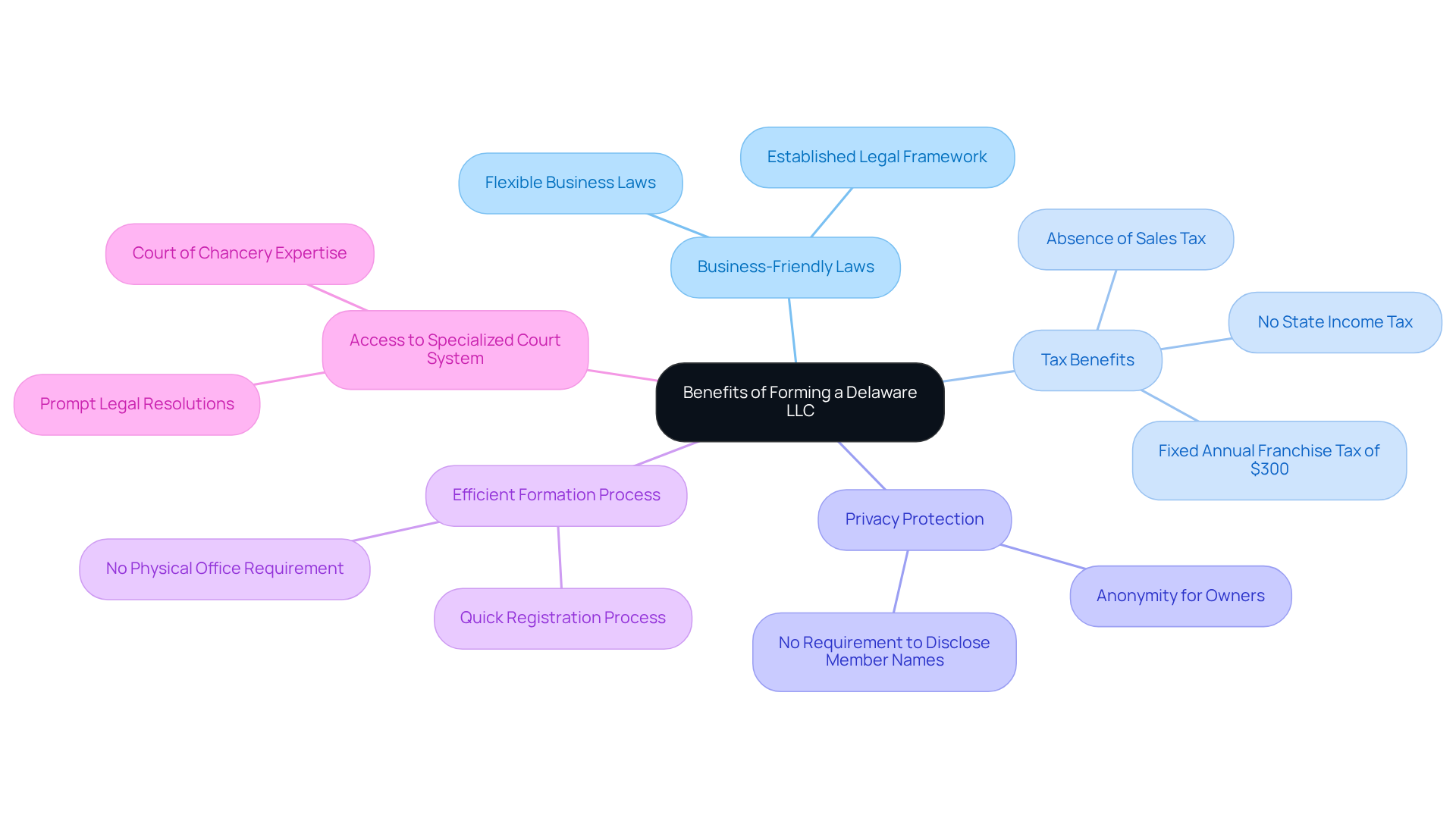

Understand the Benefits of Forming a Delaware LLC

Forming a Delaware LLC for international entrepreneurs offers numerous advantages that are particularly beneficial.

- Business-Friendly Laws: Delaware is renowned for its flexible business laws, fostering a supportive environment for LLCs. The state’s well-established legal framework is designed to facilitate smooth commercial activities, making it a preferred choice for many.

- Tax Benefits: A compelling reason to choose Delaware is its favorable tax structure. The state does not impose income tax on LLCs that do not conduct business within its borders, potentially leading to substantial savings. Additionally, the absence of a sales tax further enhances the cost-effectiveness of operating an LLC in Delaware. However, entrepreneurs should consider the annual franchise tax of $300, which is an ongoing cost that must be factored into financial planning.

- Privacy Protection: Delaware provides a high level of anonymity for LLC owners. The state does not require the disclosure of member names in public filings, allowing owners to preserve their privacy and protect sensitive information from public scrutiny.

- Efficient Formation Process: The process of forming an LLC in Delaware is remarkably efficient, often completed within just a few days. This streamlined method enables entrepreneurs to and commence operations without unnecessary delays.

- Access to a Specialized Court System: The Court of Chancery is recognized for its expertise in corporate law, offering a reliable legal setting for resolving disputes. This specialized court system is a significant advantage for businesses seeking prompt and equitable resolutions to legal matters.

These compelling benefits make a Delaware LLC for international entrepreneurs an appealing choice for those aiming to establish a foothold in the U.S. market, particularly for those looking to leverage the state’s favorable legal and tax environment. By consulting with experts at Social Enterprises, entrepreneurs can gain valuable insights into the formation process and ongoing compliance requirements, ensuring a successful business venture.

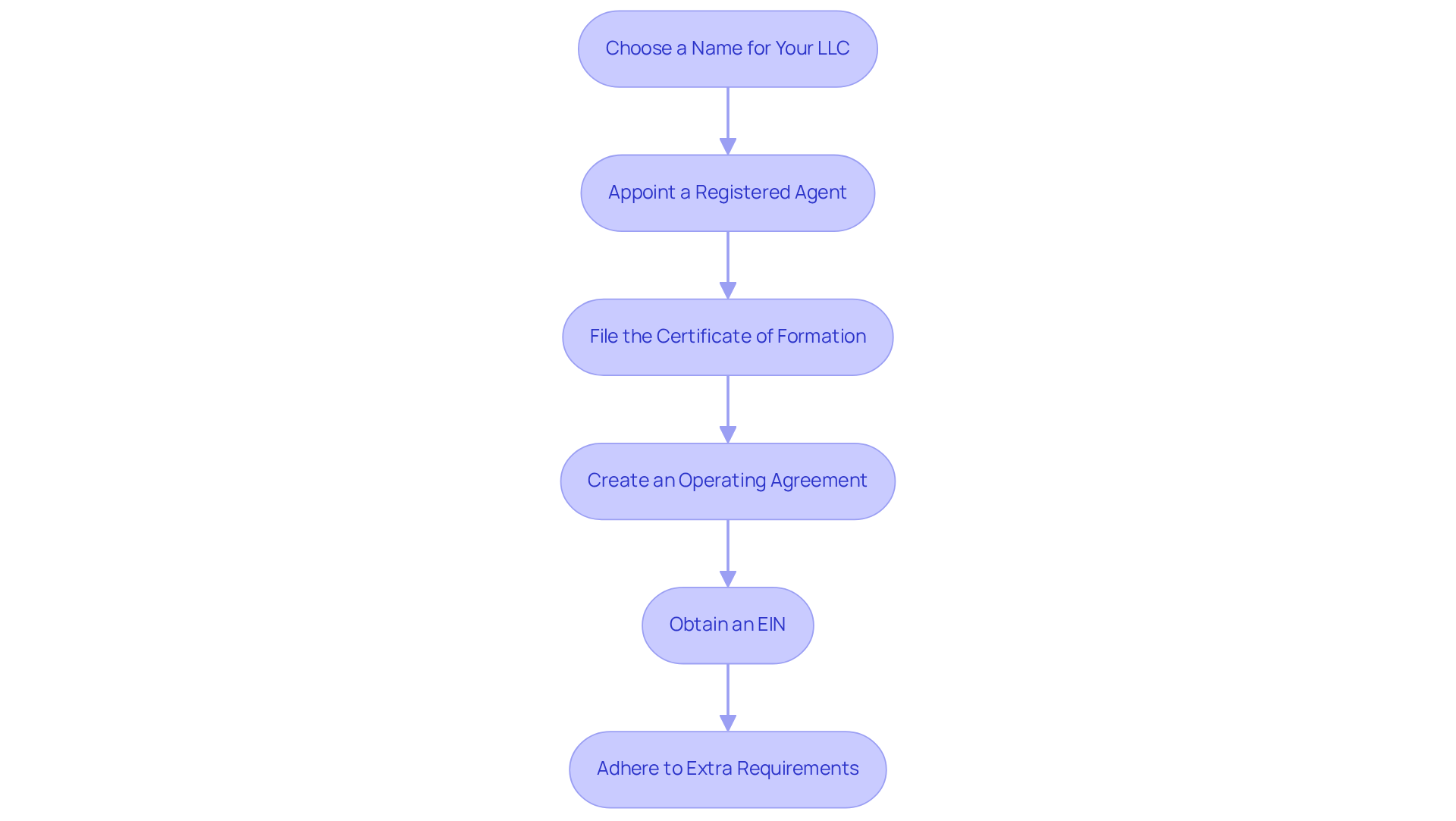

Follow the Step-by-Step Process to Form Your LLC

To establish your Delaware LLC, follow these steps:

- Choose a Name for Your LLC: Select a unique name that meets the state’s naming requirements. You can through the Division of Corporations website. Notably, in 2024, 72.9% of business formations were LLCs, underscoring the popularity of this structure.

- Appoint a Registered Agent: Designate a registered agent with a physical address in Delaware. This agent is responsible for receiving legal documents on behalf of your LLC, ensuring compliance with state regulations.

- File the Certificate of Formation: Prepare and submit the Certificate of Formation to the Delaware Division of Corporations. This document must include your LLC’s name, registered agent information, and the purpose of the venture. The filing fee is $110, and with expedited service, you can receive confirmation the same day if submitted accurately.

- Create an Operating Agreement: Although not legally required, drafting an operating agreement is highly advisable. This document outlines the management structure and operational procedures of your LLC, helping to prevent disputes and clarify member roles.

- Obtain an EIN: Apply for an Employer Identification Number (EIN) from the IRS, which is essential for tax purposes and opening a commercial bank account. The application process can be completed online in approximately 15 minutes.

- Adhere to Extra Requirements: Depending on your commercial activities, you may need to obtain additional licenses or permits. For instance, the state requires LLCs to secure a general license, which costs $75 for the initial location.

By following these steps, you can effectively set up your LLC in Delaware and embark on your entrepreneurial journey, benefiting from its favorable economic environment.

Navigate Common Challenges in LLC Formation

Forming a Delaware LLC for international entrepreneurs presents unique challenges, necessitating a thorough understanding of various legal and operational aspects.

- Understanding U.S. Legal Requirements: The U.S. legal framework is multifaceted, encompassing federal, state, and local regulations that can significantly impact business operations. Familiarity with these laws is essential to ensure compliance and avoid penalties.

- Choosing the Right Enterprise Structure: Selecting the appropriate enterprise structure can be daunting. Many entrepreneurs benefit from consulting legal experts who can provide tailored advice based on specific needs and goals. This guidance is crucial for of U.S. commercial law.

- Language Barriers: Non-native English speakers often face challenges in understanding legal documents and forms. Engaging a bilingual consultant or legal advisor can facilitate smoother communication and comprehension throughout the formation process.

- Tax Compliance: U.S. tax obligations can be intricate, particularly for foreign-owned LLCs. Collaborating with tax experts who specialize in international operations is recommended to ensure adherence to federal and state tax regulations and to enhance tax strategies. For instance, foreign-owned LLCs classified as disregarded entities must file Form 5472 annually, underscoring the importance of understanding specific filing requirements.

- Banking and Financial Setup: Opening a U.S. bank account can pose difficulties for non-residents, as banks typically require a physical address and comprehensive documentation. Researching banks that cater to international clients and understanding their specific requirements is vital for successful financial operations.

By proactively addressing these challenges and seeking expert assistance, international entrepreneurs can navigate the process of establishing a Delaware LLC for international entrepreneurs more effectively, paving the way for successful business operations in the U.S.

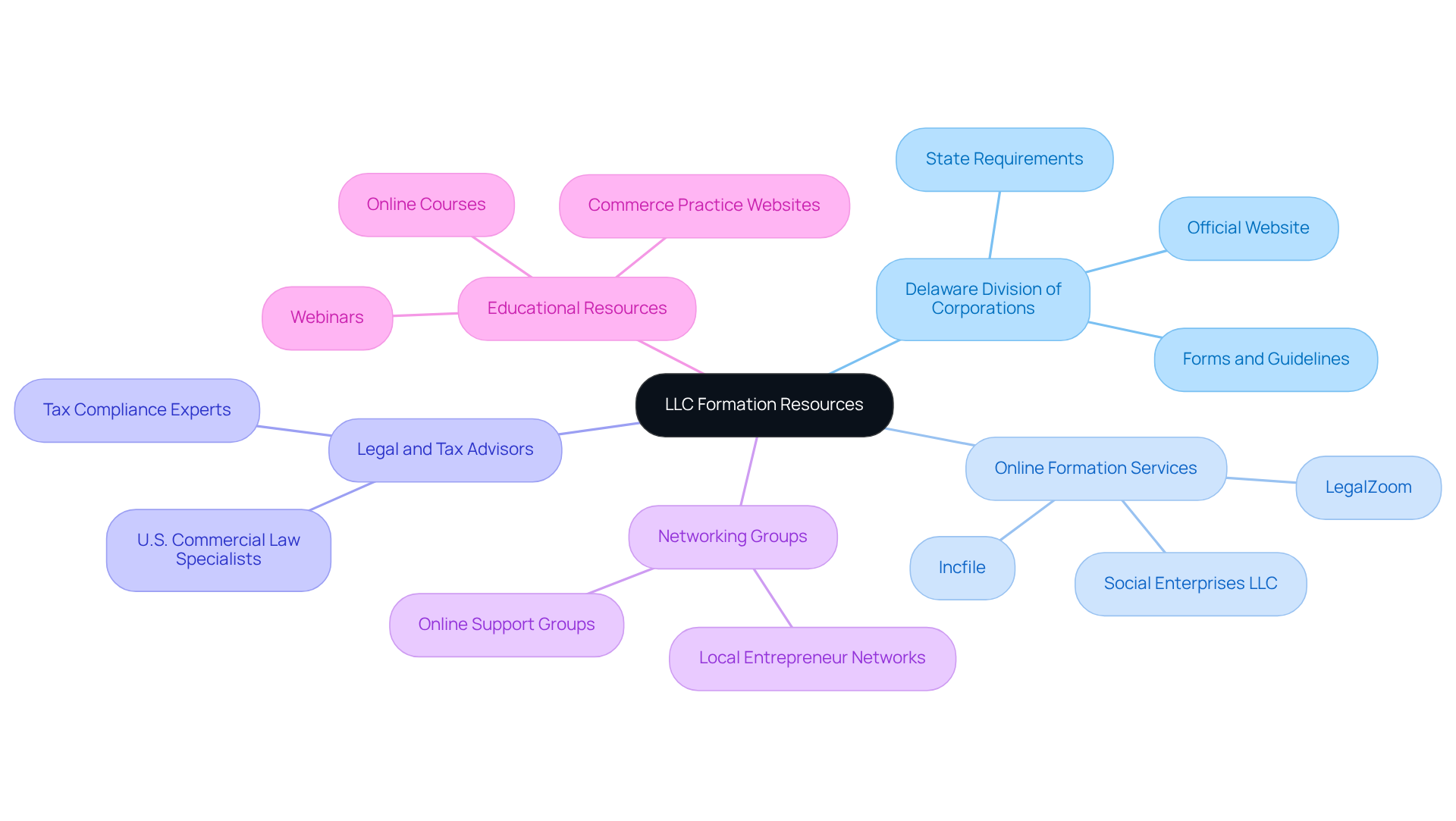

Utilize Resources and Tools for Successful LLC Formation

To facilitate your LLC formation, consider utilizing the following resources and tools:

- Delaware Division of Corporations Website: This official site is a vital resource, providing essential information, forms, and guidelines for forming an LLC in Delaware. It serves as the primary source for understanding state requirements and updates.

- Online Formation Services: Companies such as Social Enterprises LLC offer comprehensive services that manage the entire formation process, ensuring compliance and saving you valuable time. With , these services have significantly improved LLC success rates, making them a preferred choice for many entrepreneurs.

- Legal and Tax Advisors: Engaging professionals who specialize in U.S. commercial law and tax compliance can offer invaluable guidance tailored to your specific situation. Their expertise is crucial in navigating the complexities of multi-state operations and compliance obligations.

- Networking Groups: Joining local or online networking groups connects you with other entrepreneurs who have successfully navigated the formation process. These networks provide insights, support, and potential collaboration opportunities.

- Educational Resources: Websites, webinars, and online courses focused on U.S. commerce practices can enhance your understanding and prepare you for successful operations. Ongoing education is essential for adjusting to the changing commercial environment.

By leveraging these resources, you can streamline the formation of a Delaware LLC for international entrepreneurs and establish a solid foundation for your business in the U.S.

Conclusion

Forming a Delaware LLC represents a strategic opportunity for international entrepreneurs seeking to establish a presence in the U.S. market. Delaware’s business-friendly laws, advantageous tax structure, and efficient formation process make it an ideal location for setting up an LLC. The state’s combination of privacy protection and access to a specialized court system further enhances its appeal, positioning Delaware as a favorable environment for business growth.

Key insights throughout this article include:

- The step-by-step process for establishing an LLC

- The importance of understanding legal requirements

- The necessity of seeking expert guidance to navigate potential challenges

From selecting a unique name to obtaining an Employer Identification Number (EIN), each step is crucial for ensuring compliance and facilitating smooth operations. Additionally, recognizing common obstacles – such as language barriers and tax compliance – underscores the importance of utilizing available resources and expert advice.

In summary, the formation of a Delaware LLC is not merely a procedural task; it serves as a vital stepping stone for international entrepreneurs aiming to thrive in the competitive U.S. landscape. By leveraging the benefits of Delaware, proactively addressing potential challenges, and effectively utilizing resources, entrepreneurs can pave the way for successful business ventures. Embracing this opportunity could lead to significant growth and innovation, making the pursuit of establishing a Delaware LLC a worthwhile endeavor for those prepared to take the plunge.

Frequently Asked Questions

What are the main benefits of forming a Delaware LLC for international entrepreneurs?

The main benefits include business-friendly laws, tax advantages, privacy protection, an efficient formation process, and access to a specialized court system.

Why is Delaware considered business-friendly?

Delaware is renowned for its flexible business laws and well-established legal framework, which fosters a supportive environment for LLCs and facilitates smooth commercial activities.

What tax benefits are associated with forming an LLC in Delaware?

Delaware does not impose income tax on LLCs that do not conduct business within the state, and there is no sales tax. However, there is an annual franchise tax of $300 that must be considered.

How does Delaware protect the privacy of LLC owners?

Delaware allows a high level of anonymity for LLC owners by not requiring the disclosure of member names in public filings, thus protecting sensitive information from public scrutiny.

How quickly can an LLC be formed in Delaware?

The formation process for an LLC in Delaware is efficient and can often be completed within just a few days.

What is the Court of Chancery and why is it important for businesses?

The Court of Chancery is a specialized court in Delaware recognized for its expertise in corporate law, providing a reliable legal setting for resolving disputes promptly and equitably.

How can entrepreneurs get assistance with forming a Delaware LLC?

Entrepreneurs can consult with experts at Social Enterprises for valuable insights into the formation process and ongoing compliance requirements to ensure a successful business venture.