Introduction

Forming a Limited Liability Company (LLC) presents a complex challenge for many entrepreneurs. Approximately 70% of small businesses choose this structure, drawn by its combination of liability protection and tax benefits. Therefore, grasping the intricacies of LLC formation is essential for achieving success.

What key steps and potential pitfalls should aspiring business owners consider to facilitate a smooth formation process? This guide explores the fundamental aspects of LLC formation, providing a detailed roadmap to empower entrepreneurs in establishing their ventures with confidence.

Understand the Basics of an LLC

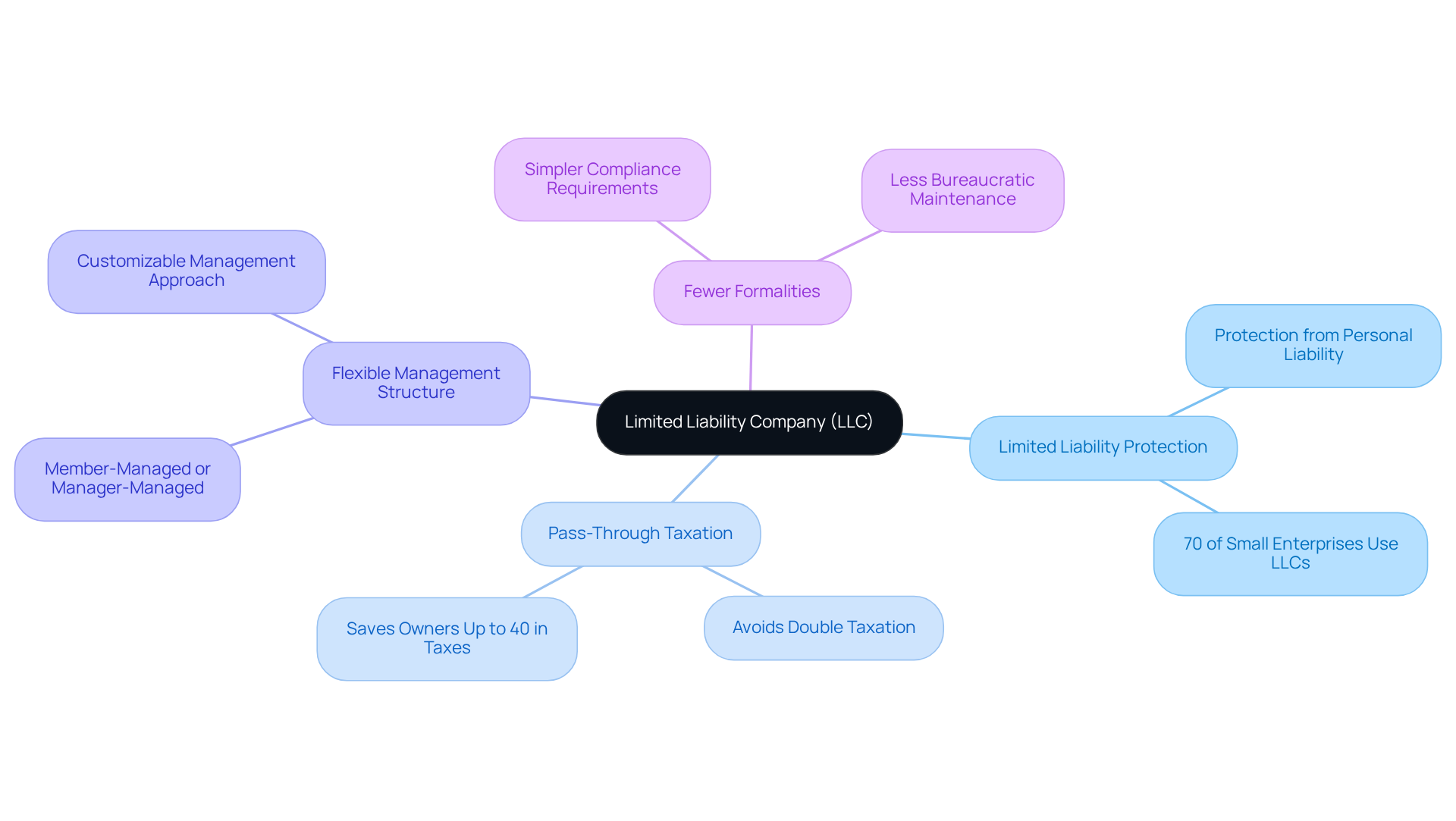

A Limited Liability Company (LLC) represents a flexible organizational structure that merges the advantages of both corporations and partnerships. The essential features include:

-

Limited Liability Protection: Members of an LLC are protected from personal liability concerning the company’s debts and obligations. This safeguard ensures that personal assets remain secure in the event of lawsuits or financial difficulties, fostering trust among entrepreneurs. Approximately 70% of small enterprises rely on LLCs for this liability protection, facilitating growth without the anxiety of personal financial loss.

-

Pass-Through Taxation: LLCs typically benefit from pass-through taxation, which allows profits and losses to be reported on the members’ personal tax returns. This arrangement helps avoid the double taxation commonly associated with corporations, enabling owners to retain a larger portion of their earnings. In fact, LLCs can save owners up to 40% in taxes, making them an appealing choice for many entrepreneurs.

-

Flexible Management Structure: LLCs can be managed by their members or by appointed managers, providing flexibility in operational decisions. This adaptability allows businesses to customize their management approach to best meet their needs.

-

Fewer Formalities: Unlike corporations, LLCs face fewer ongoing formalities and regulatory requirements, simplifying maintenance. This ease of management is particularly advantageous for entrepreneurs focused on growth rather than bureaucratic processes. According to the U.S. Small Business Administration, LLCs benefit from simpler compliance, avoiding the complex formalities mandated for corporations.

Statistics reveal that 91% of small enterprise owners prefer the LLC structure for its financial independence and flexibility. Understanding these fundamentals, along with professional guidance from Social Enterprises, will clarify why US LLC formation could be the optimal choice for your venture. Social Enterprises offers tailored services to assist you in navigating the LLC formation process, ensuring compliance with tax regulations and investment requirements.

Follow the Step-by-Step Process for LLC Formation

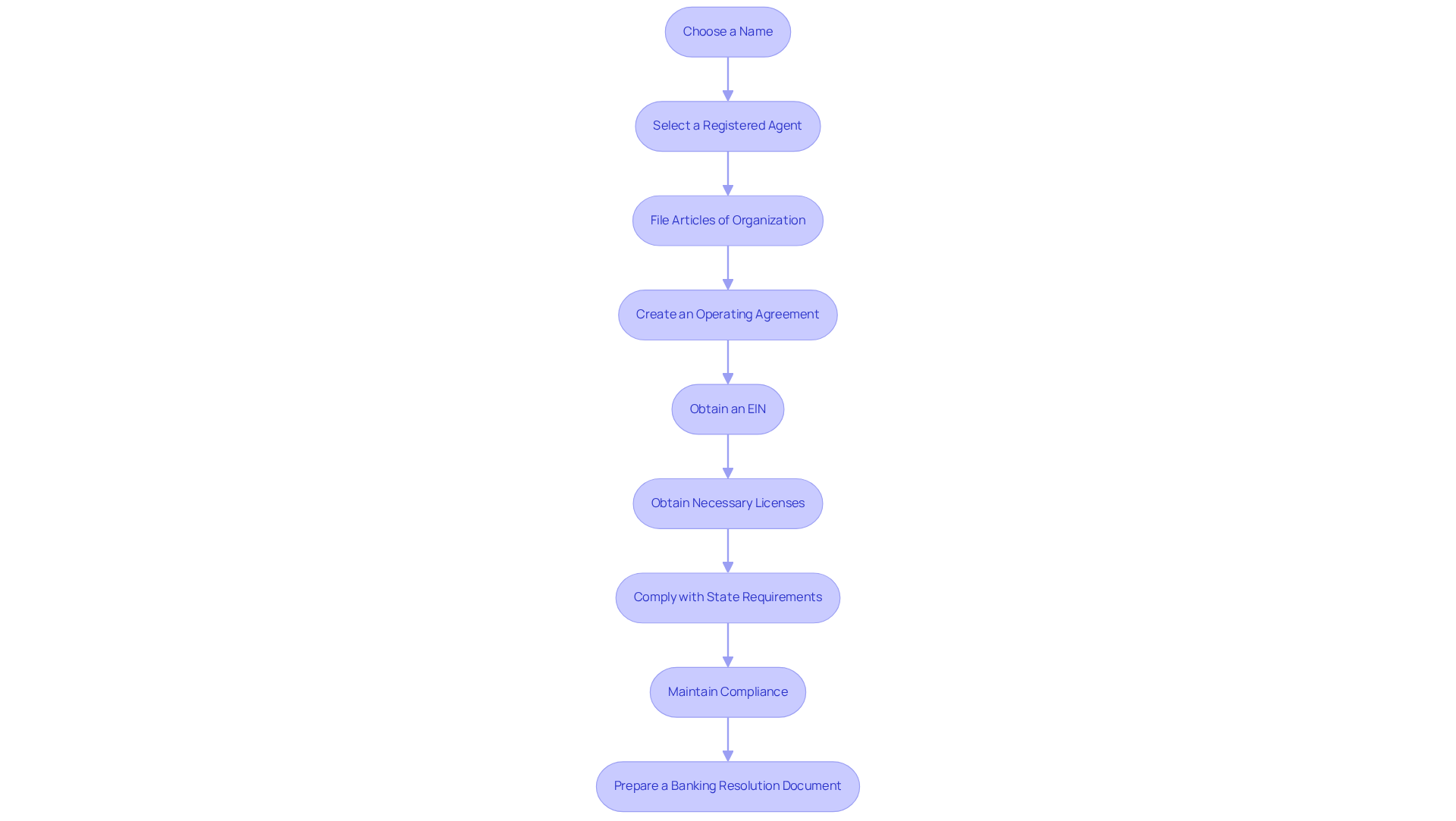

To successfully form an LLC with Social Enterprises, adhere to the following steps:

-

Choose a Name for Your LLC: Select a unique name that complies with state regulations, ensuring it includes ‘LLC’ or ‘Limited Liability Company’. This is crucial for establishing your business identity and avoiding legal issues. Consulting legal experts for guidance on name selection can help ensure adherence and avoid potential conflicts.

-

Select a Registered Agent: Designate a registered agent to receive legal documents on behalf of the LLC. This individual or entity must have a physical address in the state of formation, ensuring compliance with state laws.

-

File Articles of Organization: Submit the Articles of Organization to your state’s Secretary of State office. This document generally contains the LLC’s name, address, and registered agent’s details, officially establishing your venture.

-

Create an Operating Agreement: While not always mandatory, drafting an operating agreement is advisable. This document outlines the management structure and operational procedures of the LLC, helping to prevent disputes among members.

-

Obtain an EIN: Apply for an Employer Identification Number (EIN) from the IRS, which is essential for tax purposes and hiring employees. This number serves as your company’s tax identification. Understanding EIN requirements is vital for adhering to regulations and future updates to your company details.

-

Obtain Necessary Business Licenses and Permits: Depending on your business type and location, you may need to acquire specific licenses and permits to operate legally. Check with local and state agencies to ensure compliance with all regulations.

-

Comply with State Requirements: Depending on your state, additional documents may need to be filed, and specific fees paid. Familiarize yourself with local regulations to ensure full compliance. State filing fees for LLC registration typically range from $50 to $500.

-

Maintain Compliance: After formation, it is vital to meet ongoing requirements such as filing annual reports and tax returns to keep your LLC in good standing. Failure to do so can jeopardize your company’s legal status. It usually takes between 7 to 10 days to form an LLC, so plan accordingly.

-

Prepare a Banking Resolution Document: This document outlines who has authority over the LLC’s banking activities, ensuring that only authorized individuals can access the company accounts.

By following these steps and utilizing the knowledge of Social Enterprises, entrepreneurs can navigate the LLC formation process effectively, ensuring a solid foundation for their ventures in the U.S.

Overcome Challenges in LLC Formation

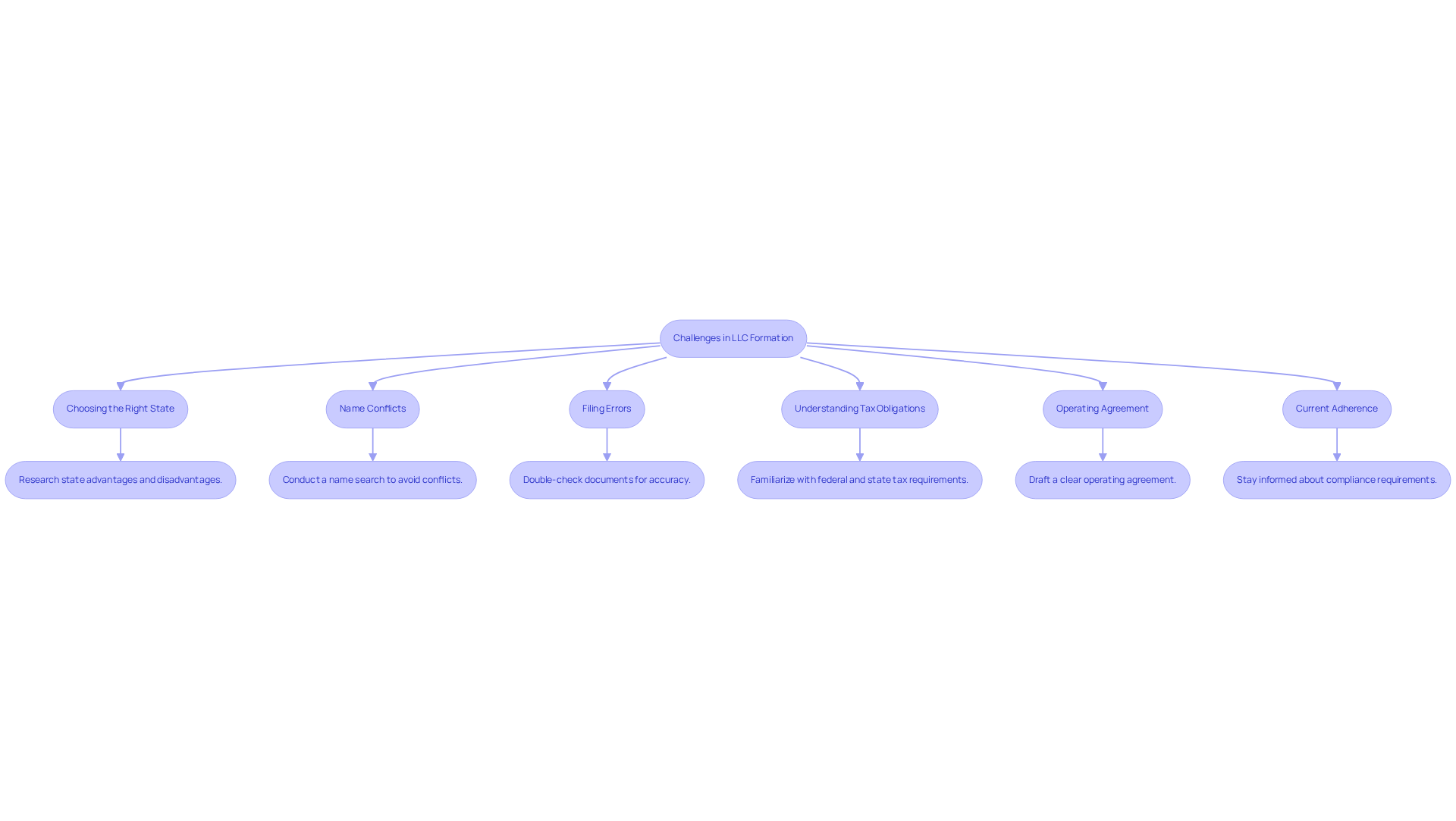

Forming an LLC can present several challenges. Here’s how to overcome them:

-

Choosing the Right State: It is essential to research the advantages and disadvantages of forming an LLC in various states. For instance, states like Wyoming and Nevada offer no corporate income tax, while Delaware is recognized for its business-friendly legal environment. Typically, for internet enterprises, the optimal state is where the proprietor operates with us llc formation, ensuring compliance with local regulations and simplifying legal responsibilities.

-

Name Conflicts: It is crucial to ensure that your chosen name is not already in use. Conduct a name search through your state’s business registry to avoid conflicts, as neglecting this step can result in delays in the formation process.

-

Filing Errors: It is advisable to double-check all documents for accuracy before submission. Errors can lead to delays or rejections, which can be both costly and time-consuming.

-

Understanding Tax Obligations: Understanding tax obligations is vital for us llc formation, as it requires familiarizing yourself with federal and state tax requirements. For example, states like Texas impose a franchise tax, whereas others, such as Wyoming, do not have such a tax. Consulting with a tax expert can help ensure compliance and optimize tax benefits.

-

Operating Agreement: The absence of a clear operating agreement can lead to disputes among members. It is important to draft one that outlines roles, responsibilities, and procedures to prevent misunderstandings and legal challenges.

-

Current Adherence: Staying informed about current adherence requirements, such as annual reports and tax filings, is necessary. States have varying requirements; for instance, Delaware mandates an annual report fee of $300. Regular audits of business practices can help avoid penalties and ensure your LLC remains in good standing.

Utilize Resources and Tools for Successful Formation

To streamline your LLC formation, consider utilizing the following essential resources:

- Online Formation Services: Platforms such as ZenBusiness and LegalZoom offer comprehensive, step-by-step guidance while managing filings on your behalf, significantly simplifying the process.

- State Government Websites: Each state’s Secretary of State website serves as a crucial resource, providing detailed information on LLC formation, including necessary forms, fees, and regulatory requirements.

- Tax Preparation Software: Tools like TurboTax are invaluable for managing tax filings, ensuring compliance with both federal and state regulations, which is essential for maintaining adherence.

- Business Consulting Services: Firms like Social Enterprises LLC specialize in providing tailored advice and support throughout the formation process, particularly for international entrepreneurs navigating U.S. regulations. By scheduling a free 15-minute consultation with Social Enterprises, you can receive expert guidance on the most suitable company structure for your needs, whether it be an LLC or a Corporation, especially within the gaming sector. As noted by Registered Agents Inc., many first-time entrepreneurs find the LLC formation process confusing and intimidating, making consulting services particularly beneficial.

- Networking Groups: Engaging with local professional groups or online forums enables you to connect with fellow entrepreneurs who can share insights and experiences, fostering a supportive community.

- Educational Resources: The U.S. Small Business Administration (SBA) provides a wealth of information on starting and managing a business, including specific guidance on LLCs, which can be instrumental in your journey.

Leveraging these resources can significantly enhance your understanding and execution of the LLC formation process, positioning your business for success in the competitive U.S. market.

Conclusion

Establishing a Limited Liability Company (LLC) represents a strategic decision for entrepreneurs aiming to achieve a balance of flexibility, protection, and tax advantages. Understanding the core benefits of an LLC – such as limited liability protection, pass-through taxation, and a simplified management structure – enables business owners to pursue their ventures with confidence, safeguarding personal assets while optimizing financial outcomes.

The outlined step-by-step process for forming an LLC underscores the necessity of meticulous planning and compliance with legal requirements. From selecting a compliant name and designating a registered agent to filing essential documents and ensuring ongoing compliance, each step is vital for establishing a solid business foundation. Furthermore, addressing potential challenges, including name conflicts, filing errors, and tax obligations, is crucial for facilitating a seamless formation experience.

In a competitive landscape, effectively leveraging available resources and tools can significantly streamline the LLC formation process. Entrepreneurs are advised to utilize online formation services, state government websites, and professional consulting firms to navigate complexities with ease. By taking proactive measures and seeking expert guidance, aspiring business owners can position themselves for success, making informed decisions that will lay the groundwork for their entrepreneurial journey. Embracing the LLC structure not only provides immediate benefits but also establishes a foundation for long-term growth and sustainability in an evolving business environment.

Frequently Asked Questions

What is an LLC?

A Limited Liability Company (LLC) is a flexible organizational structure that combines the advantages of both corporations and partnerships.

What are the main benefits of forming an LLC?

The main benefits include limited liability protection for members, pass-through taxation, a flexible management structure, and fewer formalities compared to corporations.

How does limited liability protection work for LLC members?

Members of an LLC are protected from personal liability regarding the company’s debts and obligations, ensuring that their personal assets remain secure in case of lawsuits or financial difficulties.

What is pass-through taxation, and how does it benefit LLCs?

Pass-through taxation allows profits and losses of the LLC to be reported on the members’ personal tax returns, avoiding double taxation and enabling owners to retain a larger portion of their earnings.

How much can LLC owners potentially save in taxes?

LLCs can save owners up to 40% in taxes compared to traditional corporate structures.

What is the management structure of an LLC?

LLCs can be managed by their members or by appointed managers, offering flexibility in how the business is operated.

What are the formalities and regulatory requirements for LLCs?

LLCs face fewer ongoing formalities and regulatory requirements than corporations, simplifying maintenance and allowing entrepreneurs to focus on growth.

Why do many small business owners prefer the LLC structure?

Approximately 91% of small enterprise owners prefer the LLC structure for its financial independence and flexibility.

How can Social Enterprises assist with LLC formation?

Social Enterprises offers tailored services to help navigate the LLC formation process, ensuring compliance with tax regulations and investment requirements.