Introduction

Navigating the realm of entrepreneurship often entails a complex array of legal requirements, with the decision to form a Limited Liability Company (LLC) or to obtain a business license being particularly crucial. Entrepreneurs can derive substantial benefits by comprehending the distinct functions these entities serve in protecting personal assets and ensuring adherence to local regulations. A critical question arises: should one prioritize the establishment of an LLC for its liability protection and tax advantages, or should the focus be on securing a business license first to operate legally? This article explores the intricacies of both options, elucidating their differences and guiding entrepreneurs toward making informed decisions for their ventures.

Define LLC and Business License: Key Differences

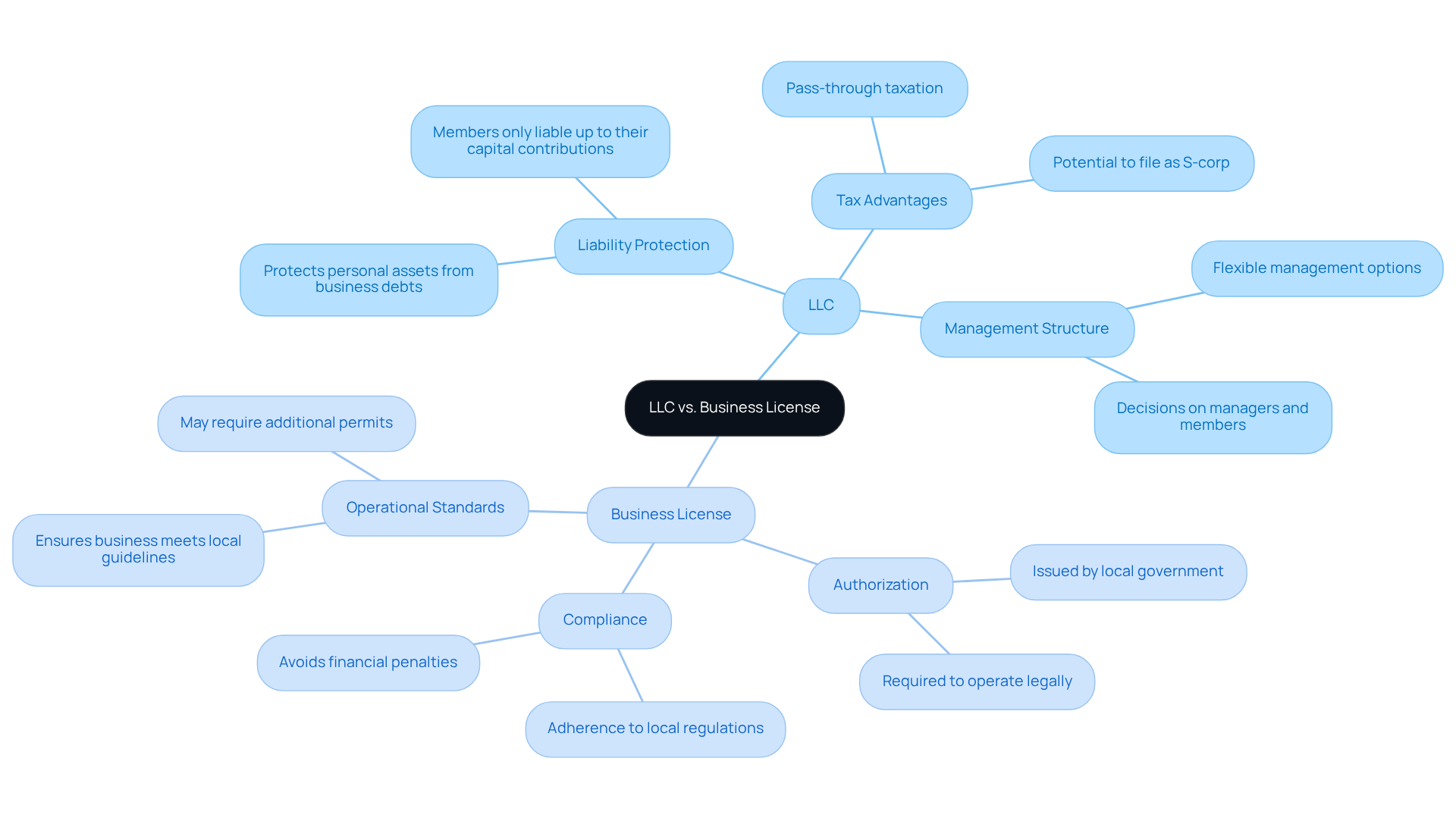

A Limited Liability Company (LLC) serves as a formal organizational structure that provides personal liability protection to its owners, effectively safeguarding personal assets from company liabilities. This feature is particularly beneficial for entrepreneurs seeking to shield their wealth from potential business-related risks. In contrast, a commercial permit is an authorization issued by governmental entities, granting individuals or companies the right to operate within a specific jurisdiction. While an LLC establishes the foundational regulatory framework for a business, a permit facilitates the execution of commercial activities, necessitating compliance with local guidelines and industry standards.

The importance of forming an LLC is highlighted by the fact that a significant percentage of entrepreneurs choose this structure primarily for its liability protection benefits, along with its tax advantages and flexible management structure. For example, many companies, especially in high-risk sectors such as e-commerce and gaming, utilize LLCs to protect their personal assets against claims and debts incurred by the entity. This strategic decision not only enhances personal security but also builds credibility with clients and investors, as it reflects a commitment to professional standards and compliance.

In conclusion, while both you should obtain an LLC or business license first and a commercial permit are crucial for lawful operation, they serve distinct purposes: the LLC provides a protective structure and potential tax advantages, whereas the permit ensures adherence to local operational standards. Engaging with Social Enterprises can further clarify the liability safeguards and tax implications associated with these frameworks, as operating without the necessary permits can lead to financial or regulatory penalties.

Determine Sequence: LLC First or Business License?

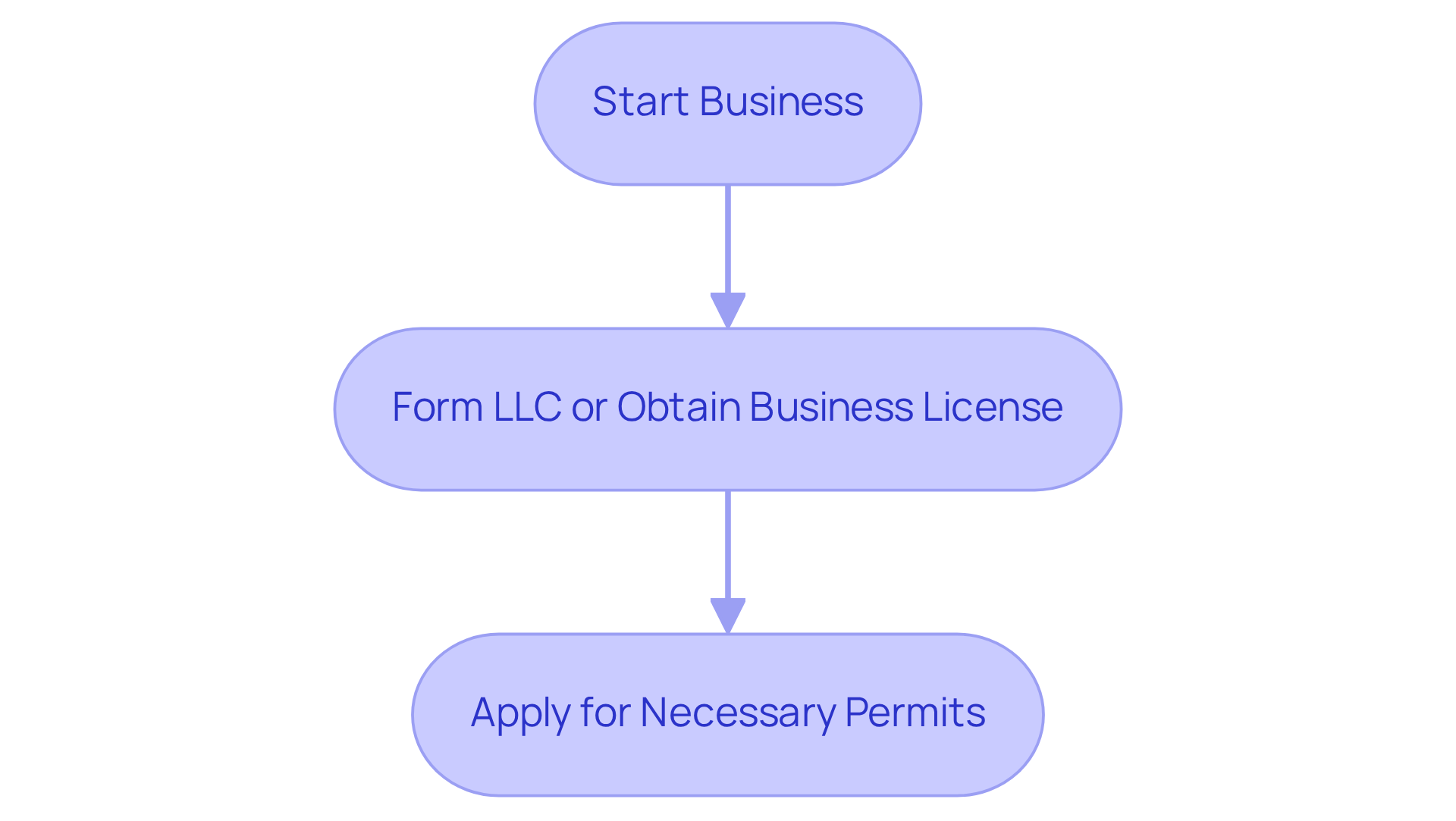

The most effective approach when starting a venture is to ensure you have an LLC or business license first before applying for a permit. Entrepreneurs should consider forming the LLC or business license first, as it creates a legal entity under which their business can operate, allowing them to utilize the LLC’s name when obtaining necessary licenses. This sequence not only streamlines the application process but also ensures that the organization is recognized as a legitimate entity from the outset.

Moreover, having an LLC significantly enhances credibility with potential clients and partners, reflecting a commitment to formal business practices. Many successful entrepreneurs have noted that their LLC status facilitated easier access to funding and partnerships, as it conveys professionalism and stability. Research indicates that companies with formal structures, such as LLCs, are perceived as more reliable, which can lead to increased customer trust and higher sales.

Additionally, Social Enterprises provides a complimentary 15-minute consultation to discuss your company formation needs and offers comprehensive post-incorporation compliance services. This foundational step is essential for entrepreneurs seeking to establish a robust market presence and effectively navigate the complexities of compliance.

Compare Requirements and Benefits: LLC vs. Business License

Establishing an LLC requires filing articles of organization with the state, paying a filing fee, and complying with ongoing requirements such as annual reports and taxes. The benefits of an LLC include personal liability protection, tax flexibility, and enhanced credibility, making it a preferred option for many entrepreneurs. For instance, LLCs facilitate pass-through taxation, significantly reducing tax obligations for owners, as profits are reported on personal tax returns rather than at the corporate level.

Conversely, obtaining a commercial permit typically involves submitting a request to local officials, paying a fee, and adhering to specific industry regulations. While a commercial permit is crucial for lawful operation within a jurisdiction, it does not offer liability protection. For example, operating without a commercial permit can lead to fines and potential closures, as evidenced by cases where entrepreneurs faced penalties for non-compliance.

Entrepreneurs must carefully evaluate these factors; they should consider obtaining an LLC or business license first for those seeking liability protection and tax advantages, while a commercial permit is necessary for compliance with local regulations. As of 2026, the average annual fee for maintaining an LLC in the U.S. is approximately $91, whereas operational permit fees can range from $50 to over $500, depending on the jurisdiction. Understanding these distinctions is vital for making informed decisions that align with organizational goals and regulatory requirements.

Clarify Misconceptions: FAQs on LLCs and Business Licenses

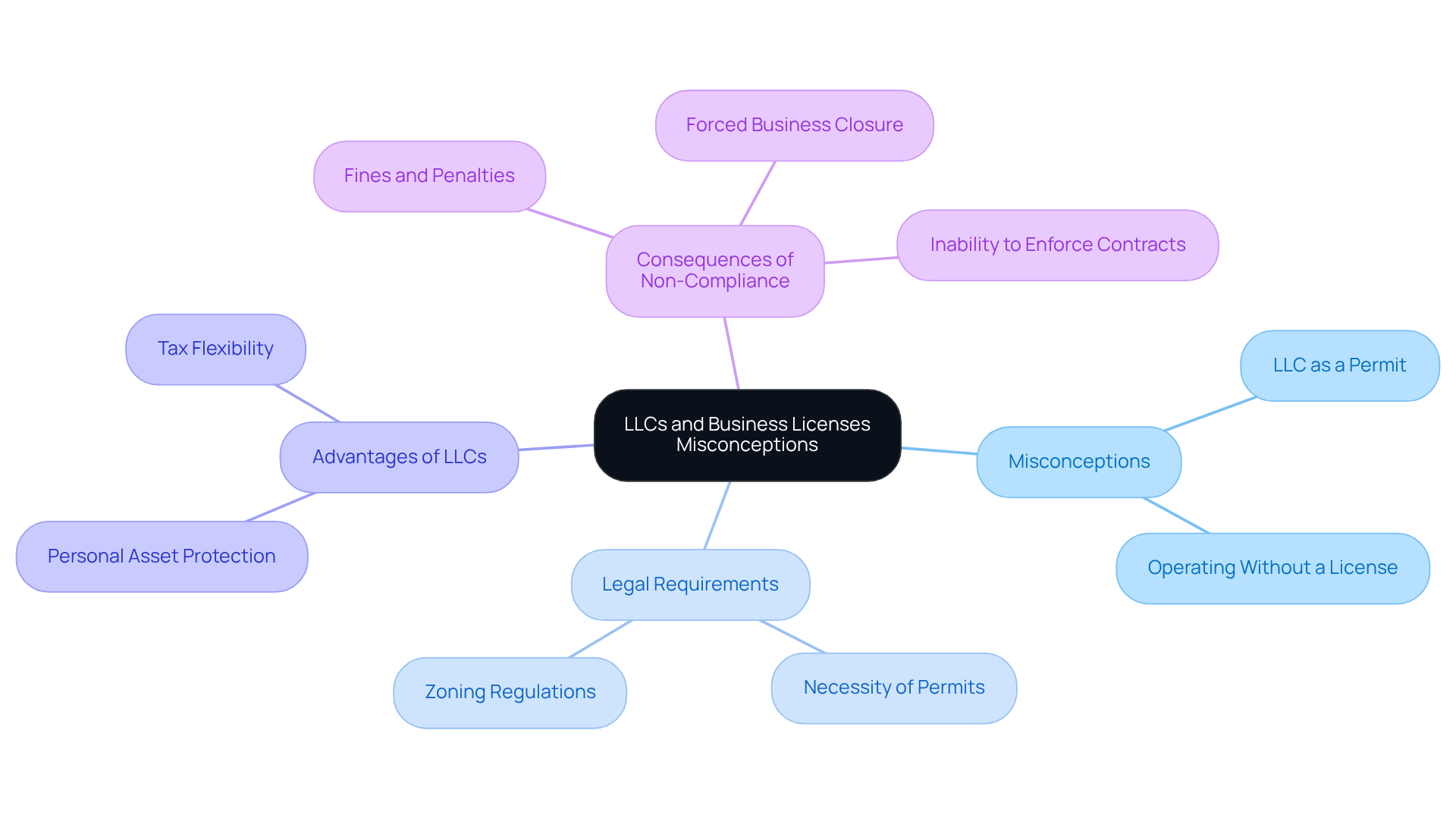

Many entrepreneurs mistakenly believe that they can operate legally by forming an LLC or business license first, thinking it serves as a company permit. In truth, for lawful operation within a specific jurisdiction, it is important to have an LLC or business license first, as the LLC is an entity designed to provide liability protection, while a commercial permit is a separate requirement. A significant number of businesses operate without the necessary permits, which can lead to severe consequences, including fines and legal complications.

While an LLC offers substantial advantages, such as personal asset protection and tax flexibility, it is not mandatory for all types of businesses; some low-risk ventures may choose simpler structures. Entrepreneurs frequently question the viability of operating without a license, but the reality is that failing to obtain the LLC or business license first can lead to enforcement actions and disruptions in operations. Understanding these distinctions is crucial for ensuring compliance and achieving long-term success in business.

Conclusion

In conclusion, establishing a business necessitates careful consideration of the foundational structures that will support its growth and compliance. Forming an LLC provides entrepreneurs with significant advantages, including personal liability protection and tax flexibility, while obtaining a business license is essential for legal operation within a specific jurisdiction. Understanding the distinct roles these entities play is crucial for entrepreneurs aiming to create a sustainable and compliant business.

This article has highlighted key insights regarding the importance of forming an LLC prior to obtaining a business license. This sequence not only enhances credibility and professionalism but also streamlines the application process for necessary permits. The benefits of an LLC, such as increased credibility and access to funding, have been underscored, alongside the necessity of a business license to adhere to local regulations and avoid potential penalties.

As entrepreneurs navigate the complexities of starting a business, prioritizing the formation of an LLC or business license is imperative. This strategic approach safeguards personal assets and positions the business for success in a competitive marketplace. By understanding the differences and requirements of LLCs and business licenses, entrepreneurs can make informed decisions that foster growth and ensure compliance, paving the way for a successful venture.

Frequently Asked Questions

What is an LLC?

A Limited Liability Company (LLC) is a formal organizational structure that provides personal liability protection to its owners, safeguarding their personal assets from company liabilities.

What is a business license?

A business license, or commercial permit, is an authorization issued by governmental entities that grants individuals or companies the right to operate within a specific jurisdiction.

What are the key differences between an LLC and a business license?

An LLC establishes a protective organizational structure for a business, while a business license permits the execution of commercial activities and ensures compliance with local guidelines and industry standards.

Why is forming an LLC important for entrepreneurs?

Forming an LLC is important for entrepreneurs because it provides liability protection, potential tax advantages, and a flexible management structure, which can enhance personal security and credibility with clients and investors.

In what sectors are LLCs particularly beneficial?

LLCs are particularly beneficial in high-risk sectors such as e-commerce and gaming, where personal assets need protection against claims and debts incurred by the business.

What are the consequences of operating without the necessary permits?

Operating without the necessary permits can lead to financial or regulatory penalties, making it essential to obtain both an LLC and a business license for lawful operation.

How can Social Enterprises assist in understanding LLCs and business licenses?

Engaging with Social Enterprises can help clarify the liability safeguards and tax implications associated with LLCs and business licenses.