Introduction

Crafting an effective operating agreement is essential for the success and legal protection of any Limited Liability Company (LLC). This foundational document outlines not only the legal requirements and member responsibilities but also establishes guidelines for dispute resolution, profit distribution, and management structure. Many LLC owners face challenges in ensuring their agreements comply with state-specific regulations and adapt to evolving business needs. Entrepreneurs must navigate these complexities to create a robust operating agreement that safeguards their interests while fostering a collaborative environment. This article explores the ten essential elements of an operating agreement, offering insights and examples that empower LLCs to thrive in a competitive landscape.

Establish Legal Requirements for Your LLC Operating Agreement

An LLC formation document must begin by outlining the legal requirements specific to the state of establishment. This includes essential elements such as:

- The name of the LLC

- The registered agent

- The purpose of the business

Additionally, it should delineate the governing laws applicable to the contract, ensuring that all participants understand the legal framework in which they operate.

Understanding these legal requirements is particularly crucial for e-commerce and gaming businesses, as it aids in ensuring compliance with state regulations and tax obligations. This foundational step is vital to mitigate potential legal disputes and to effectively navigate the complexities of tax compliance.

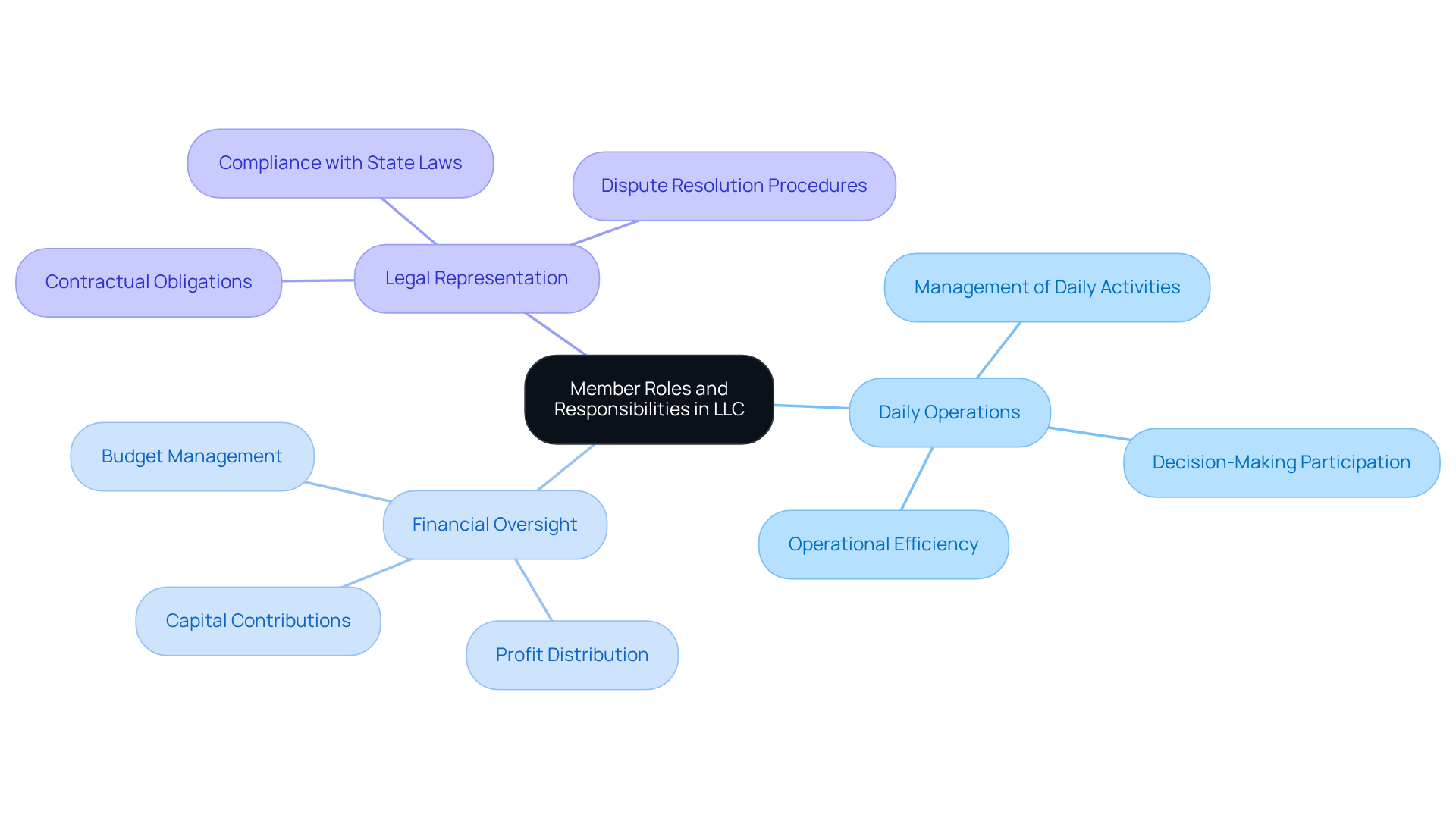

Define Member Roles and Responsibilities in the Agreement

An operating agreement example is essential for clearly outlining the roles and duties of each participant in an LLC to ensure its seamless functioning. This includes specifying who will manage daily operations, oversee financial matters, and represent the LLC in legal contexts. By defining these roles, the arrangement minimizes potential conflicts and ensures that all participants are aware of their contributions to the business.

For instance, a well-organized operational document can specify terms for role modifications as the LLC grows, adapting to changes in management dynamics and business requirements. Research indicates that LLCs with clearly defined responsibilities for participants experience higher success rates; indeed, over 27,102 reviews have led to a rating of 4.6 out of 5. Furthermore, expert perspectives suggest that a lack of clear roles can lead to conflicts, underscoring the necessity of an operating agreement example. As noted, “Without one, your company defaults to the state’s default rules,” which highlights the risks associated with not having clear guidelines.

Examples of effective operational contracts illustrate how a clear delineation of duties not only enhances operational efficiency but also serves as a foundation for conflict prevention, ensuring that all participants are aligned with the LLC’s goals.

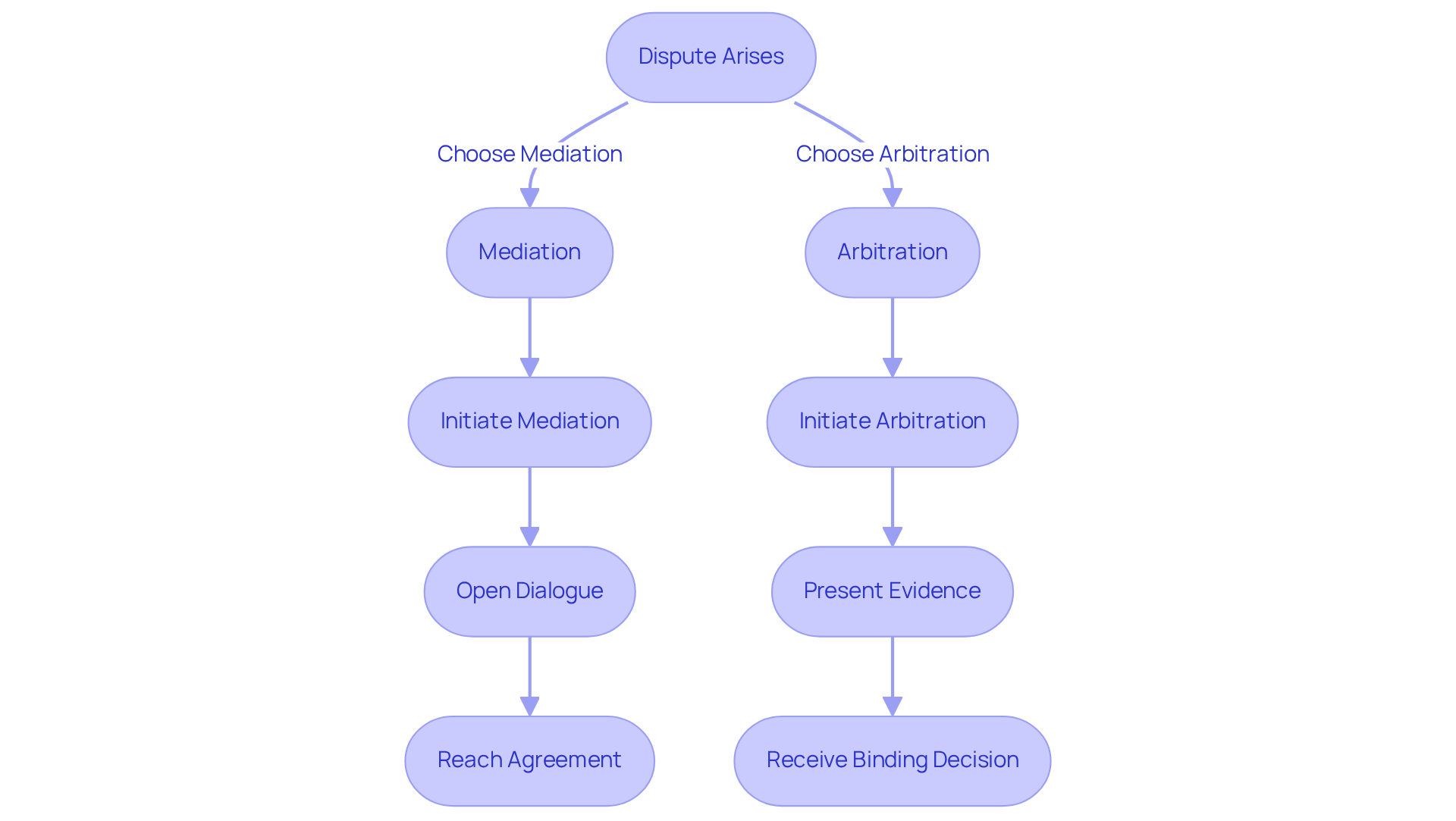

Incorporate Dispute Resolution Procedures

Including a strong segment on dispute resolution processes in a foundational document is essential for any LLC. This section should clearly outline the steps for mediation and arbitration, which serve as effective alternatives to litigation – often a costly and protracted process. By implementing a systematic method for conflict resolution, the arrangement not only facilitates effective management of disputes but also aids in preserving positive relationships among participants.

Mediation, for instance, encourages open dialogue and collaboration, allowing parties to explore mutually beneficial solutions. In contrast, arbitration provides a more formalized setting where an impartial third party makes binding decisions. Both methods can significantly reduce the emotional and financial toll associated with disputes, making them preferable options for LLCs.

Furthermore, including specific procedures for initiating mediation or arbitration can streamline the resolution process, ensuring that conflicts are addressed promptly and effectively. As noted by Klafehn, Heise & Johnson P.L.L.C., “Your LLC should have clear provisions for… Dispute resolution processes.” Additionally, it is crucial to compare the costs of mediation versus litigation, as mediation typically offers a more economical solution. Ensure your arrangement details specific procedures for initiating mediation or arbitration to assist participants in effectively applying these processes.

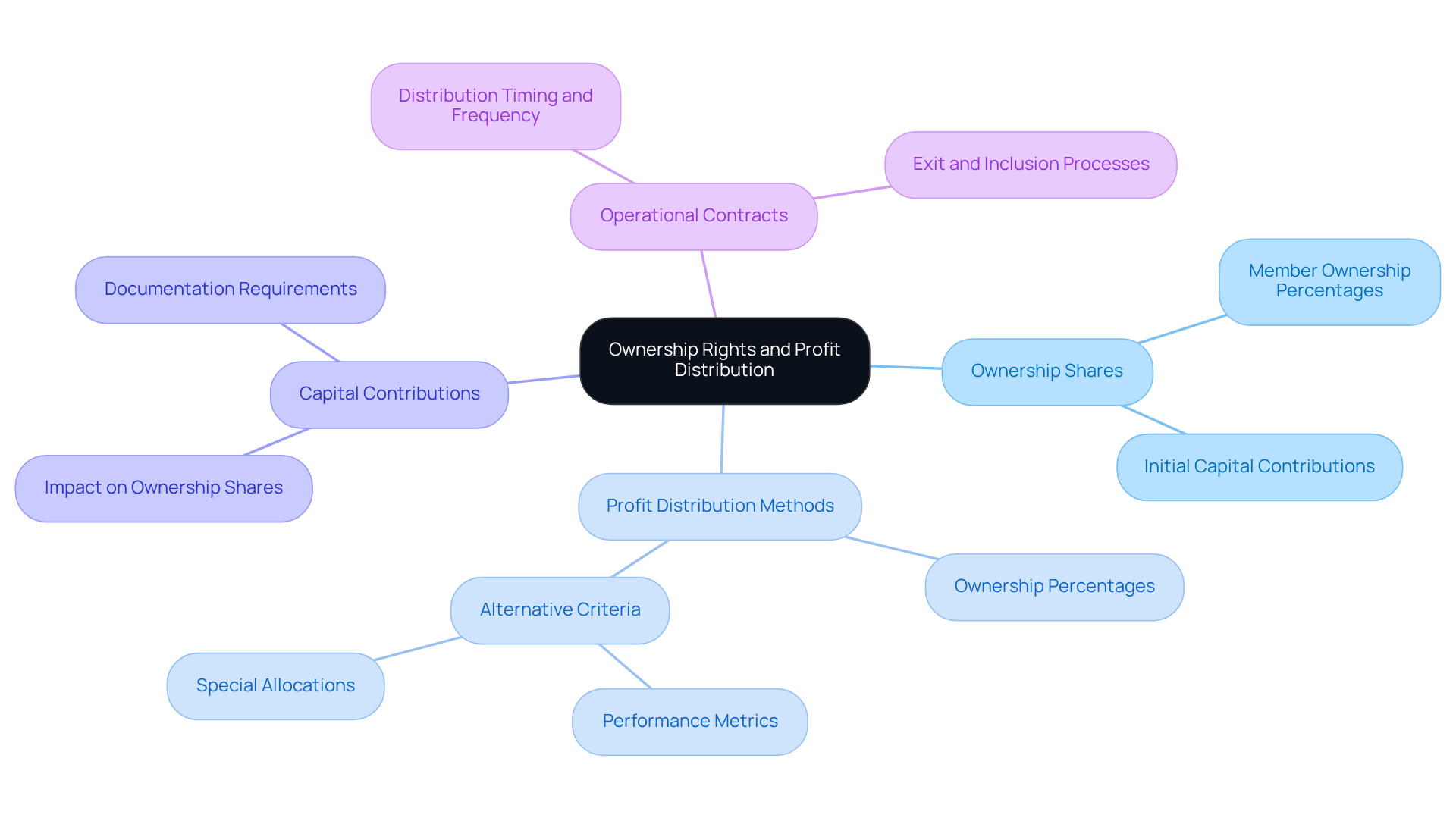

Outline Ownership Rights and Profit Distribution

An operating agreement example must clearly outline each participant’s ownership share and the method for distributing profits and losses. This includes specifying whether distributions will be allocated based on ownership percentages or through alternative criteria, such as initial capital contributions or performance metrics. Furthermore, the contract should detail how these capital contributions affect ownership shares and elaborate on the processes for managing the exit or inclusion of participants.

The operating agreement example establishes clear profit distribution guidelines, minimizing the likelihood of conflicts and aligning all participants on financial expectations. Financial advisors underscore the necessity of documenting these provisions to ensure transparency and fairness in profit-sharing arrangements.

It is essential to seek expert advice when determining the most suitable company structure, as this can significantly influence taxation and operational dynamics. Many LLCs adopt a straightforward operating agreement example where profits are divided in proportion to ownership stakes, while others may implement more complex arrangements, such as special allocations for individuals who contribute significantly to the business.

Efficient operational contracts frequently contain provisions that focus on the timing and frequency of distributions, ensuring that all participants are informed and prepared for financial transactions. Overall, a well-organized arrangement serves as a vital resource for maintaining harmony among participants and safeguarding the LLC’s operational integrity.

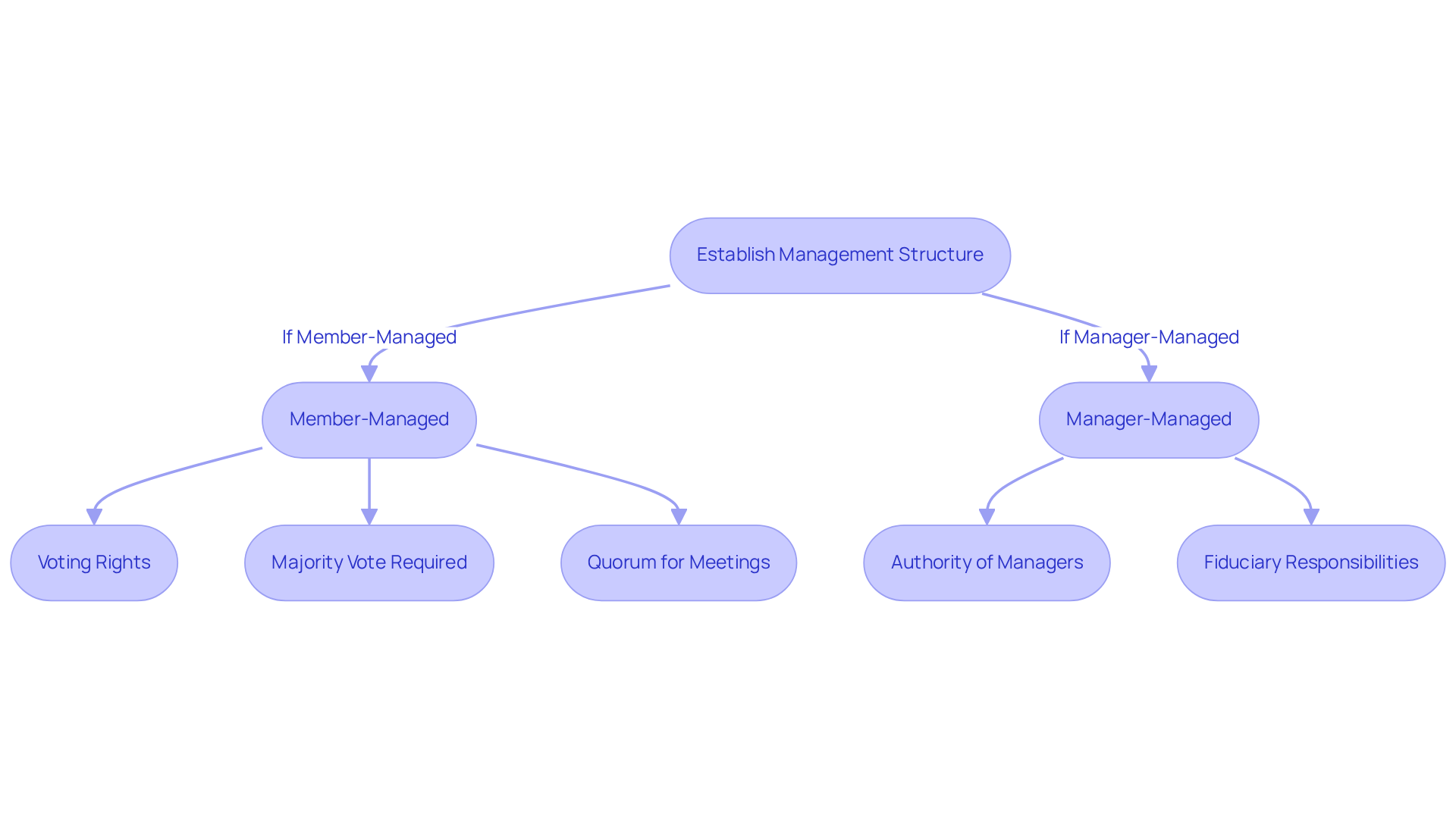

Establish Management Structure and Decision-Making Processes

The operating document must clearly specify whether the LLC will be member-managed or manager-managed, as this distinction significantly influences decision-making authority. In a member-managed LLC, each participant possesses the right to vote, with a majority vote required for any action. The agreement should detail the voting processes, including the methods of conducting votes and the quorum necessary for meetings. Furthermore, it can delineate the specific authorities of managers or participants in making decisions on behalf of the LLC, as well as the fiduciary responsibilities owed by participants in a participant-managed structure.

Establishing a clear management framework not only clarifies responsibilities but also fosters transparency among individuals regarding decision-making processes. This clarity is particularly crucial in larger LLCs, where centralized decision-making can streamline operations and reduce potential conflicts. Industry specialists emphasize that an operating agreement example can prevent disorder and delays in decision-making, ensuring that all members align with the business’s performance objectives.

Additionally, it is vital to acknowledge that under the Revised Uniform Limited Liability Company Act (RULLCA), all operational contracts, such as an operating agreement example, must be documented, underscoring the importance of formalizing these arrangements.

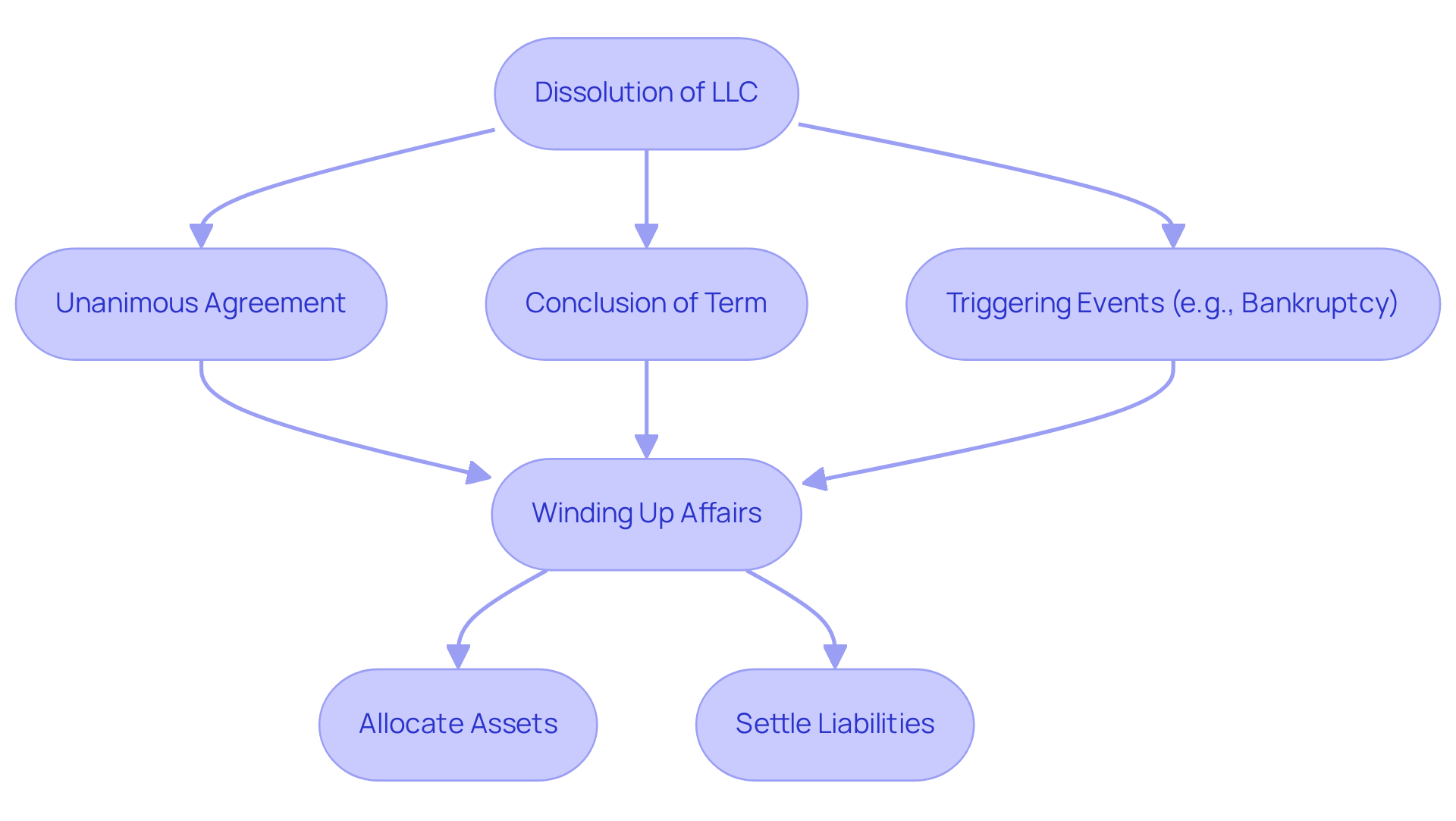

Specify Terms for Dissolution of the LLC

A comprehensive dissolution clause is essential in an operating agreement example for an LLC, specifying the conditions under which the entity may be dissolved. Typical scenarios for dissolution include:

- Unanimous agreement among participants

- The conclusion of a predetermined term

- Specific triggering events such as bankruptcy

The agreement should also delineate the procedures for winding up the LLC’s affairs, detailing the allocation of assets and the settlement of liabilities.

An operating agreement example with clear dissolution terms not only safeguards the interests of participants but also facilitates a smooth transition when the LLC ceases operations. Legal professionals emphasize that well-defined dissolution procedures can significantly influence participant retention, as they provide clarity and assurance during uncertain times. For example, LLCs with explicit dissolution processes have demonstrated improved outcomes in managing participant expectations and minimizing disputes.

Moreover, with the recent introduction of Law 239/2025, effective December 18, 2025, which outlines new regulations regarding the dissolution of legal entities, it is imperative for LLCs to remain informed and compliant to avoid potential penalties. Maintaining detailed records throughout the dissolution process is crucial, as non-compliance with these procedures can lead to significant legal and financial repercussions.

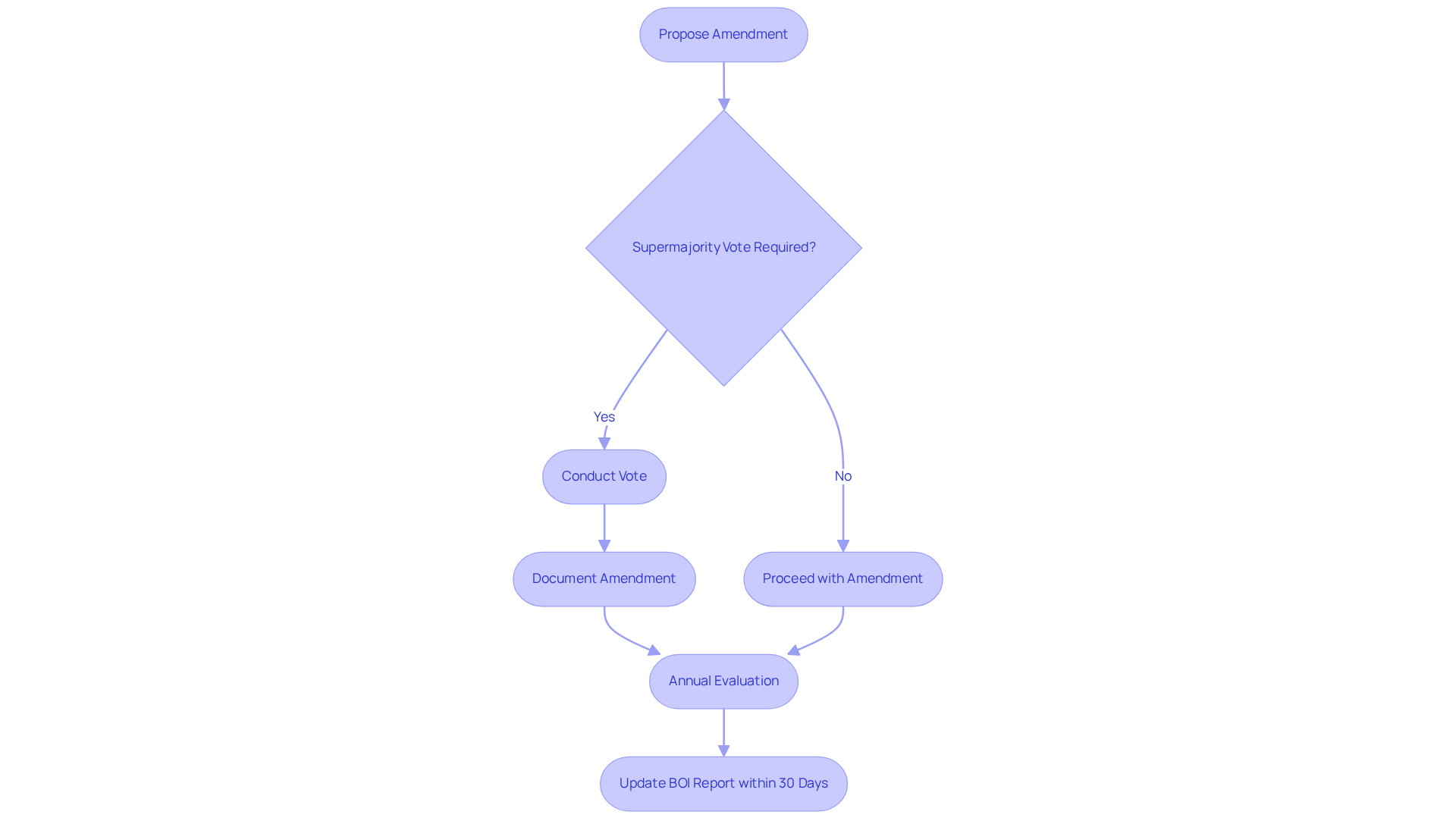

Include Amendment Procedures for Flexibility

A successful arrangement must clearly define the procedures for modifying the document, including participant approval requirements, the process for suggesting alterations, and necessary documentation. Establishing these amendment procedures is crucial for enabling the LLC to adapt to changing conditions, such as alterations in membership or modifications in business strategy, without compromising the integrity of the original contract. For instance, a flexible LLC management document might stipulate that amendments require a supermajority vote, ensuring that significant changes reflect the collective will of the members.

Regular evaluations of the operational contract, ideally on an annual basis or following significant business milestones, can facilitate timely updates and prevent disputes. As Carl Breedlove notes, keeping your business document current can yield long-term benefits, ensuring it accurately represents the current state of the enterprise. Furthermore, the frequency of amendments may vary based on the LLC’s growth and operational changes, with some businesses opting to revise their contracts multiple times a year to align with new governance rules or ownership stakes. This adaptability is essential for maintaining compliance and operational efficiency, particularly as regulatory requirements evolve.

Additionally, when considering the structure of your business, it is important to recognize that LLCs are generally subject to individual taxation, unlike corporations, which face double taxation. This distinction can significantly influence your financial strategy. For example, businesses have 30 days after an amendment to update their BOI report, underscoring the importance of timely documentation. By proactively managing amendments, LLCs can protect their interests and ensure smooth decision-making processes.

Document Accounting Practices and Financial Management

The managing document must clearly outline the accounting methods that the LLC will adopt. It should detail how financial records will be maintained, the frequency of financial reporting, and the procedures for handling income and expenses. Additionally, it should designate individuals responsible for bookkeeping and financial oversight. By formalizing these practices, the arrangement promotes transparency and responsibility among participants, ensuring that all stakeholders are aware of the LLC’s financial condition.

This structured approach not only enhances operational efficiency but also aligns with established practices in financial management, which are essential for the long-term success of the LLC. As noted by Sean M. Buckley, the clarity provided by recent amendments to the New York Limited Liability Company Transparency Act emphasizes the importance of compliance in financial practices. Furthermore, with 58% of enterprises adopting cloud accounting solutions, integrating modern accounting practices can significantly improve financial management.

LLCs formed before January 1, 2026, must also be aware of the compliance deadline to file beneficial ownership disclosures by January 1, 2027, to ensure adherence to regulatory requirements.

Ensure Compliance with State-Specific Requirements

To maintain the legal integrity of an LLC, it is essential to meticulously craft the foundational document in accordance with the specific requirements of the state where the LLC is established. This document must include mandatory provisions such as:

- Member voting rights

- Management structure

- Financial reporting obligations

Adhering to these state-specific regulations not only safeguards the LLC’s legal status but also significantly reduces the likelihood of conflicts or fines.

For example, New York has introduced new compliance measures effective January 2026, requiring all LLCs to file beneficial ownership disclosures. Understanding these nuances is vital for ensuring compliance and operational efficiency across various jurisdictions.

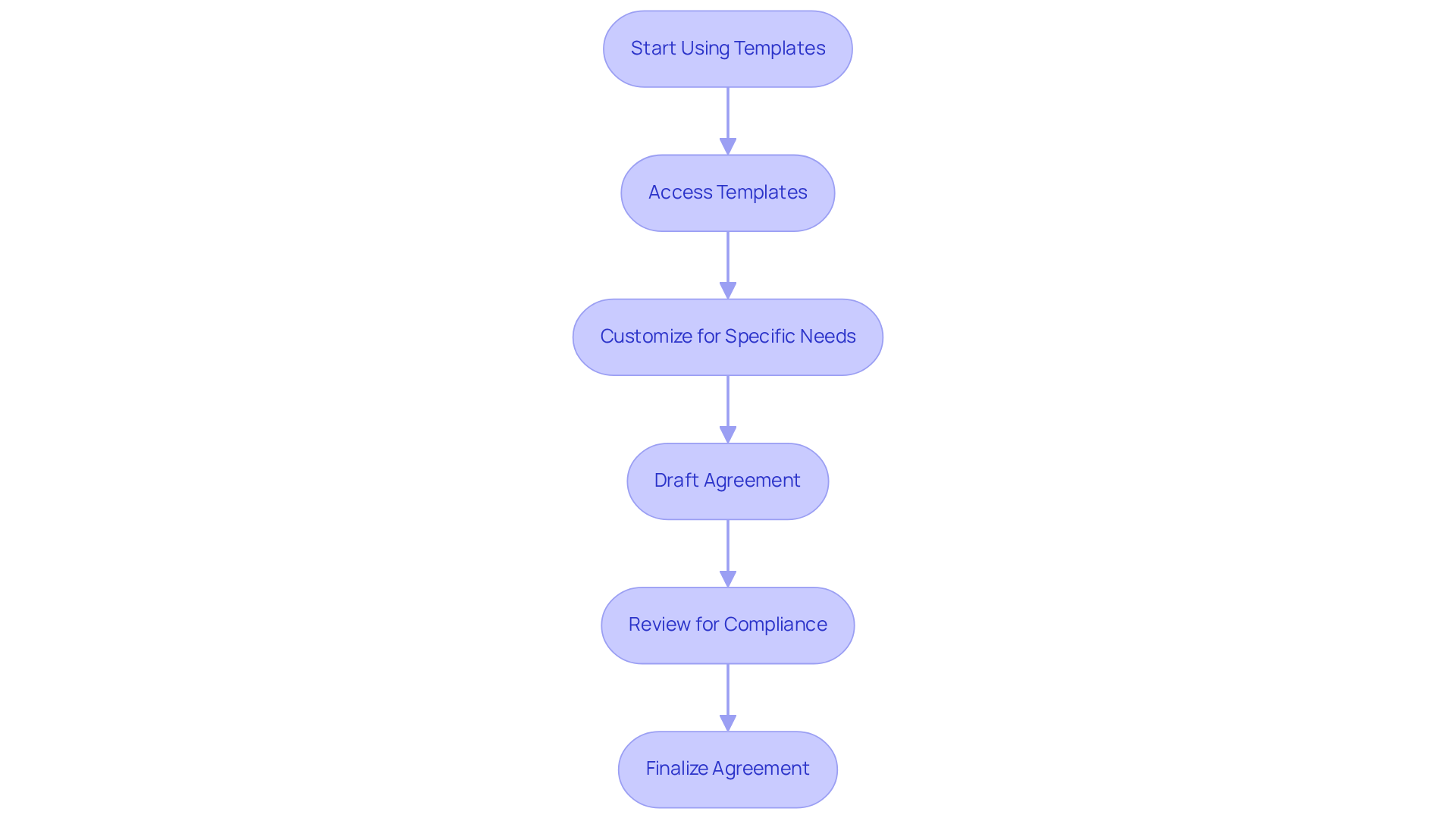

Utilize Templates for Efficient Agreement Creation with Social Enterprises

Members can enhance the efficiency of creating an operating agreement example by utilizing the templates provided by Social Enterprises LLC. These templates ensure that all essential elements are included and offer customization options to address the specific needs of the LLC. By leveraging these resources, members can significantly reduce the time typically spent on drafting and finalizing contracts, which averages between 20 to 30 days. Moreover, employing templates aids in ensuring compliance with legal standards, thereby minimizing the risk of disputes that often stem from ambiguous terms. Industry experts note that utilizing an operating agreement example can improve operational efficiency and clarity, making it an invaluable resource for any LLC.

Conclusion

A well-crafted operating agreement is essential for the successful establishment and management of an LLC. This agreement encompasses critical elements such as legal requirements, member roles, dispute resolution procedures, and financial management practices. It serves as a vital document that guides operations and relationships within the business. By ensuring clarity and compliance with state laws, the agreement protects the interests of all members and enhances the overall functionality of the LLC.

Key points throughout the article underscore the importance of:

- Defining member responsibilities

- Establishing management structures

- Outlining ownership rights and profit distribution methods

Furthermore, incorporating flexible amendment procedures and comprehensive dissolution terms significantly contributes to the longevity and adaptability of the LLC. Each of these elements plays a crucial role in preventing conflicts and ensuring smooth operations, ultimately leading to a more successful business endeavor.

In conclusion, the significance of a robust operating agreement cannot be overstated. LLCs must prioritize the creation of a comprehensive document that aligns with both legal requirements and the specific needs of the business. By leveraging templates and expert resources, LLCs can streamline the drafting process, ensuring that all essential elements are included. This proactive approach fosters a harmonious working environment and sets the foundation for long-term success and compliance in an ever-evolving regulatory landscape.

Frequently Asked Questions

What are the legal requirements for establishing an LLC operating agreement?

The legal requirements include the name of the LLC, the registered agent, the purpose of the business, and the governing laws applicable to the contract.

Why is it important to understand the legal requirements for an LLC?

Understanding the legal requirements is crucial for ensuring compliance with state regulations and tax obligations, which helps mitigate potential legal disputes.

How does an operating agreement define member roles and responsibilities?

An operating agreement outlines the roles and duties of each participant in an LLC, specifying who will manage daily operations, oversee financial matters, and represent the LLC legally.

What are the benefits of clearly defining member roles in an LLC?

Clearly defined roles minimize potential conflicts, enhance operational efficiency, and ensure all participants are aware of their contributions, leading to higher success rates for the LLC.

What happens if an LLC does not have a clear operating agreement?

Without a clear operating agreement, the LLC defaults to the state’s default rules, which can lead to conflicts and mismanagement.

Why is it important to incorporate dispute resolution procedures in an LLC operating agreement?

Including dispute resolution procedures helps manage conflicts effectively, preserves positive relationships among participants, and provides alternatives to costly litigation.

What are the two main methods of dispute resolution mentioned in the article?

The two main methods are mediation, which encourages open dialogue, and arbitration, which involves a formal setting where an impartial third party makes binding decisions.

How can including specific procedures for mediation or arbitration benefit an LLC?

Specific procedures streamline the resolution process, ensuring conflicts are addressed promptly and effectively, ultimately reducing emotional and financial tolls associated with disputes.