Introduction

Understanding the significance of an Employer Identification Number (EIN) is essential for any business navigating the complexities of tax compliance and operational legitimacy. This unique identifier is increasingly relied upon for critical functions such as tax reporting and banking, making the validation of its authenticity paramount.

However, businesses may encounter challenges when attempting to verify their EIN. This article explores practical steps and alternative methods for confirming EIN validity, providing readers with the necessary tools to avoid costly errors and maintain compliance in a business landscape that is under increasing scrutiny.

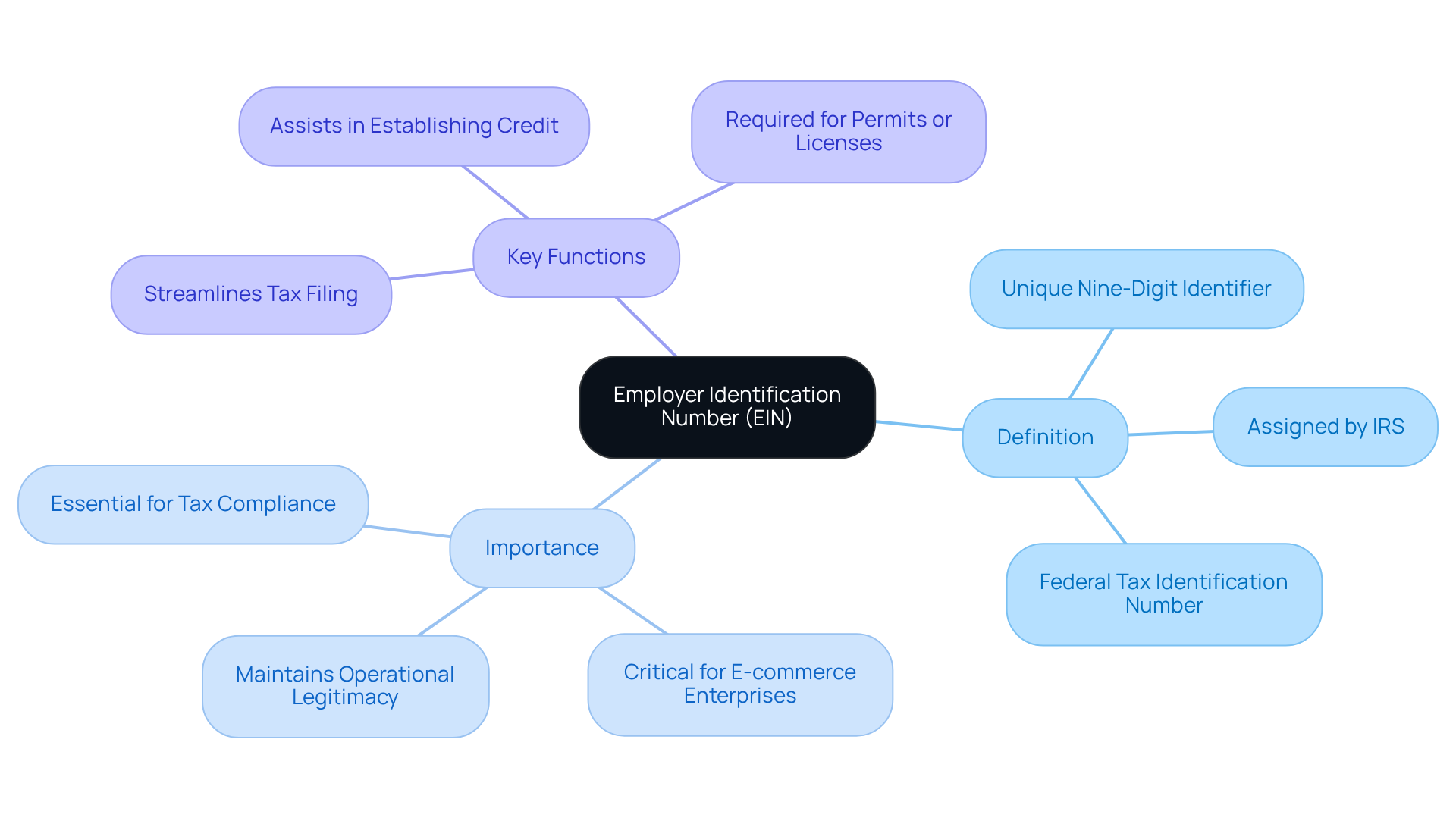

Understand the Employer Identification Number (EIN)

An Employer Identification Number (EIN) is a unique nine-digit identifier assigned by the Internal Revenue Service (IRS) to distinguish an enterprise for tax purposes, commonly referred to as a Federal Tax Identification Number. This number is essential for various corporate functions, including filing tax returns, opening bank accounts, and hiring employees. For e-commerce enterprises, a valid EIN is critical not only for tax reporting but also for compliance with international regulations. By 2026, it is projected that over 90% of enterprises in the U.S. will utilize an EIN for tax compliance, highlighting its significance in maintaining operational legitimacy.

The EIN fulfills multiple key functions in compliance and tax reporting:

- It streamlines the tax filing process.

- It assists in establishing credit.

- It is often required when applying for permits or licenses.

As e-commerce continues to grow, the role of the EIN becomes increasingly vital, especially as enterprises face evolving tax regulations and intensified scrutiny from authorities.

Tax experts emphasize that possessing an EIN is not merely a regulatory requirement but a fundamental element for sustainable business practices. Proper utilization of an EIN can avert costly mistakes and ensure that enterprises remain compliant with federal regulations, ultimately fostering their growth and stability in a competitive market.

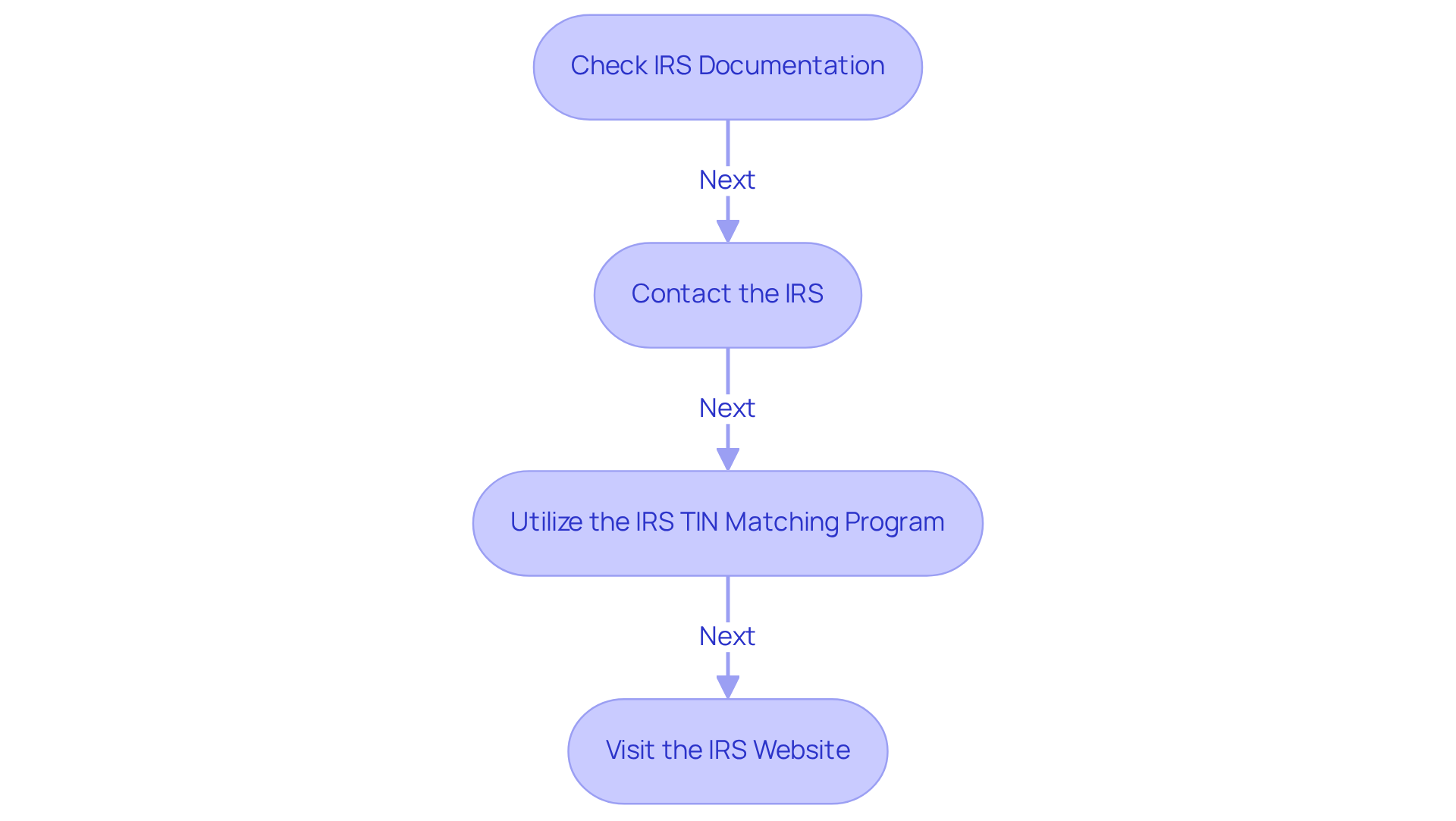

Verify Your EIN Using Official Resources

To verify your EIN, follow these steps:

- Check IRS Documentation: Locate your EIN on official IRS documents, such as your EIN confirmation letter (CP 575) or previous tax returns, where it will be clearly listed.

- Contact the IRS: If you cannot find your EIN, call the IRS Business & Specialty Tax Line at 1-800-829-4933. Be prepared to provide your company name, address, and other identifying details to assist in the confirmation process.

- Utilize the IRS TIN Matching Program: Tax professionals can leverage the IRS TIN Matching Program to verify EINs against IRS records. This tool is essential for ensuring compliance when managing client accounts, especially given the increased scrutiny on tax filings. The IRS has made updates to this program for 2026, enhancing its capabilities to support businesses in verifying EINs.

- Visit the IRS Website: The IRS site provides extensive resources and assistance on EIN validation. To learn how to check if my EIN number is valid, visit the IRS EIN page for detailed information about the confirmation process and additional support.

In recent years, the IRS has issued millions of EINs, with a significant number of enterprises utilizing these resources for verification. This proactive approach assists organizations in avoiding potential penalties related to incorrect EIN usage. Acquiring an EIN is essential for various organizational structures, particularly for those with employees or complex formations. For single-member LLCs or sole proprietorships, an ITIN may suffice, but an EIN is necessary for partnerships and corporations. Understanding these requirements is crucial for international entrepreneurs aiming to establish a venture in the U.S.

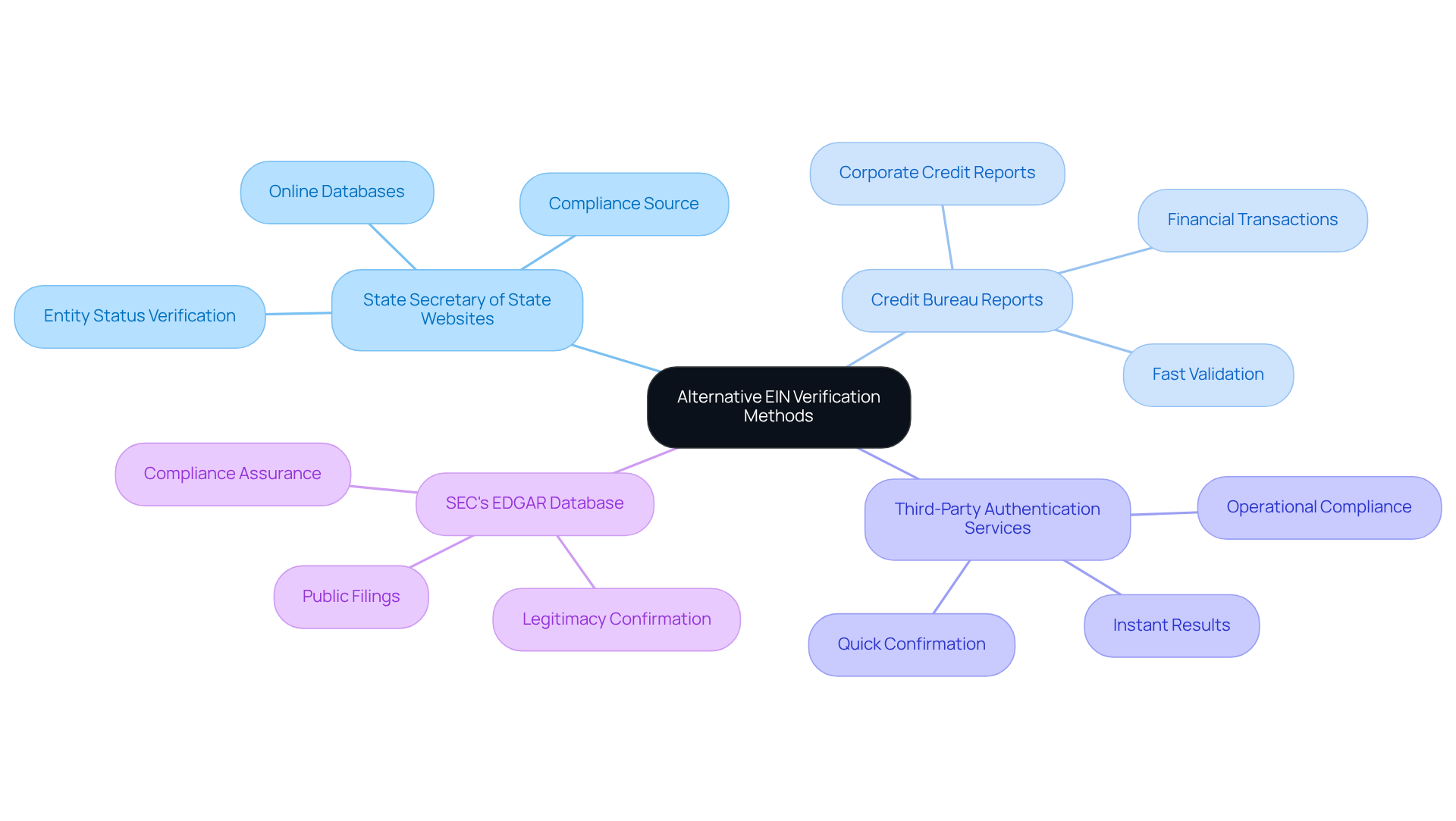

Explore Alternative EIN Verification Methods

When verifying your EIN and official IRS resources are unavailable, consider these effective alternative methods that relate to establishing a business in the U.S.:

-

State Secretary of State Websites: Many states maintain online databases that allow you to search for enterprises by name. This method demonstrates how to check if my EIN number is valid by verifying if it matches the company name and also provides additional information regarding the entity’s status. A significant number of companies rely on these state databases to understand how to check if my EIN number is valid, establishing them as a reliable source in the realm of compliance and company formation.

-

Credit Bureau Reports: Some credit agencies incorporate EIN authentication in their corporate credit reports. This service offers a fast and effective method to validate your EIN, particularly for enterprises that need to know how to check if my EIN number is valid for prompt confirmation in financial transactions or partnerships, which is vital for ensuring compliance in the U.S. commercial environment.

-

Third-Party Authentication Services: Numerous online platforms specialize in EIN authentication, providing instant results. These services are especially advantageous for companies that need quick confirmation on how to check if my EIN number is valid, without the delays associated with conventional methods, ensuring that your operations remain compliant and secure.

-

SEC’s EDGAR Database: For publicly traded companies, the SEC’s EDGAR database serves as a reliable source for verifying EINs through corporate filings. This database is essential for ensuring compliance and confirming the legitimacy of publicly listed entities, which is a critical aspect of establishing a business in the U.S.

Utilizing these alternative methods can enhance your EIN verification process, ensuring that your business operations remain compliant and secure as you navigate the complexities of establishing a business in the U.S.

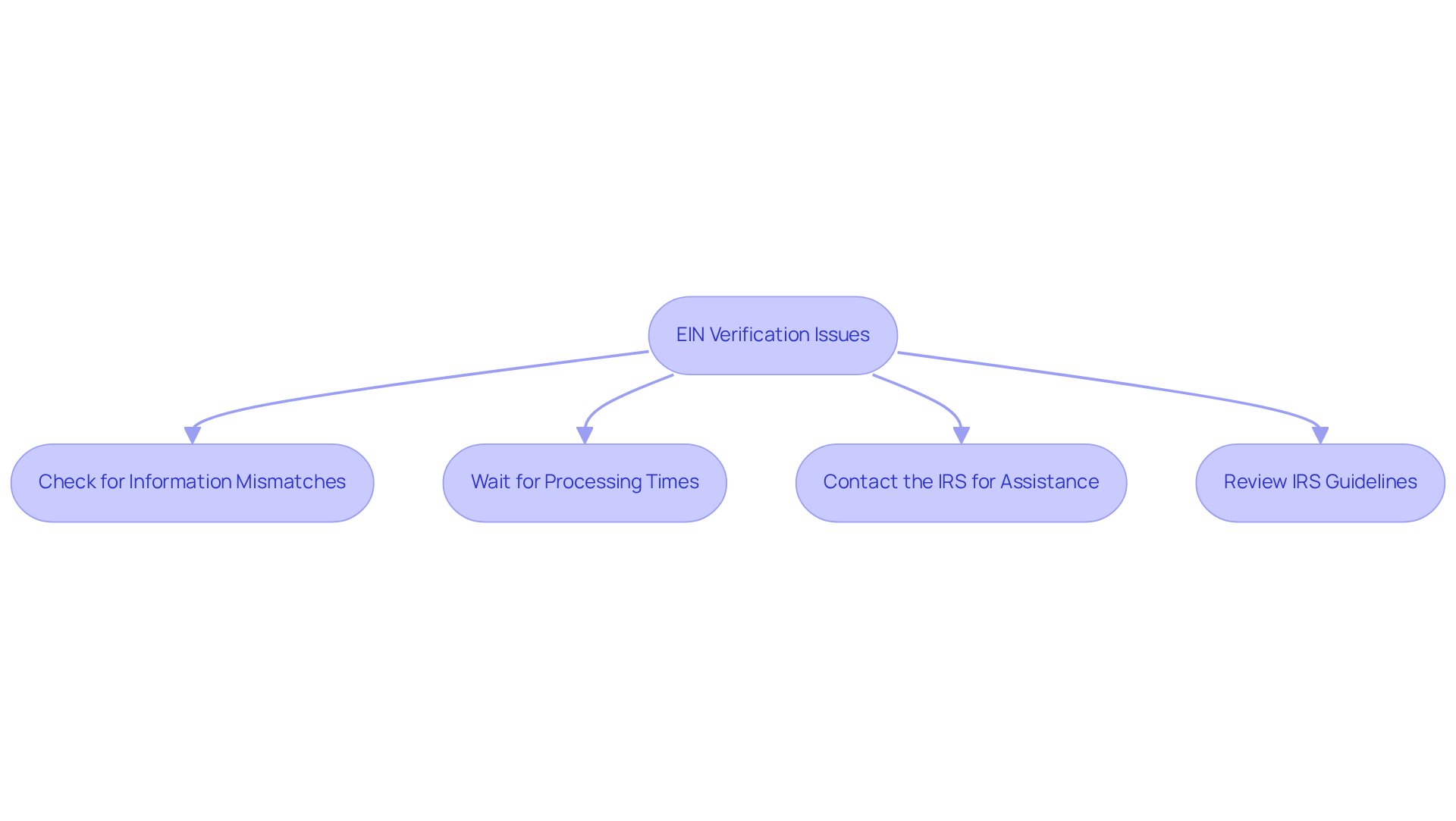

Troubleshoot Common EIN Verification Issues

When you learn how to check if my EIN number is valid, you may encounter several common issues. To assist you in resolving these, consider the following troubleshooting steps:

-

Check for Information Mismatches: Ensure that the name and address you are using for confirmation exactly match the records the IRS has on file. Even minor discrepancies can lead to validation failures, which are a significant cause of EIN validation issues.

-

Wait for Processing Times: If you have recently applied for your EIN, allow some time for the IRS to update their records. It is advisable to wait at least 24 hours before attempting to verify again, as processing delays can affect the availability of your EIN in their system.

-

Contact the IRS for Assistance: If problems persist, reach out to the IRS Business & Specialty Tax Line at 1-800-829-4933. Their representatives can provide specific advice on addressing confirmation issues and assist in clarifying any misunderstandings.

-

Review IRS Guidelines: Regularly check the IRS website for updates or changes to the EIN confirmation process. The IRS frequently revises its procedures, and staying informed can help you navigate potential issues effectively.

Understanding the importance of aligning information for EIN validation success is crucial. In 2022, the IRS indicated that mismatched information was a primary reason for EIN confirmation failures, underscoring the necessity for precision in your submissions. Additionally, for single-member LLCs or sole proprietorships, an ITIN may suffice; however, for more complex structures, obtaining an EIN is essential. By following these steps, you can enhance your chances of understanding how to check if my EIN number is valid. It is important to remember that impersonating the government is unlawful, and one should be cautious of scams; the FTC warns against paying for EIN services that can be obtained for free through the IRS.

Conclusion

Verifying the validity of an Employer Identification Number (EIN) is essential for businesses navigating the complexities of tax compliance and operational legitimacy. This guide highlights the significance of the EIN, outlines the steps to verify its validity through official IRS resources, and presents alternative methods for those who may face challenges. A valid EIN not only ensures compliance with federal regulations but also supports business growth and stability.

The article provides a systematic approach to verifying an EIN, stressing the importance of utilizing official IRS documentation, contacting the IRS directly, and exploring additional resources such as state databases and third-party services. Each method serves as a crucial tool for businesses, especially given the increasing scrutiny from tax authorities and the growing number of enterprises that require EINs for their operations.

Ultimately, verifying your EIN transcends mere procedural formality; it is a foundational element of maintaining a compliant and successful business. By adhering to the outlined steps and being cognizant of common verification issues, businesses can protect themselves against potential penalties and enhance their credibility in the marketplace. Taking proactive measures to confirm EIN validity is vital for any enterprise aiming for growth and sustainability in a competitive landscape.

Frequently Asked Questions

What is an Employer Identification Number (EIN)?

An Employer Identification Number (EIN) is a unique nine-digit identifier assigned by the Internal Revenue Service (IRS) to distinguish an enterprise for tax purposes, also known as a Federal Tax Identification Number.

Why is an EIN important for businesses?

An EIN is essential for various corporate functions, including filing tax returns, opening bank accounts, and hiring employees. It is particularly critical for e-commerce enterprises for tax reporting and compliance with international regulations.

What are some key functions of an EIN?

The EIN streamlines the tax filing process, assists in establishing credit, and is often required when applying for permits or licenses.

How prevalent is the use of EINs among U.S. enterprises?

By 2026, it is projected that over 90% of enterprises in the U.S. will utilize an EIN for tax compliance, indicating its significance in maintaining operational legitimacy.

What role does the EIN play in e-commerce?

As e-commerce continues to grow, the EIN’s role becomes increasingly vital due to evolving tax regulations and intensified scrutiny from authorities.

Why do tax experts emphasize the importance of having an EIN?

Tax experts highlight that possessing an EIN is not just a regulatory requirement but a fundamental element for sustainable business practices, helping to avoid costly mistakes and ensuring compliance with federal regulations.