Introduction

Limited Liability Companies (LLCs) serve as a fundamental asset for e-commerce entrepreneurs, offering crucial protections and advantages in a competitive digital marketplace. By establishing an LLC, business owners can safeguard their personal assets from potential liabilities while benefiting from tax efficiencies that significantly improve cash flow and operational flexibility.

As the e-commerce landscape grows increasingly complex, a pertinent question emerges: how can entrepreneurs effectively utilize LLC formation services to navigate regulatory challenges and strategically position their businesses for long-term success?

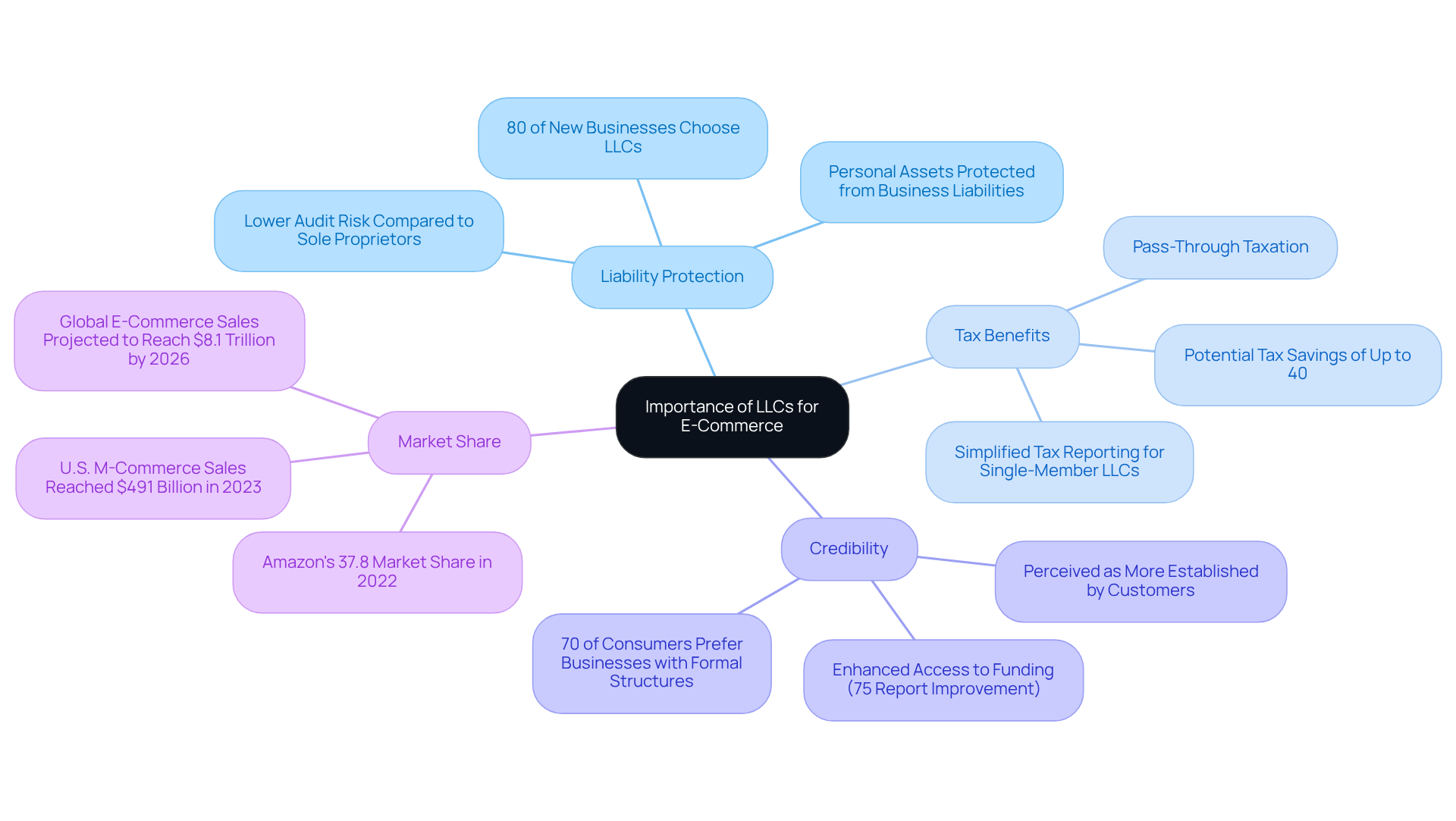

Understand the Importance of LLCs for E-Commerce Ventures

Limited Liability Companies (LLCs) have become a favored structure for online commerce ventures, offering a compelling combination of liability protection and tax benefits. By establishing an LLC, entrepreneurs can safeguard their personal assets from liabilities associated with their businesses, a crucial measure in the online commerce landscape where risks like customer disputes and data breaches are common. Notably, approximately 80% of new businesses opt for the LLC structure due to its flexibility and protective attributes.

A significant advantage of LLCs is pass-through taxation, which permits profits to be reported on the owners’ personal tax returns, thus avoiding the double taxation frequently linked with corporations. This tax efficiency not only improves cash flow but also streamlines financial management, allowing e-commerce entrepreneurs to focus on growth and innovation.

Furthermore, LLCs bolster credibility with customers and suppliers, projecting a more established company image. This perception is essential in a competitive market where trust can greatly impact purchasing decisions. For example, businesses structured as LLCs report enhanced access to funding, with 75% noting improved opportunities following formation.

Numerous successful examples exist, such as Amazon, which has leveraged its LLC structure to dominate the U.S. online retail market, capturing approximately 37.8% of the market share in 2022. This illustrates how the right organizational structure can drive significant growth and operational success.

In summary, using LLC formation services is not just a legal formality; it represents a strategic choice that provides essential protections and advantages for online business owners, enabling them to navigate the complexities of the digital marketplace with confidence. Additionally, understanding how to optimize tax deductions and manage income tax versus sales tax is crucial for maximizing the benefits of this structure.

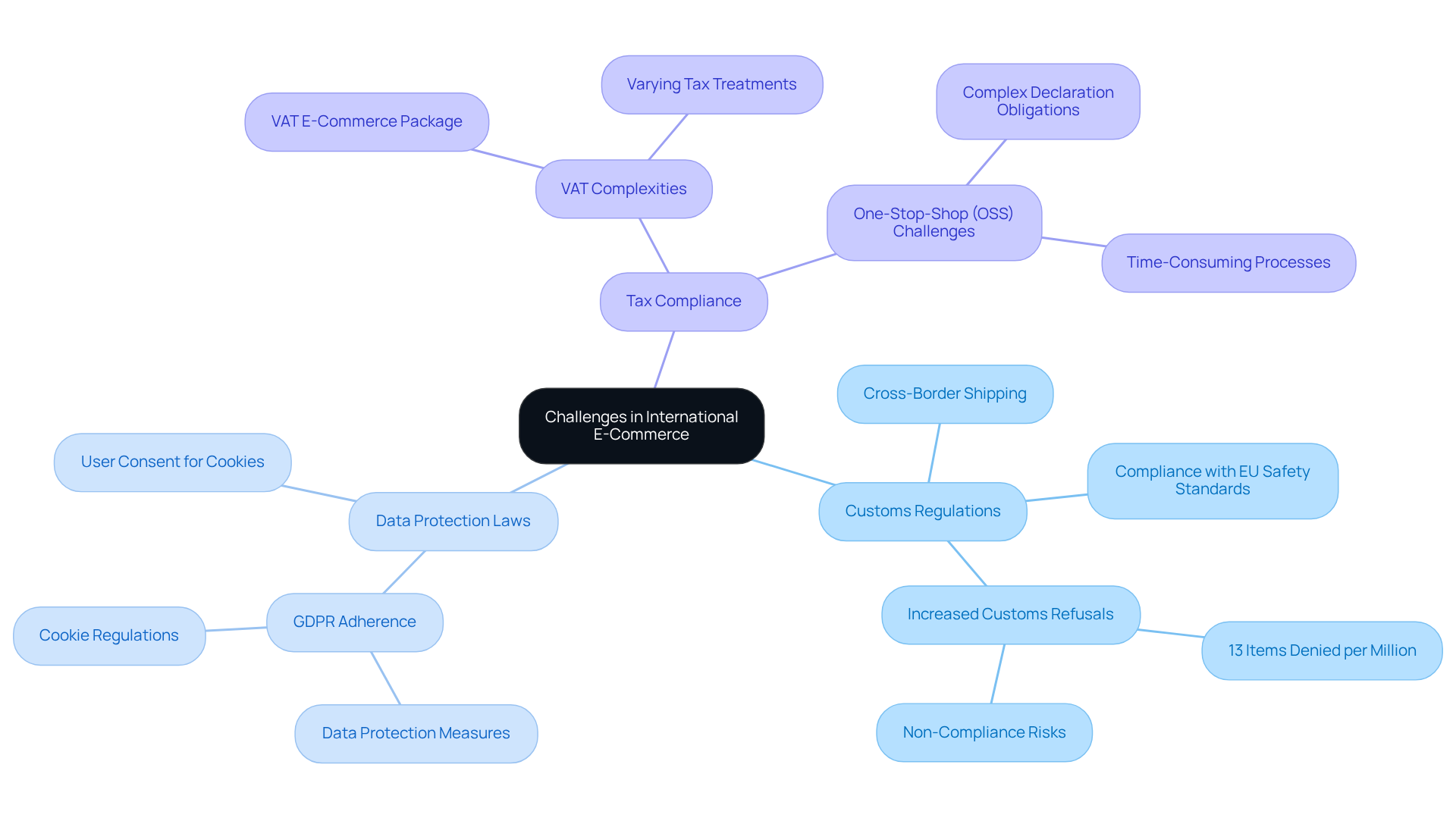

Identify Challenges in International E-Commerce and Compliance

Global online enterprises encounter significant challenges, particularly in navigating the intricate web of regulatory requirements across various regions. Key hurdles include:

- Customs regulations

- Data protection laws

- Tax compliance

All of these can hinder market entry and ongoing operations. For instance, the complexities surrounding VAT in Europe necessitate continuous adaptation by businesses, especially following the implementation of the VAT e-commerce package on July 1, 2021. This reform introduced new tax obligations that complicate compliance for online merchants, particularly due to the differing tax treatments across EU countries, which create a ‘tax tangle’ for many.

Moreover, adherence to GDPR adds another layer of complexity, requiring stringent data protection measures to avoid substantial fines and maintain customer trust. Understanding cookie regulations is also crucial for e-commerce enterprises, as these regulations impact user experience and legal responsibilities, especially in the EU where compliance is strictly enforced. Businesses must secure user consent for cookies to prevent penalties and foster customer trust in their online platforms.

Cross-border shipping and logistics further complicate these challenges, often resulting in delays and increased costs. In 2024, customs officials reported that an average of 13 items per million products were denied entry due to non-compliance with EU regulations, underscoring the critical need for companies to ensure their products meet safety standards. As the volume of small packages entering the EU continues to rise-doubling annually since 2022-merchants must proactively understand and adapt to these customs regulations to avoid disruptions and increased scrutiny.

Additionally, employing protective filing techniques can help mitigate tax risks associated with regulatory challenges, enabling companies to navigate the complexities of international trade more effectively. Strategic planning is vital for online business entrepreneurs to address the risks linked to these compliance challenges. By leveraging expert guidance and tailored solutions, organizations can successfully navigate the intricacies of international trade, ensuring smoother operations and enhancing customer trust.

Leverage LLC Formation Services for Strategic Business Advantages

LLC formation services provide e-commerce enterprises a significant strategic advantage by simplifying the process of establishing a legal entity. These LLC formation services typically encompass assistance with obtaining necessary licenses, Employer Identification Numbers (EINs), and regulatory documentation, enabling entrepreneurs to concentrate on their core activities. By ensuring compliance with state and federal regulations, LLC formation services reduce the risk of incurring costly penalties, which can be particularly harmful for startups navigating intricate compliance landscapes.

Statistics indicate that over 70% of small businesses in the U.S. opt for LLCs due to their tax advantages and liability protection. This underscores the importance of this structure in enhancing operational efficiency and credibility within the marketplace. Moreover, the expertise provided by LLC formation services equips organizations to make informed decisions regarding tax strategies, which can potentially result in annual savings of up to $3,150. This comprehensive support positions online business ventures for sustained success, enabling them to flourish in a competitive environment.

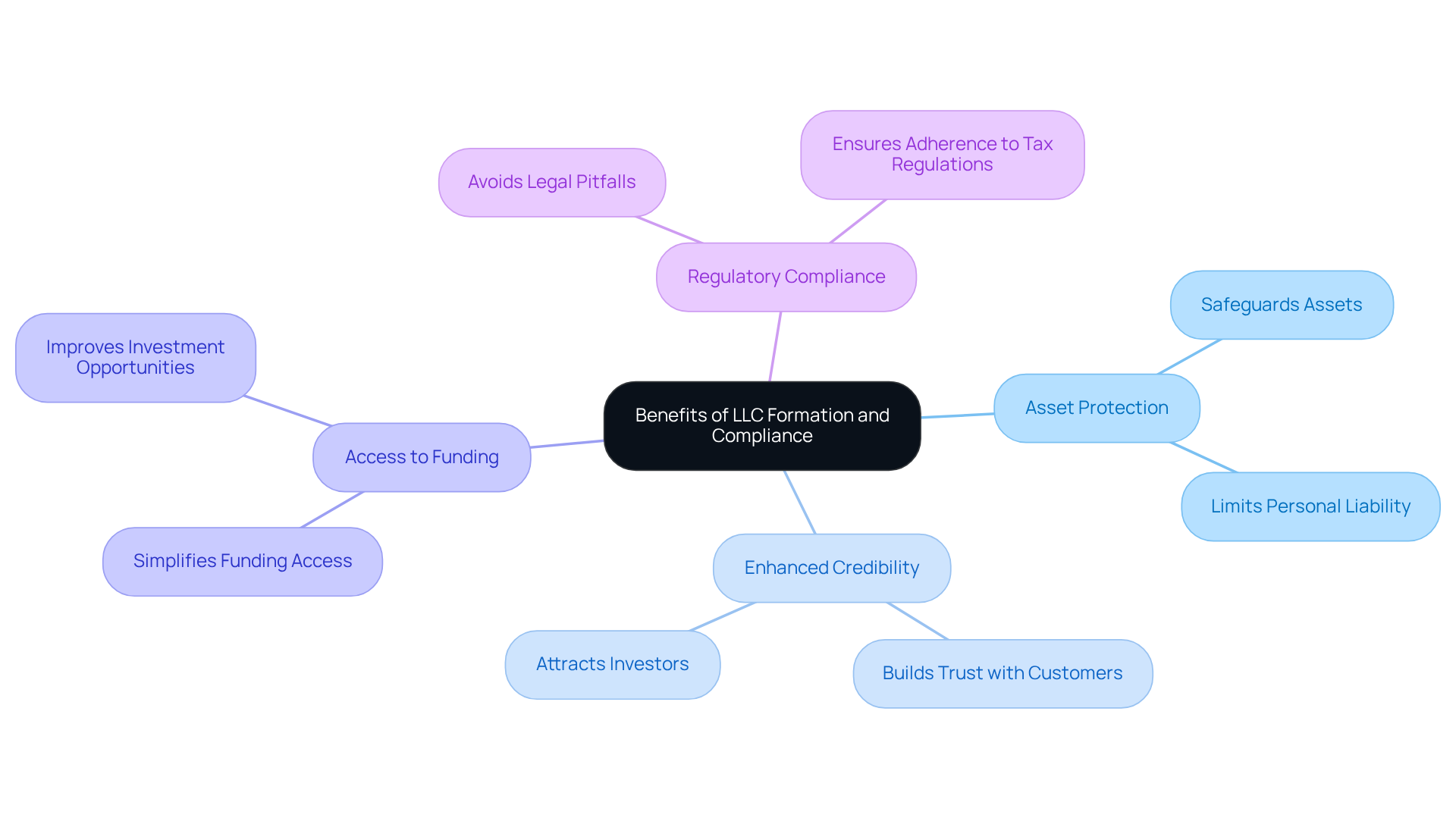

Explore Long-Term Benefits of Proper LLC Formation and Compliance

LLC formation services and ongoing compliance are essential for the long-term success of e-commerce ventures. A robust legal structure not only safeguards assets but also enhances credibility and establishes a foundation for growth. Compliance with tax regulations and corporate laws is crucial for avoiding legal pitfalls that could jeopardize operations.

Furthermore, LLC formation services provide a well-organized structure that simplifies access to funding and investment opportunities, as investors typically favor businesses that exhibit sound legal and financial practices. In the dynamic e-commerce landscape, maintaining regulatory compliance and a strong operational framework is vital for adapting to changes and capitalizing on emerging opportunities.

As the industry evolves, businesses that prioritize compliance will be better positioned to thrive and achieve sustainable growth.

Conclusion

Establishing a Limited Liability Company (LLC) is a crucial step for e-commerce entrepreneurs who seek to secure their business’s future. This strategic choice not only offers essential liability protection but also enhances credibility and provides tax advantages, positioning businesses to thrive in a competitive landscape. The formation of an LLC transcends mere legal formality; it serves as a foundational move that empowers online ventures to navigate the complexities of the digital marketplace with confidence.

The article outlines several key benefits of LLCs, including:

- The protection of personal assets

- The efficiency of pass-through taxation

- The credibility boost that LLCs confer

Furthermore, it emphasizes the necessity of compliance with international regulations and the challenges that e-commerce businesses encounter, such as customs regulations and data protection laws. By utilizing LLC formation services, entrepreneurs can streamline the establishment process, ensuring they meet essential legal requirements while concentrating on growth and innovation.

In a rapidly evolving e-commerce environment, the significance of proper LLC formation and ongoing compliance cannot be overstated. Businesses that prioritize these aspects are better equipped to address challenges and seize opportunities, ultimately fostering sustainable growth. Embracing LLC formation services is not merely a strategic decision; it represents a commitment to building a resilient and successful online business capable of thriving amidst ever-changing market dynamics.

Frequently Asked Questions

What is the primary benefit of forming an LLC for e-commerce ventures?

The primary benefit of forming an LLC for e-commerce ventures is the liability protection it offers, safeguarding personal assets from business-related liabilities, which is crucial in the online commerce landscape.

Why do many new businesses choose the LLC structure?

Approximately 80% of new businesses opt for the LLC structure due to its flexibility, protective attributes, and the advantages it provides in terms of liability protection and tax benefits.

What is pass-through taxation, and why is it advantageous for LLCs?

Pass-through taxation allows profits to be reported on the owners’ personal tax returns, avoiding the double taxation often associated with corporations. This tax efficiency improves cash flow and simplifies financial management for e-commerce entrepreneurs.

How do LLCs enhance credibility for online businesses?

LLCs bolster credibility with customers and suppliers, projecting a more established company image, which is essential in a competitive market where trust can significantly influence purchasing decisions.

What impact can forming an LLC have on funding opportunities?

Forming an LLC can improve access to funding, with 75% of businesses reporting enhanced opportunities following their formation.

Can you provide an example of a successful e-commerce business that uses the LLC structure?

Amazon is a notable example of a successful e-commerce business that has leveraged its LLC structure to dominate the U.S. online retail market, capturing approximately 37.8% of the market share in 2022.

Why is understanding tax deductions important for LLC owners?

Understanding how to optimize tax deductions and manage income tax versus sales tax is crucial for maximizing the benefits of the LLC structure, enabling online business owners to effectively navigate the complexities of the digital marketplace.