Introduction

Understanding equity in limited liability companies (LLCs) is crucial for entrepreneurs who seek to navigate the complexities of ownership and governance. This article examines the different types of equity, strategies for granting ownership to employees, and the tax implications that accompany these decisions. As entrepreneurs consider how to structure equity effectively, they may confront a pivotal question: how can they balance the need to attract investment with ensuring employee motivation, all while navigating the potential challenges of tax compliance?

Define Equity in LLCs: Key Concepts and Importance

Equity in LLC signifies the ownership stake held by its members, distinguishing it from corporations that issue shares. In LLCs, equity in LLC is represented through membership interests, which directly influence voting rights, revenue distribution, and overall control within the organization. Understanding these ownership dynamics, particularly equity in LLCs, is crucial for entrepreneurs, as they dictate how profits are allocated, decisions are made, and liabilities are managed.

The performance and governance of an LLC can be significantly impacted by the ownership framework and equity in LLC. For instance, members with larger equity in LLC typically wield greater influence over decision-making processes, potentially leading to more effective management and strategic direction. Conversely, a clearly defined ownership structure, particularly regarding equity in LLC, can foster collaboration and accountability among members, thereby enhancing overall organizational performance.

Real-world examples underscore the importance of equity in LLC ownership structures. Companies that explicitly delineate equity in LLC ownership percentages often experience smoother operations and better alignment of interests among members. This clarity can bolster investor confidence, as businesses with transparent ownership arrangements are perceived as more stable and trustworthy.

Moreover, equity in LLC ownership influences the ability of the company to attract investment. Research indicates that businesses structured as LLCs can draw 40% more investors compared to sole proprietorships, emphasizing the advantages of equity in LLC as a well-defined ownership framework. By establishing a robust ownership structure, LLCs not only enhance their operational efficiency but also position themselves favorably in the competitive landscape, ultimately promoting growth and success.

Explore Types of Equity in LLCs: Ownership and Compensation Structures

In LLCs, equity in LLC is categorized into several types, each serving distinct purposes in terms of ownership and compensation structures. The primary types include:

- Membership Shares: These shares represent ownership in the LLC and can be classified into various classes, each granting different rights and privileges to members.

- Earnings Interests: This category allows members to participate in the future earnings of the LLC without an immediate claim on current capital. As Robert Adelson points out, ‘A share in the gains allows you to participate in the future earnings and increase in value of the LLC.’ Profit incentives are often used as a compensation mechanism for employees, aligning their motivations with the company’s growth.

- Capital Holdings: Unlike profit shares, capital holdings provide a portion of the LLC’s current assets and earnings, offering immediate value to the holder. These interests are taxed upon vesting, making it essential for entrepreneurs to consider potential appreciation and duration of employment for tax planning.

- Phantom Equity: This contractual arrangement offers cash bonuses tied to the company’s valuation, rewarding employees based on performance without conferring actual ownership. Phantom ownership enables companies to incentivize employees without diluting ownership.

Understanding these ownership types, such as equity in LLC, is crucial for entrepreneurs as they develop compensation packages that inspire their teams and align with broader business goals. For instance, companies utilizing profit shares can effectively motivate employees to drive future growth, while those providing capital stakes can attract talent by offering immediate financial rewards. Additionally, it is important to note that vesting for ownership interests typically occurs over a period of 3 to 4 years, which can significantly impact the overall compensation strategy.

Grant Equity to Employees: Strategies and Best Practices

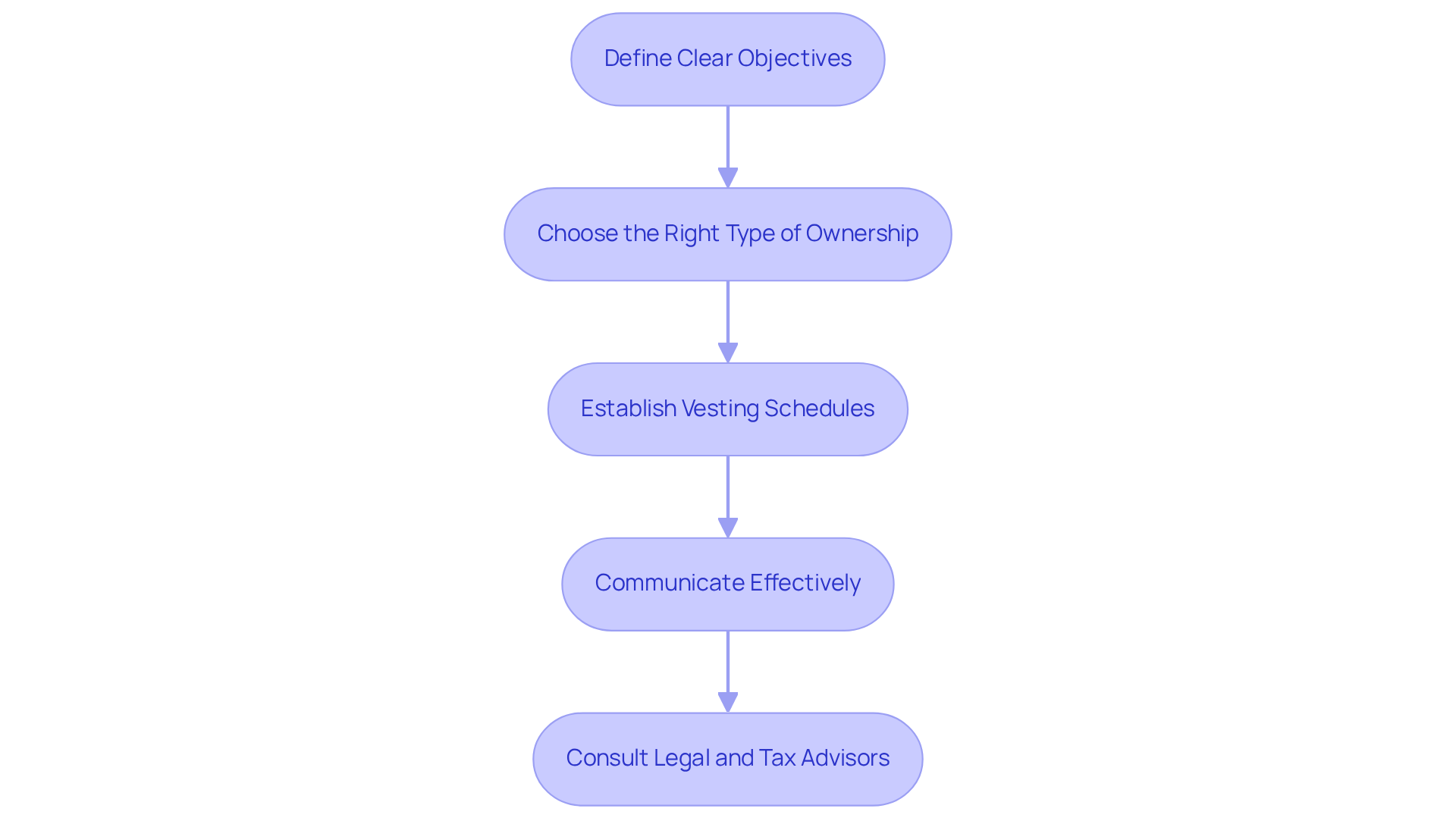

When providing ownership to employees, it is essential to adopt strategies that align with both the company’s goals and the employees’ expectations. The following best practices can guide this process:

-

Define Clear Objectives: It is crucial to determine what you aim to achieve with ownership grants. This may include attracting talent, retaining key employees, or incentivizing performance.

-

Choose the Right Type of Ownership: Selecting between profits interests, capital interests, or phantom ownership should be based on your business model and the specific needs of your employees.

-

Establish Vesting Schedules: Implementing vesting schedules encourages long-term commitment among employees. Common structures include time-based vesting or performance-based milestones.

-

Communicate Effectively: Ensure that employees understand the significance of their ownership grants and how they can benefit from the company’s growth.

-

Consult Legal and Tax Advisors: Collaborating with experts is vital to ensure compliance with tax laws and to arrange ownership grants in a tax-efficient manner.

By adhering to these strategies, entrepreneurs can develop a compelling ownership compensation plan that not only motivates employees but also drives business success.

Understand Tax Consequences of Equity in LLCs: Compliance and Strategy

The tax implications of equity in LLCs can be complex and differ depending on the type of equity granted. Here are essential considerations:

-

Tax Treatment of Membership Interests: Members are taxed on their share of the LLC’s earnings, regardless of whether distributions occur. This taxation can significantly impact cash flow, as members must prepare for tax obligations even when earnings are retained within the business. Notably, members may face self-employment taxes of 15.3% for Social Security and Medicare on their share of earnings, which is crucial for effective financial planning.

-

Benefits from Equity: When structured appropriately, benefits from equity can be granted without immediate tax implications. This arrangement allows employees to engage in the LLC’s future growth without incurring upfront tax burdens, making it an appealing option for incentivizing key personnel. An LLC taxed as a partnership offers built-in protection through the ‘Charging Order,’ enhancing personal liability protection for its members.

-

Capital Interests: In contrast to profits interests, capital interests are generally taxed at the time of grant, potentially leading to immediate tax liabilities for recipients. This situation can affect cash flow planning, as recipients may need to factor these taxes into their financial strategies.

-

Phantom Equity: This form of compensation is typically taxed as ordinary income upon payout, necessitating careful cash flow management to ensure that funds are available to cover tax obligations when they arise.

-

Compliance Requirements: It is essential to ensure that all stock grants comply with IRS regulations, including proper documentation and reporting. Non-compliance can result in significant penalties and complications in tax treatment.

By thoroughly understanding these tax implications, including the fact that LLCs accounted for 71.7% of all partnership returns filed in 2021, entrepreneurs can strategically plan their equity in LLC compensation, minimizing tax liabilities while enhancing employee satisfaction and retention.

Conclusion

Understanding equity in LLCs is crucial for entrepreneurs who seek to navigate the complexities of ownership and governance. This concept fundamentally shapes how profits are allocated, decisions are made, and responsibilities are shared among members. By clearly defining equity through membership interests and various ownership types, LLCs can foster collaboration, attract investment, and maintain operational efficiency.

The article explores the types of equity available within LLCs, including:

- Membership shares

- Earnings interests

- Capital holdings

- Phantom equity

Each type serves distinct purposes, influencing compensation strategies and motivating employees to align their efforts with the company’s growth objectives. Furthermore, the best practices for granting equity to employees underscore the importance of strategic planning, clear communication, and compliance with legal and tax requirements. This ensures that ownership structures benefit both the organization and its members.

Ultimately, understanding the significance of equity in LLCs empowers entrepreneurs to create effective ownership frameworks and positions their businesses for long-term success. By leveraging the insights shared in this article, entrepreneurs can make informed decisions that cultivate a thriving workplace culture, attract talent, and optimize tax implications, equipping their LLCs to navigate the competitive landscape.

Frequently Asked Questions

What does equity in LLCs signify?

Equity in LLCs signifies the ownership stake held by its members, represented through membership interests, which influence voting rights, revenue distribution, and overall control within the organization.

How does equity in LLCs differ from equity in corporations?

Unlike corporations that issue shares, equity in LLCs is represented through membership interests, which directly affect how profits are allocated, decisions are made, and liabilities are managed.

Why is understanding equity in LLCs important for entrepreneurs?

Understanding equity in LLCs is crucial for entrepreneurs as it dictates how profits are allocated, how decisions are made, and how liabilities are managed within the organization.

How does ownership framework impact the performance of an LLC?

The ownership framework and equity in LLC can significantly impact an LLC’s performance, as members with larger equity typically have greater influence over decision-making processes, leading to more effective management and strategic direction.

What benefits arise from a clearly defined ownership structure in an LLC?

A clearly defined ownership structure regarding equity in LLC can foster collaboration and accountability among members, enhancing overall organizational performance and improving investor confidence.

How does equity in LLC ownership affect investment attraction?

Equity in LLC ownership influences the ability of the company to attract investment, with research indicating that businesses structured as LLCs can draw 40% more investors compared to sole proprietorships.

What are the advantages of having a well-defined ownership framework in an LLC?

Establishing a robust ownership structure enhances operational efficiency, promotes growth and success, and positions LLCs favorably in the competitive landscape.