Introduction

Understanding the distinctions between a Federal ID and an Employer Identification Number (EIN) is essential for business owners navigating the complexities of tax compliance. Although these terms are frequently used interchangeably, recognizing their unique functions can greatly influence operational efficiency and legal compliance.

What are the consequences when a business owner mistakenly believes these identifiers are identical? This article explores the fundamental differences, practical applications, and troubleshooting strategies for verifying and managing these critical tax identifiers, ensuring that businesses are adequately prepared to fulfill their obligations and avoid costly errors.

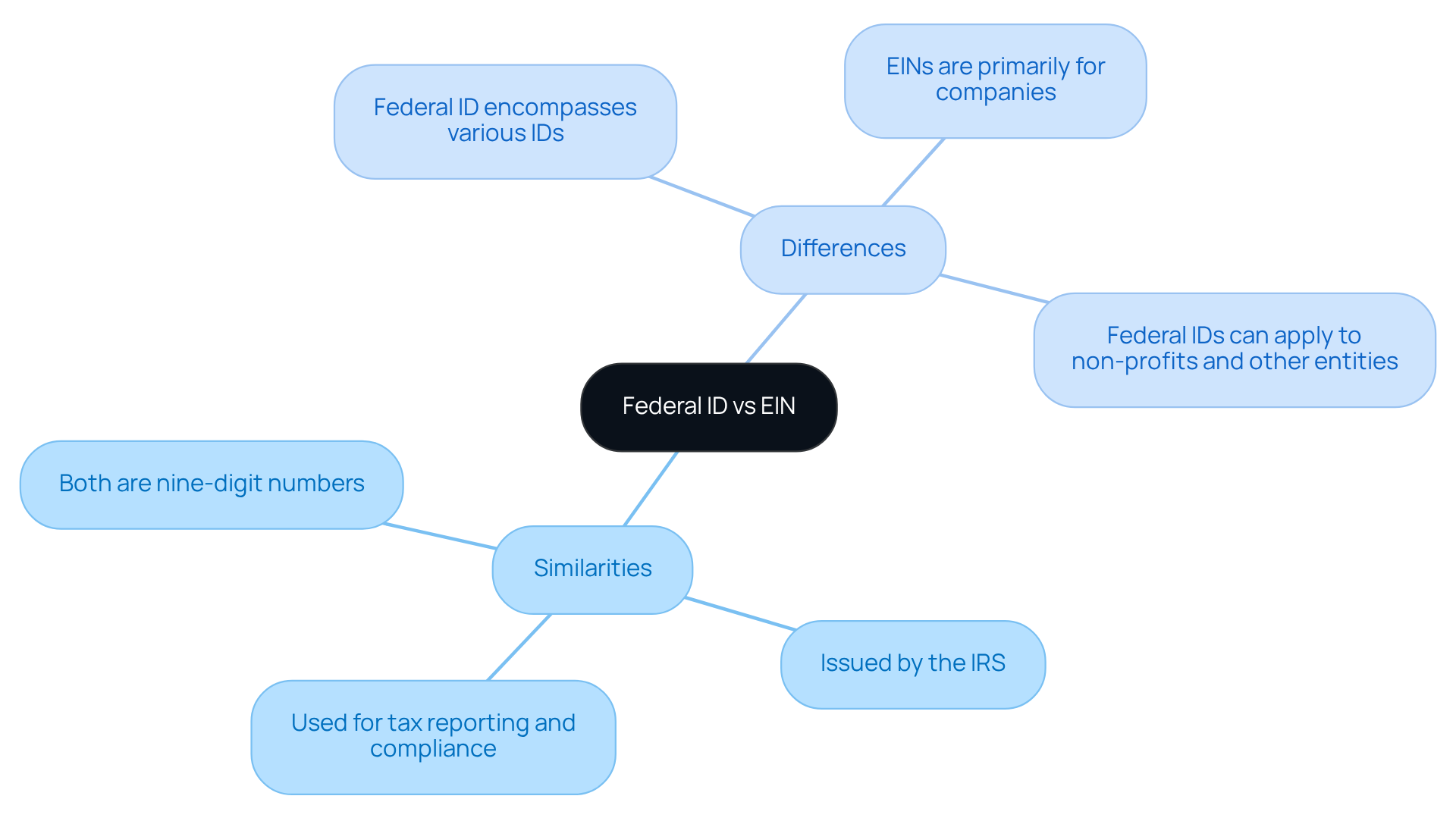

Define Federal ID and EIN: Key Differences and Similarities

A Federal ID, commonly referred to as an Employer Identification Number (EIN), is a unique nine-digit number assigned by the IRS to identify an entity for tax purposes. While the terms ‘Federal ID’ and ‘EIN’ are often used interchangeably, it is important to note that is fed id same as ein, which is crucial for owners managing tax filings and compliance.

Key similarities include that both are nine-digit numbers issued by the IRS and that the IRS number is fed id same as ein, serving the purpose of identifying an enterprise for tax reporting and compliance.

However, there are key differences:

- The term ‘Federal ID’ may encompass various identification numbers, while EIN specifically refers to the employer identification number used for tax purposes.

- EINs are primarily utilized by companies, whereas Federal IDs can also apply to non-profit organizations and other entities.

As of 2026, the IRS continues to underscore the importance of EINs within the tax landscape. With the opening of the 2026 filing season on January 26, the IRS anticipates that approximately 164 million individual tax returns will be filed, many of which will utilize EINs for business-related tax purposes. This highlights the significance of EINs in ensuring compliance and facilitating economic opportunities.

Real-world examples illustrate the practical use of EINs: numerous enterprises, including e-commerce platforms and service providers, rely on their EINs to manage payroll, file taxes, and maintain compliance with federal regulations. Understanding the differences between Federal IDs and EINs is essential for any enterprise aiming to operate effectively in the U.S. market.

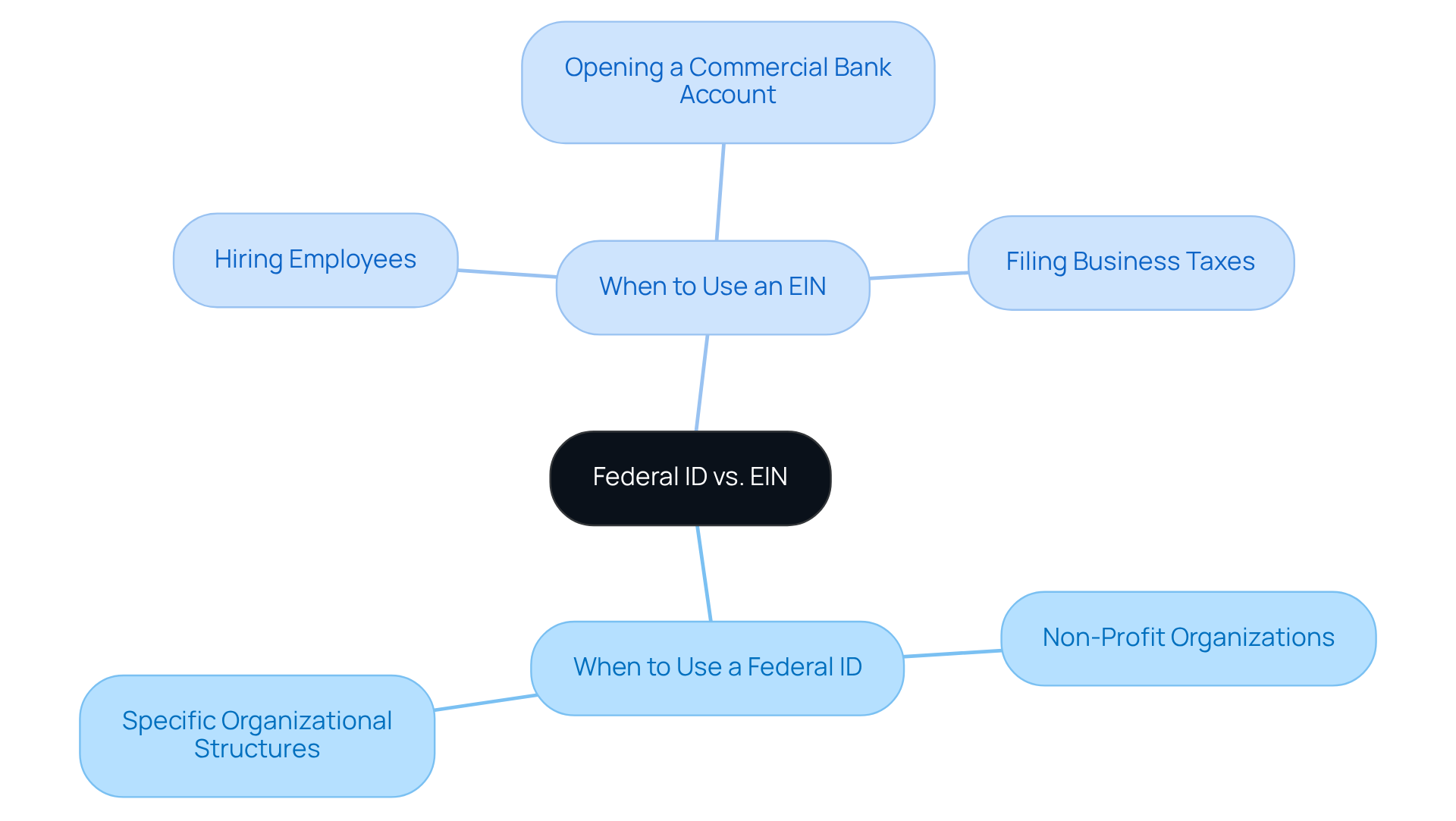

Identify When to Use Federal ID vs. EIN

Understanding when to use a Federal ID versus an EIN is essential for effective operations. Here are key scenarios to consider:

When to Use a Federal ID:

- Non-Profit Organizations: Non-profits must obtain a Federal ID to qualify for tax-exempt status, ensuring compliance with IRS regulations.

- Specific Organizational Structures: Certain entities, such as trusts or estates, may require a Federal ID to adhere to regulatory requirements.

When to Use an EIN:

- Hiring Employees: Businesses intending to hire employees must secure an EIN to accurately report taxes and manage payroll obligations. As of 2026, there is a notable increase in EIN applications, reflecting the rise in employment opportunities across various sectors.

- Opening a Commercial Bank Account: Most financial institutions require an EIN for establishing a commercial bank account, facilitating proper financial management.

- Filing Business Taxes: An EIN is crucial for filing federal tax returns for corporations and partnerships, ensuring compliance with IRS guidelines.

In summary, while a Federal ID is primarily associated with non-profit organizations and specific organizational structures, an EIN is essential for enterprises that employ staff, open bank accounts, and file taxes. Understanding these distinctions is vital for ensuring compliance and supporting seamless operations.

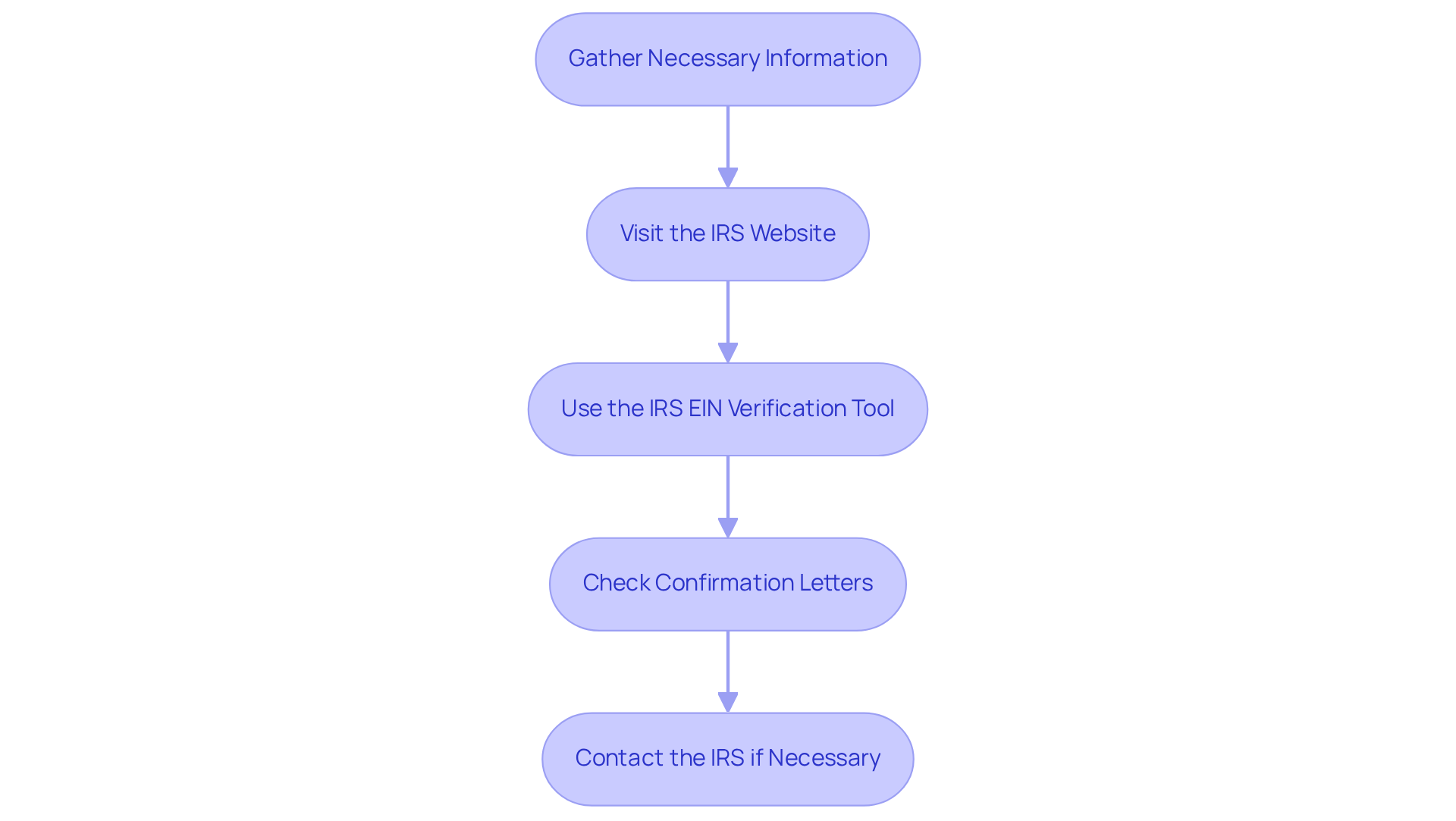

Verify Your Federal ID and EIN: Step-by-Step Process

To verify your Federal ID and EIN, follow these steps:

-

Gather Necessary Information

Begin by collecting your business name, address, and the EIN or Federal ID number you wish to verify. -

Visit the IRS Website

Navigate to the IRS website and locate the EIN verification section. If you have access, consider utilizing the IRS’s TIN Matching Program for additional verification options. -

Use the IRS EIN Verification Tool

Enter your information as prompted by the tool. This will confirm whether the EIN is valid and accurately linked to your enterprise. -

Check Confirmation Letters

Cross-reference the EIN with any previous confirmation letters you may have received, such as the CP 575, to ensure consistency. -

Contact the IRS if Necessary

If you encounter any issues, reach out to the IRS Business & Specialty Tax Line at 1-800-829-4933 for assistance. This resource is available to help resolve any verification challenges you may face.

In 2026, the IRS anticipates receiving approximately 164 million individual income tax returns, underscoring the significance of accurate EIN verification for compliance. Utilizing the IRS’s tools not only streamlines the verification process but also enhances your organization’s credibility and operational efficiency.

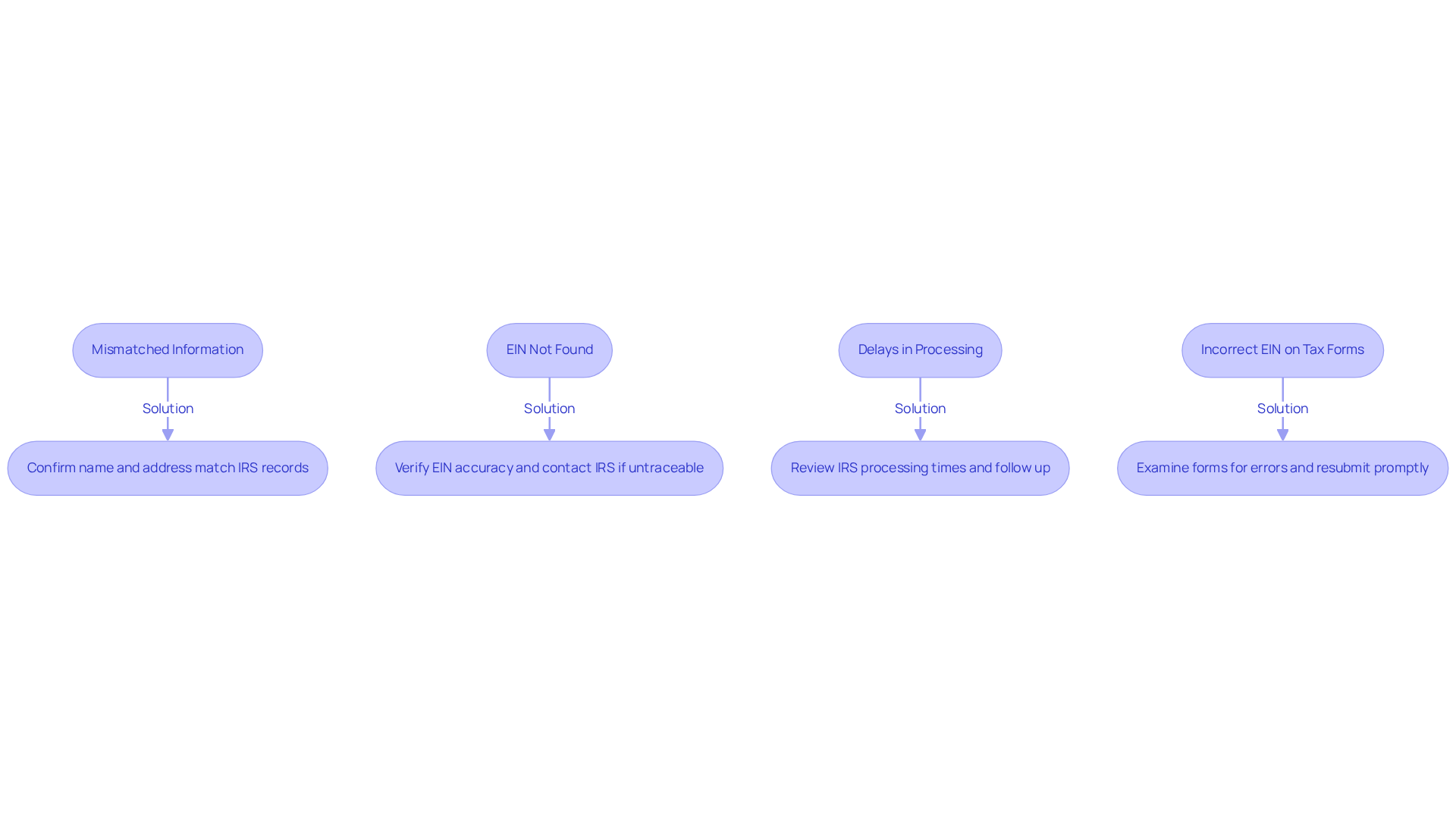

Troubleshoot Common Issues with Federal ID and EIN

When encountering issues with your Federal ID or EIN, adhere to the following troubleshooting steps to resolve common problems:

Issue 1: Mismatched Information

- Solution: Confirm that the name and address associated with your EIN precisely match IRS records. Discrepancies can result in verification failures, a frequent issue for businesses. In 2026, a notable percentage of EIN mismatches reported to the IRS originated from such inconsistencies.

Issue 2: EIN Not Found

- Solution: Carefully verify the EIN for accuracy. If it remains untraceable, contact the IRS for assistance. Tax professionals underscore the necessity of ensuring that your EIN is accurately reported to prevent complications.

Issue 3: Delays in Processing

- Solution: If you have applied for an EIN and have not received confirmation, review the IRS processing times. Delays may occur during peak filing seasons; thus, consider following up directly with the IRS to expedite your request.

Issue 4: Incorrect EIN on Tax Forms

- Solution: If your tax return is rejected due to an incorrect EIN, meticulously examine the forms for errors. Resubmit with the correct information promptly. Tax consultants recommend that addressing EIN verification issues swiftly can avert further complications, such as penalties or processing delays.

By following these steps, you can effectively troubleshoot EIN-related issues and ensure compliance with IRS regulations.

Conclusion

Understanding the distinction between a Federal ID and an EIN is crucial for any business or organization navigating the complexities of tax compliance. While both terms are often used interchangeably, recognizing their specific applications can significantly impact operational efficiency and adherence to IRS regulations.

This guide has explored the definitions, similarities, and differences between Federal IDs and EINs. It has outlined scenarios for their appropriate usage and provided a step-by-step process for verification. From the necessity of obtaining an EIN for businesses hiring employees to the requirement of a Federal ID for non-profit organizations, each aspect underscores the importance of accurate identification in maintaining compliance and facilitating business operations.

Ultimately, being informed about the nuances of Federal IDs and EINs aids in avoiding common pitfalls and empowers organizations to manage their tax responsibilities effectively. Whether verifying your EIN or troubleshooting common issues, taking proactive steps ensures that your business remains compliant and positioned for growth. Embrace the knowledge shared in this guide to streamline your operations and enhance your understanding of these essential identifiers in the tax landscape.

Frequently Asked Questions

What is a Federal ID?

A Federal ID, commonly known as an Employer Identification Number (EIN), is a unique nine-digit number assigned by the IRS to identify an entity for tax purposes.

Are Federal ID and EIN the same thing?

While the terms ‘Federal ID’ and ‘EIN’ are often used interchangeably, ‘Federal ID’ may encompass various identification numbers, whereas EIN specifically refers to the employer identification number used for tax purposes.

Who primarily uses EINs?

EINs are primarily utilized by companies, but Federal IDs can also apply to non-profit organizations and other entities.

What is the significance of EINs in tax filings?

EINs are crucial for managing tax filings and compliance, and they are expected to be used in approximately 164 million individual tax returns filed during the 2026 filing season.

How do EINs help businesses?

EINs help businesses manage payroll, file taxes, and maintain compliance with federal regulations.

Why is it important to understand the differences between Federal IDs and EINs?

Understanding the differences is essential for any enterprise aiming to operate effectively in the U.S. market, ensuring proper tax reporting and compliance.