Introduction

A Single Purpose LLC serves as a strategic tool for entrepreneurs and investors aiming to effectively manage assets and mitigate risks. This specialized limited liability company structure isolates risks associated with individual projects, thereby enhancing operational efficiency and ensuring compliance. As the popularity of Single Purpose LLCs grows, it is essential to address their legal requirements and best practices for maximizing benefits. Business owners must consider how to leverage this powerful entity to its fullest potential while safeguarding their interests.

Define Single Purpose LLC: Key Concepts and Characteristics

A Single Purpose LLC is a specialized limited liability company created for a specific, defined purpose, typically linked to a single project or resource. This structure is particularly common in real estate transactions, where a single purpose LLC holds title to a designated property or project.

Key characteristics of SPEs include:

- Isolation of Risk: By limiting liability to the assets contained within the SPE, owners can safeguard their personal assets from claims related to the project. This segregation is vital for minimizing exposure to litigation.

- Simplicity: SPEs are generally easier to manage than multi-purpose entities, as they focus on a singular objective, which streamlines operational processes and decision-making.

- Compliance: To maintain their status, SPEs must adhere to strict operational guidelines, including the prohibition of asset commingling with other entities. This compliance is essential for preserving the legal protections afforded by the LLC structure.

Understanding these traits is crucial for entrepreneurs and investors aiming to leverage the benefits of a single purpose LLC in their ventures. For instance, the average yearly growth rate of limited liability companies has reached an impressive 21%, reflecting a growing preference for this adaptable organizational structure. Furthermore, with 96% of limited liability companies classified as small businesses, the SPE model presents an attractive option for those looking to mitigate risks while engaging in specific projects.

Explore Asset Protection Benefits of Single Purpose LLCs

Single Purpose LLCs provide substantial protection benefits, making them a preferred choice for investors and entrepreneurs, particularly in the context of U.S. company formation and tax compliance. The primary advantages include:

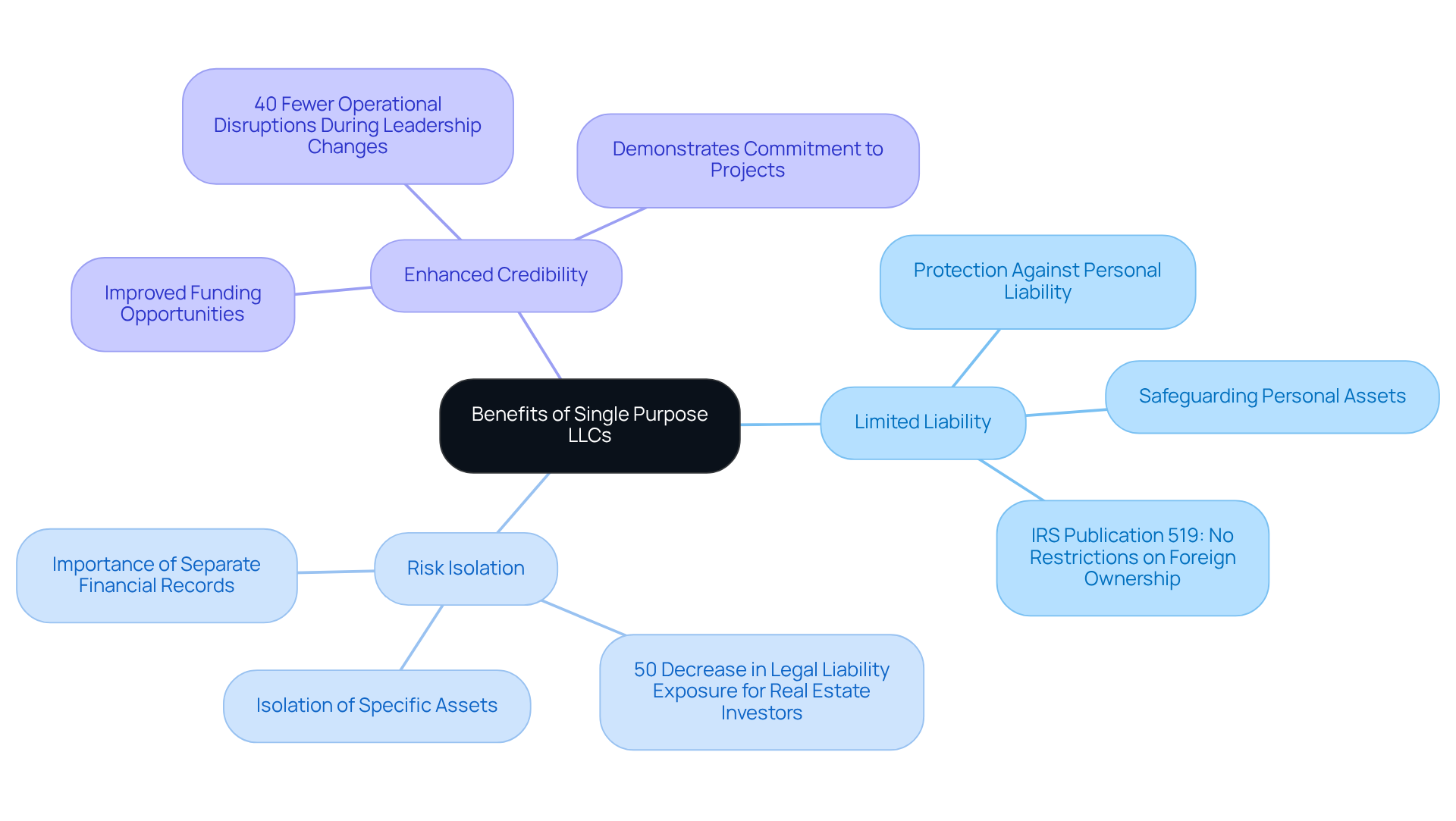

- Limited Liability: Owners generally benefit from protection against personal liability concerning the LLC’s debts and obligations. This means that personal assets remain safeguarded from business-related legal actions, a crucial aspect for many entrepreneurs. According to IRS Publication 519, an LLC does not impose restrictions on foreign ownership, which makes it especially attractive for international entrepreneurs seeking to establish a foothold in the U.S. market.

- Risk Isolation: By isolating specific assets or projects within an SPE, the risks associated with one venture do not endanger the owner’s other assets or business interests. This strategic separation is particularly advantageous in high-risk sectors, such as real estate, where legal claims can emerge unexpectedly. Research indicates that single purpose LLC entities, which are a form of limited liability companies, can decrease exposure to legal liabilities by as much as 50% for real estate investors. It is essential to maintain separate financial records to uphold these limited liability benefits, as highlighted by legal experts.

- Enhanced Credibility: Creating a dedicated entity for a specific purpose can significantly enhance credibility with lenders and investors. It demonstrates a focused commitment to the project, which can facilitate funding opportunities and partnerships. In fact, companies utilizing formal entities such as limited liability companies experience 40% fewer operational disruptions during leadership transitions, underscoring the stability these structures can provide.

Expert opinions underscore the importance of a single purpose LLC in resource protection strategies. Legal professionals stress that maintaining separate financial records and adhering to formalities are crucial for preserving limited liability benefits. This organized approach not only protects personal assets but also enhances the overall management of business endeavors.

The rising trend of single purpose LLCs reflects their distinct advantages, including operational flexibility and tax benefits, making single purpose LLCs an attractive option for entrepreneurs aiming to mitigate risk while pursuing specific business goals. In 2023, the U.S. Census Bureau recorded over 2.5 million new LLC registrations, illustrating the increasing popularity of LLC formations.

Utilize Single Purpose LLCs in Real Estate and Intellectual Property

Single Purpose Entities (SPEs) provide notable advantages in the realms of real estate and intellectual property management. Their effective utilization can significantly enhance resource management and risk mitigation for companies.

Real Estate: SPEs are commonly used to hold titles to individual properties, allowing investors to isolate risks associated with each asset. This structure not only safeguards each property from liabilities linked to others but also improves financing opportunities. Lenders typically prefer to engage with an SPE, as it limits their exposure to risk. For instance, Florida real estate investors often establish distinct limited liability companies for each property, ensuring that legal claims against one do not jeopardize the others.

Intellectual Property: For firms possessing valuable intellectual property, the establishment of an SPE can shield these assets from obligations arising from other business operations. By segmenting intellectual property into separate limited liability companies, companies can license or sell these resources without endangering their overall business interests. This approach is supported by regulations from the United States Patent and Trademark Office, which allow the assignment of intellectual property rights to legal entities, including limited liability companies. Such a structure not only enhances the protection of resources but also facilitates smoother transactions involving intellectual property.

By strategically employing a single purpose LLC in these sectors, companies can enhance their resource management and effectively mitigate risks, thereby ensuring a more secure operational framework.

Understand Legal Requirements and Compliance for Single Purpose LLCs

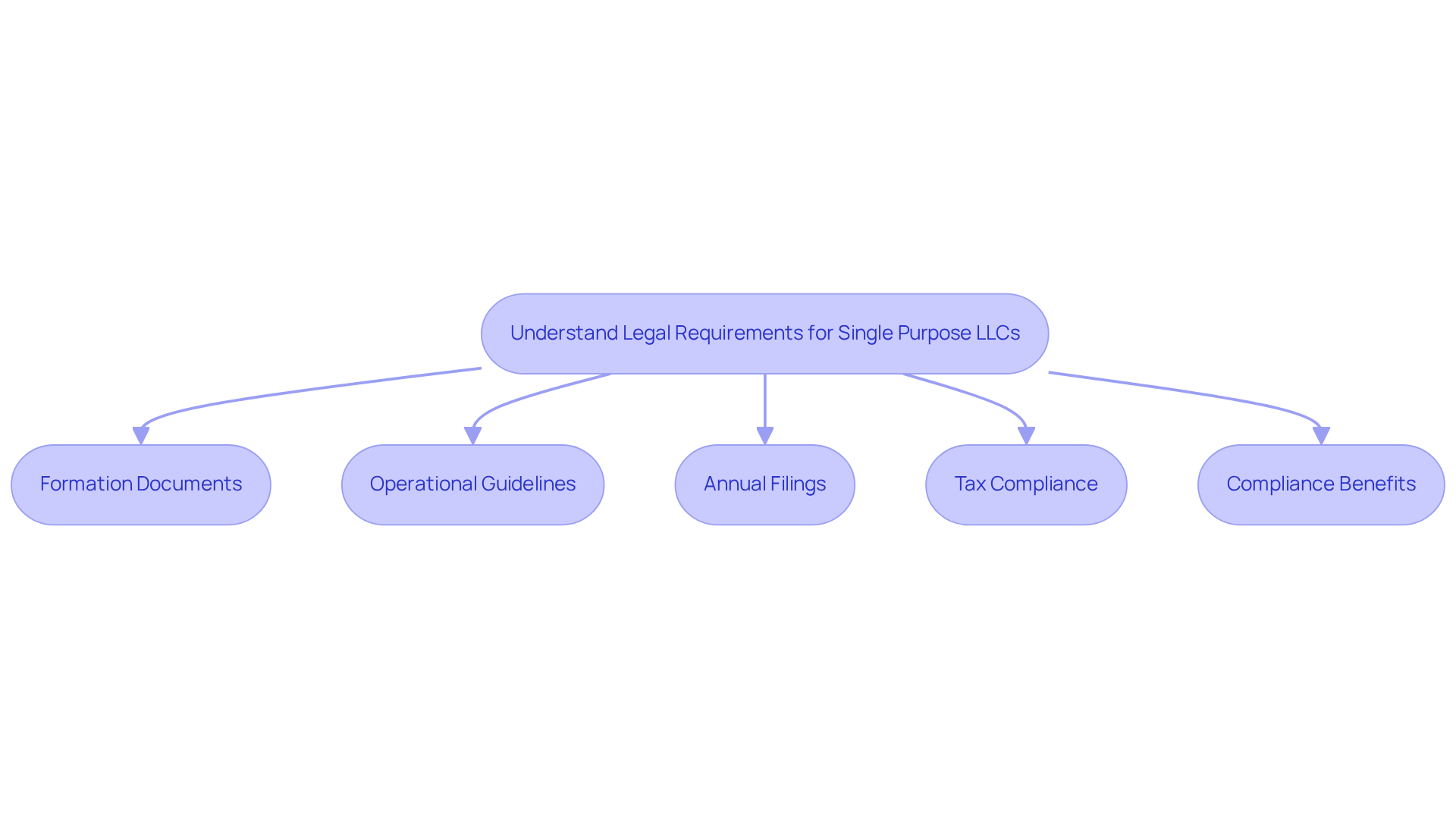

To fully leverage the advantages of a Single Purpose LLC, it is crucial to adhere to specific legal requirements and compliance measures:

-

Formation Documents: Filing the Articles of Organization with the state is imperative, as it explicitly outlines the LLC’s purpose. This clarity establishes the entity’s legitimacy and operational focus.

-

Operational Guidelines: Implementing strict operational guidelines is essential to prevent the commingling of assets. This practice ensures that the LLC functions exclusively for its designated purpose, thereby safeguarding its legal protections.

-

Annual Filings: Compliance with annual reporting requirements is necessary to maintain good standing with state authorities. Failure to comply can lead to penalties or the loss of the LLC’s status.

-

Tax Compliance: Meeting all tax obligations is vital, which includes obtaining an Employer Identification Number (EIN) and filing the necessary tax returns. Non-compliance can result in significant financial repercussions.

By understanding and following these legal requirements, business owners can effectively manage their single purpose LLCs, ensuring both compliance and protection of their interests. Statistics indicate that LLCs maintaining rigorous compliance practices are less likely to face legal challenges, reinforcing the importance of these measures.

Conclusion

Establishing a Single Purpose LLC serves as a strategic avenue for entrepreneurs and investors aiming to mitigate risks and enhance operational efficiency. This specialized limited liability company, tailored for a specific project or asset, presents distinct advantages such as risk isolation, simplified management, and increased credibility. By leveraging the unique characteristics of a Single Purpose LLC, individuals can protect their personal assets while pursuing targeted business objectives.

The article outlines several key benefits of Single Purpose LLCs, including:

- Limited liability protection

- Risk isolation for high-stakes ventures

- Improved financing opportunities

These entities are particularly beneficial in sectors such as real estate and intellectual property, where they facilitate the careful management of assets and obligations. Moreover, adhering to stringent legal requirements and compliance measures is essential for maintaining the integrity and protections afforded by the LLC structure.

In a landscape where effective risk management is critical, the Single Purpose LLC emerges as a powerful tool for entrepreneurs. By comprehending its benefits and implementing best practices, business owners can not only safeguard their interests but also position themselves for success in their specific ventures. Embracing this organizational model can lead to more secure and efficient business operations, paving the way for growth and innovation in an ever-evolving market.

Frequently Asked Questions

What is a Single Purpose LLC?

A Single Purpose LLC is a specialized limited liability company created for a specific, defined purpose, typically linked to a single project or resource, often used in real estate transactions.

What are the key characteristics of a Single Purpose LLC?

Key characteristics include isolation of risk, simplicity in management, and strict compliance with operational guidelines.

How does a Single Purpose LLC isolate risk?

By limiting liability to the assets contained within the LLC, owners can protect their personal assets from claims related to the project, minimizing exposure to litigation.

Why is simplicity an advantage of a Single Purpose LLC?

Single Purpose LLCs are easier to manage than multi-purpose entities because they focus on a singular objective, which streamlines operational processes and decision-making.

What compliance requirements must a Single Purpose LLC adhere to?

SPEs must follow strict operational guidelines, including the prohibition of asset commingling with other entities, to maintain their legal protections.

Why is understanding Single Purpose LLCs important for entrepreneurs and investors?

Understanding these traits is crucial for leveraging the benefits of a Single Purpose LLC in ventures, particularly for mitigating risks associated with specific projects.

What is the growth trend for limited liability companies?

The average yearly growth rate of limited liability companies has reached 21%, indicating a growing preference for this adaptable organizational structure.

What percentage of limited liability companies are classified as small businesses?

96% of limited liability companies are classified as small businesses, making the Single Purpose LLC model an attractive option for those looking to engage in specific projects while mitigating risks.