Introduction

Establishing a business in the U.S. presents a range of complexities for international entrepreneurs, particularly when it comes to fulfilling essential requirements such as obtaining an Employer Identification Number (EIN). This unique identifier is not just a bureaucratic formality; it is fundamental for tax compliance, banking, and operational legitimacy in a competitive landscape.

However, the process of applying for an EIN can be challenging, prompting many to ask: what are the critical steps and common pitfalls that could hinder their progress? This guide delineates the key aspects of acquiring an EIN, enabling foreign business owners to streamline their applications and lay a robust foundation for success.

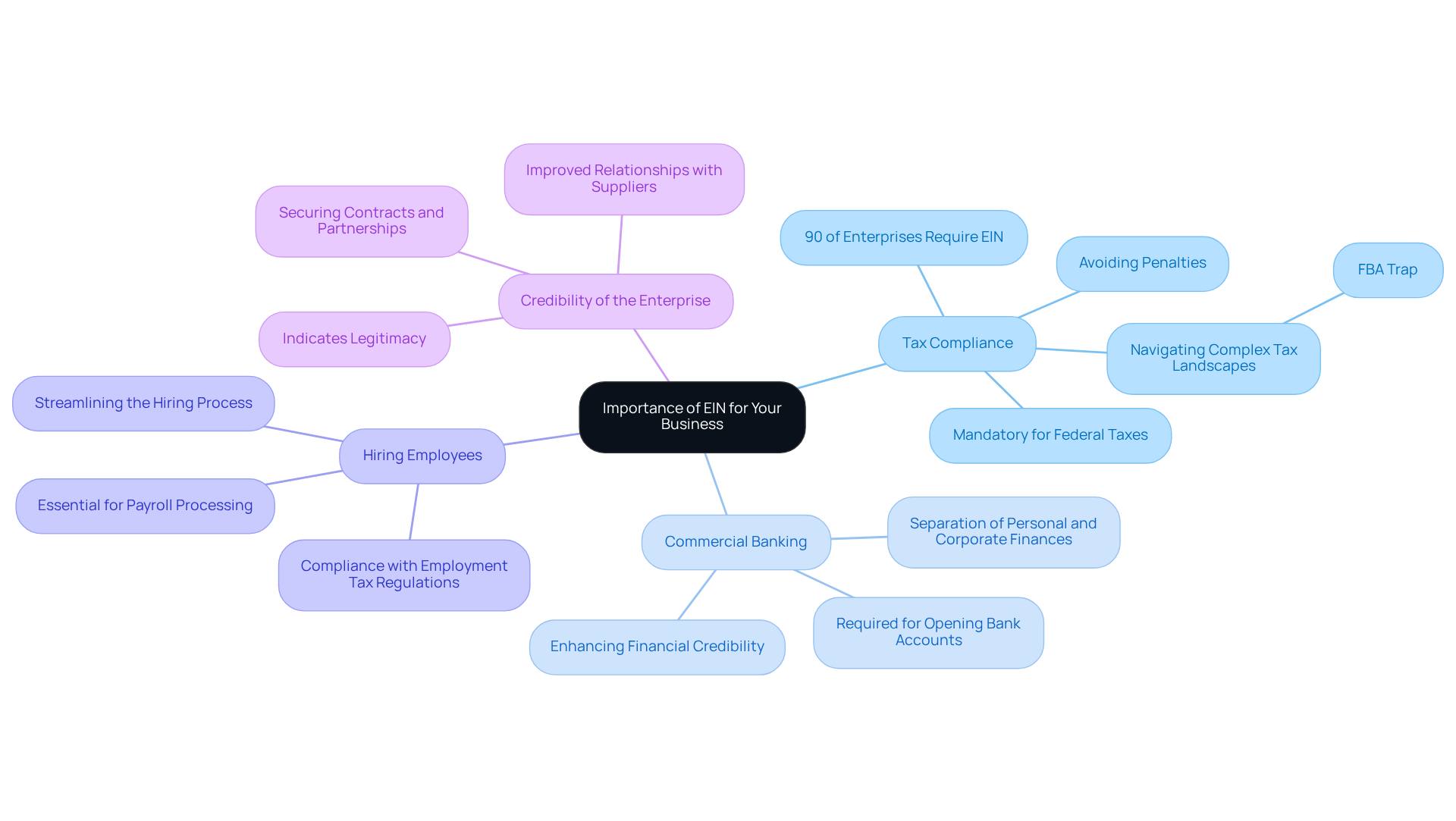

Understand the Importance of an EIN for Your Business

An Employer Identification Number (EIN) is a unique nine-digit identifier assigned by the IRS, crucial for your enterprise’s tax and operational needs, especially for e-commerce and gaming ventures in the U.S. Here are the key reasons why obtaining an EIN is essential:

- Tax Compliance: An EIN is mandatory for filing federal taxes, ensuring your business meets legal obligations and avoids penalties. Approximately 90% of enterprises require an EIN for tax compliance, highlighting its significance in maintaining regulatory standards, particularly for e-commerce firms navigating complex tax landscapes, including the FBA trap.

- Commercial Banking: Most banks require an EIN to open a commercial bank account, which is vital for distinguishing personal and corporate finances. This separation simplifies accounting and enhances financial credibility, a crucial factor for e-commerce entrepreneurs.

- Hiring Employees: If you plan to hire employees, an EIN is essential for payroll processing and tax reporting. It streamlines the hiring process and ensures compliance with employment tax regulations, which is particularly important for startups in the e-commerce sector.

- Credibility of the Enterprise: Having an EIN enhances your enterprise’s credibility with clients and suppliers, indicating that you are a legitimate entity. This credibility can be a deciding factor in securing contracts and partnerships, especially in competitive markets like e-commerce and gaming.

Real-world examples illustrate the benefits of having an EIN. Enterprises that have obtained an EIN report smoother banking experiences and improved relationships with suppliers, as they can demonstrate their legitimacy and compliance. As international entrepreneurs face unique challenges in 2026, such as navigating complex U.S. regulations and potential delays in the EIN application process, having an EIN will remain a fundamental requirement for operational success. Thus, an EIN is not just a number; it is a cornerstone of your enterprise identity in the U.S., essential for various operational aspects.

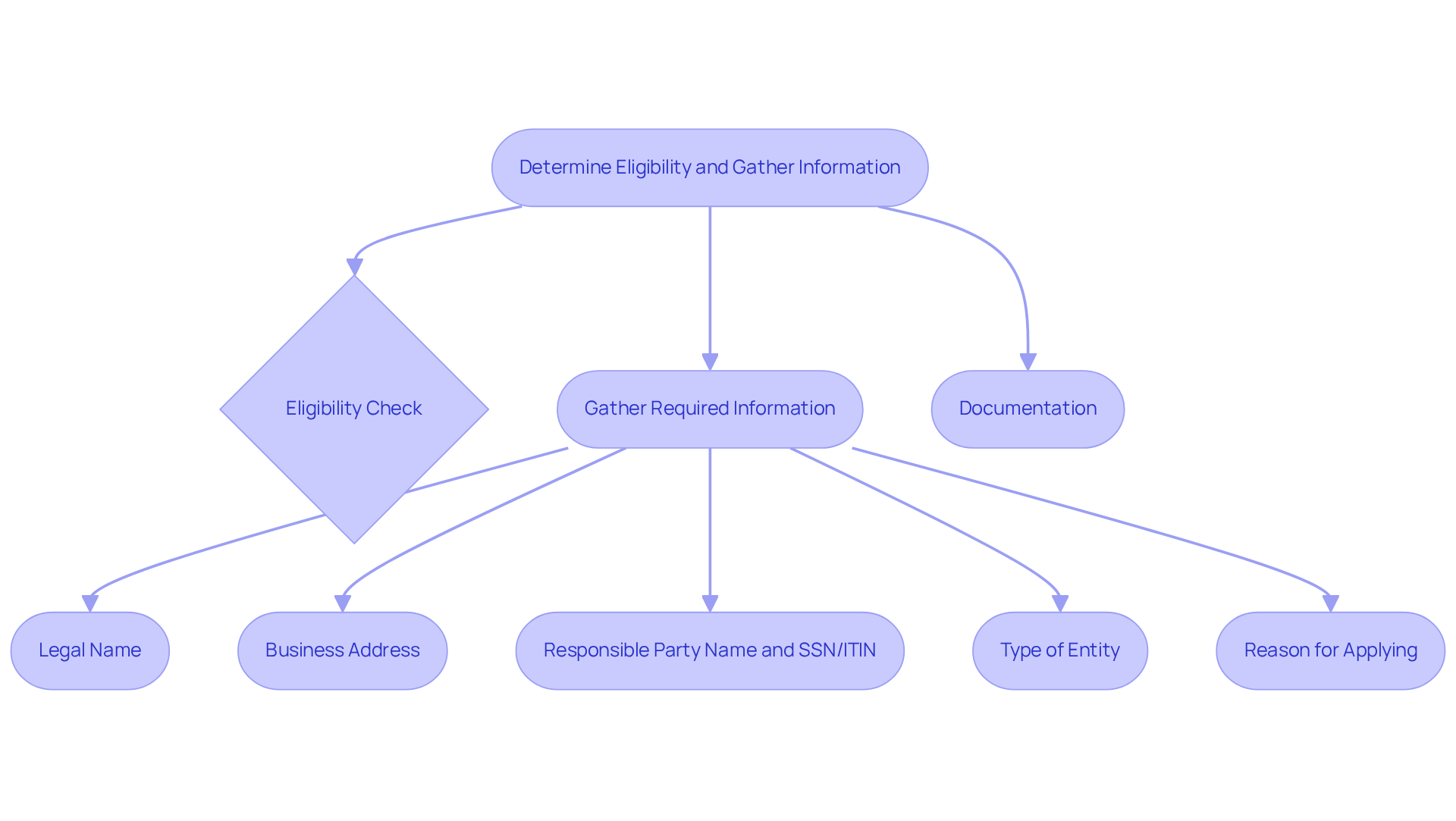

Determine Your Eligibility and Gather Required Information

Before applying for a new EIN number, it is essential to confirm your eligibility and gather the necessary information. Follow these steps:

-

Eligibility Check: Verify that you qualify to apply for an EIN. Typically, any commercial organization, including sole proprietors, partnerships, corporations, and nonprofits, is eligible. For certain structures, such as single-member LLCs or sole proprietorships, an Individual Taxpayer Identification Number (ITIN) may suffice; however, an EIN is required for more complex arrangements and those with employees.

-

Gather Required Information: Collect the following details:

- Legal name of the business entity.

- Business address (a U.S. address is typically required for compliance).

- Name and Social Security Number (SSN) or ITIN of the responsible party, who manages or directs the organization.

- Type of entity (LLC, corporation, etc.).

- Reason for applying (e.g., starting a new venture, hiring employees).

-

Documentation: Prepare any additional documents that may be necessary, such as formation documents or partnership agreements.

Having all necessary information and documentation prepared can significantly simplify the process, assisting you in avoiding common pitfalls. For instance, ensuring that the business name matches exactly with the legal documents can prevent delays. Additionally, international applicants should be aware that they can apply for an EIN via phone if they have the necessary information at hand; however, this method may result in longer wait times for receiving the EIN. This preparation is crucial, as the enrollment process can take only a few minutes online, with immediate issuance of the EIN upon successful submission.

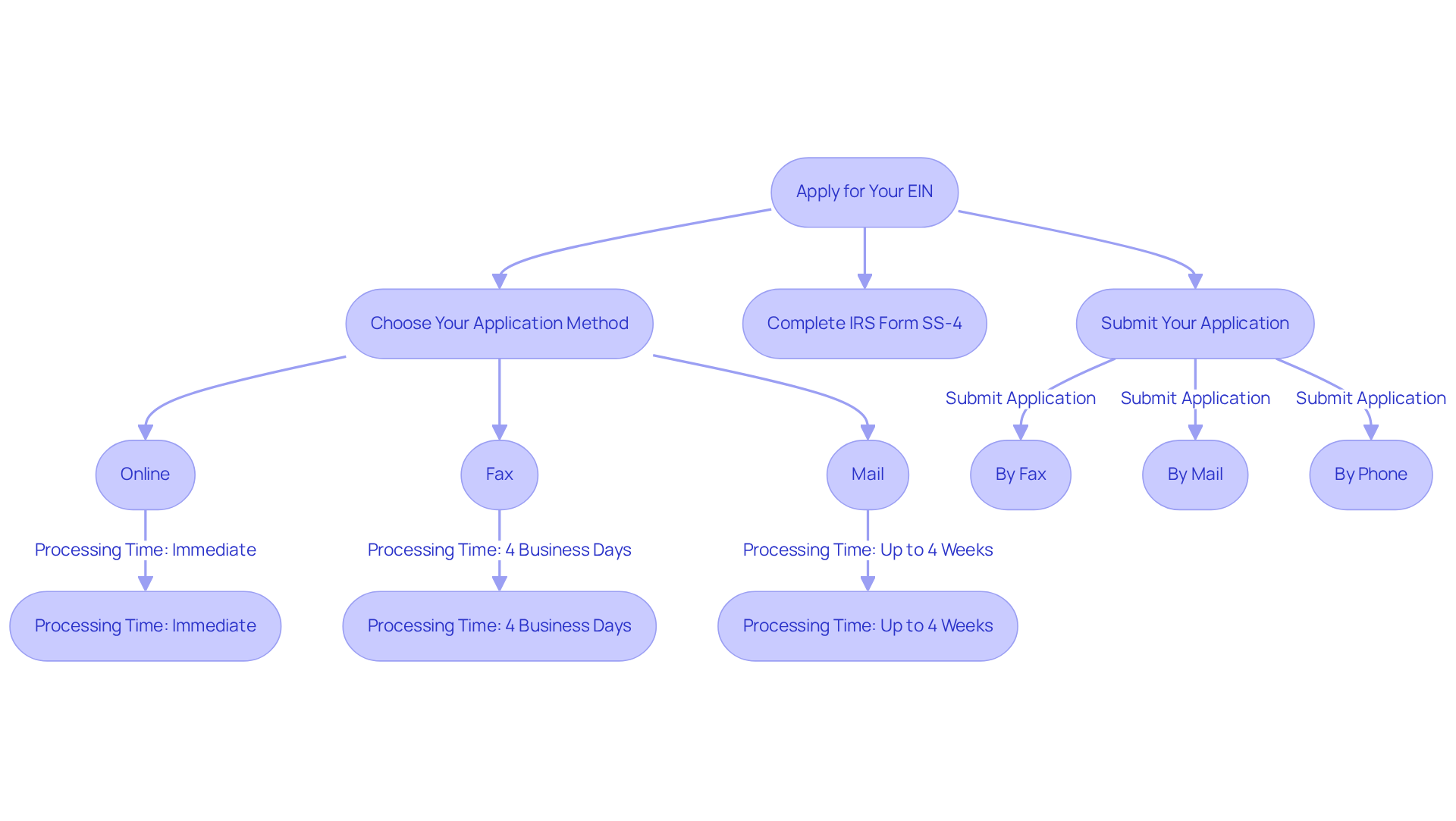

Apply for Your EIN: Step-by-Step Application Process

To apply for your EIN, follow these steps:

-

Choose Your Application Method: You can apply for an EIN online, by fax, or by mail. For international candidates, online submissions are generally not accessible, so fax or mail is advised. Online applications allow for the prompt issuance of the new EIN number, whereas fax applications require around four working days, and mail applications may take up to four weeks, particularly during peak IRS workload.

-

Complete IRS Form SS-4: Download and fill out Form SS-4. Ensure that all information is accurate and matches your business documents. Key sections to complete include:

- Line 1: Legal name of the entity.

- Line 7a: Name of the responsible party.

- Line 8a: Type of entity. Precision is vital; mistakes can result in setbacks as the IRS may highlight submissions for clarification or rejection.

-

Submit Your Application:

- By Fax: Send the completed Form SS-4 to the appropriate fax number provided by the IRS (855-641-6935 for international applicants). This method typically results in faster processing compared to mail.

- By Mail: If you prefer to apply by mail, send your completed form to the address specified on the IRS website. Be aware that this method is the slowest, often taking several weeks.

- By Phone: International applicants can also apply for an EIN by calling 267-941-1099 from 6:00 a.m. to 11:00 p.m. ET, Monday through Friday.

Obtain your new EIN number: If your request is approved, you will receive your new EIN number promptly if applying by fax. For postal requests, anticipate waiting a few weeks. Keep this number secure, as it is essential for your business operations, including tax filings and opening bank accounts. Additionally, if you make any changes to your company details, such as address or partners, ensure to inform the IRS to avoid future issues.

Following these steps carefully will help ensure a successful request for your EIN.

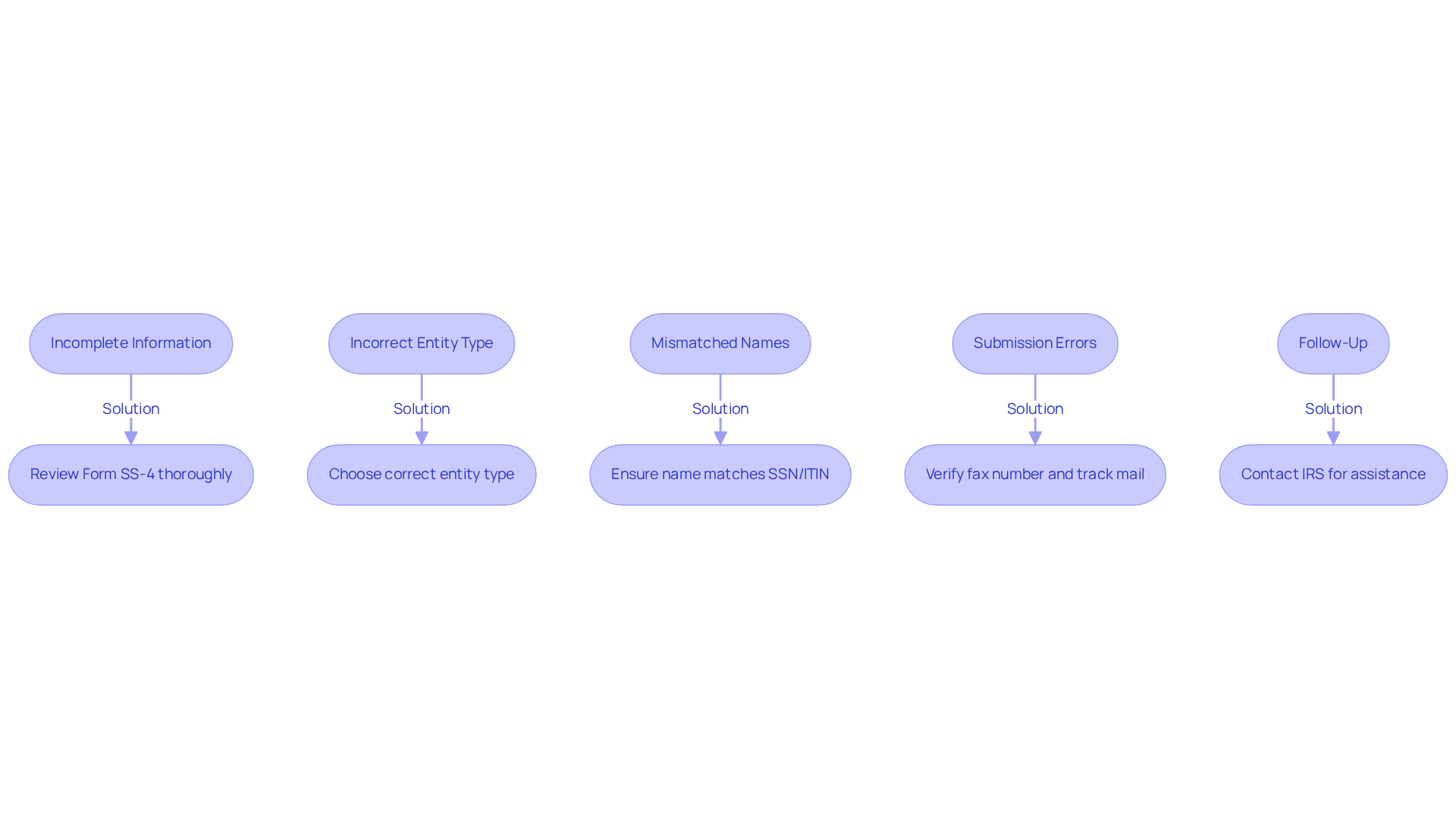

Avoid Common Mistakes and Troubleshoot Application Issues

To ensure a smooth EIN application process, it is crucial to be aware of common mistakes and how to troubleshoot them effectively:

-

Incomplete Information: Thoroughly review Form SS-4 to ensure all fields are filled out completely. Missing information can result in considerable delays or outright denials, with statistics indicating that nearly 30% of EIN requests are rejected due to incomplete submissions.

-

Incorrect Entity Type: Selecting the correct entity type is essential. Misclassification can lead to errors that complicate the process and delay your EIN issuance. For game companies, it is important to consider whether an LLC or Corporation is more suitable for your needs, as LLCs offer flexibility and tax advantages.

-

Mismatched Names: The name of the responsible party must exactly match the SSN or ITIN provided. Discrepancies can lead to rejections, underscoring the significance of precision in your submission.

-

Submission Errors: When applying by fax, verify that the fax number is correct and ensure you receive confirmation of receipt. For mailing purposes, utilizing a trackable mailing service can provide peace of mind and assist in preventing lost submissions.

-

Follow-Up: If your EIN is not received within the expected timeframe, promptly contact the IRS at +1-267-941-1099 for assistance. Be prepared to provide your company details and the date of your request to facilitate the inquiry.

By proactively addressing these common issues, international entrepreneurs can significantly enhance their chances of successfully applying for a new EIN number, thereby avoiding potential pitfalls that could hinder their business operations.

Conclusion

Obtaining an Employer Identification Number (EIN) is a crucial step for international entrepreneurs aiming to establish their businesses in the U.S. This unique identifier not only facilitates tax compliance but also enhances credibility, simplifies banking processes, and is essential when hiring employees. Understanding the importance of an EIN significantly impacts the operational success of e-commerce and gaming ventures, making it more than just a regulatory requirement; it serves as a cornerstone of business identity.

The article highlights key points regarding:

- The eligibility criteria for obtaining an EIN

- The necessary documentation

- The step-by-step application process

It emphasizes the importance of accuracy and completeness in submissions while addressing common pitfalls that could lead to application delays or rejections. By being proactive and informed, international entrepreneurs can navigate the EIN application process more effectively, ensuring their businesses are set up for success.

In conclusion, the significance of securing an EIN cannot be overstated for foreign entrepreneurs aiming to thrive in the U.S. market. By understanding the requirements and avoiding common mistakes, business owners can streamline their application process and focus on growing their enterprises. For those embarking on this journey, taking the first step towards obtaining an EIN is crucial, as it lays the foundation for a compliant and credible business presence in a competitive landscape.

Frequently Asked Questions

What is an Employer Identification Number (EIN)?

An EIN is a unique nine-digit identifier assigned by the IRS that is crucial for a business’s tax and operational needs, particularly for e-commerce and gaming ventures in the U.S.

Why is obtaining an EIN important for tax compliance?

An EIN is mandatory for filing federal taxes, helping businesses meet legal obligations and avoid penalties. Approximately 90% of enterprises require an EIN for tax compliance, especially in complex tax landscapes.

How does an EIN facilitate commercial banking?

Most banks require an EIN to open a commercial bank account, which is essential for separating personal and corporate finances, simplifying accounting, and enhancing financial credibility.

What role does an EIN play in hiring employees?

An EIN is essential for payroll processing and tax reporting when hiring employees, streamlining the hiring process and ensuring compliance with employment tax regulations.

How does having an EIN enhance a business’s credibility?

An EIN enhances a business’s credibility with clients and suppliers, indicating that it is a legitimate entity, which can be crucial for securing contracts and partnerships.

What are some real-world benefits of having an EIN?

Enterprises with an EIN report smoother banking experiences and improved relationships with suppliers, as they can demonstrate their legitimacy and compliance.

What challenges might international entrepreneurs face regarding EINs in 2026?

International entrepreneurs may encounter challenges such as navigating complex U.S. regulations and potential delays in the EIN application process, making it essential to have an EIN for operational success.

Why is an EIN considered a cornerstone of a business’s identity in the U.S.?

An EIN is fundamental for various operational aspects, making it a cornerstone of a business’s identity and essential for legitimacy and compliance in the U.S. market.