Introduction

Transferring ownership in a Limited Liability Company (LLC) involves complexities that can be overwhelming, particularly when considering the implications of death and inheritance. The Transfer on Death (TOD) LLC Membership Interest Form provides a streamlined solution, enabling members to designate beneficiaries who will automatically inherit their shares, thus bypassing the probate process. However, navigating the legal nuances and potential tax implications can pose significant challenges.

How can LLC owners ensure their intentions are honored while minimizing complications for their heirs? This guide explores the essential steps and considerations for effectively completing the TOD form, empowering members to secure their legacy and ensure business continuity.

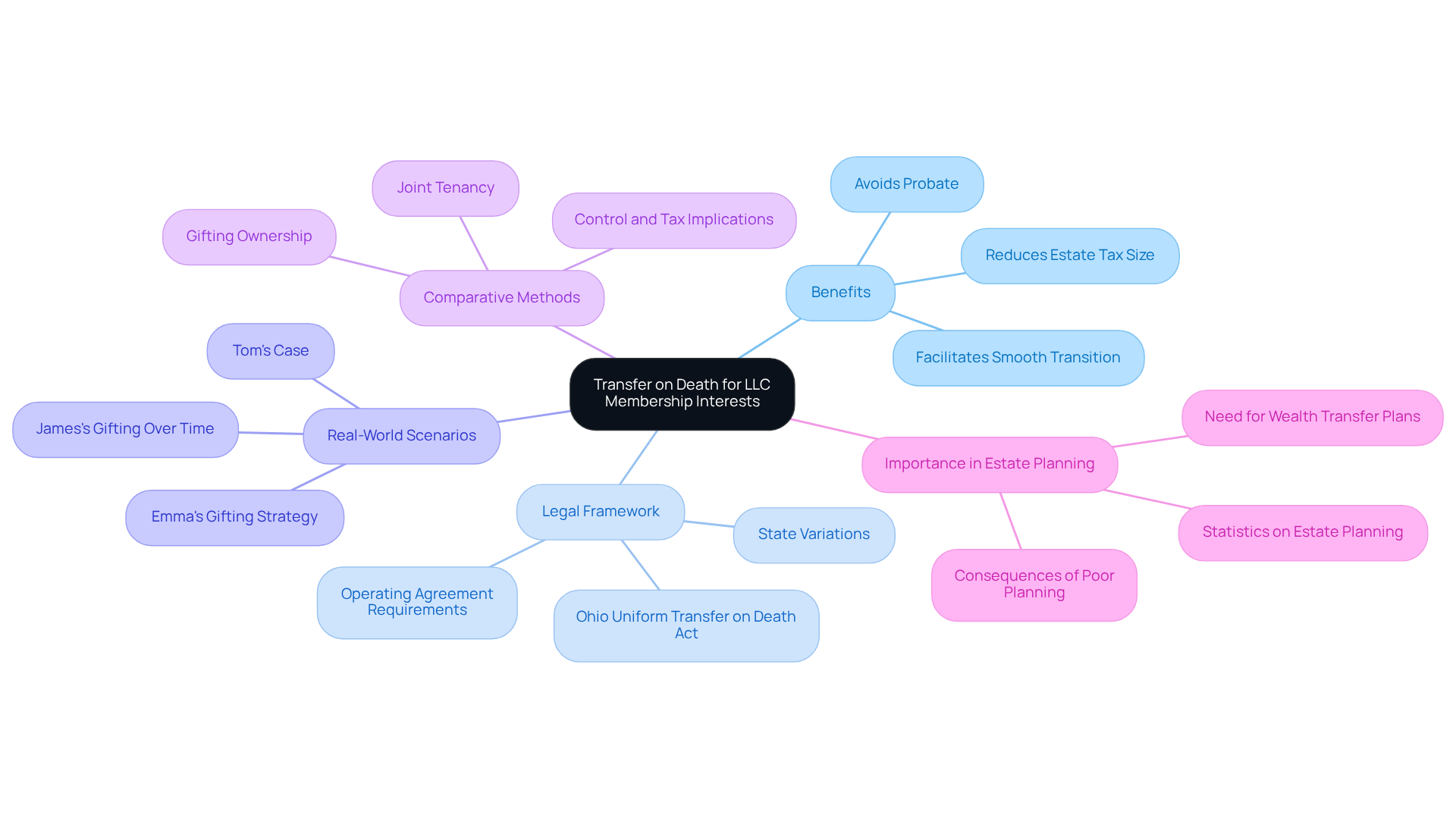

Understand Transfer on Death for LLC Membership Interests

A transfer on death LLC membership interest form enables LLC members to appoint a beneficiary who will automatically inherit their ownership stake upon their death, thereby circumventing the probate process. This mechanism not only facilitates a smooth transition of ownership but also reduces potential delays and costs associated with probate, which can consume as much as 10% of an estate’s value. Understanding the legal framework for the transfer on death LLC membership interest form is essential, as it varies by state and often necessitates specific language in the LLC’s operating agreement. For instance, the Ohio Uniform Transfer on Death LLC membership interest form explicitly includes LLC ownership stakes, providing a clear path for execution.

The advantages of TOD designations are illustrated by real-world scenarios. For example, Tom, a single-member LLC owner, successfully transferred ownership to his daughter without encountering probate delays, ensuring uninterrupted business operations. This case underscores the practical benefits of TOD in maintaining business continuity. Additionally, the strategic application of TOD can significantly decrease the taxable estate size, assisting heirs in avoiding considerable estate taxes.

Beyond TOD, joint tenancy with rights of survivorship can also facilitate ownership transfer without probate complications. However, it is crucial to evaluate the implications of each option, as the decision between TOD and alternative methods, such as gifting LLC ownership, involves considerations of control, tax ramifications, and the overall continuity of the business. As estate planning becomes increasingly important-especially given that 28% of investors lack a wealth transfer plan-grasping these mechanisms is vital for effective business succession planning.

Complete the Transfer on Death LLC Membership Interest Form

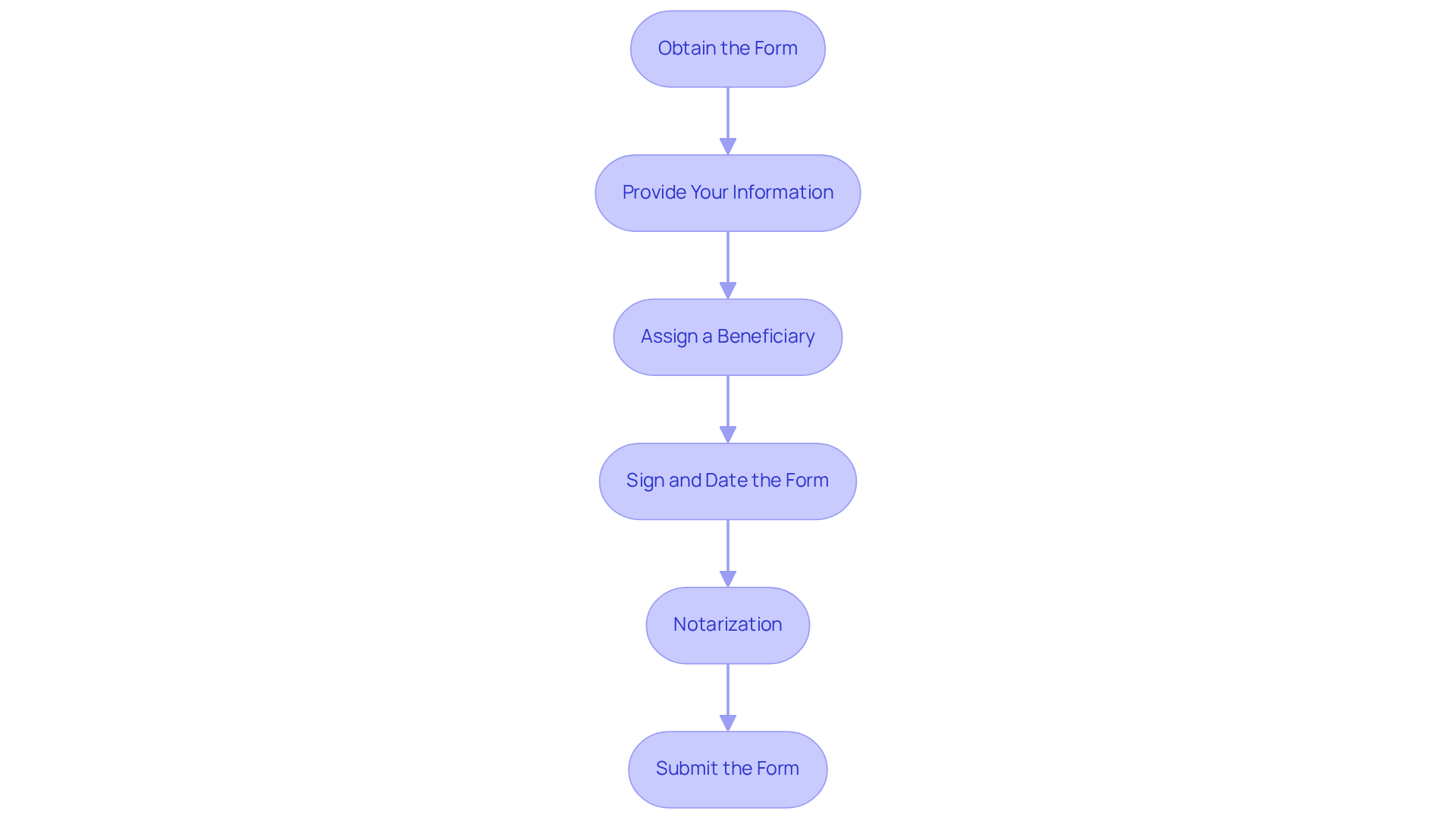

To successfully complete the Transfer on Death (TOD) LLC Membership Interest Form, follow these steps:

- Obtain the transfer on death LLC membership interest form by accessing the appropriate TOD form specific to your state, which is typically available through the Secretary of State’s website or legal resources.

- Provide Your Information: Include your name, the LLC’s name, and specifics of your stake. Ensure all information aligns with the LLC’s records to prevent discrepancies.

- Assign a Beneficiary: Clearly indicate the name of the beneficiary who will receive your share upon your death. Precision is crucial to avoid any potential ambiguity.

- Sign and Date the Form: Your signature is essential for validating the form. Ensure it is dated correctly to reflect the completion date.

- Notarization: Verify if your state mandates notarization of the form. Compliance with state-specific requirements is vital for the form’s validity.

- The transfer on death LLC membership interest form is needed. Submit the transfer on death LLC membership interest form together with the LLC’s operating agreement and notify the other members of the LLC about the TOD designation.

By carefully following these steps, you can ensure a smooth transfer of your stake in accordance with your wishes, thereby reducing the chance of mistakes that could complicate the process.

Consider Legal and Tax Implications of the Transfer

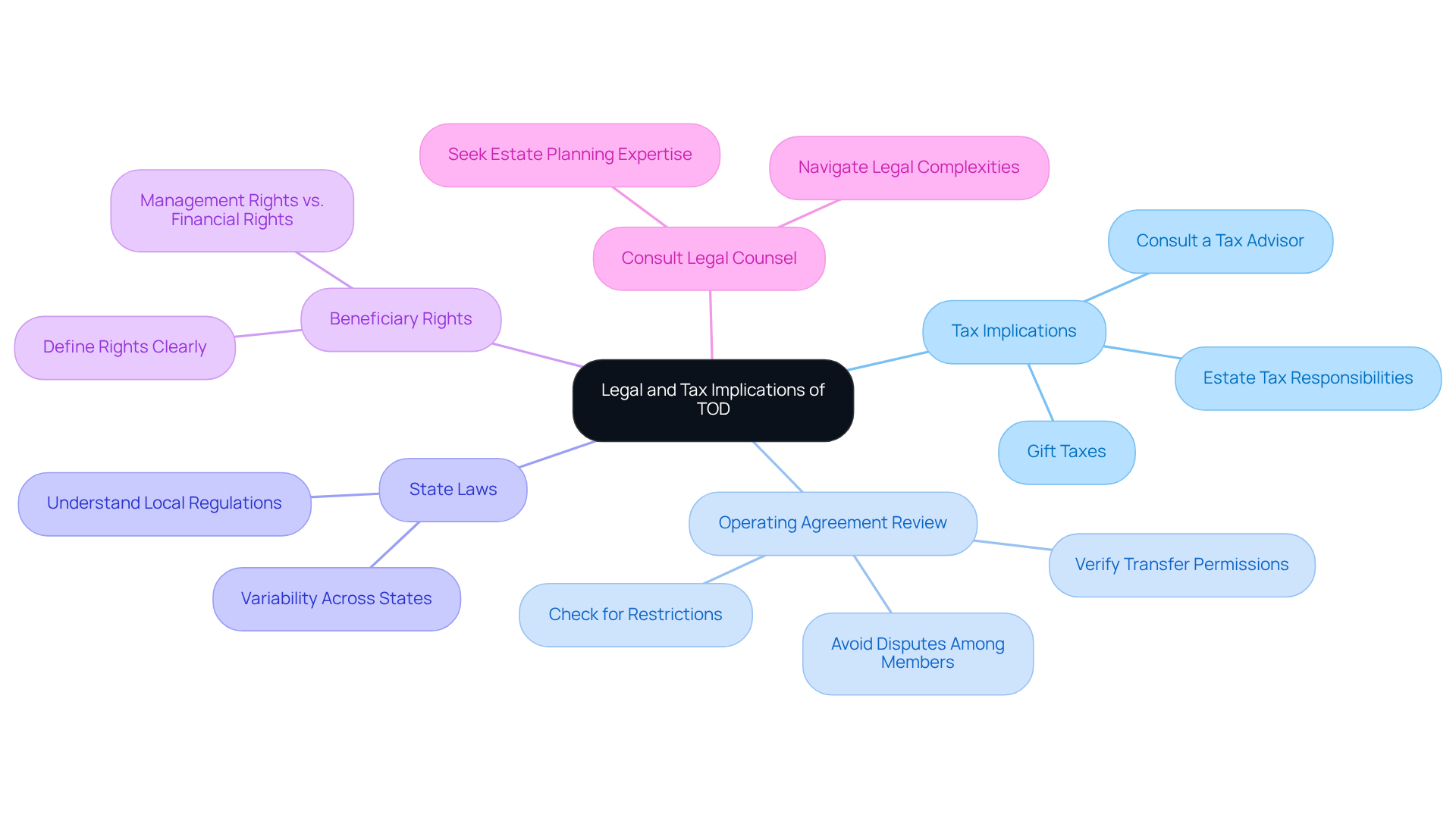

Before finalizing the Transfer on Death (TOD) designation, it is crucial to consider the following legal and tax implications:

-

Tax Implications: Transferring ownership stakes may activate gift taxes or affect your estate tax responsibilities. Engaging a tax advisor is essential to evaluate potential liabilities and ensure compliance with tax regulations.

-

Operating Agreement Review: Verify that your LLC’s operating agreement permits the transfer on death LLC membership interest form. Some agreements may impose restrictions that complicate the transfer process, potentially leading to disputes among members.

-

State Laws: Familiarize yourself with the specific laws governing TOD transfers in your state. Regulations vary significantly, and understanding these differences is vital for the validity of your designation.

-

Beneficiary Rights: Clearly define the rights of the designated beneficiary. Without explicit provisions in the operating agreement, beneficiaries may lack management rights, which can result in conflicts with surviving members.

-

Consult Legal Counsel: It is advisable to seek guidance from an attorney specializing in estate planning or business law. Their expertise will help navigate the complexities of the transfer and ensure adherence to all legal requirements.

By thoughtfully evaluating these factors, you can make informed choices that protect your priorities and those of your beneficiaries.

Access Resources and Tools for Completing the Transfer

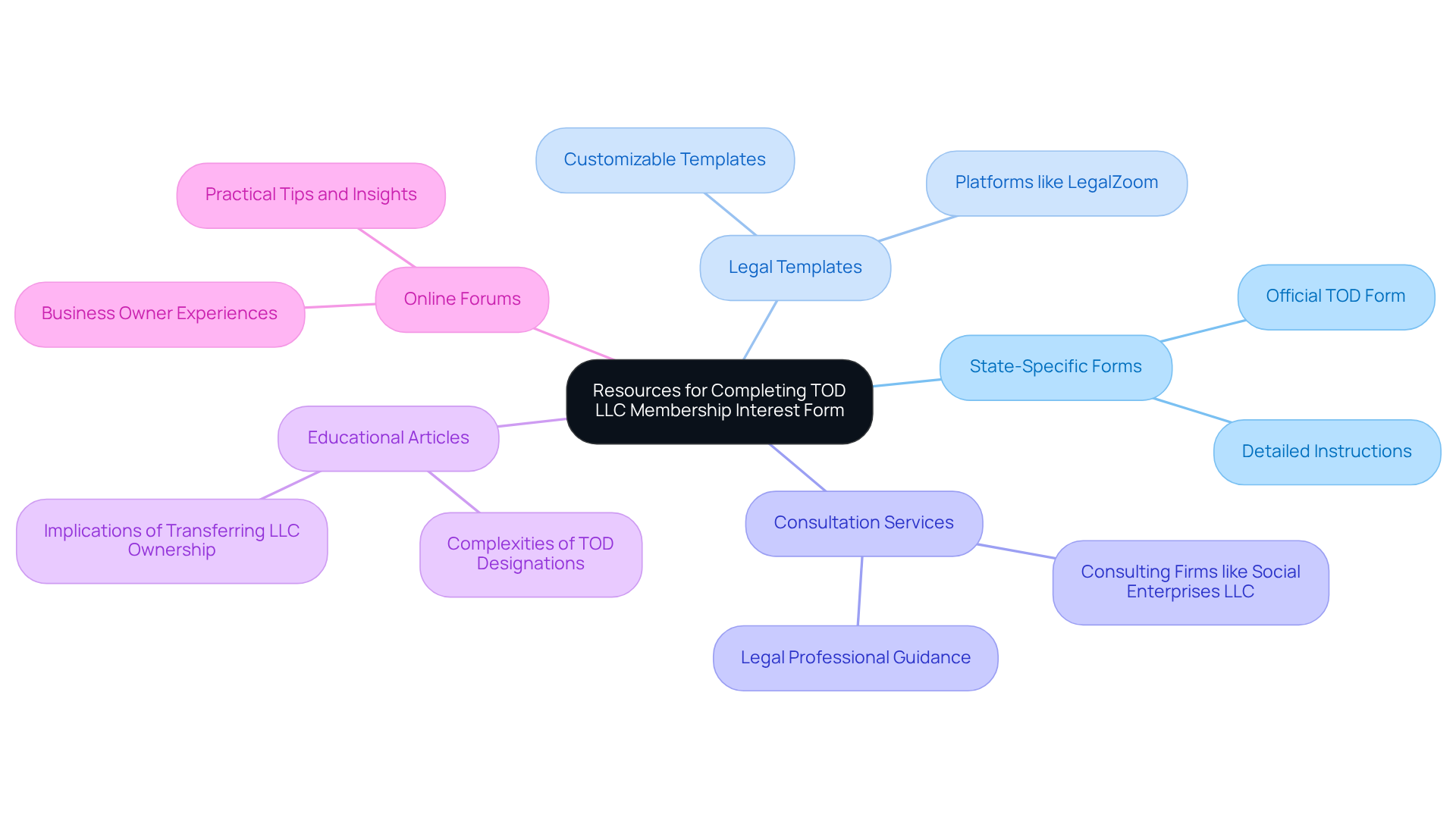

To facilitate the completion of your Transfer on Death (TOD) LLC Membership Interest Form, consider utilizing the following resources:

- State-Specific Forms: Access your state’s Secretary of State website to locate the official TOD form along with detailed instructions.

- Legal Templates: Platforms such as LegalZoom and Rocket Lawyer offer customizable templates for TOD agreements, enabling you to tailor them to your specific requirements.

- Consultation Services: Seek guidance from a legal professional or a consulting firm like Social Enterprises LLC, which specializes in business formation and compliance, to receive personalized advice and support.

- Educational Articles: Examine articles and guides from reputable legal websites that explore the complexities of TOD designations and the implications of transferring LLC ownership stakes.

- Online Forums: Engage in online forums or communities where business owners share their experiences with TOD transfers, providing valuable insights and practical tips from those who have navigated the process.

By leveraging these resources, you can enhance your understanding and ensure a smooth transfer on death LLC membership interest form process.

Conclusion

Completing a Transfer on Death (TOD) LLC Membership Interest Form is essential for ensuring that ownership of an LLC transitions smoothly to designated beneficiaries upon the member’s passing. This process simplifies asset transfer and helps avoid the lengthy and costly probate process, making it a vital component of effective estate planning.

This guide emphasizes the importance of understanding the legal framework surrounding TOD transfers and provides practical steps for accurately completing the form. Key insights include:

- The necessity of assigning a clear beneficiary

- Considering tax implications

- Ensuring compliance with state laws

Additionally, evaluating the LLC’s operating agreement and consulting with legal professionals can significantly mitigate potential complications during the transfer process.

Ultimately, efficiently completing a Transfer on Death LLC Membership Interest Form is paramount for business owners aiming to secure their legacy and provide for their heirs. By taking the time to understand and implement this mechanism, individuals can ensure their business’s continuity and protect their beneficiaries’ interests, making informed decisions that resonate well beyond their lifetime.

Frequently Asked Questions

What is a transfer on death (TOD) LLC membership interest form?

A transfer on death LLC membership interest form allows LLC members to designate a beneficiary who will automatically inherit their ownership stake upon their death, avoiding the probate process.

What are the benefits of using a TOD designation for LLC membership interests?

The benefits include a smooth transition of ownership, reduced delays and costs associated with probate, and the potential to decrease the taxable estate size, helping heirs avoid significant estate taxes.

How does the TOD mechanism help in business continuity?

The TOD mechanism ensures uninterrupted business operations by allowing ownership to transfer directly to the designated beneficiary without probate delays, as demonstrated by the example of Tom, a single-member LLC owner who successfully transferred ownership to his daughter.

Does the legal framework for TOD vary by state?

Yes, the legal framework for the transfer on death LLC membership interest form varies by state and often requires specific language in the LLC’s operating agreement.

What is the significance of the Ohio Uniform Transfer on Death LLC membership interest form?

The Ohio Uniform Transfer on Death LLC membership interest form explicitly includes LLC ownership stakes, providing a clear and established path for executing a TOD transfer.

What alternative methods exist for transferring LLC ownership without probate?

Joint tenancy with rights of survivorship is one alternative method that can facilitate ownership transfer without probate complications.

What factors should be considered when choosing between TOD and other ownership transfer methods?

Considerations include control, tax ramifications, and the overall continuity of the business when deciding between TOD and alternatives like gifting LLC ownership.

Why is understanding these transfer mechanisms important for estate planning?

Understanding these mechanisms is vital for effective business succession planning, especially since a significant percentage of investors lack a wealth transfer plan.