Introduction

The emergence of Limited Liability Companies (LLCs) has significantly reshaped the entrepreneurial landscape. This organizational structure offers a distinctive combination of protection and flexibility, making it appealing to a wide array of business owners. As more entrepreneurs become aware of the advantages associated with LLCs, it is crucial to understand what the designation “LLC” signifies after a company name. This knowledge is vital for effectively navigating the legal and financial environments.

However, with the existence of various types of LLCs and the differing regulations across states, aspiring business owners face a pressing question: how can they select the appropriate LLC structure that not only safeguards their assets but also optimizes tax benefits?

Define LLC: Understanding Limited Liability Companies

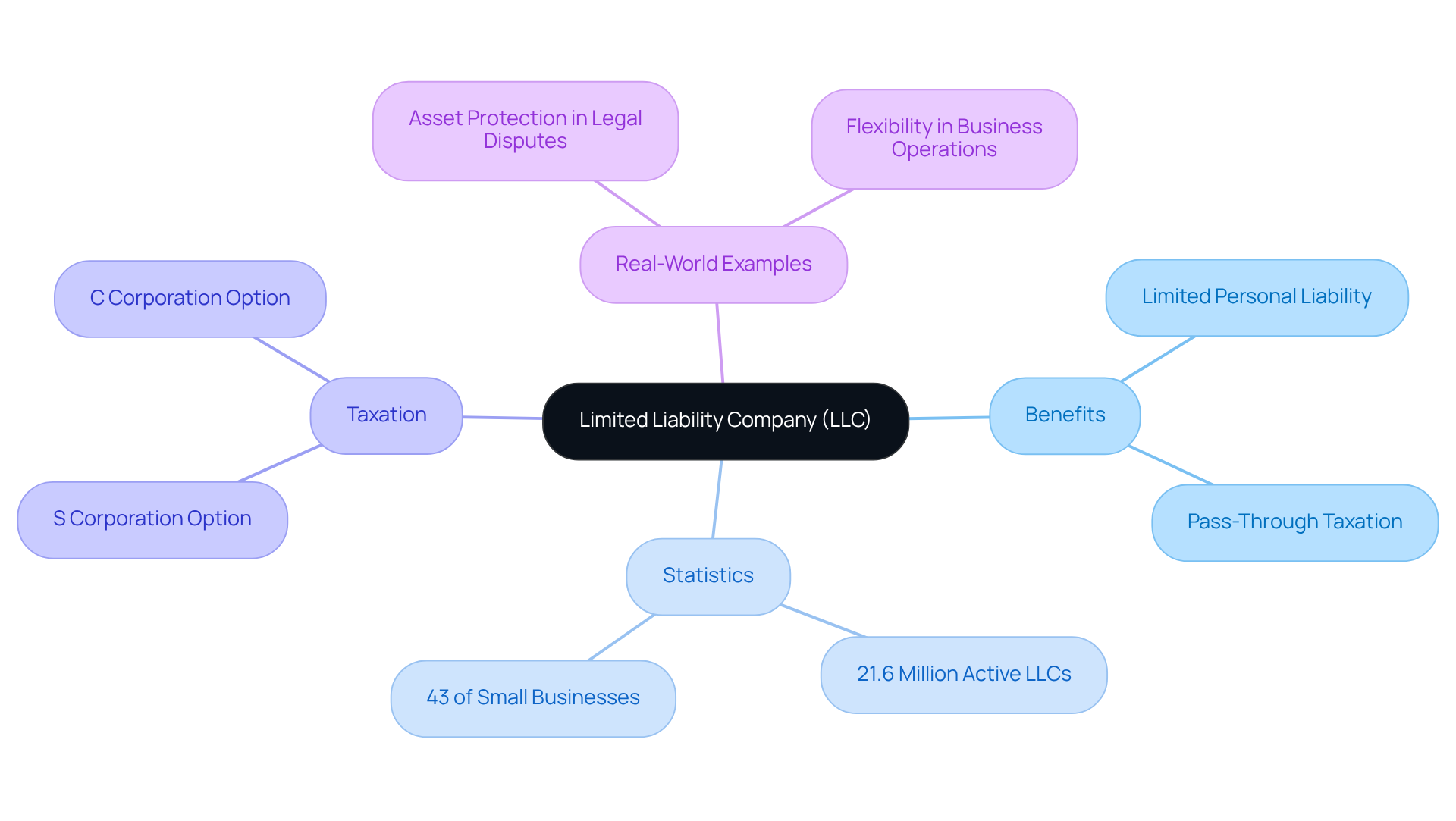

A Limited Liability Company (LLC) is a versatile organizational structure that merges the benefits of both corporations and partnerships. It provides its owners, referred to as members, with limited personal liability concerning the company’s debts and obligations. Consequently, in instances of lawsuits or financial challenges, the personal assets of the members are generally protected. As of 2026, approximately 21.6 million active limited liability companies exist in the United States, accounting for nearly 43% of all small businesses. This structure is recognized across all 50 states, with its formation governed by state law, which can differ significantly from one jurisdiction to another.

The flexibility of limited liability companies allows entrepreneurs to customize their organizational framework to meet specific needs while enjoying the advantages of limited liability and pass-through taxation. Under this taxation model, profits are taxed at the individual level instead of the corporate level, thereby enhancing financial efficiency. For instance, limited liability companies have the option to be taxed as S Corporations or C Corporations, providing additional tax flexibility that appeals to many entrepreneurs.

Real-world examples illustrate the protective features of limited liability companies; they have played a vital role in safeguarding personal assets during legal disputes. This liability protection acts as a compelling incentive for individuals to establish LLCs, fostering entrepreneurship and innovation. As the business landscape evolves in 2026, the LLC format continues to be a preferred choice for entrepreneurs seeking to protect their personal assets while navigating the complexities of modern operations.

Contextualize LLC: Importance in Business Formation

Entrepreneurs have increasingly adopted the Limited Liability Company (LLC) structure, largely because of what does LLC mean after a company name, which offers a unique blend of flexibility and protection. Unlike sole proprietorships, where owners bear personal liability for debts, limited liability companies, which is what does LLC mean after a company name, shield members from such liabilities, thereby safeguarding personal assets. This characteristic is particularly attractive for startups and small businesses that want to know what does LLC mean after a company name to mitigate risk.

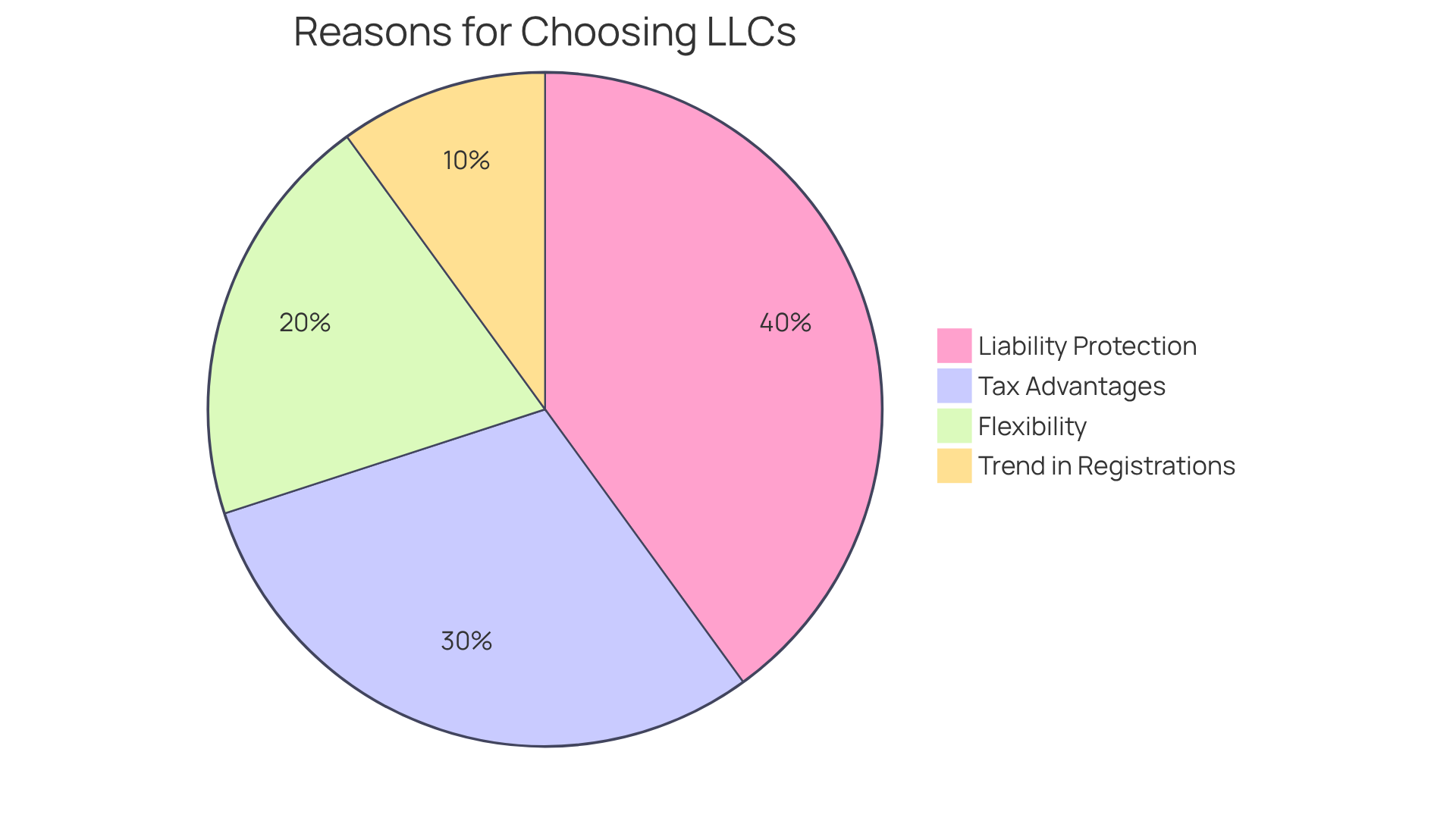

In addition, limited liability companies, often abbreviated as LLC, raise the question of what does LLC mean after a company name, while also offering substantial tax advantages, including pass-through taxation, which allows profits to be reported on members’ personal tax returns. This structure effectively circumvents the double taxation faced by corporations, which raises the question of what does LLC mean after a company name, as it positions limited liability companies as a financially prudent choice. Research indicates that LLCs can lower business-related taxes through deductions such as the Qualified Business Income (QBI) Deduction, potentially reducing total tax obligations by as much as 20%.

As of 2026, the trend toward LLC formations continues to escalate, with over 2.5 million new registrations recorded last year alone. This trend reflects a broader shift among entrepreneurs who prioritize the legal protections and tax benefits, raising the question of what does LLC mean after a company name. With 91% of small enterprise owners opting for this structure, it is clear that LLCs are becoming the preferred option for those looking to establish a formal entity while minimizing risk and enhancing financial efficiency, leading many to wonder what does LLC mean after a company name.

Trace the Origins: History of Limited Liability Companies

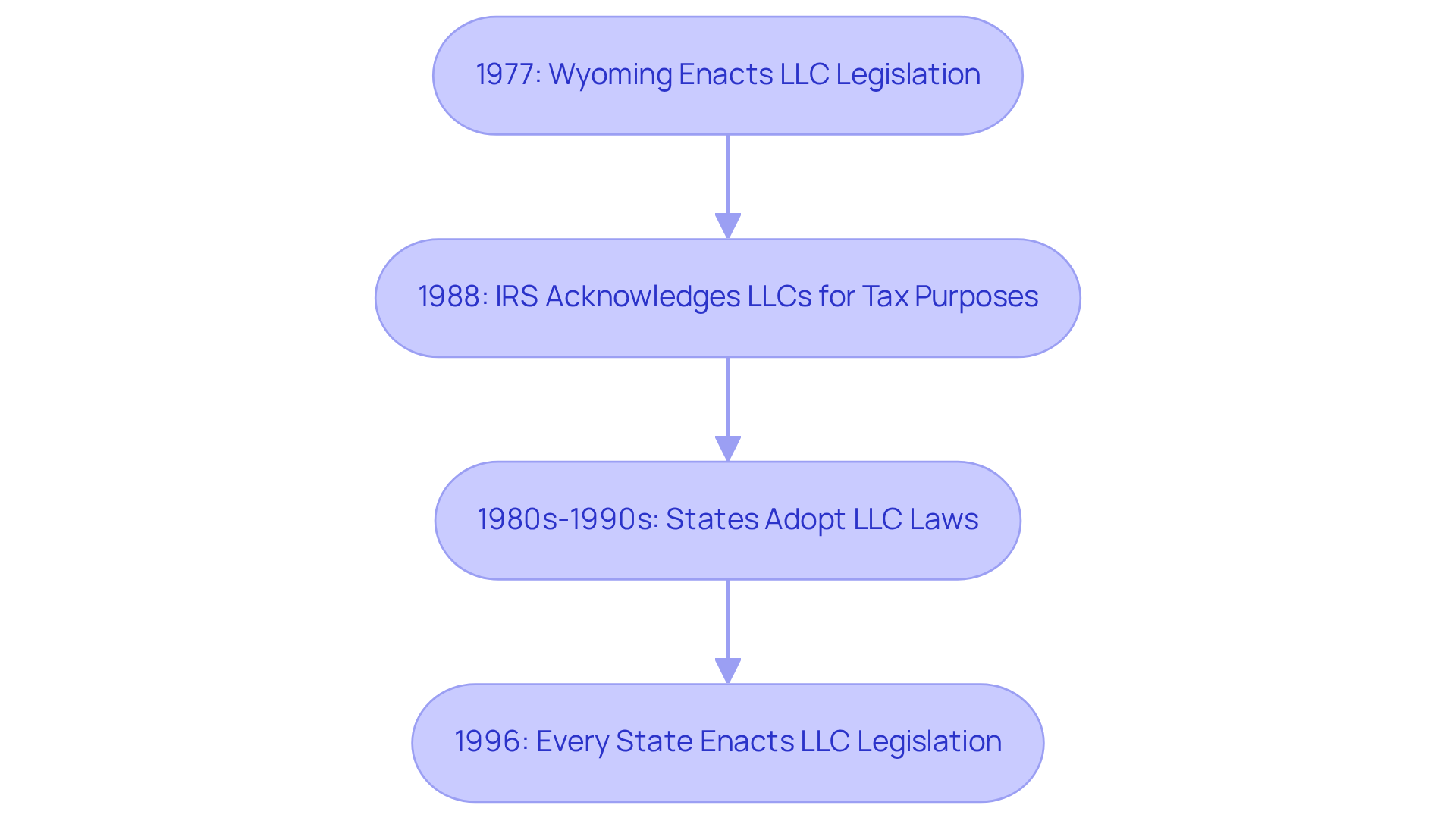

The Limited Liability Company (LLC) format was first introduced in the United States in 1977, when Wyoming enacted its pioneering legislation. This innovation arose from the need for an organizational structure that combines the liability protection characteristic of corporations with the operational flexibility typical of partnerships. The IRS’s acknowledgment of limited liability companies for tax purposes in 1988 further solidified their legitimacy as a preferred organizational structure.

Following Wyoming’s lead, numerous states adopted LLC laws throughout the 1980s and 1990s, marking a significant shift in the commercial landscape. By 1996, every state had enacted legislation allowing for LLC formation, demonstrating the widespread acceptance of this model among entrepreneurs. The development of limited liability companies signifies a broader trend towards accommodating the diverse needs of contemporary enterprises, providing a balance of protection and flexibility that is increasingly vital in today’s dynamic economic environment.

For global entrepreneurs, particularly those from Turkey, understanding what does LLC mean after a company name is essential for navigating the complexities of U.S. establishment and tax compliance, as detailed in our comprehensive guide to commerce and finance in America.

Highlight Key Features: Characteristics of LLCs

Limited Liability Companies (LLCs) present several key features that make them an appealing option for entrepreneurs, particularly those aiming to establish their business in the U.S. with the support of Social Enterprises.

-

Limited Liability Protection: Members enjoy protection from personal liability concerning the company’s debts, thereby safeguarding their personal assets from operational risks.

-

Pass-Through Taxation: Unlike corporations, LLCs generally do not incur federal income tax at the corporate level. Instead, profits and losses are reported on members’ personal tax returns, streamlining the tax process. This structure allows LLCs to take advantage of the Qualified Business Income deduction, enabling eligible members to deduct up to 20% of their income.

-

Flexible Management Structure: LLCs can be managed by their members or by appointed managers, offering flexibility in operational arrangements. This adaptability is particularly beneficial in 2026, as trends indicate a growing preference for management frameworks that accommodate remote work and diverse operational needs, thereby reshaping traditional practices.

-

Fewer Formalities: LLCs encounter fewer ongoing compliance requirements compared to corporations, simplifying maintenance. This reduced administrative burden is appealing to many entrepreneurs, especially those launching home-based businesses, which represent 55% of small ventures. With Social Enterprises, establishing your LLC can take as little as 1-3 working days, ensuring compliance effectively and allowing you to focus on expanding your venture.

-

Enduring Existence: LLCs can continue to exist beyond the lifespan of their members, providing continuity and stability. This characteristic is vital for long-term planning and growth.

Together, these attributes position limited liability companies as a favorable choice for entrepreneurs seeking to balance risk and reward in their endeavors. As the business landscape evolves, understanding these features will be essential for making informed decisions regarding organizational structure, particularly with the extensive support offered by Social Enterprises.

Explore Variations: Types of Limited Liability Companies

Limited Liability Companies (LLCs) come in several forms, each tailored to specific business needs:

-

Single-Member LLC: Owned by one individual, this arrangement offers simplicity and complete control, making it ideal for solo entrepreneurs. It allows for pass-through taxation, meaning profits are reported on the owner’s personal tax return, thus avoiding double taxation.

-

Multi-Member LLC: Comprising two or more members, this type facilitates shared management and resources. It operates similarly to a partnership, with profits passing through to members’ personal tax returns, enhancing financial flexibility.

-

Series LLC: This innovative arrangement permits several LLCs to function under a single parent company, each possessing unique assets and liabilities. The Series LLC has gained popularity due to its efficiency in managing multiple ventures while limiting liability exposure across different series.

-

Professional LLC (PLLC): Specifically designed for licensed professionals such as doctors and lawyers, a PLLC meets regulatory requirements while providing liability protection and operational flexibility. This structure is essential for professionals who need to protect their personal assets from commercial liabilities.

-

Foreign LLC: Established in one state but operating in another, a foreign LLC must register in the state where it functions. This enables enterprises to utilize favorable laws in various jurisdictions while ensuring adherence to local regulations.

Understanding these variations is crucial for entrepreneurs as they select the appropriate LLC structure that aligns with their goals and operational strategies. While limited liability companies represent a flexible option for many, corporations may be more suitable for larger-scale projects and investments, particularly in the gaming industry. With approximately 4.1 million LLC formations projected for 2025, representing a significant portion of the 5.6 million new business applications filed, the growth of LLCs underscores their importance in the current entrepreneurial landscape. Consulting with experts like Social Enterprises can provide invaluable guidance in navigating these choices, ensuring that entrepreneurs make informed decisions that align with their objectives.

Conclusion

In conclusion, Limited Liability Companies (LLCs) stand out as a robust organizational structure that merges the advantages of both corporations and partnerships. They provide entrepreneurs with vital liability protection and tax benefits. Understanding the significance of LLC after a company name is essential for anyone navigating the complexities of business formation and management. This structure not only protects personal assets but also offers flexibility in taxation and management, making it an appealing choice for a wide array of businesses.

The key characteristics of LLCs include:

- Limited liability protection

- Pass-through taxation

- Fewer formalities compared to corporations

These features contribute to the increasing popularity of LLCs, with millions of new registrations annually as entrepreneurs aim to mitigate risks while enhancing financial efficiency. The evolution of LLCs since their introduction in 1977 highlights their adaptability and relevance in today’s dynamic business landscape, establishing them as a preferred option for both new and established enterprises.

Given the substantial advantages that LLCs provide, entrepreneurs are encouraged to consider this structure as they embark on their business ventures. By grasping the implications of LLC after a company name and exploring the various types of LLCs available, business owners can make informed decisions that align with their objectives. Adopting the LLC format not only strengthens legal protection but also promotes innovation and growth in the ever-evolving realm of entrepreneurship.

Frequently Asked Questions

What is a Limited Liability Company (LLC)?

A Limited Liability Company (LLC) is an organizational structure that combines the benefits of corporations and partnerships, providing its owners, known as members, with limited personal liability for the company’s debts and obligations.

How does an LLC protect its members?

LLCs protect their members’ personal assets from being used to satisfy the company’s debts or obligations, especially in cases of lawsuits or financial challenges.

How many LLCs were active in the United States as of 2026?

As of 2026, there were approximately 21.6 million active limited liability companies in the United States, accounting for nearly 43% of all small businesses.

What are the tax advantages of an LLC?

LLCs benefit from pass-through taxation, meaning profits are taxed at the individual level rather than the corporate level, which can enhance financial efficiency. They can also choose to be taxed as S Corporations or C Corporations for additional tax flexibility.

Why do entrepreneurs choose to form LLCs?

Entrepreneurs choose LLCs for their flexibility, protection of personal assets, and substantial tax advantages, making them an attractive option for startups and small businesses.

What is the trend in LLC formations as of 2026?

The trend towards LLC formations is increasing, with over 2.5 million new registrations recorded in the previous year, indicating a growing preference among entrepreneurs for the legal protections and tax benefits offered by LLCs.

What does ‘LLC’ signify after a company name?

‘LLC’ after a company name indicates that the business is a Limited Liability Company, which provides members with limited liability protection and certain tax advantages.