Introduction

Obtaining an Employer Identification Number (EIN) for a Limited Liability Company (LLC) presents a complex challenge for many entrepreneurs. The timeline for receiving an EIN can vary significantly, influenced by several key factors, including the accuracy of the submitted information and the chosen application method. As businesses navigate this crucial step in their formation process, they often face the pressing question: how can they ensure a swift and efficient EIN acquisition? This article explores ten critical elements that affect the duration of obtaining an EIN for an LLC, offering valuable insights and practical tips to streamline the process and avoid common pitfalls.

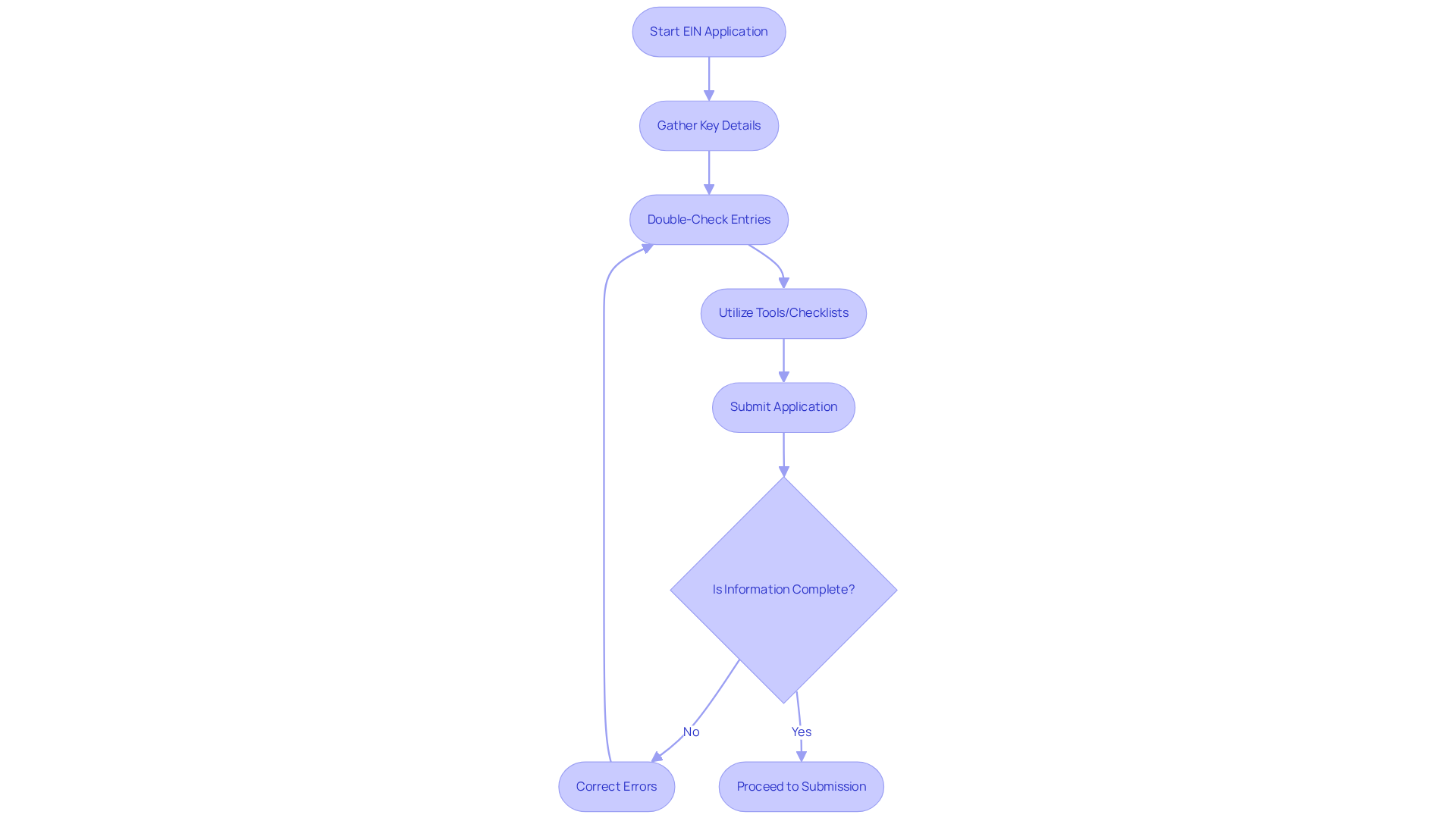

Ensure Accurate Information Submission

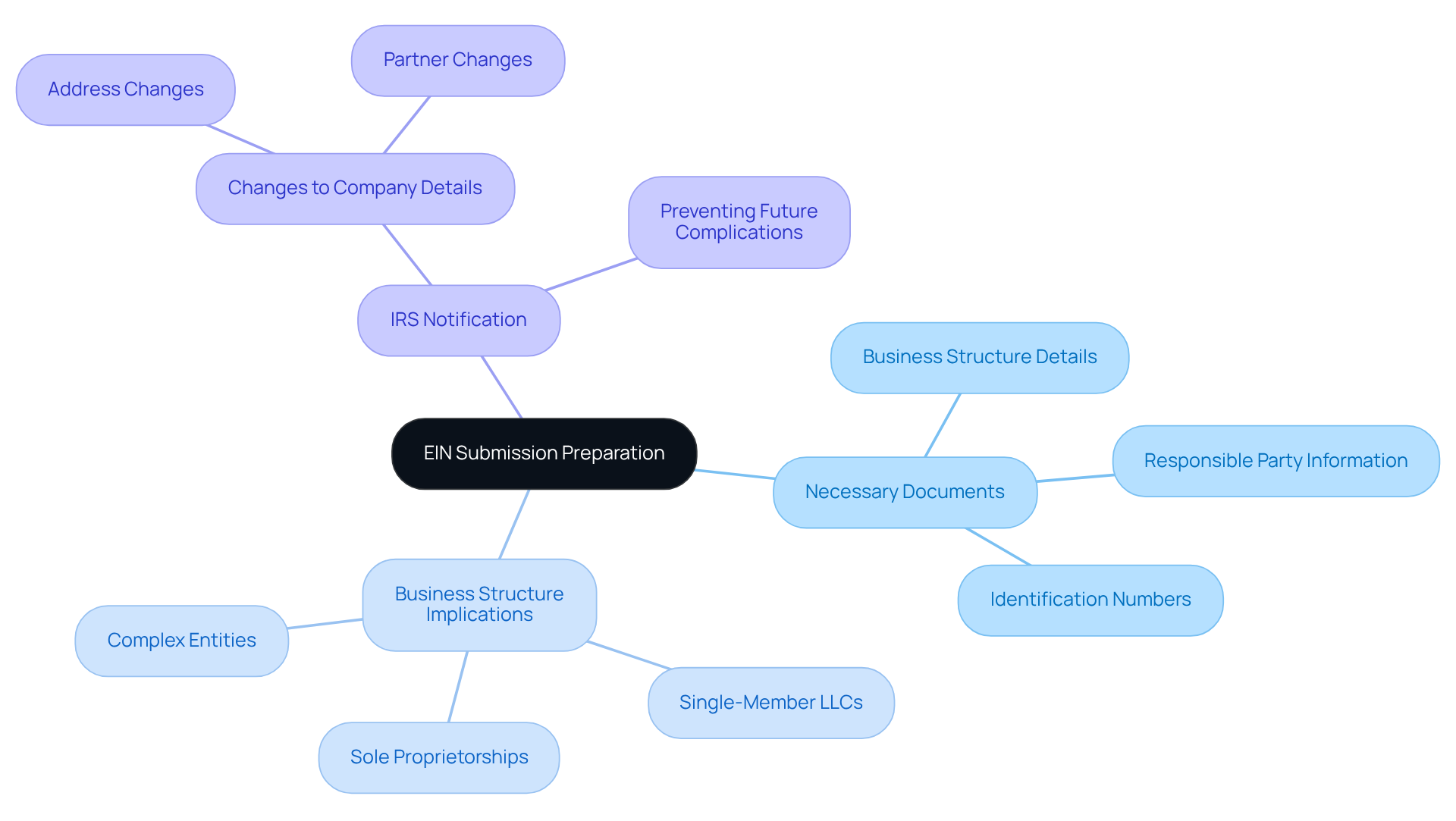

Accurate and complete information is essential when applying for an Employer Identification Number (EIN). Key details include the organization’s legal name, entity type, and the responsible party’s information. For specific business structures, such as Limited Liability Companies (LLCs) and corporations, obtaining an EIN is necessary, particularly if the company has employees or operates in a more complex manner.

Incomplete or incorrect submissions are the primary causes of delays in processing requests. Mistakes in the application can result in processing delays of several weeks, as noted by IRS experts. Typical reasons for these delays include incomplete information and errors in the submission, according to the IRS.

To mitigate such issues, it is advisable to meticulously double-check all entries for typos and ensure that every required field is accurately filled out. Utilizing tools or checklists can significantly , helping to minimize errors and expedite the application timeline.

Businesses that have encountered delays due to incorrect EIN submissions often emphasize the importance of thorough preparation and attention to detail, as it affects how long does it take to get an ein number for an llc, reinforcing that accurate information directly impacts processing times.

Furthermore, it is crucial to understand that an EIN is necessary for certain organizational structures, while an ITIN (Individual Taxpayer Identification Number) may suffice for sole proprietorships or single-member LLCs. Consulting with experts, such as Social Enterprises, can provide valuable guidance in selecting the appropriate organizational structure and ensuring compliance with tax regulations.

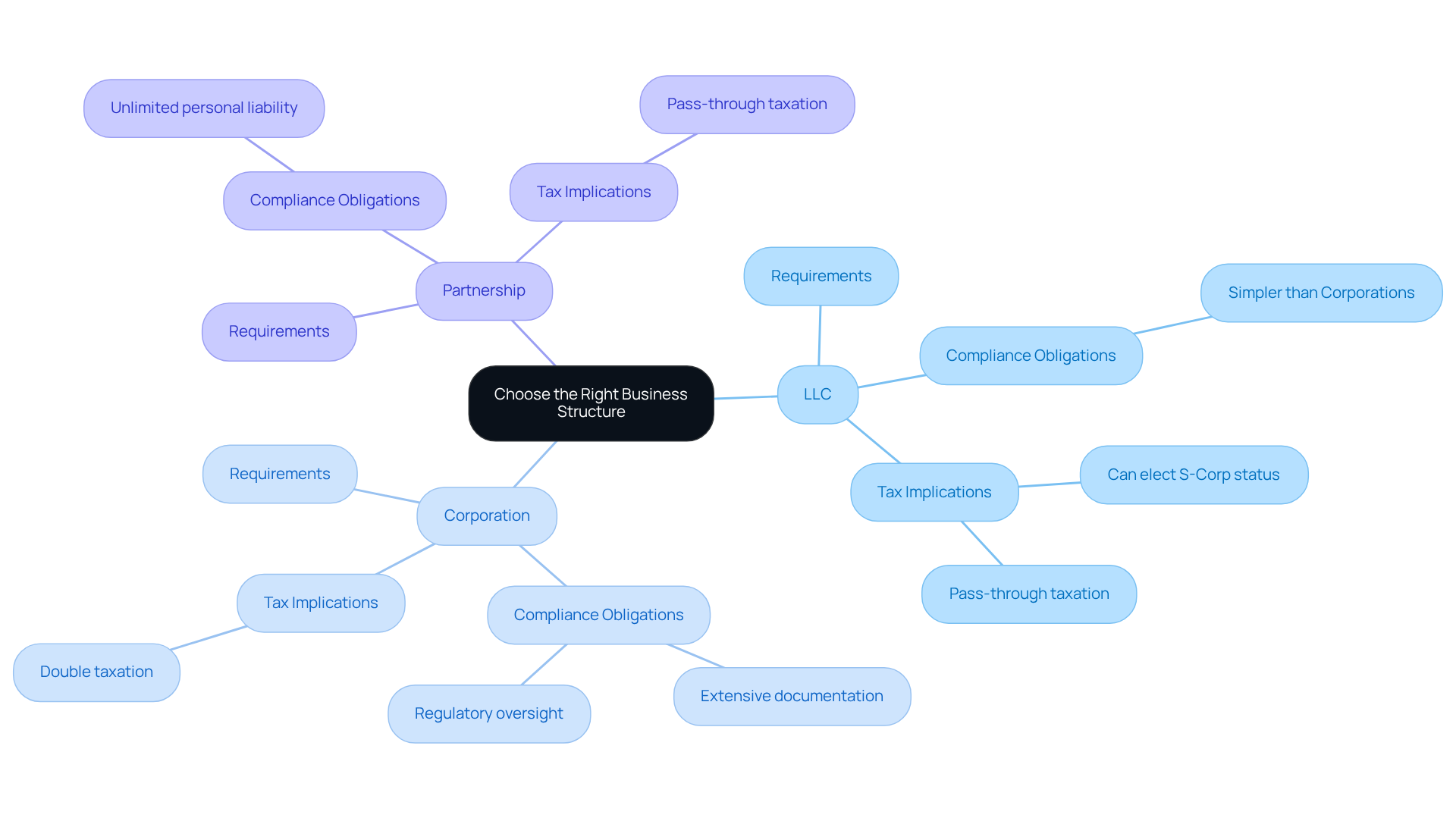

Choose the Right Business Structure

Selecting the appropriate organizational structure – whether an LLC, corporation, or partnership – can significantly influence how long it takes to get an EIN number for an LLC. Each structure presents distinct requirements and tax implications. For instance, LLCs generally face simpler compliance obligations compared to corporations, which often entail more extensive documentation and regulatory oversight. This distinction can streamline the EIN application process and clarify how long it takes to get an EIN number for an LLC, ensuring that the chosen structure aligns with the organization’s operational goals and compliance needs. Understanding these differences is crucial for entrepreneurs aiming to in the U.S.

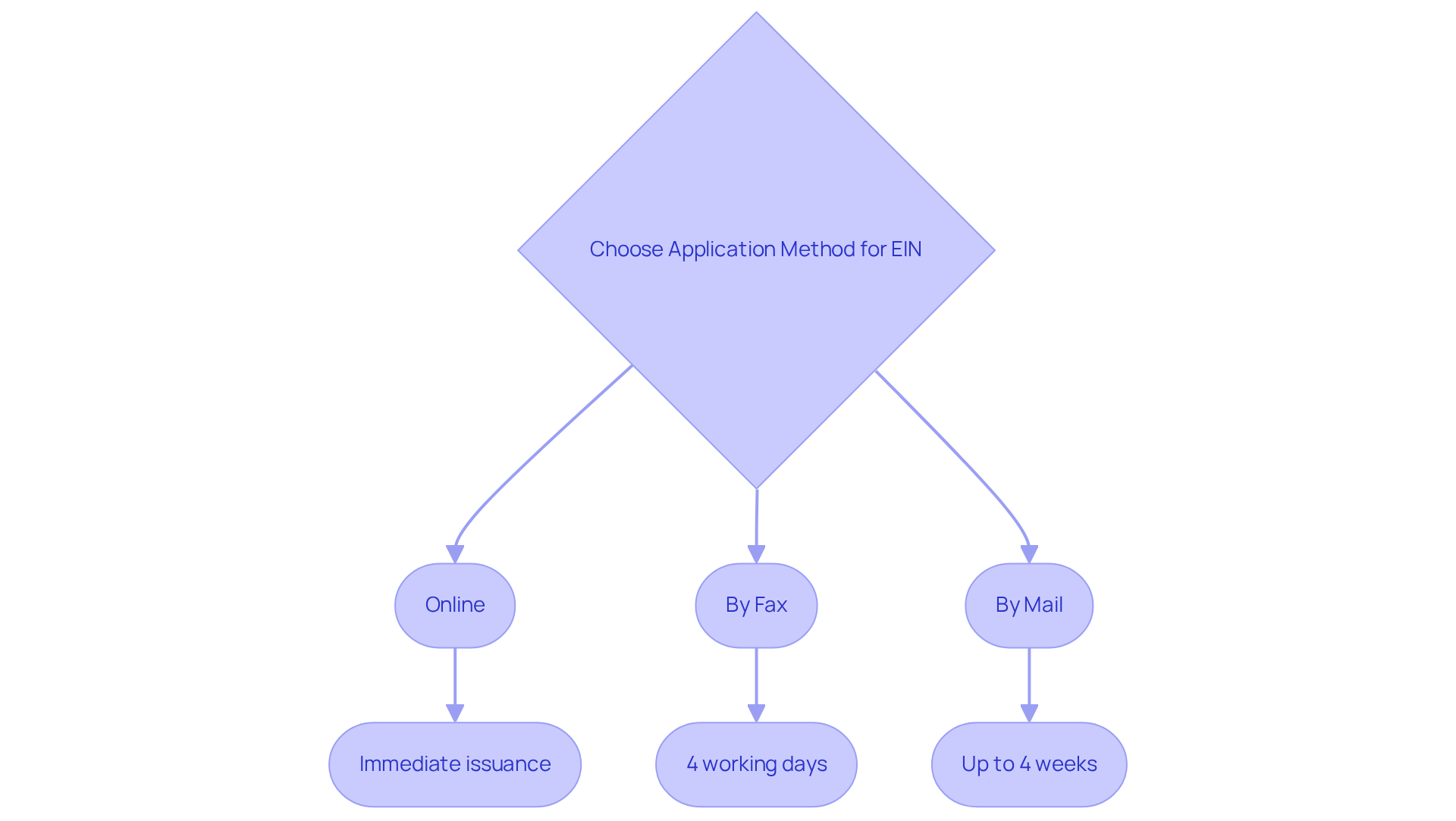

Select the Application Method Wisely

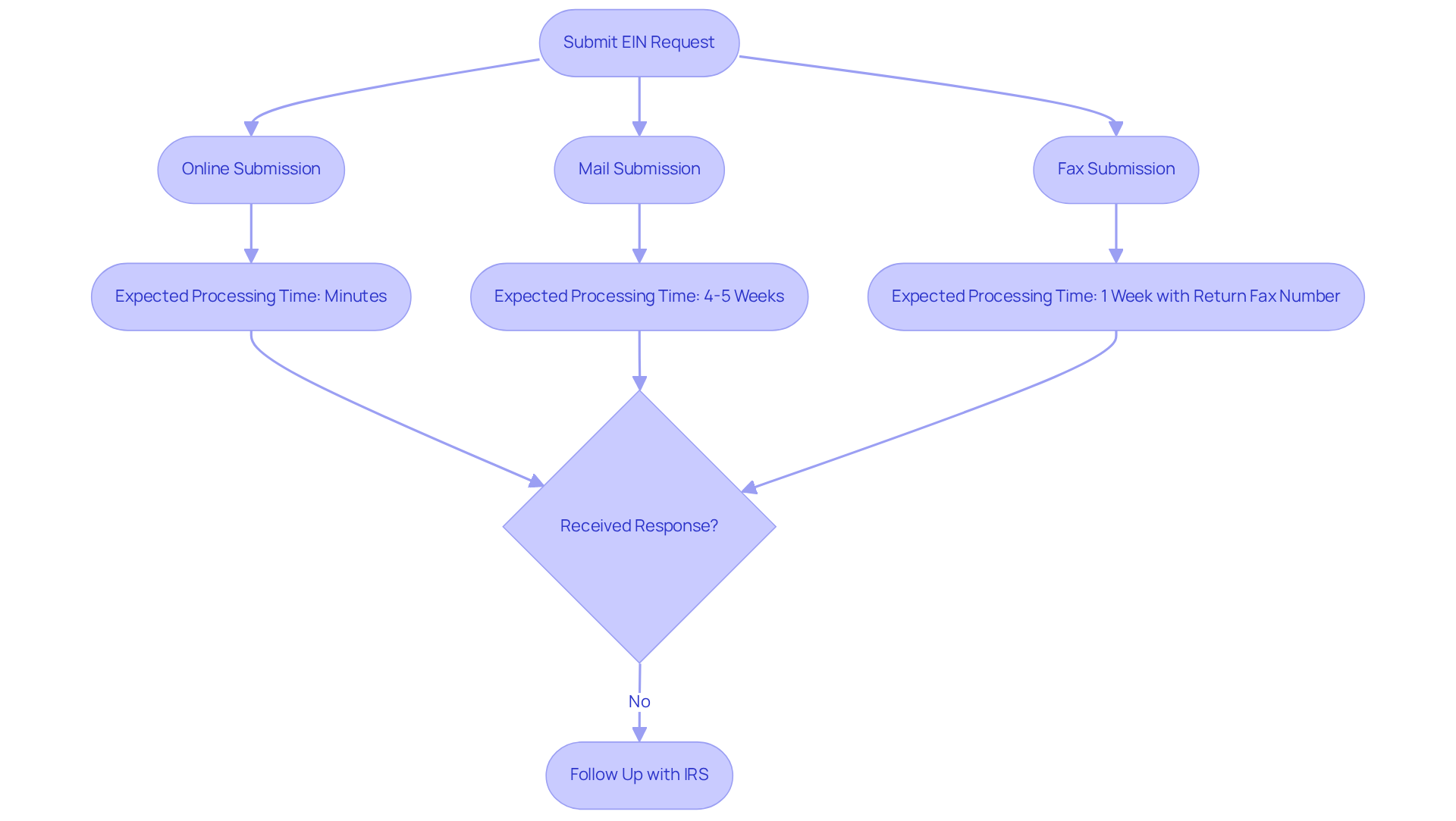

When applying for an Employer Identification Number (EIN), companies have several methods to choose from:

- Online

- By fax

- By mail

The online form is the fastest option, often resulting in immediate issuance of the EIN upon successful submission. In contrast, fax submissions typically require about four working days to complete, while postal requests can take as long as four weeks. For those with urgent needs, the online method is highly recommended to expedite the process.

Companies that have utilized the online submission method have reported obtaining their EIN in as little as two working days, demonstrating the effectiveness of this approach. However, it is essential to ensure that all information is accurate and complete, as errors can lead to significant delays.

In summary, selecting the appropriate method is crucial for timely EIN acquisition, especially when considering how long does it take to get an EIN number for an LLC, with the online route being the most efficient for businesses aiming to establish operations quickly.

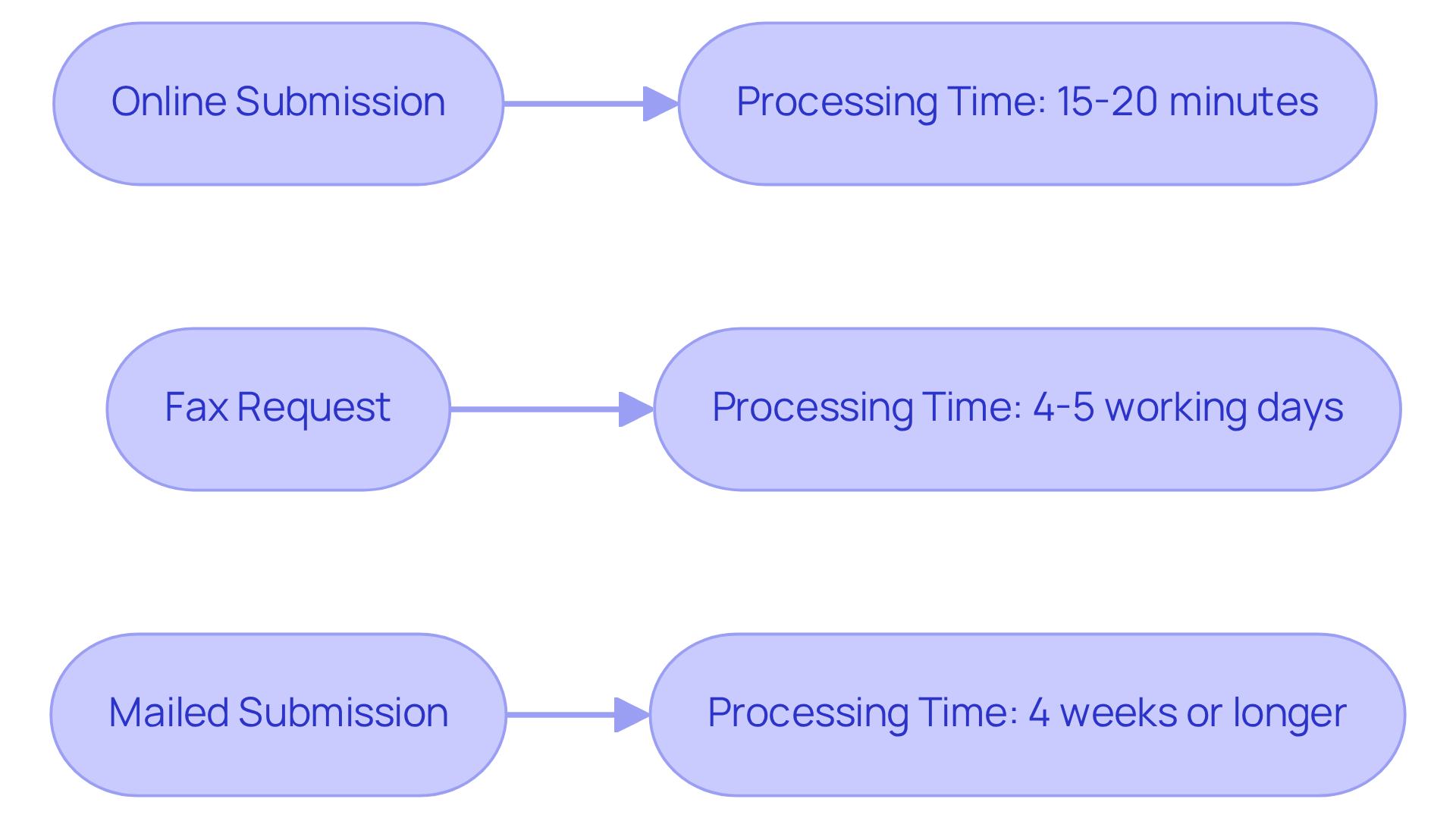

Understand IRS Processing Times

The IRS processes EIN requests according to the submission method, each with distinct timelines.

- Online submissions are the fastest, yielding results typically within 15 to 20 minutes upon entry.

- In contrast, fax requests generally take about 4 to 5 working days,

- While mailed submissions may extend to four weeks or longer, particularly during peak periods.

For example, companies that submitted applications in early January 2026 might face delays due to the surge in filings at the beginning of the tax season. Understanding how long it takes to get an is crucial for organizations to effectively manage expectations and plan their operations. By anticipating potential delays, companies can ensure they are prepared to proceed with their activities as soon as they receive their EIN.

Possess a Valid SSN or ITIN

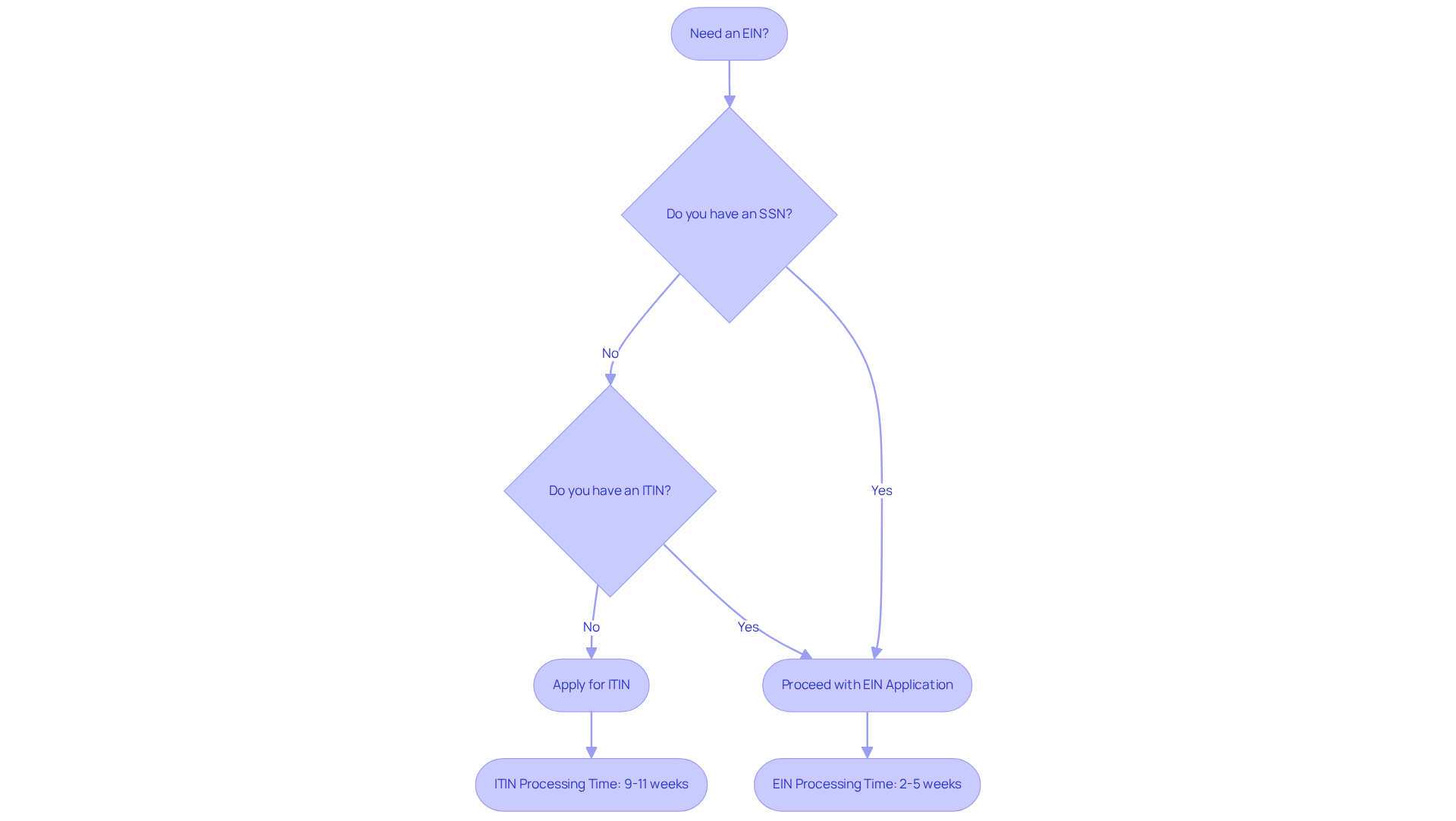

To obtain an Employer Identification Number (EIN), applicants generally need a valid Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). This requirement is particularly important for non-residents or foreign entities aiming to establish a business in the United States. For those lacking an SSN or ITIN, applying for an ITIN is a necessary preliminary step before proceeding with the EIN application.

The Internal Revenue Service (IRS) issues EINs to foreign founders daily, even in the absence of an SSN. However, possessing an ITIN can streamline the process and ensure compliance with U.S. tax obligations. Many non-residents successfully navigate this procedure, illustrating that with appropriate guidance, obtaining these identifiers can be straightforward. Statistics indicate that a significant percentage of EIN applicants do not possess an SSN or ITIN, underscoring the prevalence of this situation. As Ema Todorovska observes, “For many non-U.S. founders, the EIN alone is enough to get started with their company.”

Entrepreneurs can leverage resources from Social Enterprises, which specialize in assisting foreign founders, ensuring they meet all requirements efficiently. Scheduling a free 15-minute consultation with Social Enterprises can provide valuable insights into company formation and taxation. When considering how long does it take to get an EIN number for an LLC, typically range from 2 to 5 weeks, while ITIN requests may take approximately 9 to 11 weeks. Seeking expert advice can further facilitate the submission process.

Avoid Common Application Errors

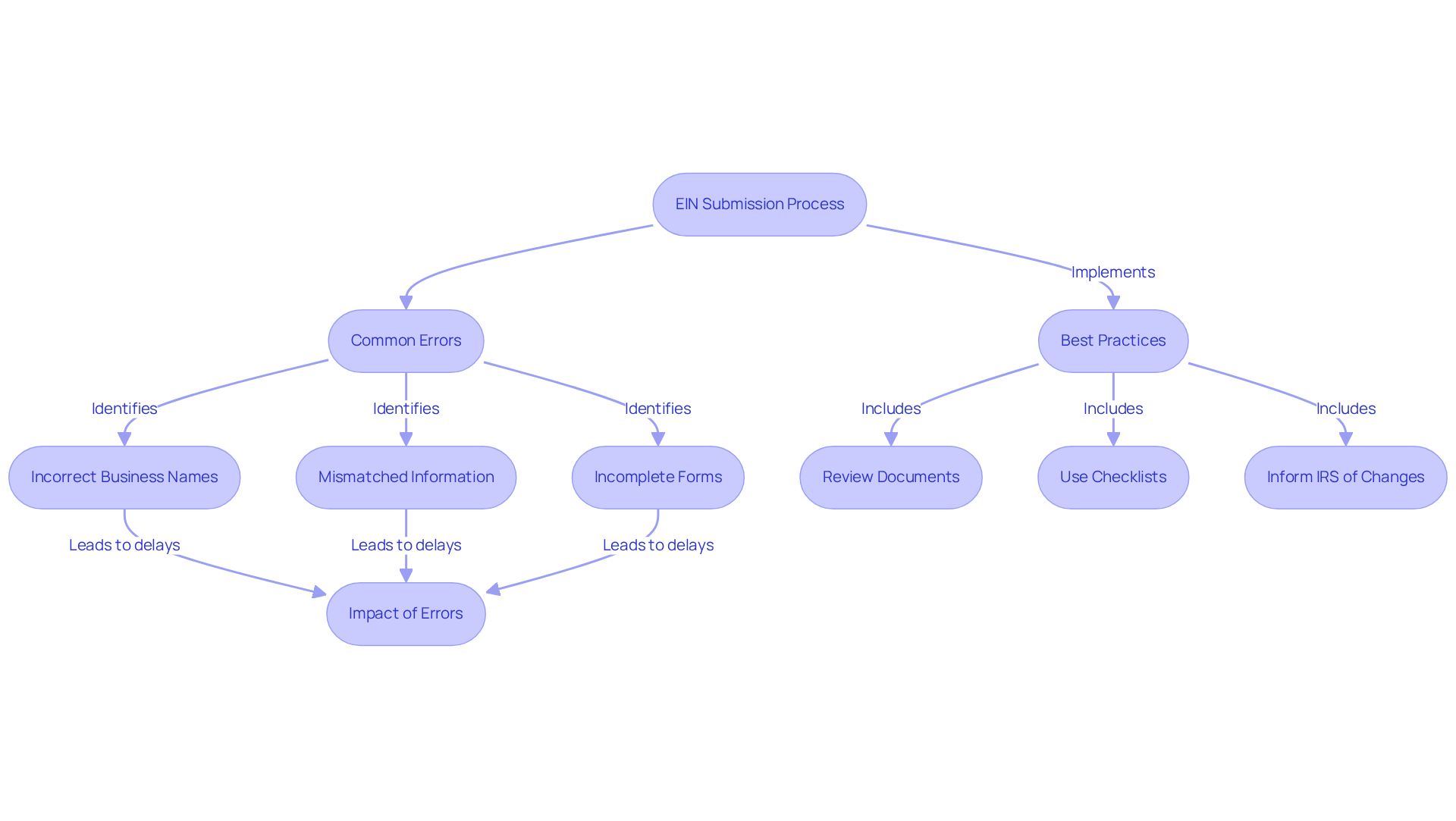

Common mistakes in EIN submissions can significantly delay processing and lead to complications. Frequent errors include:

- Incorrect business names

- Mismatched information

- Incomplete forms

To mitigate these issues, it is essential to meticulously review the document before submission.

Understanding that an EIN is not mandatory for simpler company structures, such as single-member LLCs or sole proprietorships, is crucial for entrepreneurs. can ensure that all required information is accurate and complete. Statistics indicate that a substantial number of EIN submissions are resubmitted due to mistakes, underscoring the necessity of carefulness in this procedure.

Additionally, it is important to inform the IRS of any changes made to your company details. By adopting these best practices, companies can save valuable time and avoid unnecessary delays when considering how long does it take to get an EIN number for an LLC.

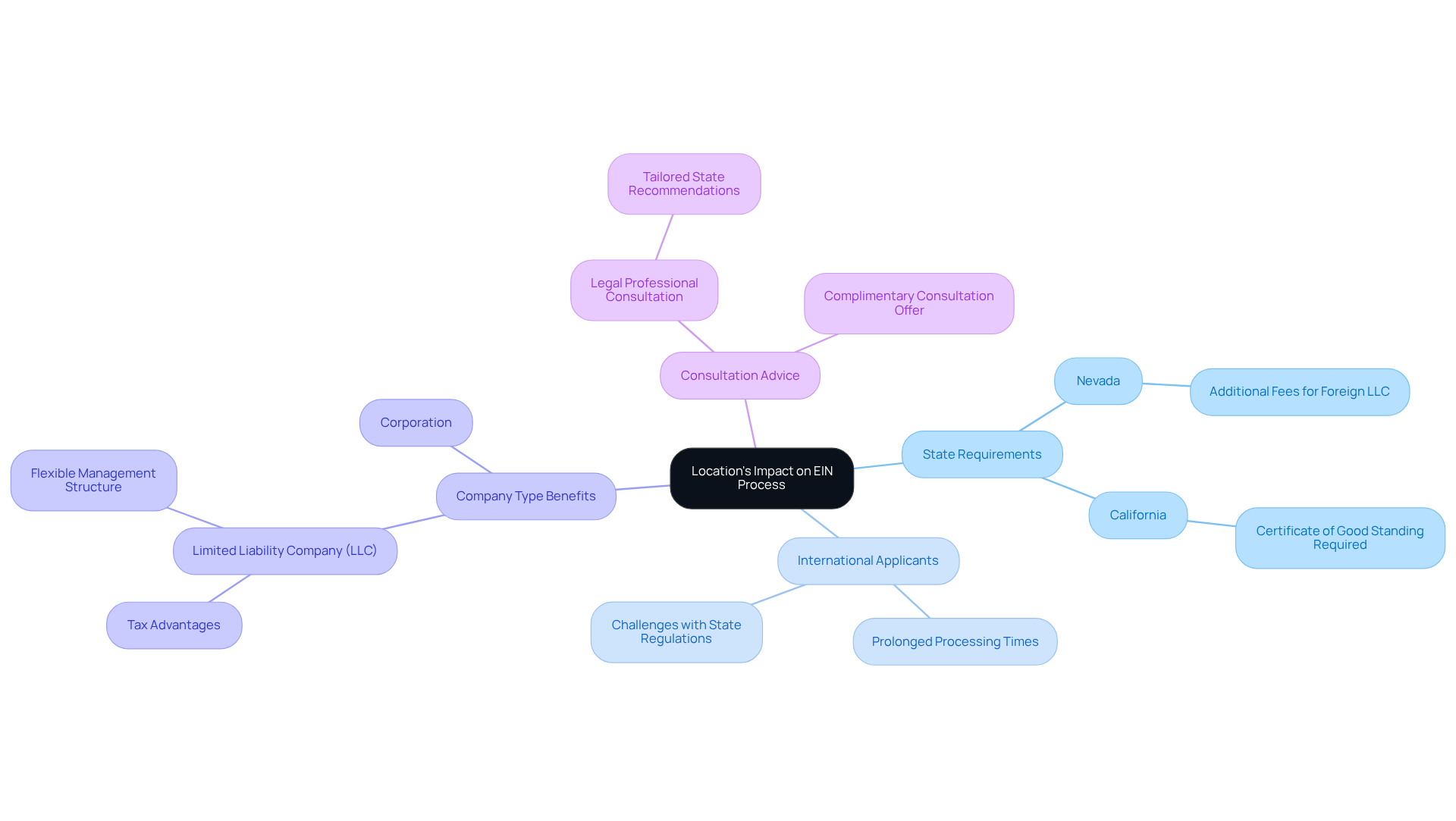

Consider Your Location’s Impact

The location of a company plays a crucial role in determining how long does it take to get an EIN number for an LLC. For international applicants, processing times can be significantly prolonged, especially when applications are submitted via mail or fax. Each state has unique requirements that can complicate the procedure; for example, Nevada imposes additional fees for registering as a foreign LLC, while California requires foreign entities to register and obtain a Certificate of Good Standing. Businesses outside the U.S. often face challenges in navigating these state-specific regulations, which can impact how long does it take to get an EIN number for an LLC.

Moreover, selecting the appropriate type of company, such as a Limited Liability Company (LLC) or Corporation, can offer substantial benefits, including tax advantages and a flexible management structure. As noted by Allison, users have expressed satisfaction with resources that provide clear answers to their inquiries, underscoring the importance of understanding these factors. Consulting a legal professional can also yield tailored advice on the most advantageous state for LLC formation, facilitating a smoother entry into the U.S. market. To discuss your specific needs and explore optimal options for your business, consider scheduling a with our expert team.

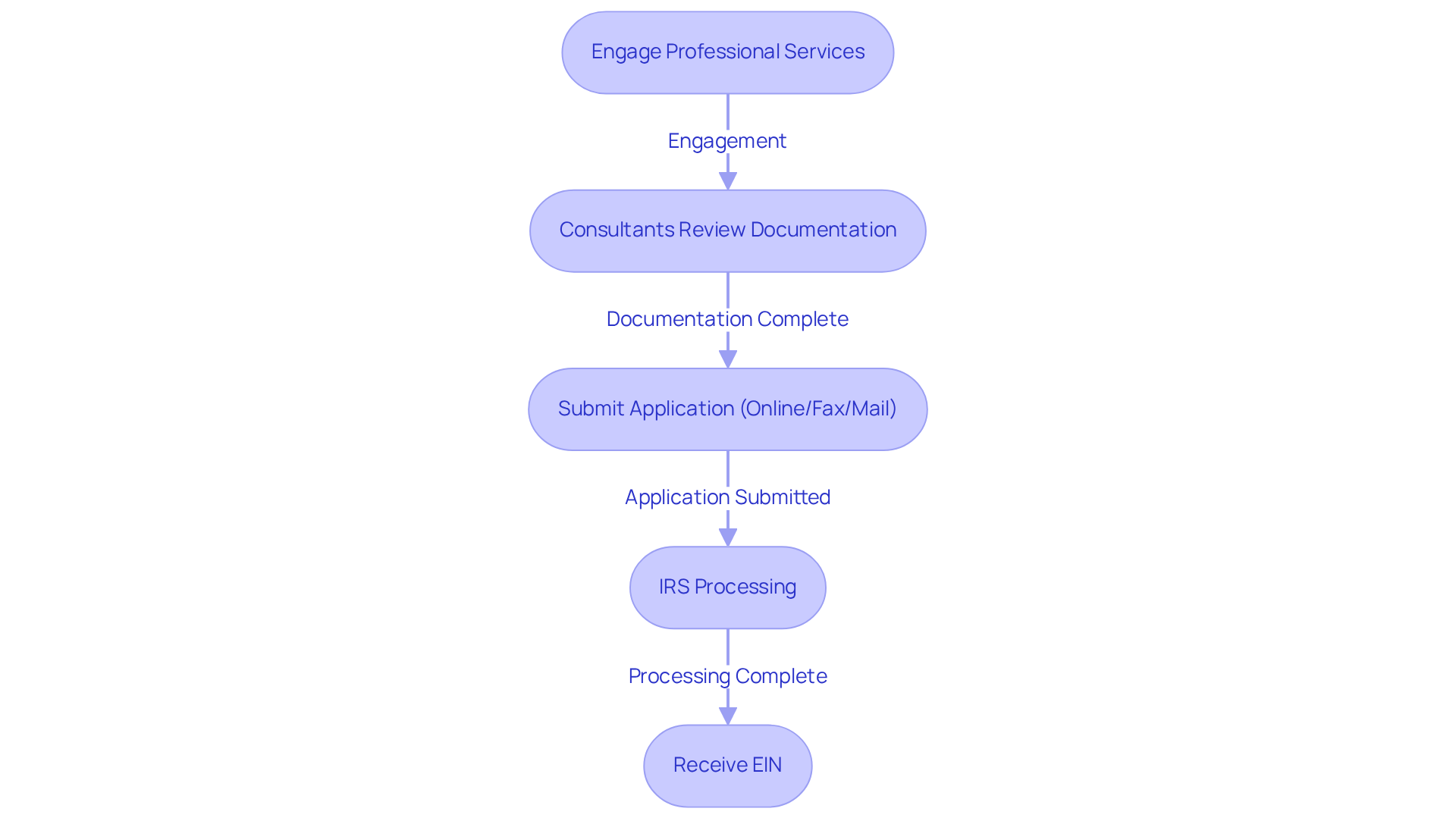

Utilize Professional Services for Expediency

Engaging professional services from Social Enterprises can significantly expedite how long it takes to get an EIN number for an LLC. Our consultants bring expertise that ensures all documentation is accurate and complete, thereby minimizing the risk of errors that could lead to delays. Their familiarity with IRS procedures enables them to provide tailored guidance on the most , whether online, by fax, or through mail. For instance, companies that have utilized our consulting services have reported markedly shorter processing times, often wondering how long does it take to get an EIN number for an LLC, and receiving their EINs within days rather than weeks.

According to the AICPA, delays in EIN issuance can have a substantial impact on U.S. commercial entities, particularly those lacking a social security number or individual taxpayer identification number. By leveraging the expertise of specialists at Social Enterprises, entrepreneurs can effectively navigate the complexities of understanding how long does it take to get an EIN number for an LLC processes, ensuring compliance and facilitating smoother business operations.

Additionally, we offer an EIN Expedition service, which allows Certified Acceptance Agents to collaborate directly with the IRS to expedite the retrieval of an EIN, addressing the question of how long does it take to get an EIN number for an LLC. Schedule your complimentary 15-minute consultation today to address your company formation and taxation inquiries.

Follow Up Timely with the IRS

Following up with the IRS after submitting your EIN request is essential, particularly if you have not received a response within the expected timeframe. The IRS typically processes online requests within minutes, while mail submissions may take four to five weeks, and fax submissions can take about one week if a return fax number is provided, leading many to ask how long does it take to get an EIN number for an LLC. However, when asking how long does it take to get an EIN number for an LLC, delays can occur due to incomplete information or a high volume of submissions. Maintaining detailed records of your submission and any correspondence with the IRS can significantly assist in resolving issues.

For instance, companies that proactively contacted the IRS regarding their EIN applications often found that straightforward follow-ups clarified misunderstandings or expedited processing. Tax professionals emphasize that timely follow-up is crucial, as it not only helps identify potential problems but also demonstrates a commitment to compliance.

An EIN is foundational for establishing your entity’s financial identity, particularly for complex structures such as LLCs and corporations. Therefore, is vital for your operations. Additionally, understanding when an EIN is required-such as for firms with employees or those aiming to formalize their organization-can simplify your company setup and facilitate efficient management of U.S. taxation. In contrast, simpler structures like sole proprietorships or single-member LLCs may only require an ITIN, highlighting the importance of knowing which identification number is appropriate for your type of enterprise.

Be Prepared and Organized

Preparation is crucial for a seamless . It is important to gather all necessary documents and information in advance, including:

- Details about your business structure

- Responsible party information

- Any required identification numbers

While an EIN is not mandatory for simpler structures, such as sole proprietorships and single-member LLCs, it is essential for more complex entities and those with employees. By organizing these elements, we can expedite the application process and reduce the risk of errors, helping to clarify how long does it take to get an EIN number for an LLC. Furthermore, if there are any changes to your company details, such as address or partners, it is imperative to inform the IRS to prevent future complications.

Conclusion

Obtaining an Employer Identification Number (EIN) for an LLC is essential for establishing a business. Understanding the factors that influence the timeline can significantly ease this process. Accurate information submission, the selection of the right business structure, and the appropriate application method are critical elements that can drastically affect how quickly an EIN is issued.

Key insights emphasize the necessity of meticulous preparation to avoid common errors that can lead to delays. The impact of IRS processing times varies based on submission methods, and utilizing professional services can streamline the application process. Additionally, understanding the implications of location and ensuring timely follow-ups with the IRS can further enhance the efficiency of obtaining an EIN.

In light of these considerations, entrepreneurs should be proactive and organized when applying for an EIN. By taking the necessary steps to ensure accuracy and seeking expert guidance when needed, businesses can navigate the EIN application process more effectively. This ultimately sets a solid foundation for their operations. Embracing these strategies not only expedites the EIN acquisition but also fosters compliance and readiness in the competitive business landscape.

Frequently Asked Questions

What is an Employer Identification Number (EIN) and why is it important?

An EIN is a unique identifier assigned to businesses for tax purposes. It is essential for certain organizational structures, such as Limited Liability Companies (LLCs) and corporations, particularly if the company has employees or operates in a complex manner.

What information is required when applying for an EIN?

Key details required for EIN applications include the organization’s legal name, entity type, and information about the responsible party. It is crucial to provide accurate and complete information to avoid processing delays.

What are the common causes of delays in EIN processing?

Incomplete or incorrect submissions are the primary causes of delays. Typical issues include missing information and errors in the application, which can lead to processing delays of several weeks.

How can I avoid delays when applying for an EIN?

To mitigate delays, it is advisable to double-check all entries for typos and ensure that every required field is accurately filled out. Utilizing tools or checklists can help streamline the application process and minimize errors.

Does the type of business structure affect the EIN application process?

Yes, selecting the appropriate organizational structure, such as an LLC or corporation, can influence the EIN application process. LLCs generally have simpler compliance obligations compared to corporations, which may require more documentation.

What application methods are available for obtaining an EIN?

Companies can apply for an EIN online, by fax, or by mail. The online method is the fastest, often resulting in immediate issuance of the EIN, while fax submissions take about four working days, and postal requests can take up to four weeks.

How quickly can I expect to receive my EIN if I apply online?

Companies that use the online submission method have reported obtaining their EIN in as little as two working days, making it the most efficient option for urgent needs.

When might an Individual Taxpayer Identification Number (ITIN) be used instead of an EIN?

An ITIN may suffice for sole proprietorships or single-member LLCs, while an EIN is necessary for certain organizational structures. Consulting with experts can help determine the appropriate identification number based on the business’s needs.