Introduction

Understanding the complexities of tax identification numbers is crucial for international entrepreneurs who seek to navigate U.S. tax compliance effectively. These unique identifiers, including the Employer Identification Number (EIN) and Individual Taxpayer Identification Number (ITIN), serve as essential tools rather than mere bureaucratic formalities. They facilitate legal operations, financial transactions, and enhance overall business credibility.

However, a significant challenge persists: how can entrepreneurs select the appropriate tax number to prevent costly penalties and operational delays? This article explores the importance of tax numbers, their various types, and the application process, providing readers with the knowledge necessary to succeed in the U.S. market.

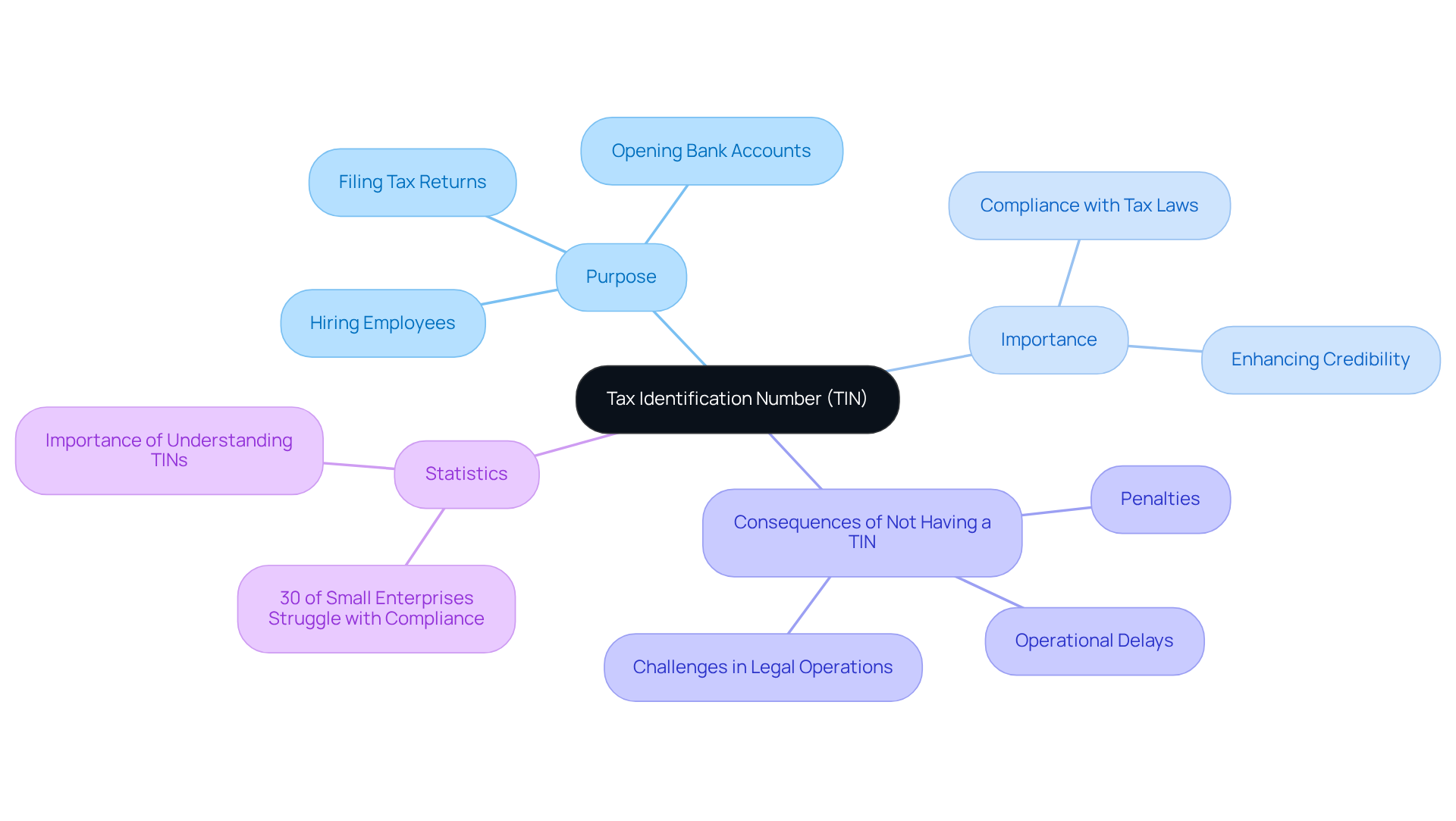

Define Tax Number: Understanding Its Purpose and Importance

A tax code, commonly known as a Tax Identification Number (TIN), raises the question of what is tax number, as it serves as a unique identifier issued by the Internal Revenue Service (IRS) to individuals and businesses for tax-related purposes. This identifier is essential for various operations, including filing tax returns, opening bank accounts, and hiring employees.

For international entrepreneurs, grasping the significance of a tax identifier is crucial, as it underpins compliance with U.S. tax laws and regulations. Without a tax identifier, companies may encounter significant challenges in legal operations, tax reporting, and securing financial services. For example, numerous international companies have faced compliance issues, leading to penalties and operational delays due to the absence of a TIN.

Statistics reveal that nearly 30% of small enterprises in the U.S. struggle with tax compliance, often stemming from a lack of understanding regarding the importance of tax identifiers. Experts assert that obtaining a tax identification not only facilitates adherence to tax regulations but also enhances a company’s credibility and operational efficiency.

Thus, a tax identifier is not merely a bureaucratic requirement; it is a vital tool for establishing a legitimate business presence in the United States.

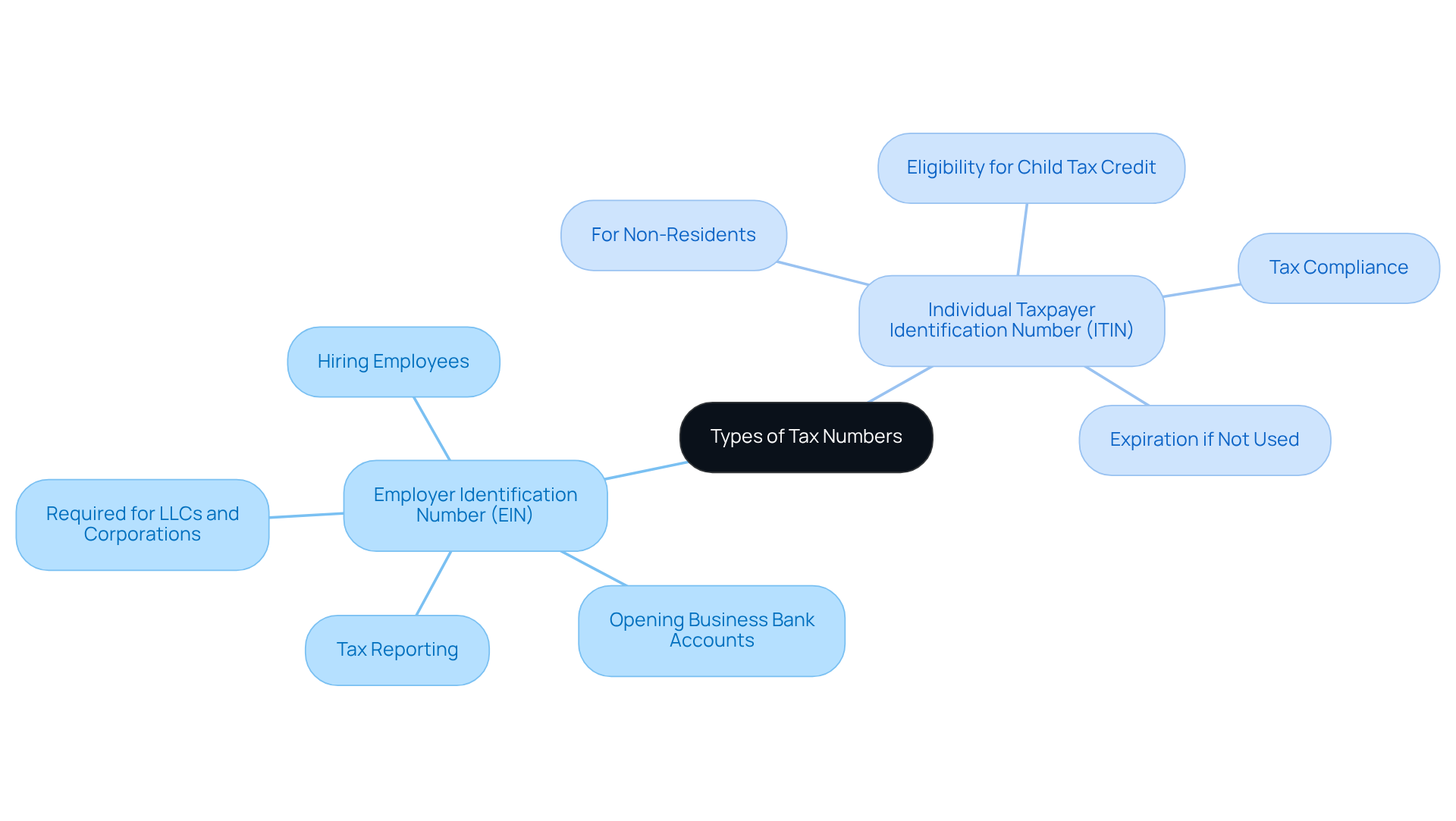

Explore Types of Tax Numbers: EIN, ITIN, and More

In America, companies require various tax identification codes, and what is tax number includes the Employer Identification Number (EIN) and the Individual Taxpayer Identification Number (ITIN). The EIN, a nine-digit identifier issued by the IRS, is vital for tax reporting, hiring employees, and opening business bank accounts. This number is particularly crucial for start-ups as they establish a solid foundation for their operations.

Conversely, the ITIN is intended for individuals who do not qualify for a Social Security Number (SSN) but must fulfill U.S. tax obligations. This distinction is especially important for international entrepreneurs, as selecting the appropriate tax identifier can significantly impact compliance and operational efficiency. Choosing the wrong tax number can lead to complications, including potential penalties and operational delays, which raises the question of what is tax number.

While the EIN is essential for commercial entities, the ITIN serves personal tax reporting needs for non-residents. It is important to note that if an ITIN is not utilized on a federal tax return for three consecutive years, it will expire, and holders of an ITIN are not eligible for Social Security benefits. Understanding these differences is crucial for effectively navigating the American tax landscape.

Additionally, other tax identifiers, such as the Preparer Tax Identification Number (PTIN) for tax preparers and the Adoption Taxpayer Identification Number (ATIN) for adopted children, may be relevant in specific contexts. However, the EIN and ITIN remain the primary identifiers for commercial operations.

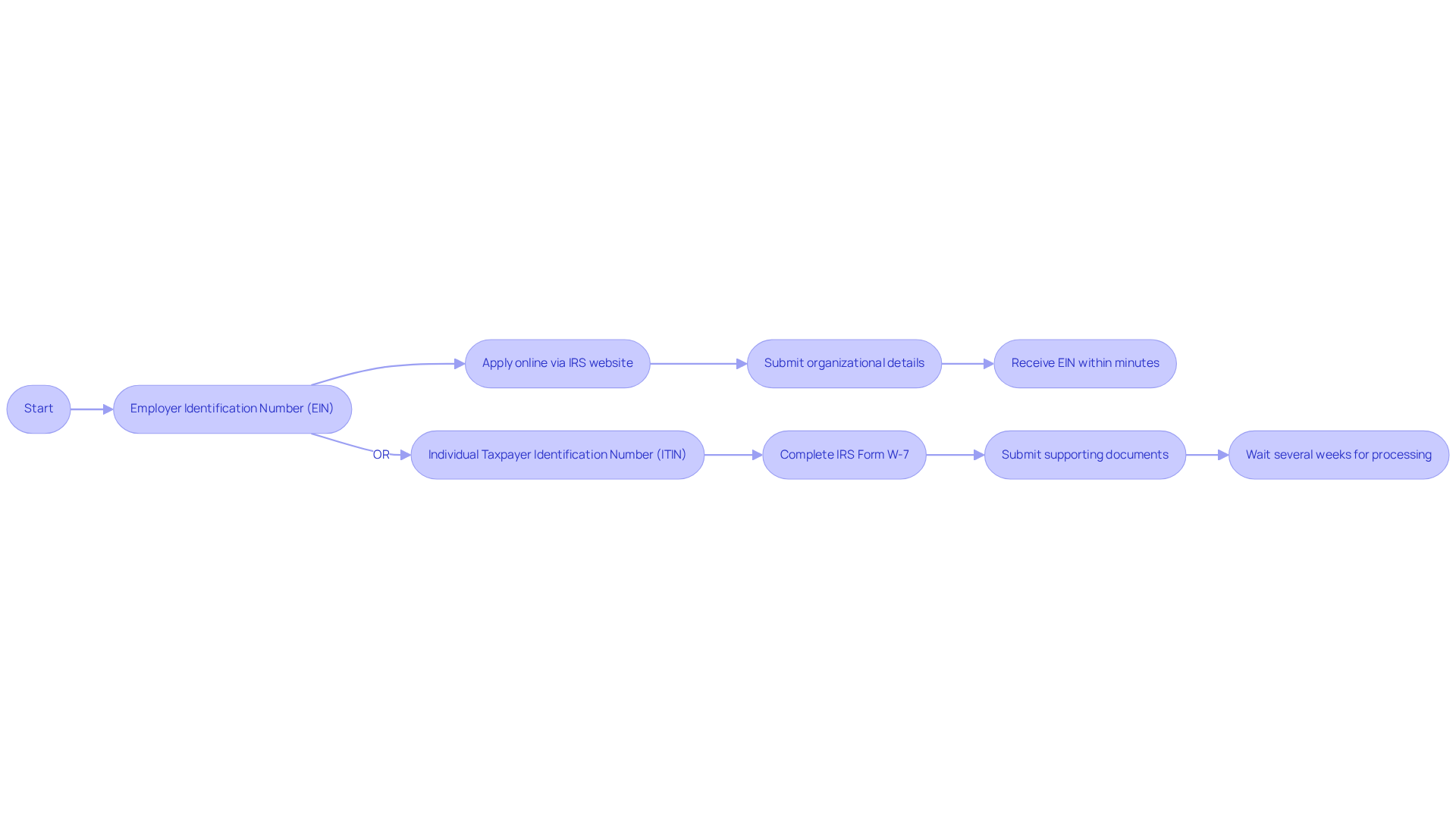

Outline the Application Process: How to Obtain Your Tax Number

Understanding what is tax number is a crucial step for both enterprises and individuals operating in the U.S. The application process varies based on the type of number required.

-

For an Employer Identification Number (EIN), entities can apply online via the IRS website. This process necessitates the submission of details regarding the organizational structure and ownership. Typically, applications are processed swiftly, allowing entities to receive their EIN within minutes.

-

Conversely, individuals seeking an Individual Taxpayer Identification Number (ITIN) must complete IRS Form W-7 and submit it alongside supporting documents, including proof of identity and foreign status. This process may take several weeks, underscoring the importance for international entrepreneurs to plan accordingly.

Understanding what is tax number not only ensures compliance with American tax regulations but also helps prevent potential delays in business operations. By being well-prepared and informed, entrepreneurs can navigate the tax identification application process more effectively.

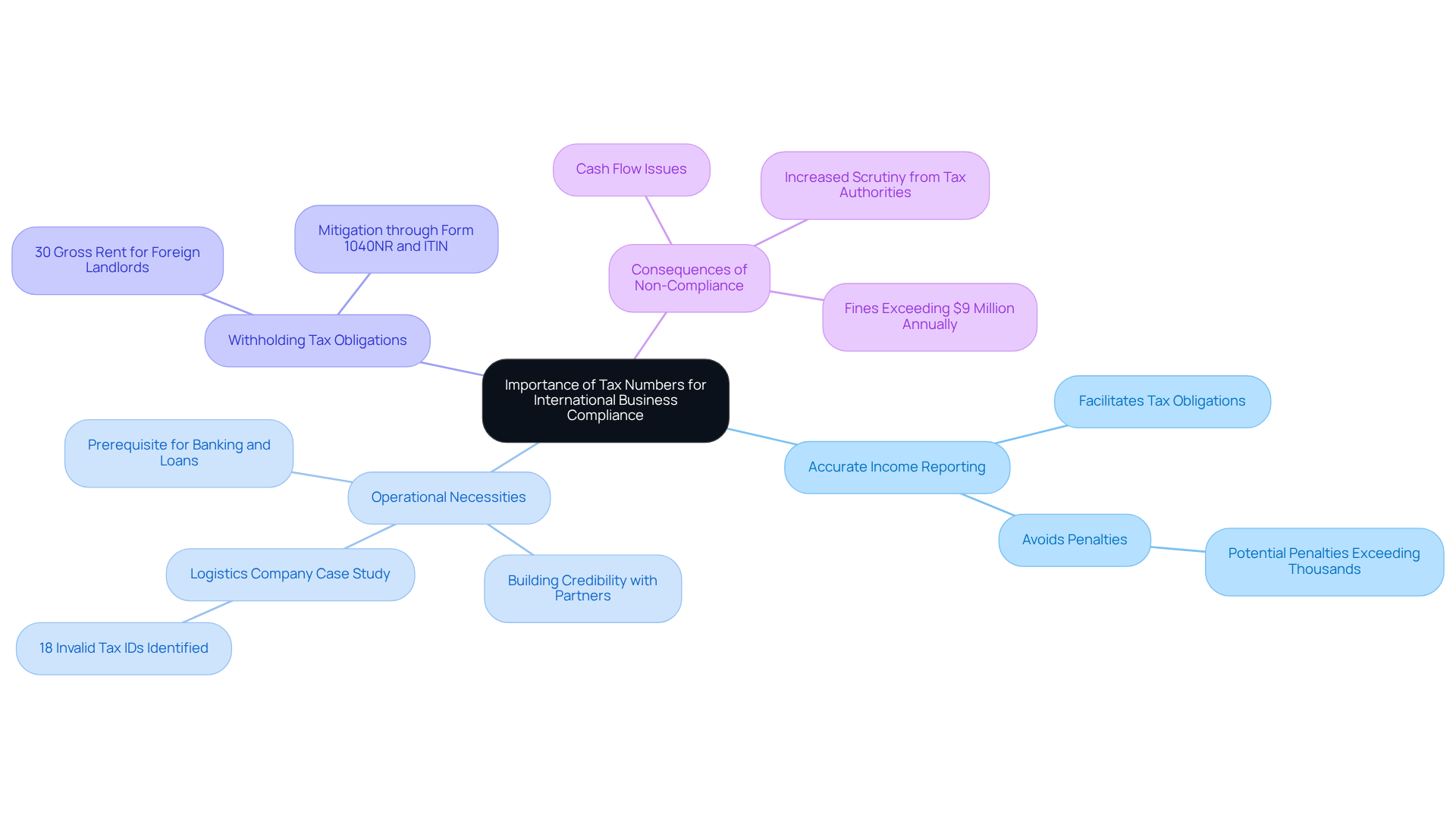

Highlight the Importance of Tax Numbers for International Business Compliance

Tax identification codes are not just bureaucratic formalities; they are crucial for compliance with U.S. tax laws. For international entrepreneurs, possessing the correct tax identification is vital for several reasons.

-

It facilitates accurate income reporting and the fulfillment of tax obligations, helping to avert penalties that can escalate into thousands of dollars. For instance, companies that lack tax identification codes may face penalties that accumulate quickly, leading to significant financial strain.

-

Tax identifiers are often prerequisites for opening bank accounts, securing loans, and establishing contracts with suppliers and customers. Without a tax identification, entrepreneurs may encounter operational delays and challenges in building credibility with partners and clients. A logistics company that automated its tax ID validation process discovered that 18% of invalid tax IDs were identified at the point of collection, thus preventing extensive reconciliation work and potential penalties.

-

Foreign landlords must also recognize their withholding tax obligations when renting property in the U.S. This tax mandates that foreign landlords pay 30% of the gross rent received to the IRS, which can be burdensome. However, by filing an income tax return using Form 1040NR and applying for an ITIN, landlords can potentially mitigate this tax. Understanding these obligations is essential for international entrepreneurs engaged in real estate investment.

-

Expert opinions underscore the importance of tax identifiers; failing to obtain one can result in serious consequences, including cash flow issues and increased scrutiny from tax authorities. Statistics indicate that businesses without tax identification codes are at a heightened risk of operational disruptions, with many facing fines that can exceed $9 million annually due to incorrect tax information.

In conclusion, grasping what a tax number is critical for any entrepreneur aiming to succeed in the U.S. market. The ramifications of non-compliance can be severe, making it imperative to prioritize the acquisition and maintenance of accurate tax identification.

Conclusion

Understanding the complexities of a tax number is crucial for any entrepreneur aiming to navigate the challenges of conducting business in the United States. This unique identifier not only ensures compliance with tax regulations but also serves as a foundation for operational legitimacy and credibility. For international entrepreneurs, possessing the correct tax identification number can significantly impact their success and sustainability in a competitive market.

This article explores the various types of tax numbers, including the Employer Identification Number (EIN) and the Individual Taxpayer Identification Number (ITIN), highlighting their distinct purposes and the application processes involved. It underscores the essential role these identifiers play in facilitating accurate tax reporting, securing financial services, and avoiding penalties that could jeopardize business operations. Moreover, the insights provided emphasize the necessity of being well-informed about tax obligations, particularly for those engaged in international business.

Ultimately, the importance of obtaining and maintaining a tax number cannot be overstated. Entrepreneurs must recognize that these identifiers are not merely administrative hurdles but vital tools for fostering business growth and compliance. By prioritizing the acquisition of the appropriate tax identification, international entrepreneurs can pave the way for smoother operations and a more robust presence in the U.S. market. Taking proactive steps to understand and address tax requirements will not only mitigate risks but also enhance overall business credibility and success.

Frequently Asked Questions

What is a tax number?

A tax number, also known as a Tax Identification Number (TIN), is a unique identifier issued by the Internal Revenue Service (IRS) to individuals and businesses for tax-related purposes.

What is the purpose of a tax number?

The purpose of a tax number is to serve as a unique identifier for filing tax returns, opening bank accounts, and hiring employees, among other tax-related operations.

Why is a tax identifier important for international entrepreneurs?

A tax identifier is crucial for international entrepreneurs as it ensures compliance with U.S. tax laws and regulations. Without it, companies may face significant challenges in legal operations, tax reporting, and securing financial services.

What challenges can arise from not having a tax identifier?

Companies without a tax identifier may encounter compliance issues, leading to penalties and operational delays, as well as difficulties in accessing financial services.

How does a lack of understanding about tax identifiers affect small enterprises?

Statistics show that nearly 30% of small enterprises in the U.S. struggle with tax compliance due to a lack of understanding regarding the importance of tax identifiers.

What benefits does obtaining a tax identification provide to a business?

Obtaining a tax identification not only facilitates adherence to tax regulations but also enhances a company’s credibility and operational efficiency.

Is a tax identifier just a bureaucratic requirement?

No, a tax identifier is a vital tool for establishing a legitimate business presence in the United States, not merely a bureaucratic requirement.