Introduction

Understanding the nuances of tax identification numbers is crucial for e-commerce businesses as they navigate the complexities of tax compliance. These unique identifiers – such as the Social Security Number (SSN), Employer Identification Number (EIN), and Individual Taxpayer Identification Number (ITIN) – are essential for ensuring legal operations and effective financial management. Entrepreneurs often question the specific purposes of these numbers and the consequences of operating without one. This article examines the significance of tax ID numbers, detailing their various functions and the potential risks associated with neglecting this critical aspect of business operations.

Define Tax ID Number: Purpose and Types

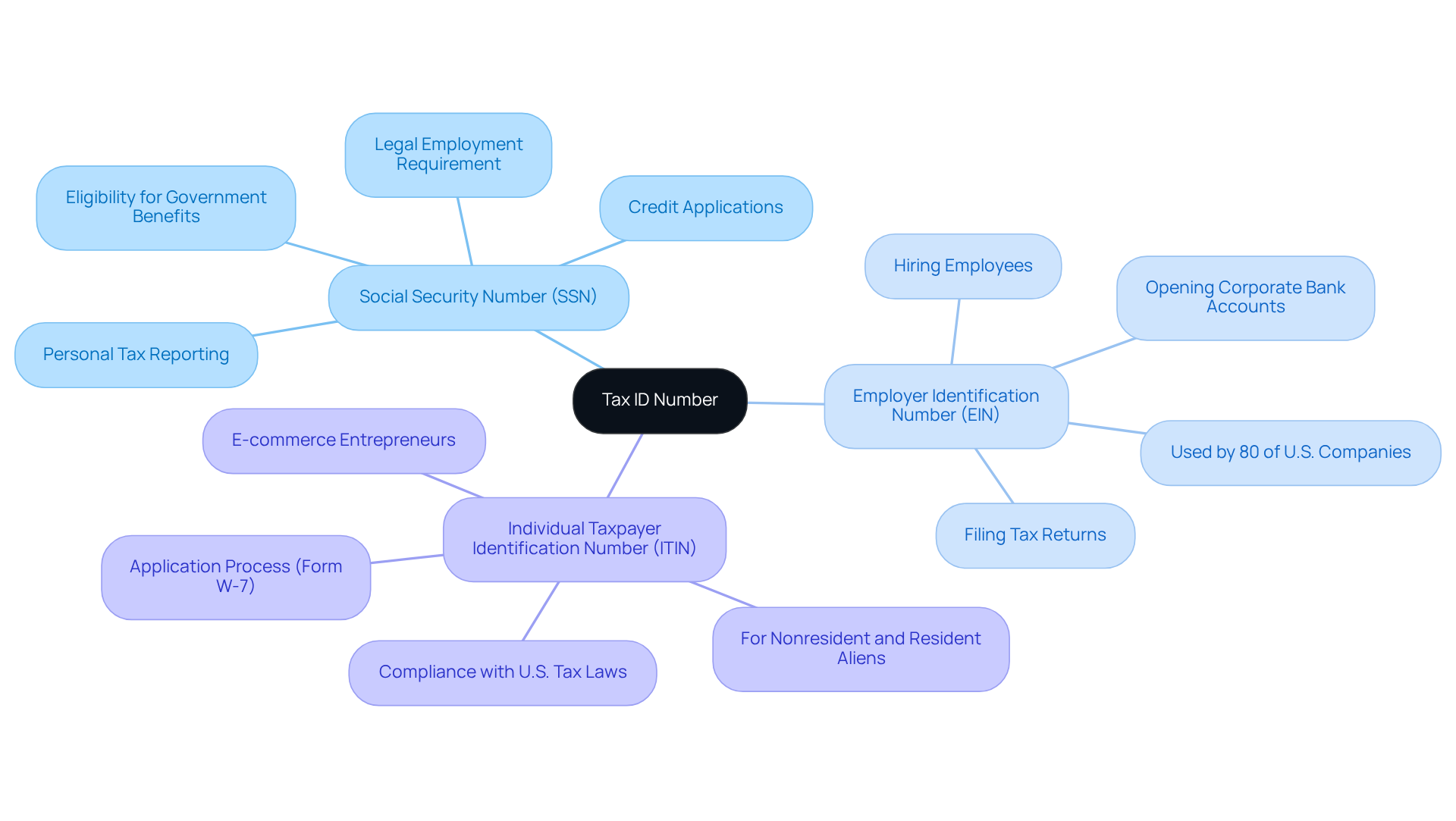

A Tax Identification Code (TIN) serves as a unique identifier assigned by the government to individuals and businesses for tax purposes, leading to the question of what is a tax id number used for in tax administration and compliance. The primary types of TINs include the Social Security Number (SSN), Employer Identification Number (EIN), and Individual Taxpayer Identification Number (ITIN), each fulfilling distinct functions.

-

Social Security Number (SSN): This number is primarily used by individuals for personal tax reporting and determining eligibility for government benefits. It is essential for legal employment in the U.S. and is required by banks and lenders for credit applications.

-

Employer Identification Number (EIN): A nine-digit code critical for businesses, the EIN is necessary for hiring employees, opening corporate bank accounts, and filing tax returns. Approximately 80% of companies in the U.S. utilize an EIN, underscoring its importance in the corporate sector.

-

Individual Taxpayer Identification Number (ITIN): This number is designed for individuals who do not qualify for an SSN. The ITIN enables nonresident and resident aliens to comply with U.S. tax laws, making it particularly significant for e-commerce entrepreneurs who may lack an SSN but need to report income and meet tax obligations.

Recent changes in TIN classifications in 2026 have clarified the distinctions and requirements for each category, ensuring organizations can effectively navigate their tax responsibilities. Understanding what a tax id number is used for is crucial for e-commerce enterprises as they establish operations and ensure compliance with U.S. tax regulations.

Explain the Importance of Tax ID Numbers in Business Operations

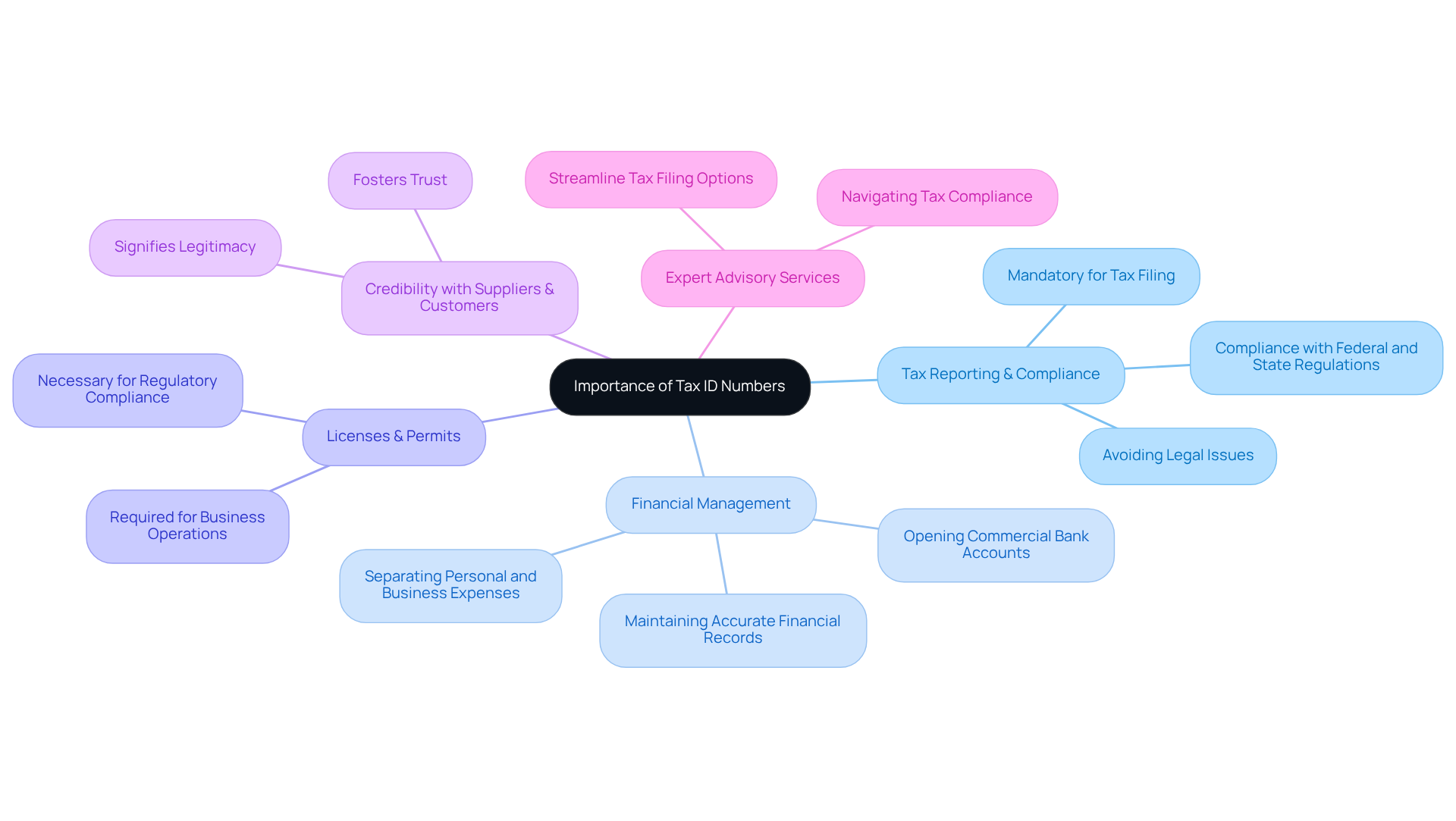

Tax ID numbers are crucial for e-commerce enterprises, especially in understanding what a tax ID number is used for. Firstly, understanding what a tax ID number is used for is mandatory for tax reporting and compliance with federal and state regulations. Understanding what a tax ID number is used for is crucial, as operating without one can result in significant legal issues, preventing companies from filing taxes or hiring employees legally. For instance, many e-commerce businesses have faced operational challenges due to the absence of a Tax ID, leading to penalties and disruptions in their activities.

Moreover, possessing a tax identification code is essential for understanding what a tax ID number is used for when opening commercial bank accounts. This facilitates efficient financial management and helps distinguish personal expenses from professional ones. Such separation is vital for maintaining accurate financial records and ensuring compliance with tax obligations. Additionally, when considering what a tax ID number is used for, it’s important to note that these numbers are often required when applying for various licenses and permits, which are necessary for lawful operation within specific jurisdictions.

Establishing credibility with suppliers and customers is another significant advantage of having a valid tax ID. It signifies that the enterprise is legitimate and compliant with regulatory requirements, fostering trust and enabling smoother transactions. Furthermore, Social Enterprises provides expert tax advisory services, including the Streamline Tax Filing option, which assists businesses in navigating the complexities of tax compliance, particularly concerning cryptocurrency-related activities. As we approach 2026, understanding the implications of tax IDs on compliance will become increasingly important, especially as regulations evolve and the e-commerce landscape continues to change. Businesses that prioritize acquiring and maintaining their Tax IDs will be better positioned to navigate these complexities and ensure operational efficiency.

Trace the History and Evolution of Tax ID Numbers

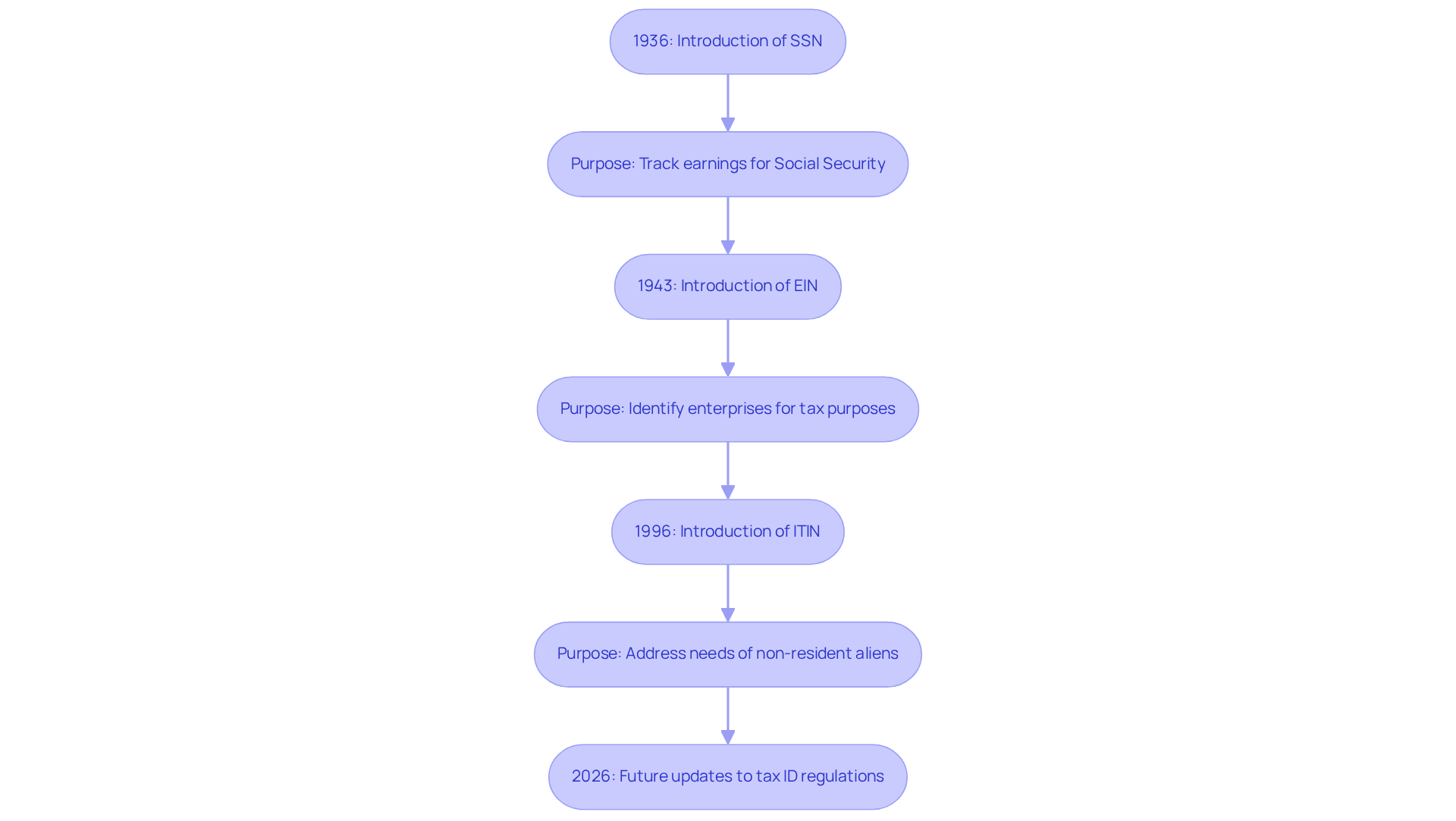

The evolution of taxpayer identification numbers has played a crucial role in shaping tax compliance in the United States, particularly in understanding what a tax ID number is used for. Initially introduced in 1936, the Social Security Identifier (SSN) was designed to track earnings for Social Security benefits. However, as tax administration complexities grew, the IRS established the Employer Identification Number (EIN) in 1943 to identify enterprises for tax purposes. This advancement significantly streamlined tax reporting and compliance, which clarifies what a tax ID number is used for in businesses of all sizes.

In 1996, the introduction of the Individual Taxpayer Identification Number (ITIN) marked another important development, specifically addressing the needs of non-resident aliens and individuals required to comply with U.S. tax laws but ineligible for an SSN. This inclusion has allowed millions to meet their tax obligations, contributing approximately $14.4 billion in taxable income reported by ITIN holders in 2022.

The evolution of these identification numbers illustrates the increasing complexity of the U.S. tax system and the necessity for distinct identifiers for compliance and operational purposes. For instance, knowing what a tax ID number is used for, the EIN has become essential for companies to open bank accounts, apply for licenses, and file tax returns, while the ITIN has enabled many immigrants to participate legally in the economy. As we approach 2026, updates to tax ID regulations will continue to influence business operations, underscoring the importance of understanding these identifiers in the context of e-commerce and beyond.

Identify Key Characteristics and Variations of Tax ID Numbers

Tax ID numbers possess distinct characteristics and variations that serve different purposes:

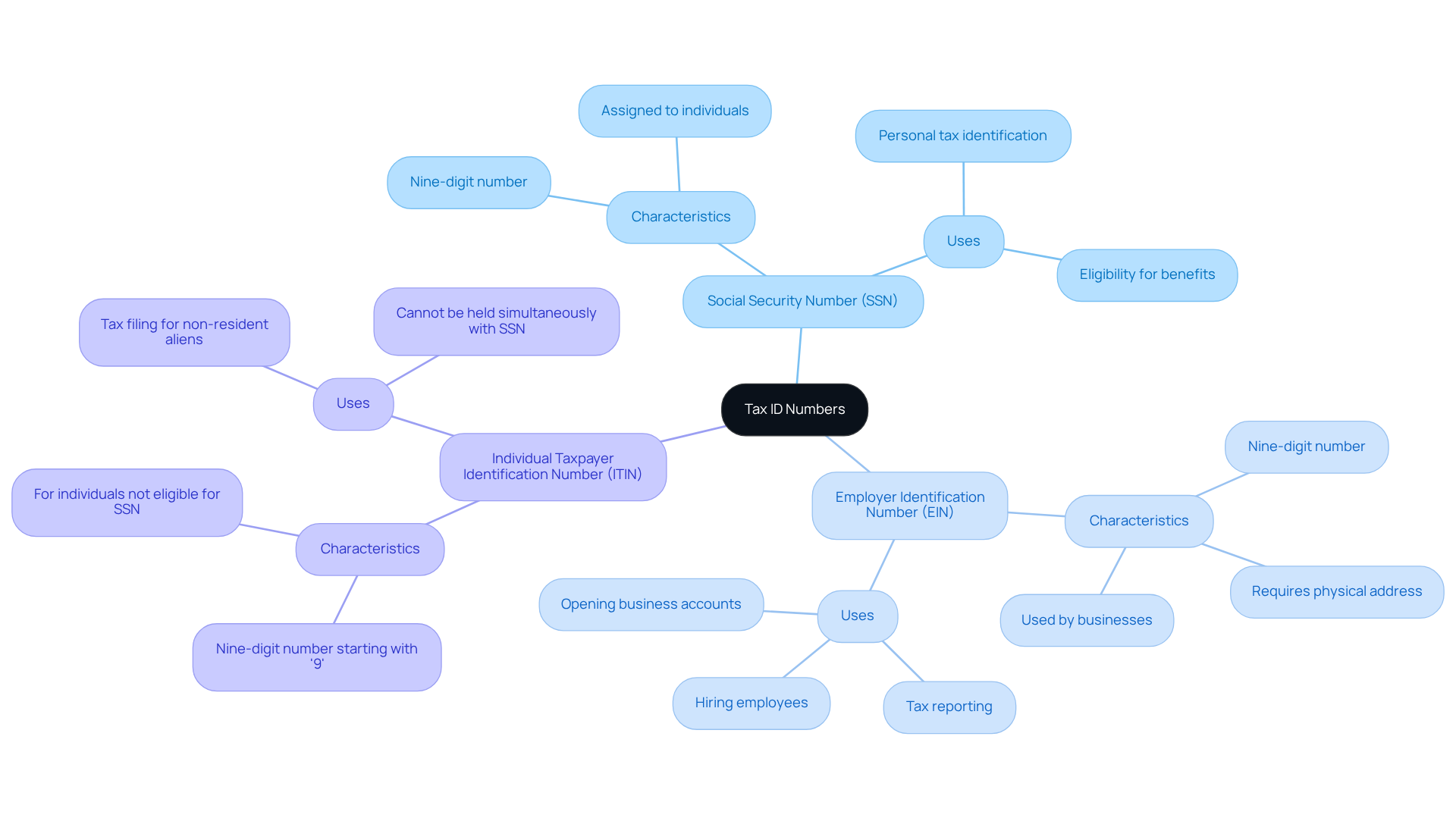

- Social Security Number (SSN): This nine-digit number is assigned to individuals primarily for personal tax identification. It is essential for personal tax filings and benefits.

- Employer Identification Number (EIN): Also a nine-digit number, the EIN is utilized by businesses for tax reporting, hiring employees, and opening accounts. It is crucial for corporations, partnerships, and LLCs. However, it is not legally required for sole proprietors and single-member LLCs if they report income from their operations on their personal tax returns. Businesses should use their EIN on all tax and payroll paperwork to ensure compliance. Additionally, a physical commercial address is required when applying for an EIN.

- Individual Taxpayer Identification Number (ITIN): This nine-digit identifier is designated for individuals who are not eligible for an SSN but need to file taxes. It is primarily used by non-resident aliens and their dependents. Importantly, a person can possess either an ITIN or an SSN, but not both simultaneously.

Understanding what a tax ID number is used for is critical for e-commerce businesses, especially for international sellers navigating U.S. tax obligations. For example, even if sales tax is not owed because platforms like Amazon manage it, income tax on net profit remains due, making Form 1040-NR essential. Tax advisors emphasize, “Make sure you use the right one for your situation,” underscoring the importance of selecting the appropriate tax ID number based on individual circumstances to ensure compliance with tax regulations and to mitigate potential legal issues.

Conclusion

Understanding the role of a Tax Identification Number (TIN) is essential for navigating the complexities of e-commerce. A TIN serves as a unique identifier for tax purposes and plays a critical role in ensuring compliance with federal and state regulations. Whether it’s a Social Security Number (SSN), Employer Identification Number (EIN), or Individual Taxpayer Identification Number (ITIN), each type fulfills specific functions vital for the operational success of e-commerce businesses.

Key points discussed throughout the article highlight the necessity of TINs for:

- Tax reporting

- Legal employment

- Financial management

The distinction between SSNs, EINs, and ITINs underscores their importance in various business contexts, from hiring employees to opening business bank accounts and applying for licenses. Furthermore, the historical evolution of these identifiers illustrates how they have adapted to meet the growing complexities of tax compliance, particularly as the e-commerce landscape continues to change.

Recognizing the significance of tax ID numbers is imperative for e-commerce entrepreneurs aiming to establish and maintain compliant operations. As regulations evolve, staying informed about the implications of these identifiers empowers businesses to navigate potential challenges effectively. Prioritizing the acquisition and proper use of TINs enhances operational efficiency and builds credibility with customers and suppliers alike, ultimately leading to a more successful e-commerce venture.

Frequently Asked Questions

What is a Tax Identification Number (TIN)?

A Tax Identification Number (TIN) is a unique identifier assigned by the government to individuals and businesses for tax purposes.

What are the primary types of TINs?

The primary types of TINs include the Social Security Number (SSN), Employer Identification Number (EIN), and Individual Taxpayer Identification Number (ITIN).

What is the purpose of a Social Security Number (SSN)?

The SSN is primarily used by individuals for personal tax reporting, determining eligibility for government benefits, and is essential for legal employment in the U.S. It is also required by banks and lenders for credit applications.

What is an Employer Identification Number (EIN) and its importance?

An EIN is a nine-digit code necessary for businesses, used for hiring employees, opening corporate bank accounts, and filing tax returns. Approximately 80% of companies in the U.S. utilize an EIN, highlighting its significance in the corporate sector.

Who needs an Individual Taxpayer Identification Number (ITIN)?

The ITIN is designed for individuals who do not qualify for an SSN, allowing nonresident and resident aliens to comply with U.S. tax laws, which is particularly important for e-commerce entrepreneurs who need to report income and meet tax obligations.

What recent changes have been made regarding TIN classifications?

Recent changes in TIN classifications in 2026 have clarified the distinctions and requirements for each category, helping organizations navigate their tax responsibilities more effectively.

Why is understanding TINs important for e-commerce enterprises?

Understanding TINs is crucial for e-commerce enterprises as they establish operations and ensure compliance with U.S. tax regulations.