Introduction

Understanding the nuances of business suffixes is crucial for e-commerce entrepreneurs navigating a complex digital landscape. These suffixes, such as ‘LLC’ and ‘Inc.’, define a company’s legal structure and significantly influence liability, taxation, and consumer trust. As the e-commerce sector continues to expand, the challenge lies in selecting the appropriate designation that aligns with business objectives while ensuring compliance and fostering credibility. What implications do these choices hold for the future success of online ventures?

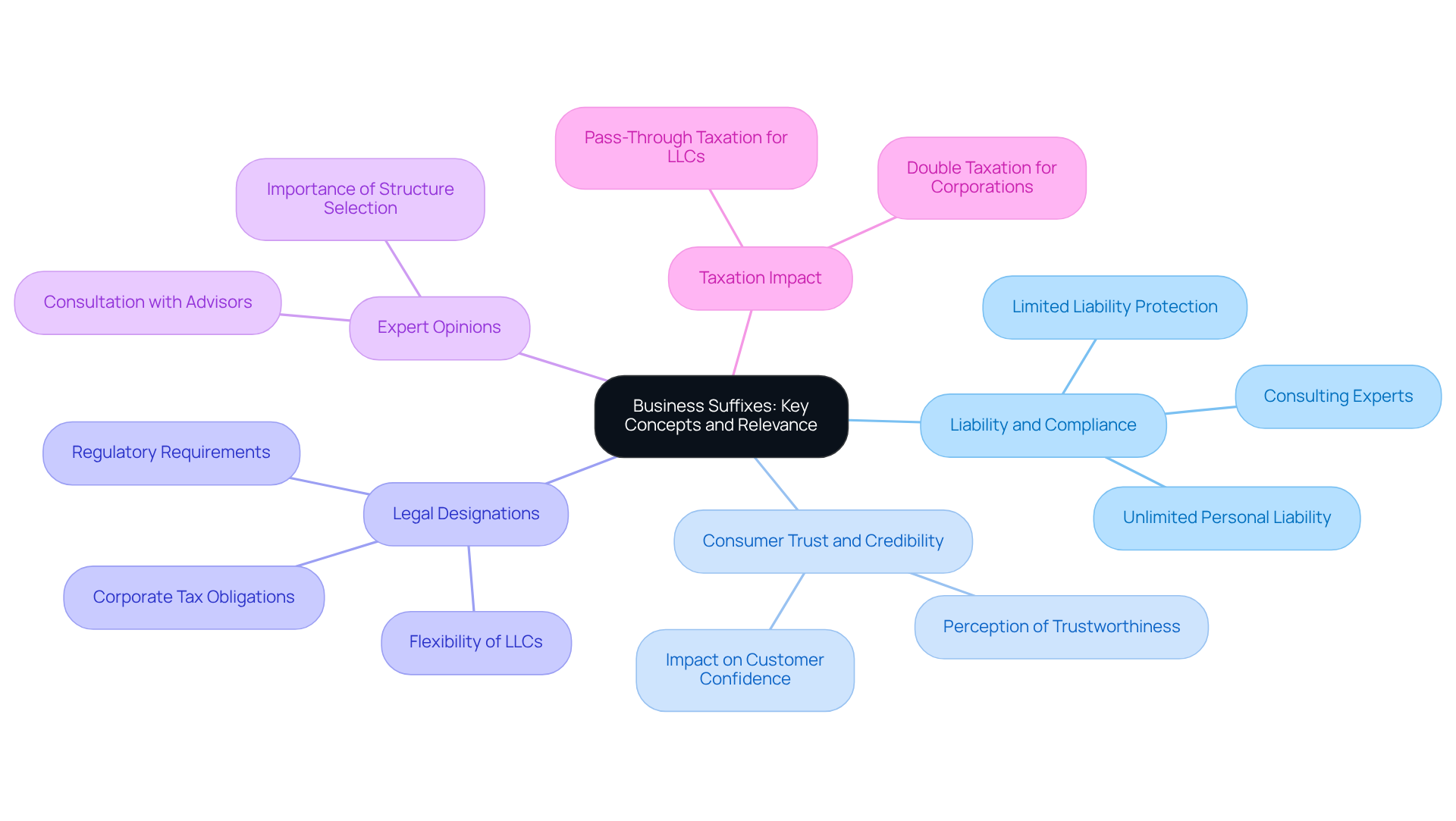

Define Business Suffixes: Key Concepts and Relevance

Business suffixes are the official titles that follow a company’s name, indicating its structure and ownership type. Common endings include ‘LLC’ (Limited Liability Company), ‘Inc.’ (Incorporated), and ‘Corp.’ (Corporation). These endings not only signify the legal status of a business but also convey essential information to consumers and partners regarding the nature of the entity. For e-commerce business owners, understanding business suffixes is crucial because they directly impact liability, taxation, and compliance with state regulations.

-

Liability and Compliance: The suffix chosen can significantly influence personal liability. For instance, an LLC offers limited liability protection, meaning owners are generally not personally responsible for business debts. In contrast, sole proprietorships expose owners to unlimited personal liability. This distinction regarding business suffixes is vital for entrepreneurs aiming to protect their personal assets. Consulting with experts, such as Social Enterprises, can aid in navigating these complexities.

-

Consumer Trust and Credibility: The ending also plays a role in establishing credibility. Companies with recognized endings like ‘Inc.’ or ‘Corp.’ may be perceived as more trustworthy by consumers and investors. This perception can bolster customer confidence, which is particularly important in the competitive e-commerce landscape.

-

Legal Designations: Each ending carries specific legal implications. For example, corporations are subject to corporate tax and have stricter regulatory requirements compared to LLCs, which enjoy greater flexibility in management and taxation options. Understanding these differences helps entrepreneurs make informed decisions about their organizational structure, including the appropriate business suffixes.

-

Expert Opinions: Industry specialists emphasize the importance of selecting the appropriate extension based on business objectives and operational needs. Consulting with legal and financial advisors can provide valuable insights into the ramifications of each ending, ensuring compliance and optimal tax strategies.

-

Taxation Impact: The choice of an ending can also affect taxation. LLCs often benefit from pass-through taxation, where profits are taxed at the owner’s personal tax rate, while corporations face double taxation on profits and dividends. This aspect is crucial for e-commerce business owners seeking to maximize their financial efficiency.

In summary, the selection of an enterprise designation, including appropriate business suffixes, is not merely a formality; it is a strategic decision that influences liability, compliance, consumer trust, and taxation. E-commerce entrepreneurs must carefully consider these factors to establish a solid foundation for their venture.

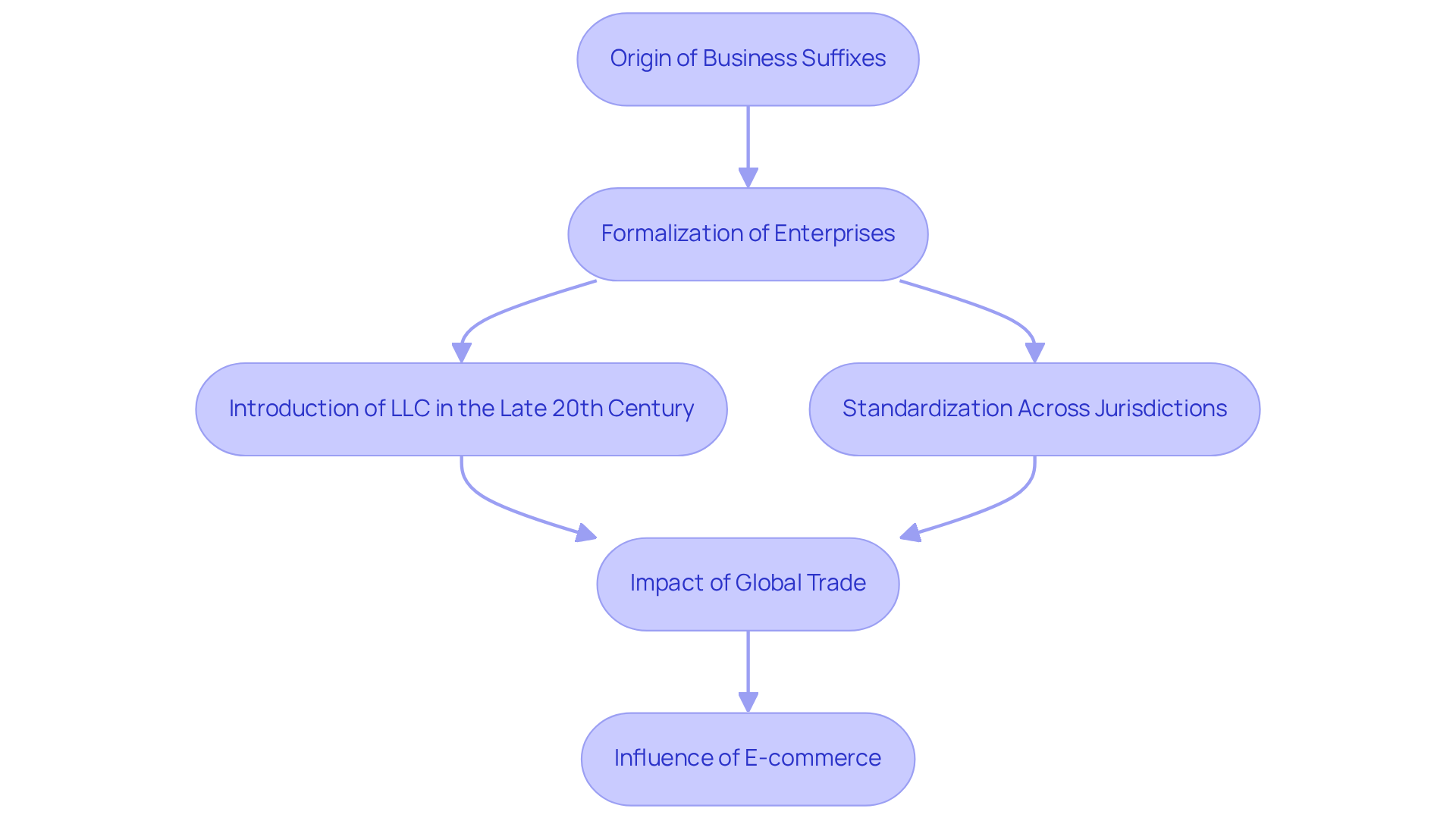

Explore the Origin and Evolution of Business Suffixes

The concept of commercial endings originates from the formalization of enterprises, which arose as communities shifted from informal trading practices to organized commerce. Initially, business suffixes indicated the type of business and the legal protections it offered. For instance, the ‘LLC’ suffix was introduced in the United States in the late 20th century, providing a hybrid structure that combines the benefits of corporations and partnerships. This innovation facilitated limited liability while preserving operational flexibility, making it an appealing choice for many entrepreneurs.

As global trade flourished, the need for clear regulatory designations became increasingly critical. This led to the standardization of business suffixes across various jurisdictions, reflecting the growing complexity of commercial activities and the necessity for transparent regulatory frameworks that safeguard both consumers and businesses. The evolution of business suffixes illustrates how regulatory structures adapt to meet the demands of an interconnected marketplace, ensuring that enterprises can navigate compliance landscapes effectively while fostering trust among stakeholders.

In recent years, the rise of e-commerce has further influenced the development of corporate extensions, as companies strive to establish credibility and recognition in a competitive digital landscape. The ongoing evolution of business suffixes not only highlights the dynamic nature of global trade but also underscores the importance of understanding legal classifications for business owners aiming to succeed in the international market.

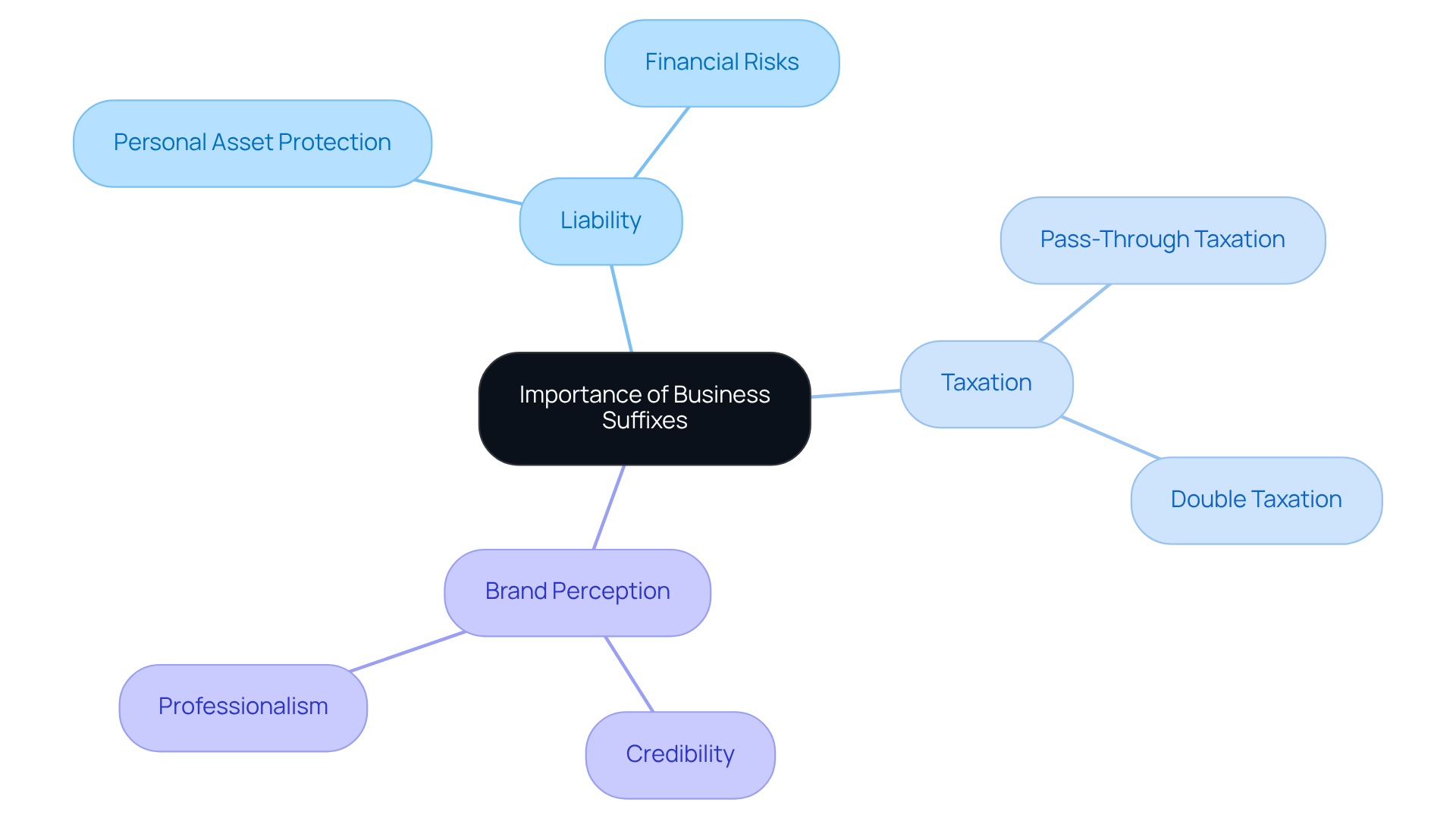

Understand the Importance of Business Suffixes for Entrepreneurs

For business owners in the e-commerce sector, selecting the appropriate business suffixes is a critical decision that extends beyond mere formality; it significantly impacts liability, taxation, and regulatory compliance. For instance, an LLC structure provides essential personal liability protection, safeguarding business owners’ personal assets from business-related debts. This protection is particularly vital in the e-commerce landscape, where financial risks can be considerable. Additionally, the choice of business ending influences tax treatment; LLCs typically benefit from pass-through taxation, allowing profits to be taxed only at the individual level, whereas corporations may encounter double taxation on their earnings. This distinction can significantly affect an entrepreneur’s financial outcomes.

Furthermore, the business ending plays a role in shaping brand perception. A well-chosen ending can enhance an enterprise’s credibility, making it more appealing to potential clients. For example, an LLC designation may project professionalism and stability, which can be advantageous in competitive markets. Therefore, understanding the implications of business suffixes is essential for entrepreneurs aiming to establish a robust and compliant presence in the e-commerce sector.

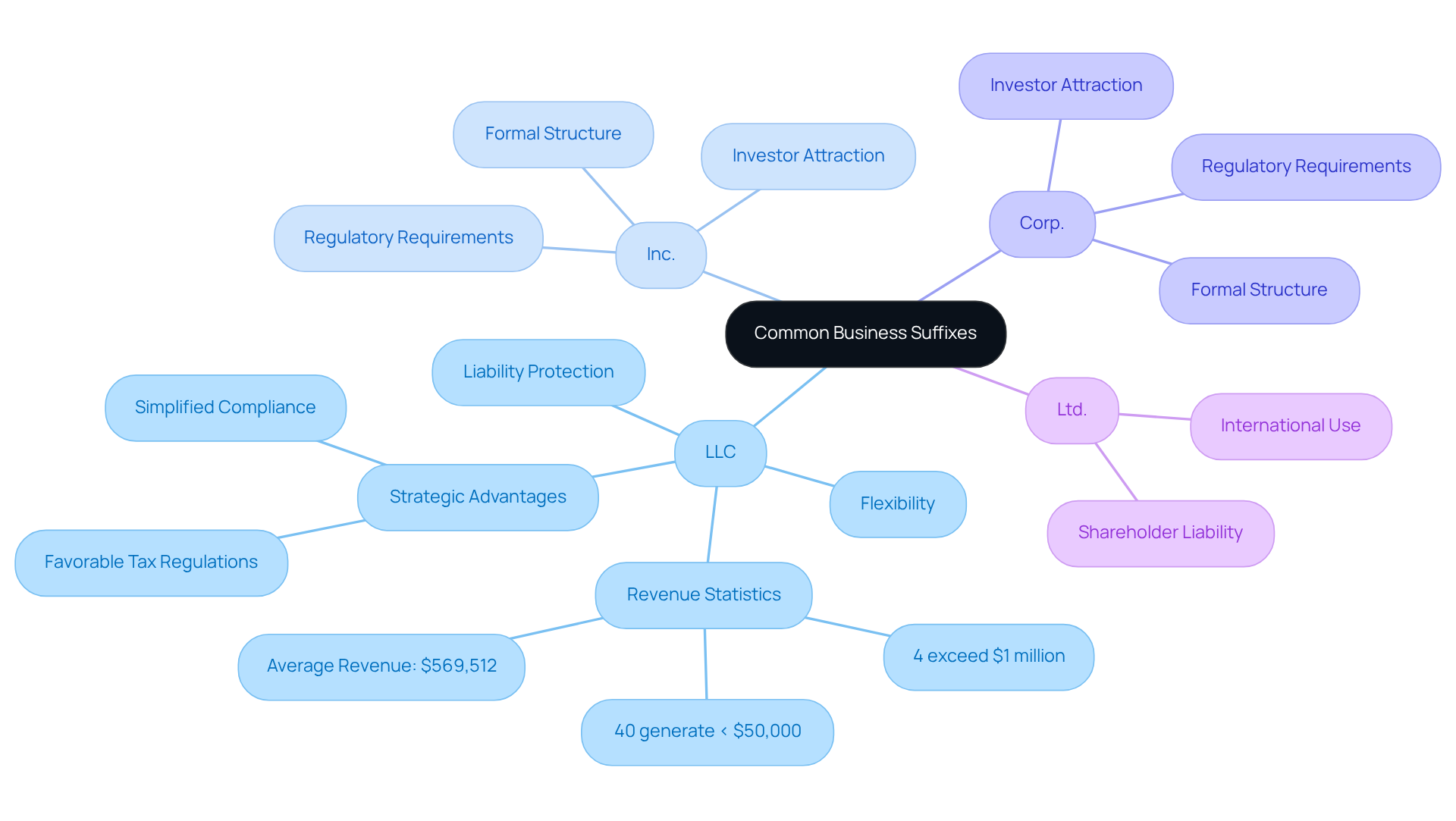

Examine Common Business Suffixes and Their Applications

Common organizational suffixes include ‘LLC’, ‘Inc.’, ‘Corp.’, and ‘Ltd.’, each serving distinct purposes. An ‘LLC’ (Limited Liability Company) is favored by small business owners due to its flexibility and protection against personal liability. Notably, 40% of LLCs generate less than $50,000 in annual revenue, while only 4% exceed $1 million. This structure allows profits and losses to transfer to personal income without incurring corporate taxes, making it an attractive option for business owners, especially in e-commerce and start-ups. Additionally, forming an LLC in states like Wyoming or Delaware can offer strategic advantages, such as favorable tax regulations and simplified compliance obligations, which are essential for international business owners aiming to establish a presence in the U.S.

‘Inc.’ and ‘Corp.’ signify that an organization is incorporated, providing a formal structure that can attract investors but also involves more regulatory requirements. The average revenue for an LLC is approximately $569,512 per year, underscoring the potential financial benefits of this structure. ‘Ltd.’ (Limited) is commonly used in international contexts, indicating limited liability for shareholders. Understanding these business suffixes enables founders to choose the most appropriate framework for their organizational needs, ensuring compliance with legal obligations while enhancing operational efficiency. For example, successful e-commerce companies like Shopify and Etsy have opted for ‘LLC’ due to its simplicity and tax advantages, while others may select ‘Inc.’ to capitalize on the benefits of a corporate structure, such as improved access to capital and increased credibility in the marketplace. By examining the regulatory requirements and implications of each suffix, along with the strategic benefits of establishing a business in states like Wyoming and Florida, entrepreneurs can make informed decisions that align with their business objectives.

Conclusion

Understanding the significance of business suffixes is crucial for e-commerce entrepreneurs aiming to establish a credible and legally compliant business. These suffixes are not mere formalities; they encapsulate essential information regarding a company’s structure, liability, and tax implications, ultimately shaping the identity and perception of the business within the marketplace.

This article has discussed key insights regarding the impact of business suffixes on personal liability, consumer trust, and taxation. The choice between structures such as LLC, Inc., and Corp. can directly influence an entrepreneur’s financial outcomes and operational flexibility. Furthermore, the evolution of these suffixes underscores their role in adapting to modern commerce and regulatory demands, highlighting the necessity for informed decision-making.

Ultimately, the careful selection of a business suffix can yield strategic advantages in the competitive e-commerce landscape. Entrepreneurs are encouraged to explore the implications of each suffix, consult with experts, and make informed choices to establish a robust foundation for their ventures. By doing so, they not only safeguard their interests but also enhance their brand’s credibility and consumer trust, paving the way for long-term success in the digital marketplace.

Frequently Asked Questions

What are business suffixes and why are they important?

Business suffixes are official titles that follow a company’s name, indicating its structure and ownership type, such as ‘LLC’ (Limited Liability Company), ‘Inc.’ (Incorporated), and ‘Corp.’ (Corporation). They are important because they signify the legal status of a business and convey essential information about the entity to consumers and partners.

How do business suffixes impact liability?

The suffix chosen can significantly influence personal liability. For example, an LLC offers limited liability protection, meaning owners are generally not personally responsible for business debts, whereas sole proprietorships expose owners to unlimited personal liability.

What role do business suffixes play in consumer trust and credibility?

Business suffixes like ‘Inc.’ or ‘Corp.’ can enhance a company’s credibility. Consumers and investors may perceive businesses with recognized endings as more trustworthy, which can increase customer confidence, especially in competitive markets like e-commerce.

What are the legal implications of different business suffixes?

Each suffix has specific legal implications. Corporations have stricter regulatory requirements and are subject to corporate tax, while LLCs enjoy greater flexibility in management and taxation options. Understanding these differences is crucial for making informed decisions about organizational structure.

Why is it important to consult with experts when choosing a business suffix?

Consulting with legal and financial advisors can provide valuable insights into the ramifications of each business suffix, ensuring compliance with laws and optimal tax strategies tailored to business objectives and operational needs.

How does the choice of business suffix affect taxation?

The choice of suffix can impact taxation significantly. LLCs often benefit from pass-through taxation, where profits are taxed at the owner’s personal tax rate, while corporations may face double taxation on profits and dividends. This is an important consideration for e-commerce business owners aiming to maximize financial efficiency.

What should e-commerce entrepreneurs consider when selecting a business suffix?

E-commerce entrepreneurs should consider factors such as liability, compliance, consumer trust, and taxation when selecting a business suffix, as this decision is strategic and foundational for their venture.