Introduction

Understanding the distinctions between a company and a corporation is essential for anyone navigating the intricate landscape of business formation. The term “company” broadly encompasses various commercial entities, whereas a corporation signifies a specific legal structure that offers distinct benefits and obligations. As entrepreneurs evaluate the optimal framework for their ventures, the challenge lies in comprehending these differences and their implications for liability, compliance, and operational flexibility.

What factors should be considered when deciding between these two fundamental business forms?

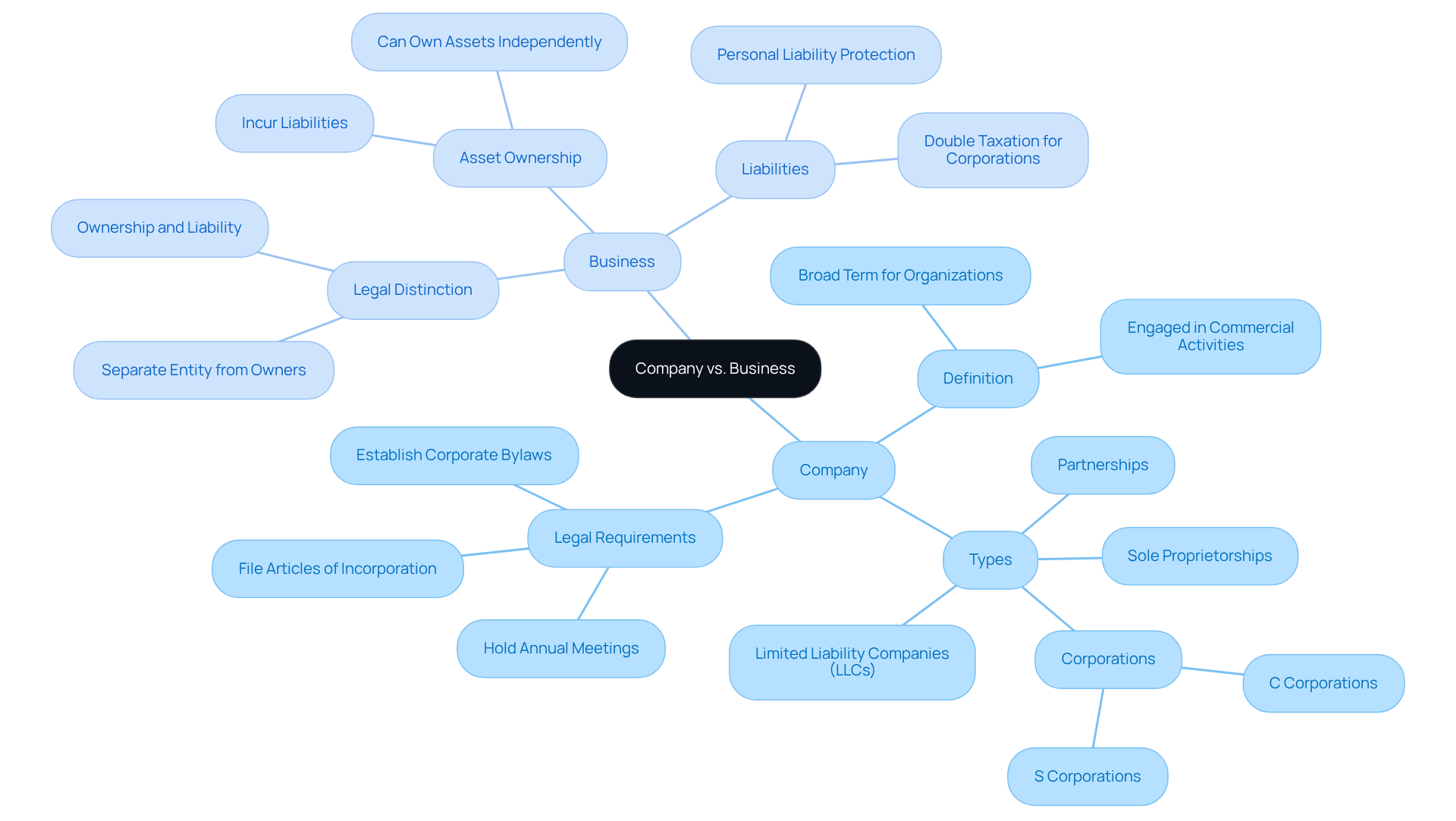

Define Company and Corporation

A company is a broad term encompassing any organization engaged in commercial activities, including sole proprietorships and partnerships. It represents various business structures that operate with the aim of generating profit. In contrast, a business is a specific type of company that is legally recognized as a distinct entity from its owners, known as shareholders. This legal distinction allows businesses to own assets, incur liabilities, and enter into contracts independently of their owners.

In the United States, approximately 20% of enterprises are classified as companies, highlighting their significance in the economic landscape. Understanding these definitions is crucial for navigating the complexities of enterprise formation and compliance within the U.S. market. Companies face more stringent legal requirements compared to other types of entities. For instance, businesses are required to:

- File articles of incorporation with the state

- Establish corporate bylaws

- Hold annual meetings to elect a board of directors

These requirements do not apply to most other types of enterprises.

This structured approach not only provides personal liability protection to owners but also facilitates capital raising through stock issuance, a feature that is often unavailable to smaller businesses.

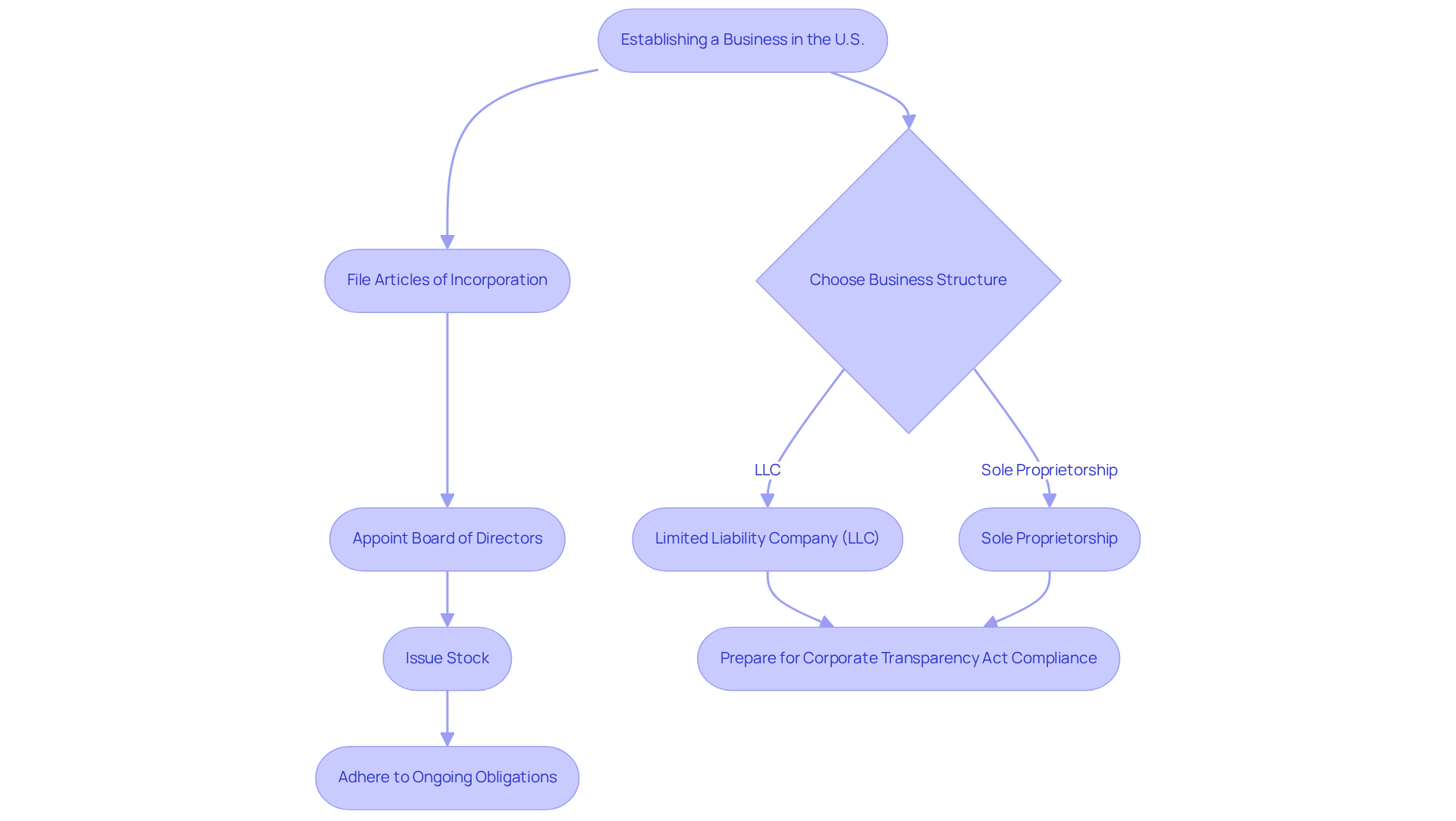

Explore Legal Context and Formation Processes

Establishing a company or business in the United States requires navigating specific legal requirements that vary by state. Typically, this process involves filing articles of incorporation with the relevant state authority, which legally recognizes the entity as a distinct unit. Key steps include:

- Appointing a board of directors

- Issuing stock

- Adhering to ongoing obligations such as annual reports and meetings

However, the prerequisites for establishing a company can differ significantly due to the difference between company and corporation based on the chosen organizational structure. For instance, a sole proprietorship demands minimal documentation, whereas a limited liability company (LLC) combines features of both businesses and partnerships, offering flexibility and limited liability protection.

In 2026, entrepreneurs must also consider the Corporate Transparency Act, which, although currently paused for reassessment, will mandate many enterprises to report their beneficial owners to FinCEN. This underscores the necessity of maintaining accurate records and preparing for future compliance. Furthermore, successful case studies highlight the formation processes across various states. For example, in New York, companies must adhere to specific filing processes to ensure compliance with state regulations, while California’s evolving minimum wage laws impact payroll arrangements for new enterprises.

Understanding these legal frameworks is crucial for entrepreneurs aiming to establish a business in the U.S., as it lays the foundation for operational legitimacy and long-term success. By seeking expert guidance from Social Enterprises, including a complimentary 15-minute consultation, entrepreneurs can navigate the complexities of establishing a venture, ensuring compliance with tax regulations and selecting the appropriate structure tailored to their industry needs.

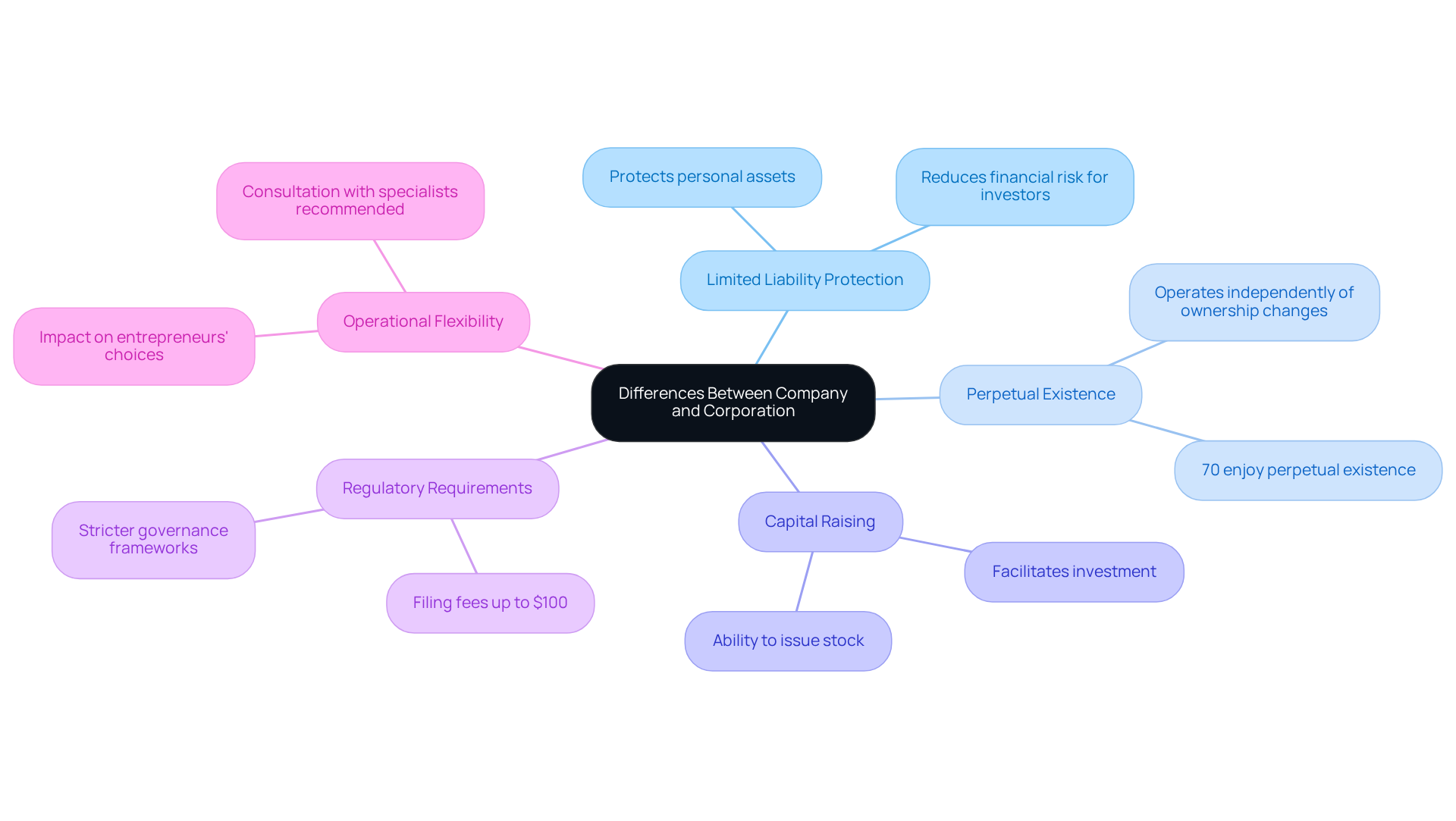

Identify Key Characteristics and Differences

The essential features that illustrate the difference between company and corporation include:

- Limited liability protection

- Perpetual existence

- The capacity to raise capital through stock issuance

Corporations provide their shareholders with protection from personal liability, safeguarding personal assets from business debts and liabilities. This characteristic is particularly attractive to investors, as it reduces financial risk and facilitates the transferability of shares.

Moreover, approximately 70% of corporations in the U.S. enjoy perpetual existence, enabling them to operate independently of ownership changes. This illustrates the difference between company and corporation, unlike sole proprietorships and partnerships that typically dissolve upon the death or withdrawal of an owner.

Corporations also face more stringent regulatory requirements, necessitating formal governance frameworks and adherence to corporate laws, including filing fees that can reach $100 for articles of incorporation.

This complexity is a significant consideration for entrepreneurs when selecting an enterprise framework, as it impacts the difference between company and corporation in terms of operational flexibility and compliance obligations. For those considering launching a venture, particularly in sectors like e-commerce or fintech, consulting with specialists such as Social Enterprises can provide tailored guidance on tax compliance strategies and investment processes, ensuring a successful launch.

Provide Examples of Companies and Corporations

Corporations are represented by major players such as Apple Inc., Microsoft Corporation, and Amazon.com, Inc. These publicly traded entities possess intricate frameworks that facilitate capital raising through stock markets, enabling consistent growth and innovation. In contrast, many small enterprises function outside this corporate structure, often as sole proprietorships or partnerships. For example, local restaurants and family-owned shops illustrate these non-corporate establishments, which typically feature simpler structures and fewer regulatory burdens.

Understanding the difference between company and corporation is crucial for entrepreneurs, especially for Turkish-speaking individuals aspiring to establish a business in the U.S. The difference between company and corporation, such as when choosing to form a Limited Liability Company (LLC), can significantly impact operational flexibility, tax obligations, and the ability to attract investment. Notably, while corporations can amass substantial capital through share sales, small enterprises often rely on personal savings or loans.

Moreover, states like Delaware, Wyoming, and Florida offer unique advantages for business formation, making them attractive options for entrepreneurs. This underscores the diverse pathways available for business establishment in today’s economy.

Conclusion

In conclusion, grasping the distinction between a company and a corporation is crucial for anyone navigating the business landscape. While these terms are often used interchangeably, they signify different structures with unique legal implications and operational frameworks. A company encompasses a wide array of business entities, whereas a corporation is a specific type of company that provides distinct advantages, such as limited liability and perpetual existence.

This article has explored key points, including the legal requirements for establishing a company or corporation, the characteristics that differentiate them, and real-world examples that illustrate these differences. It has been emphasized that corporations face more stringent regulatory obligations, which can significantly influence the choice of structure for entrepreneurs. Furthermore, understanding the implications of the Corporate Transparency Act and the benefits offered by states like Delaware and Florida can further assist in making informed decisions.

As the business environment continues to evolve, recognizing the nuances between companies and corporations becomes increasingly vital. Entrepreneurs are encouraged to seek expert guidance to navigate these complexities effectively. Whether starting a small business or launching a corporation, understanding these distinctions can pave the way for operational success and compliance in a competitive market.

Frequently Asked Questions

What is the definition of a company?

A company is a broad term that encompasses any organization engaged in commercial activities, including sole proprietorships and partnerships, with the aim of generating profit.

How does a business differ from a company?

A business is a specific type of company that is legally recognized as a distinct entity from its owners, known as shareholders. This legal distinction allows businesses to own assets, incur liabilities, and enter into contracts independently of their owners.

What percentage of enterprises in the United States are classified as companies?

Approximately 20% of enterprises in the United States are classified as companies.

Why is it important to understand the definitions of company and business?

Understanding these definitions is crucial for navigating the complexities of enterprise formation and compliance within the U.S. market.

What are some legal requirements that businesses must fulfill?

Businesses are required to file articles of incorporation with the state, establish corporate bylaws, and hold annual meetings to elect a board of directors.

Do the legal requirements for businesses apply to other types of enterprises?

No, these requirements do not apply to most other types of enterprises.

What benefits do companies have compared to smaller businesses?

Companies provide personal liability protection to owners and facilitate capital raising through stock issuance, which is often unavailable to smaller businesses.