Introduction

The decision to establish a Limited Liability Company (LLC) is frequently motivated by the need for personal asset protection and operational flexibility, making it a favored option among entrepreneurs. However, the costs involved in both the formation and maintenance of an LLC can differ significantly from one state to another, prompting critical considerations regarding affordability and long-term financial consequences.

As prospective business owners evaluate their choices, it is essential to account not only for the initial filing fees but also for the ongoing expenses that may affect their profitability.

What unforeseen costs could arise during the process of forming an LLC, and how can entrepreneurs effectively navigate these financial challenges to ensure their business succeeds?

Understanding Limited Liability Companies (LLCs)

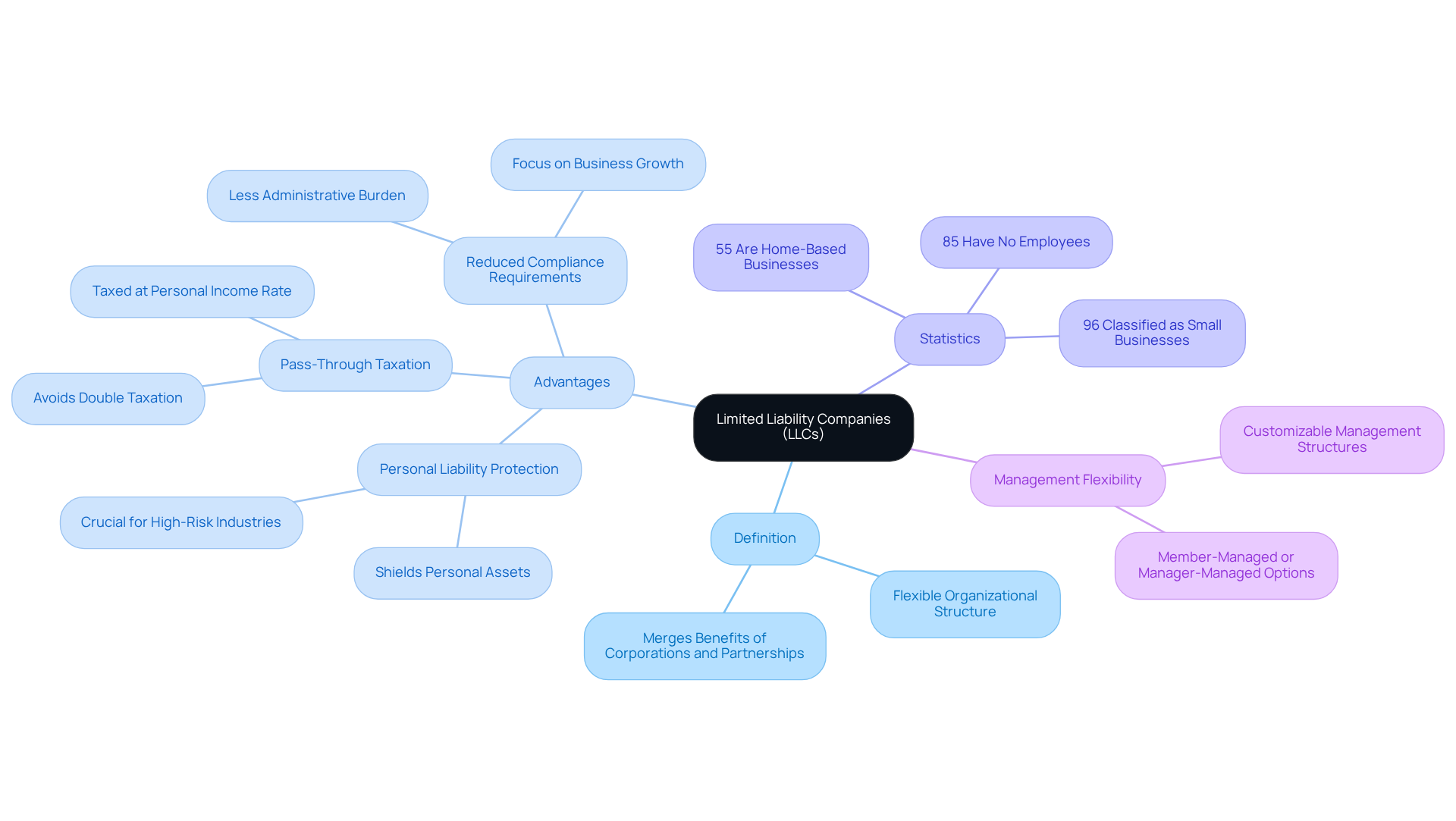

A Limited Liability Company (LLC) represents a flexible organizational structure that merges the benefits of both corporations and partnerships. A primary advantage of an LLC is the personal liability protection it offers its owners, shielding personal assets from debts and legal claims. This protection is crucial, especially for entrepreneurs in high-risk industries, as it allows them to operate without the constant worry of losing personal assets due to liabilities.

In 2026, statistics reveal that approximately 96% of LLCs are classified as small businesses, with a significant number operating as sole proprietorships – 85% of LLCs have no employees other than the owner. This highlights the structure’s appeal to individual entrepreneurs and small business owners seeking both flexibility and security. Additionally, LLCs benefit from pass-through taxation, where profits are taxed at the owner’s personal income tax rate, thus avoiding the double taxation typically associated with corporations.

The management flexibility and reduced compliance requirements make LLCs particularly appealing. In contrast to corporations, which must adhere to more stringent regulations, LLCs generally face a lighter administrative load, allowing owners to focus on growing their business rather than managing paperwork. This streamlined approach is especially beneficial for home-based businesses, which constitute 55% of small enterprises, many of which are LLCs.

Business consultants stress the significance of choosing the appropriate structure for long-term success. As one expert noted, “For small businesses with limited administrative resources, the reduced paperwork of an LLC can be advantageous.” Real-world examples further illustrate this point: numerous successful LLCs have utilized their structure to expand operations while preserving personal asset protection, enabling them to tackle challenges without risking their owners’ financial security. Overall, the LLC structure continues to be a favored option for entrepreneurs aiming to balance liability protection with operational flexibility.

Comparing LLC Formation Costs by State

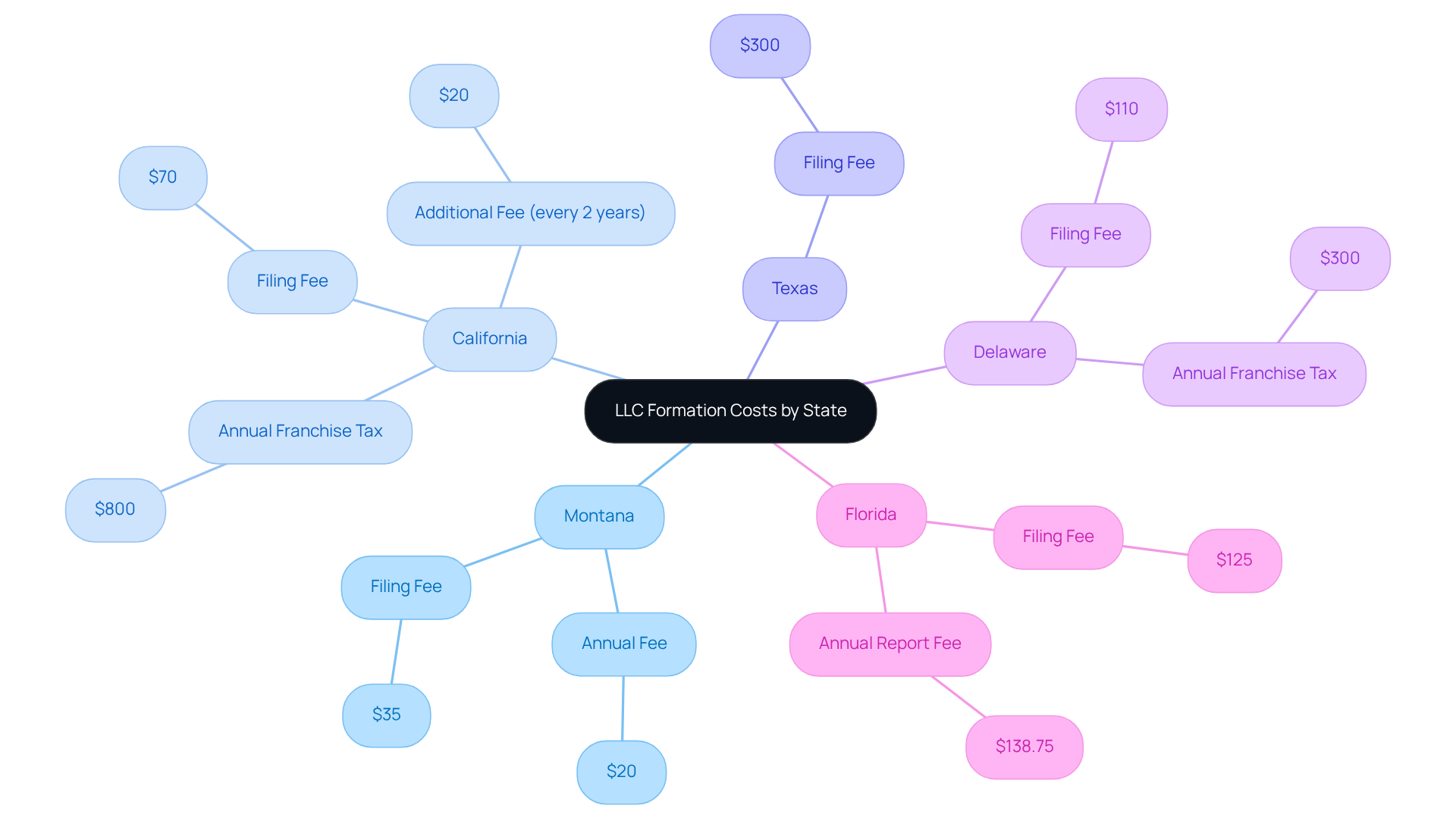

When considering forming an LLC, one might wonder, do you have to pay for an LLC, as the costs can vary significantly across the United States? As of 2023, the filing fee for an LLC in Montana is $35, whereas Massachusetts imposes a fee of $520. California further adds to the financial burden with an annual franchise tax of $800, which considerably increases the overall cost of maintaining an LLC. Below is a summary of notable state fees:

- Montana: $35 filing fee

- California: $70 filing fee + $800 annual tax

- Texas: $300 filing fee

- Delaware: $110 filing fee + $300 annual franchise tax

- Florida: $125 filing fee + $138.75 annual report fee

These costs are pivotal in influencing a business owner’s decision regarding where to establish their LLC. While lower initial costs may seem attractive, it is essential to consider the ongoing expenses related to compliance, particularly when you ask, do you have to pay for an LLC, as these can significantly impact long-term financial strategies. Recent trends indicate that states like Nevada and Wyoming are favored for their business-friendly environments and lower overall costs, making them appealing options for entrepreneurs aiming to minimize expenses while maximizing legal protections.

Ongoing Costs of Maintaining an LLC

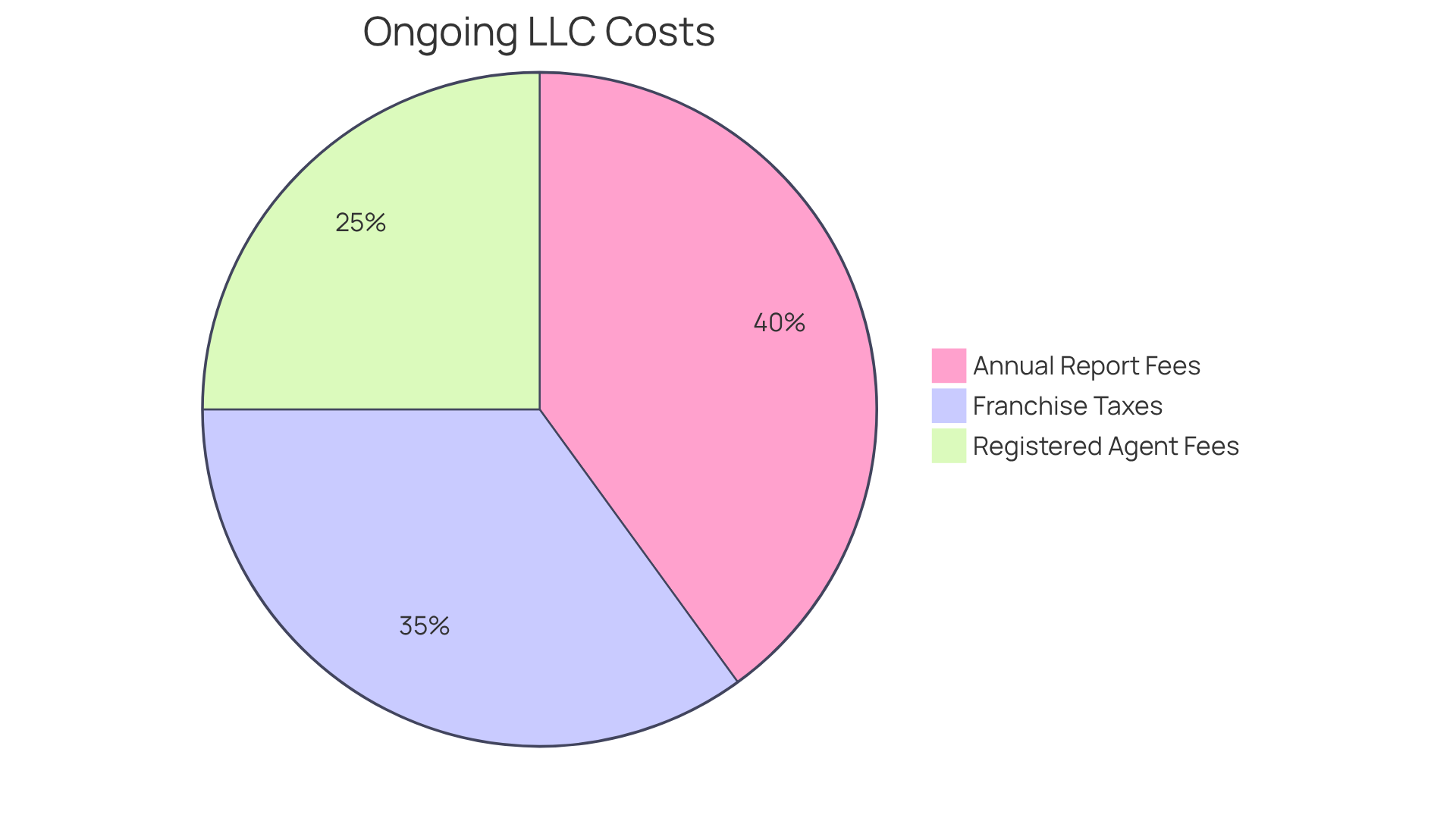

After forming an LLC, owners often wonder, do you have to pay for an LLC to navigate several ongoing costs to maintain compliance and good standing. Key expenses include:

- Annual Report Fees: Most states mandate LLCs to file annual reports, with fees ranging from $10 to $500. For instance, Florida’s average yearly report fee is roughly $138.75, while regions like California impose a minimum franchise tax of $800.

- Franchise Taxes: These taxes differ considerably by region. While California has a significant minimum franchise tax, many regions do not levy any franchise tax at all, making it essential for entrepreneurs to comprehend their particular area’s requirements.

- Registered Agent Fees: If an LLC opts for a registered agent service, costs typically range from $100 to $300 annually. This service can offer privacy and ensure adherence to regional regulations.

In addition to these ongoing expenses, it is crucial for owners to consider the initial costs of setting up a company in the U.S., which can differ depending on the state and type of entity selected. For example, Limited Liability Companies (LLCs) and Corporations are popular structures for game companies, each with its own set of advantages and costs. Awareness of these ongoing and initial costs is vital for owners to sustain their LLC, as it raises the question of do you have to pay for an LLC to avoid incurring penalties or risking the loss of their status. Consulting with experts from Social Enterprises can provide tailored guidance on the costs associated with maintaining compliance and the best business structure for specific needs.

State-Specific Advantages and Disadvantages for LLC Formation

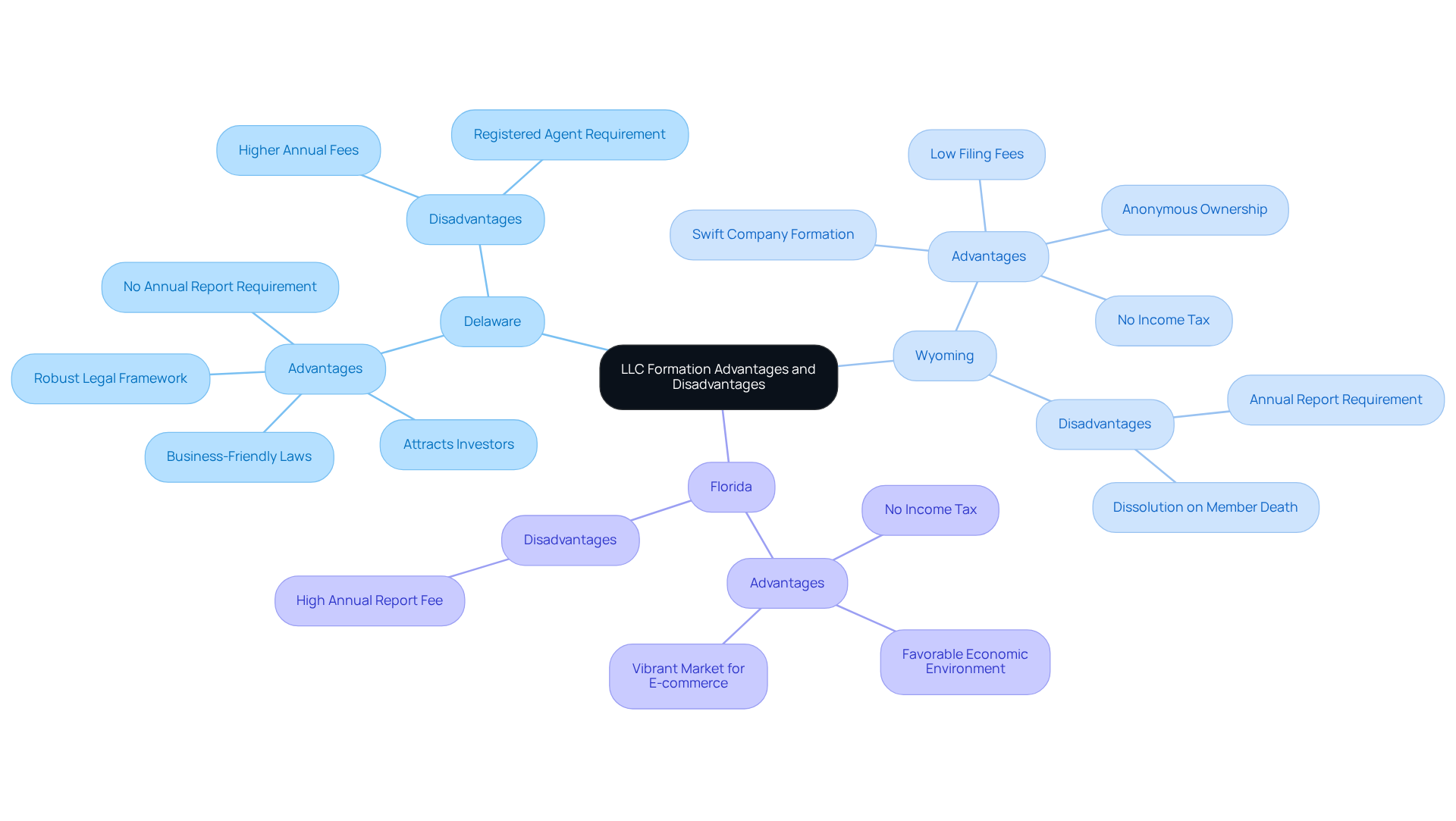

When considering where to establish an LLC, it is essential to evaluate the distinct benefits and drawbacks associated with each region.

-

Delaware is renowned for its business-friendly laws and well-established legal framework, providing robust protections for LLC owners. This state is particularly advantageous for international entrepreneurs due to its favorable tax policies and capacity to attract investors. However, it is important to note that when considering Delaware, one might wonder do you have to pay for an LLC due to its higher annual fees compared to other regions.

-

Wyoming, often referred to as the Switzerland of the United States, offers low filing fees and no income tax, making it an appealing option for many entrepreneurs. Furthermore, Wyoming allows for anonymous ownership, which adds a layer of privacy that many business owners find valuable. This state is particularly suited for those seeking efficient company formation solutions.

-

Florida boasts a favorable economic environment and no income tax, making it an attractive choice for numerous entrepreneurs. Nevertheless, when considering starting a business, do you have to pay for an LLC, as it does have a relatively high annual report fee? The vibrant market in Florida can be especially beneficial for e-commerce entrepreneurs aiming to establish a foothold in the U.S.

Each state presents unique advantages and challenges. Business owners should carefully consider their specific needs, including market access, tax implications, and the regulatory environment, when deciding where to form their LLC. For Turkish-speaking entrepreneurs, seeking expert consulting from Social Enterprises can provide tailored guidance to navigate these considerations effectively.

Conclusion

Understanding the costs associated with forming and maintaining a Limited Liability Company (LLC) is essential for entrepreneurs who seek to protect their personal assets while pursuing business opportunities. An analysis of state-specific fees reveals significant variations that can influence decisions regarding where to establish an LLC. By recognizing these financial implications, business owners can make informed choices that align with their long-term goals.

Key factors affecting LLC costs include:

- Initial filing fees

- Annual franchise taxes

- Ongoing compliance expenses

For example, states like Montana offer low filing fees, whereas California imposes substantial annual taxes that can strain budgets. Additionally, the advantages of specific states, such as the business-friendly environment in Delaware or the tax benefits in Wyoming and Florida, further complicate the decision-making process. These insights underscore the importance of evaluating all financial aspects before forming an LLC.

Ultimately, the journey of establishing an LLC extends beyond initial costs. It invites entrepreneurs to consider their unique business needs, regulatory environments, and market opportunities. By carefully analyzing the costs and benefits associated with different states, business owners can strategically position themselves for success. For those contemplating the question, “Do you have to pay for an LLC?”, understanding these financial dynamics is crucial for making a choice that fosters both growth and protection.

Frequently Asked Questions

What is a Limited Liability Company (LLC)?

An LLC is a flexible organizational structure that combines the benefits of both corporations and partnerships, providing personal liability protection to its owners.

What is the main advantage of an LLC?

The primary advantage of an LLC is the personal liability protection it offers, which shields owners’ personal assets from debts and legal claims.

What percentage of LLCs are classified as small businesses?

In 2026, approximately 96% of LLCs are classified as small businesses.

How many LLCs operate as sole proprietorships?

85% of LLCs have no employees other than the owner, indicating that many operate as sole proprietorships.

What is pass-through taxation in the context of LLCs?

Pass-through taxation means that the profits of an LLC are taxed at the owner’s personal income tax rate, avoiding the double taxation typically associated with corporations.

What makes LLCs appealing in terms of management and compliance?

LLCs offer management flexibility and reduced compliance requirements compared to corporations, allowing owners to focus more on business growth rather than administrative tasks.

Why are LLCs beneficial for home-based businesses?

The streamlined administrative approach of LLCs is especially beneficial for home-based businesses, which make up 55% of small enterprises.

What do business consultants say about choosing the right business structure?

Business consultants emphasize the importance of selecting the appropriate structure for long-term success, noting that the reduced paperwork of an LLC can be advantageous for small businesses with limited administrative resources.

Can you provide examples of successful LLCs?

Numerous successful LLCs have expanded operations while maintaining personal asset protection, allowing them to address challenges without jeopardizing their owners’ financial security.