Introduction

Understanding the complexities of the Employer Identification Number (EIN) is crucial for any business navigating the intricate landscape of tax compliance. This unique nine-digit identifier not only streamlines tax filing but also serves a vital role in establishing a company’s legitimacy and operational efficiency. Despite its importance, many entrepreneurs are unaware of the key situations that require obtaining an EIN, which raises concerns about potential pitfalls and compliance challenges.

What does it mean for a business to secure an EIN, and how can it reshape their approach to taxes and operations?

Define EIN: Understanding the Employer Identification Number

What is an EIN number for taxes? It is a unique nine-digit code assigned by the Internal Revenue Service (IRS) to identify an organization for tax purposes, also known as a Federal Tax Identification Number. The format of an EIN is XX-XXXXXXX. This number is crucial for various commercial functions, including filing tax returns, opening a bank account, and applying for licenses. It serves as a mechanism for the IRS to monitor a company’s tax responsibilities and compliance, making it an essential component of operations in the United States.

For online retail and gaming enterprises, understanding the role of the EIN is vital for ensuring tax compliance and operational legitimacy. Most LLCs, corporations, and partnerships need to know what is an EIN number for taxes in order to file their tax returns. In contrast, sole proprietors without employees may use their Social Security Number for tax purposes. The application process for an EIN is free and straightforward, typically taking less than 10 minutes to complete.

Furthermore, businesses must acquire a new EIN when changing their legal structure, underscoring its significance. Millions of enterprises across the U.S., including those in the gaming industry, utilize EINs, highlighting their importance in maintaining operational legitimacy and facilitating tax compliance.

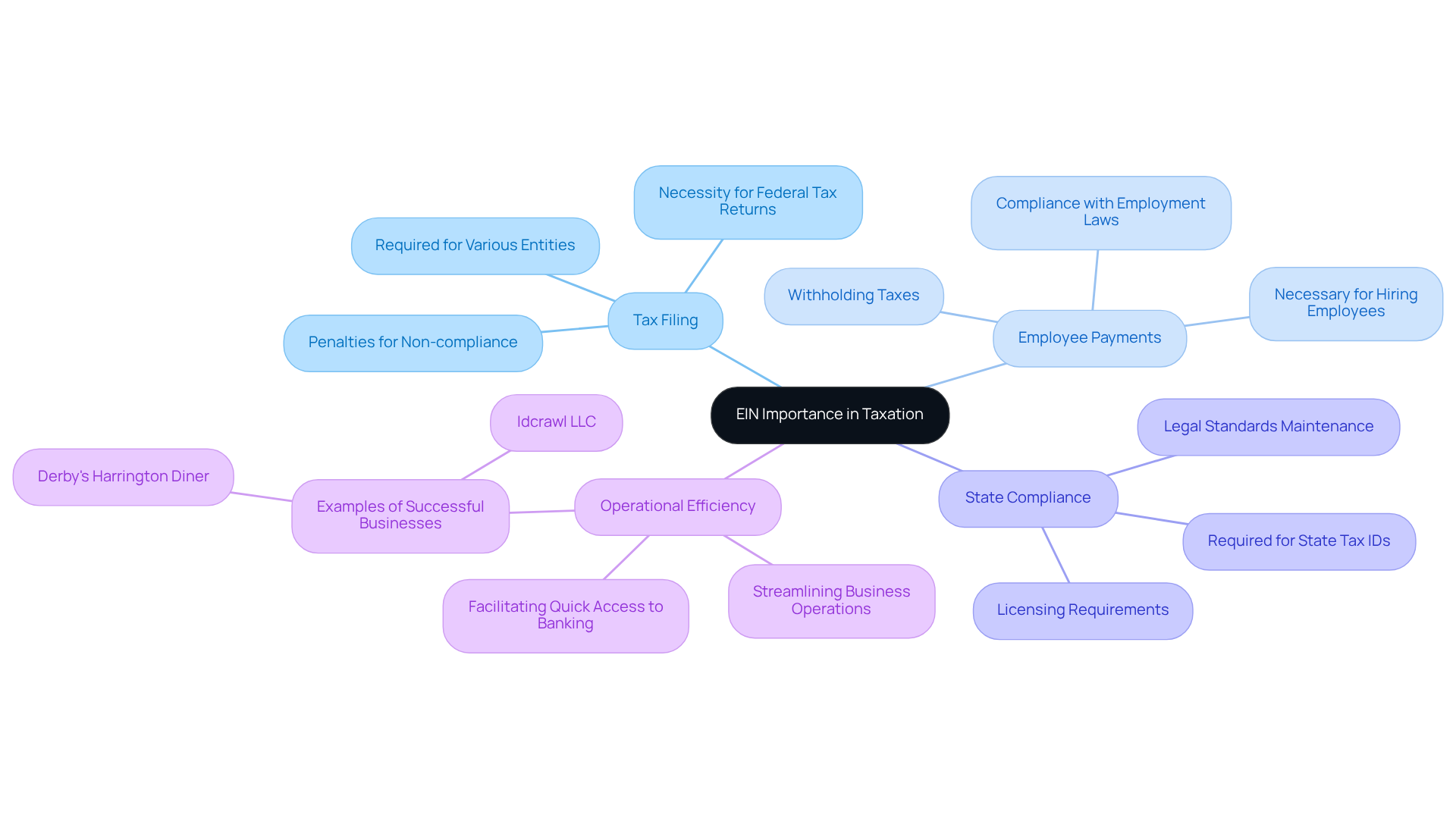

Contextualize EIN: Importance in Taxation and Business Compliance

Understanding what is an EIN number for taxes is essential, as it serves as a critical component of organizational compliance in the United States for various tax-related activities. It is necessary for filing federal tax returns, paying employees, and reporting income. Without an EIN, companies risk facing penalties and complications in their tax filings, which can lead to significant operational disruptions. Additionally, the EIN is often required for obtaining state tax IDs and licenses, underscoring its importance in maintaining legal standards.

For e-commerce businesses, the need for an EIN is particularly significant. It not only ensures compliance with federal and state tax regulations but also streamlines operations, thereby reducing the likelihood of audits. For instance, companies like Idcrawl LLC and Derby’s Harrington Diner have successfully managed their tax obligations with the help of their EINs, ensuring compliance and operational efficiency.

Tax professionals consistently emphasize that understanding what an EIN number for taxes is is essential for businesses with employees or those engaged in activities requiring tax withholding. The process of acquiring an EIN is straightforward and free, allowing organizations to focus on growth rather than compliance challenges. In conclusion, obtaining an EIN is not merely a regulatory formality; it is a strategic decision that enables e-commerce enterprises to operate smoothly within the legal framework.

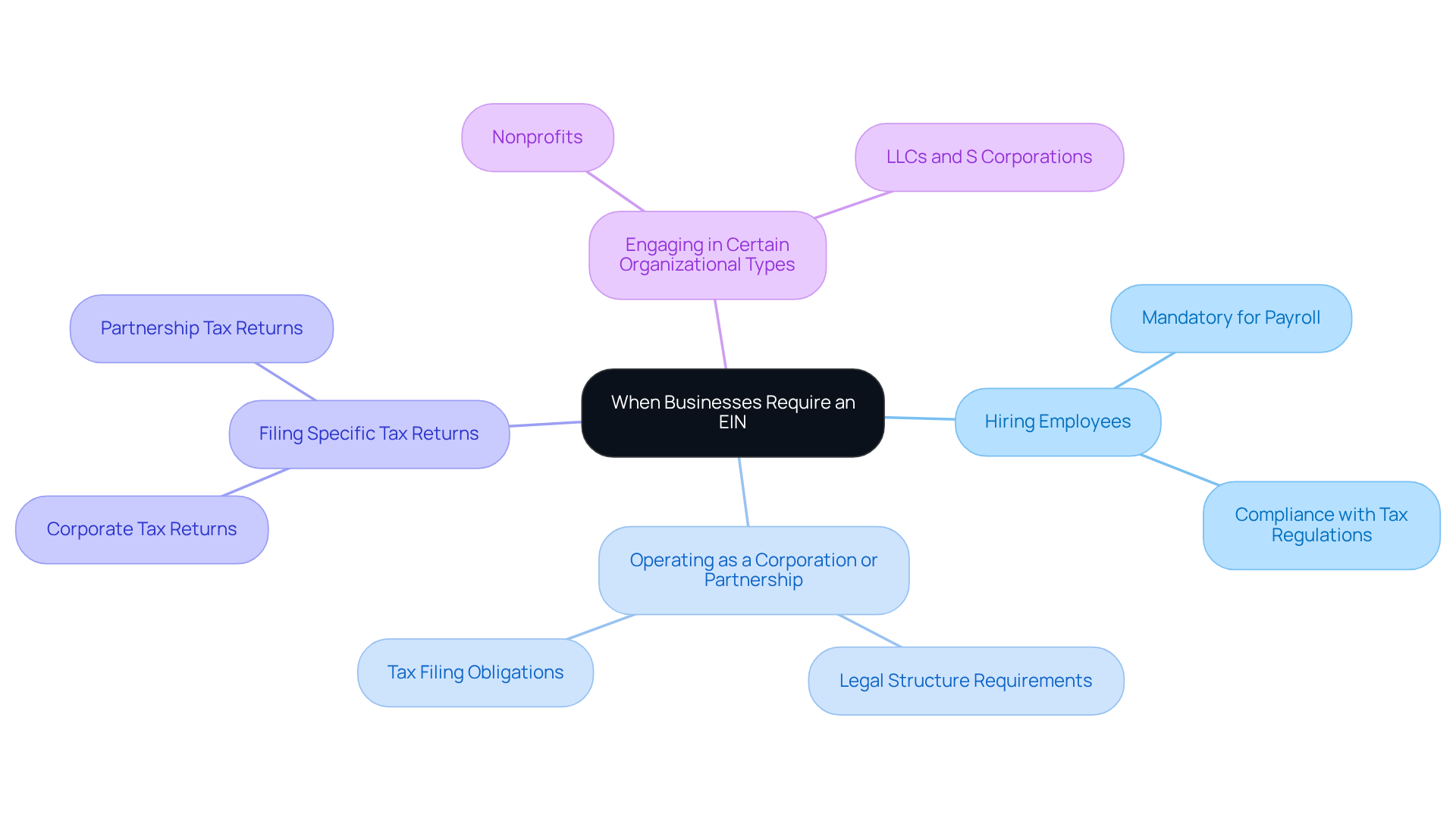

Identify When Businesses Require an EIN: Key Scenarios and Criteria

Businesses often require an Employer Identification Number (EIN) in several critical scenarios. These scenarios include:

- Hiring employees

- Operating as a corporation or partnership

- Filing specific tax returns

- Engaging in certain organizational types, such as nonprofits

While sole proprietors without employees may not be mandated to obtain an EIN, acquiring one can significantly aid in separating personal and operational finances. This separation enhances financial clarity and professionalism.

Moreover, enterprises seeking licenses or permits frequently need an EIN to complete their applications, making it a vital component of compliance. Understanding these criteria is essential for business owners to determine the appropriate timing for applying for an EIN. This ensures compliance with tax regulations and facilitates smoother operations.

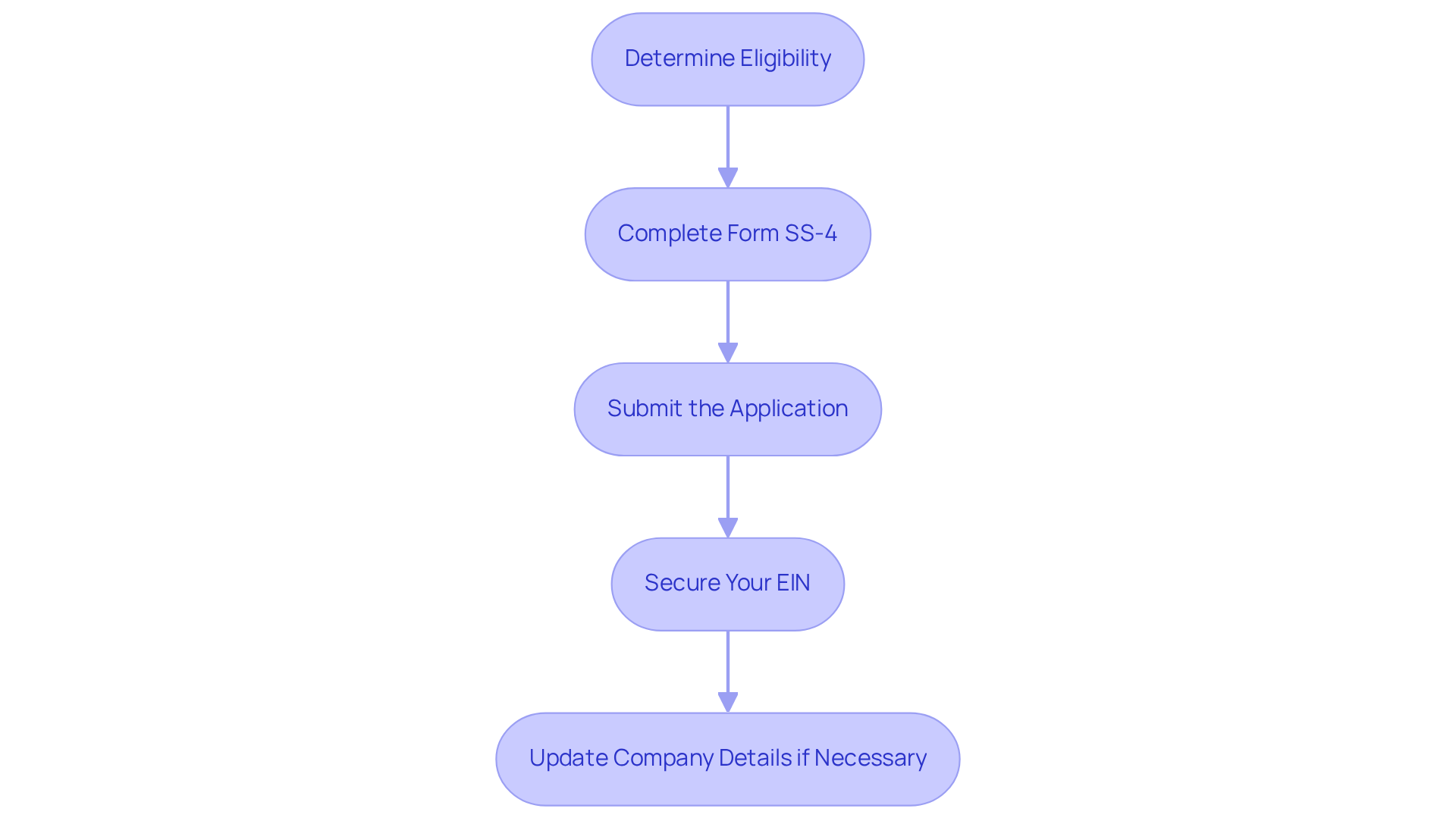

Obtain an EIN: Step-by-Step Application Process

To obtain an Employer Identification Number (EIN), organizations should follow these essential steps:

-

Determine Eligibility: Confirm that your entity structure, such as an LLC or corporation, requires an EIN. For simpler structures like single-member LLCs or sole proprietorships, an ITIN may suffice; however, an EIN is necessary for more complex structures and companies with employees.

-

Complete Form SS-4: This form can be filled out online, by fax, or by mail. The IRS recommends using the online method for immediate processing.

-

Submit the Application: If applying online, you will receive your EIN instantly upon completion. For fax or mail submissions, processing times may vary.

-

Secure Your EIN: Once acquired, keep your EIN secure, as understanding what is an EIN number for taxes is essential for various tax filings and commercial transactions. The application process is designed to be straightforward, often taking just minutes when completed online.

In recent years, the number of EIN applications has surged, reflecting the increasing quantity of new enterprises entering the market, with applications reaching a high of 1.465 million in Q3 2020. This trend highlights the significance of the EIN in facilitating operations and compliance. Additionally, if you need to update your company details, such as address or partners, you must prepare the necessary documents as required by your state and inform the IRS of any changes. The IRS warns, “Beware of websites that charge for an EIN; you never have to pay a fee for an EIN.

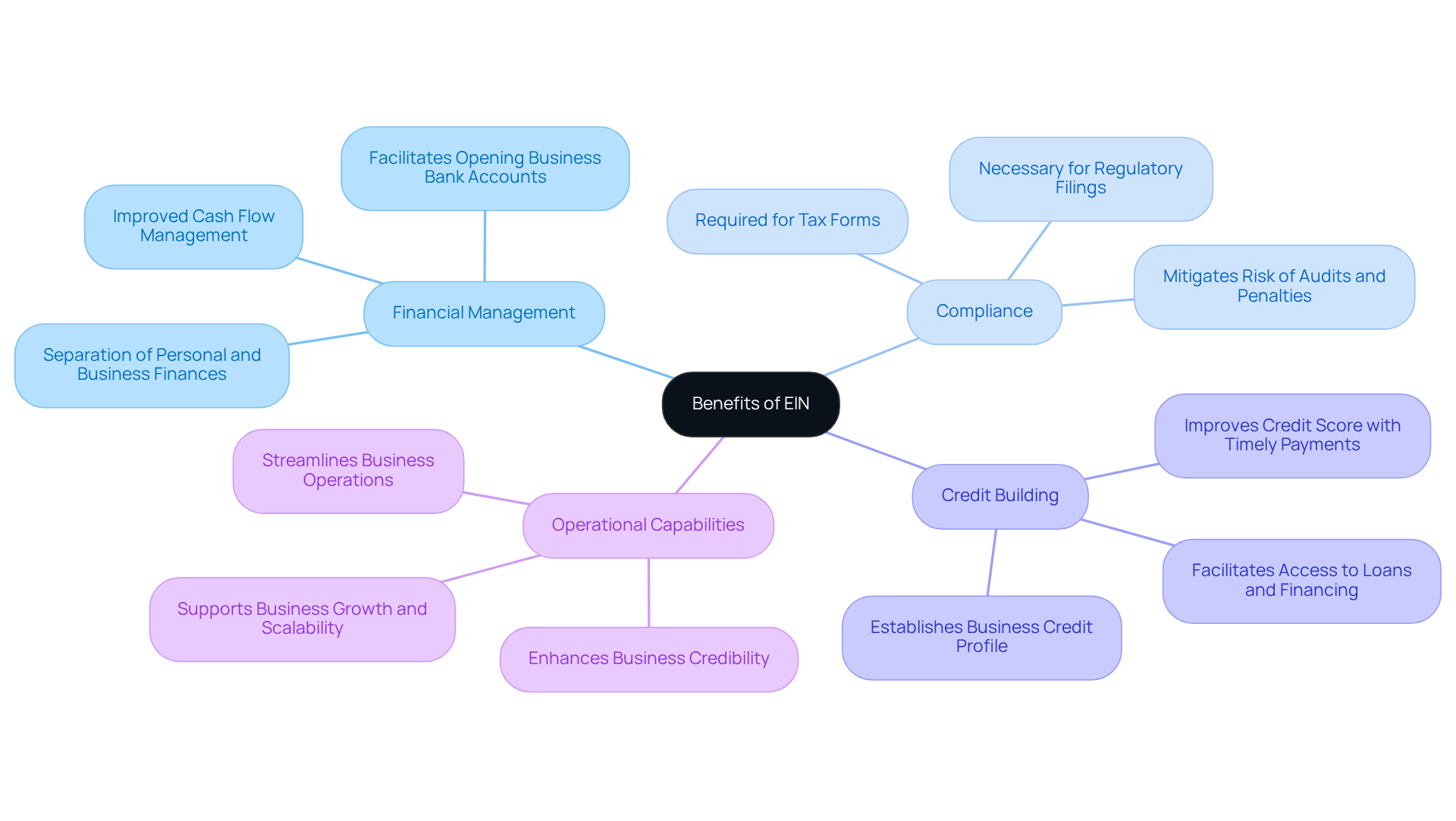

Explore Benefits of an EIN: Enhancing Business Operations and Compliance

Acquiring an Employer Identification Number (EIN) offers significant advantages that are essential for any business, particularly for Turkish-speaking entrepreneurs looking to establish a foothold in the U.S. It helps to clarify what an EIN number is for taxes and facilitates the separation of personal and business finances, which is crucial for liability protection. This distinction not only safeguards personal assets but also delineates financial boundaries, ensuring that only business assets are considered in debt resolution. Moreover, an EIN is often necessary for opening a bank account, which greatly improves financial management by enabling businesses to monitor income and expenses more efficiently.

Additionally, businesses with an EIN can build their credit profiles, simplifying the process of obtaining loans and financing. For example, a small café owner leveraged her EIN to set up a merchant services account, streamlining transactions and enhancing cash flow management. Similarly, a freelance graphic designer adopted an EIN, which allowed him to secure a credit card and qualify for tax deductions related to his work, thereby strengthening his financial position.

What is an EIN number for taxes, and how does it streamline the tax filing process, as it is required for various tax forms and reporting obligations? Compliance with IRS regulations not only mitigates the risk of audits and penalties but also enhances the organization’s standing with financial institutions. In fact, consistent, timely payments associated with an EIN can improve a company’s credit score, facilitating access to larger credit lines. Furthermore, starting January 1, 2024, all LLCs must possess an EIN for CTA/BOI filings, highlighting its regulatory importance.

For Turkish-speaking entrepreneurs, grasping the EIN application process is vital. It not only fulfills regulatory requirements but also serves as a strategic initiative that enhances operational capabilities and financial management for businesses. By securing an EIN, entrepreneurs can more effectively navigate the complexities of launching a business in the U.S., making it an invaluable asset for their endeavors.

Conclusion

Understanding the significance of an Employer Identification Number (EIN) is essential for any business operating in the United States. This unique nine-digit identifier not only facilitates tax compliance but also plays a critical role in establishing operational legitimacy. By acquiring an EIN, businesses can effectively navigate the complexities of tax obligations, streamline their operations, and enhance their financial management.

The necessity of an EIN spans various business structures, and the application process is straightforward. An EIN ensures compliance with federal and state tax regulations while allowing for the separation of personal and business finances. It serves as an essential tool for both new and established enterprises. Moreover, it is vital for hiring employees, applying for licenses, and building a robust credit profile, thereby reinforcing its importance in the business landscape.

In conclusion, obtaining an EIN transcends mere regulatory compliance; it represents a strategic initiative that empowers businesses to operate effectively within the legal framework. Entrepreneurs, particularly those entering the U.S. market, should prioritize securing their EIN to access a range of operational advantages and ensure adherence to tax obligations. By doing so, they position themselves for growth and success in an increasingly competitive environment.

Frequently Asked Questions

What is an EIN number for taxes?

An Employer Identification Number (EIN) is a unique nine-digit code assigned by the Internal Revenue Service (IRS) to identify an organization for tax purposes. It is also known as a Federal Tax Identification Number and is formatted as XX-XXXXXXX.

Why is an EIN important for businesses?

An EIN is crucial for various commercial functions, including filing tax returns, opening bank accounts, and applying for licenses. It helps the IRS monitor a company’s tax responsibilities and compliance, making it essential for operational legitimacy in the United States.

Who needs an EIN?

Most LLCs, corporations, and partnerships need an EIN to file their tax returns. Sole proprietors without employees can use their Social Security Number for tax purposes instead.

How can a business apply for an EIN?

The application process for an EIN is free and straightforward, typically taking less than 10 minutes to complete.

When does a business need to acquire a new EIN?

A business must acquire a new EIN when changing its legal structure, which underscores the significance of the EIN in maintaining compliance.

What are the consequences of not having an EIN?

Without an EIN, companies risk facing penalties and complications in their tax filings, which can lead to significant operational disruptions.

How does an EIN benefit e-commerce businesses?

For e-commerce businesses, an EIN ensures compliance with federal and state tax regulations and streamlines operations, thereby reducing the likelihood of audits.

Is obtaining an EIN considered a regulatory formality?

No, obtaining an EIN is not merely a regulatory formality; it is a strategic decision that enables e-commerce enterprises to operate smoothly within the legal framework.