Introduction

A company registration number (CRN) is fundamental to a business’s legal identity, yet many entrepreneurs are often unaware of its importance. This unique identifier not only confirms a company’s existence but also plays a critical role in essential operations, such as:

- Securing loans

- Opening bank accounts

- Ensuring compliance with tax regulations

As businesses navigate an increasingly complex regulatory landscape, it is vital to consider the consequences for those who overlook the significance of their CRN. Understanding its implications is essential for fostering growth and establishing credibility in today’s competitive market.

Define Company Registration Number

What is my company registration number? A Company Registration Number (CRN) is a unique identifier assigned to an enterprise upon registration with a governmental authority, typically the Secretary of State or a similar regulatory body, and it varies by state. What is my company registration number serves as official proof of the company’s existence and is vital for various legal and administrative processes.

In the United States, the CRN is crucial for tax purposes, enabling the government to oversee enterprises for tax collection and compliance. It is also necessary in official documents, including tax filings, licenses, and contracts, ensuring that the entity is legally recognized and can operate within the regulatory framework.

Without a CRN, companies may face significant challenges, such as difficulties in opening bank accounts, securing loans, or establishing credibility with clients and suppliers. In 2025, the Census Bureau estimated around 30,438 new enterprises with payroll tax responsibilities, underscoring the ongoing importance of proper documentation in fostering entrepreneurial activity.

Overall, a CRN not only enhances an enterprise’s legitimacy but also protects personal assets and facilitates growth opportunities.

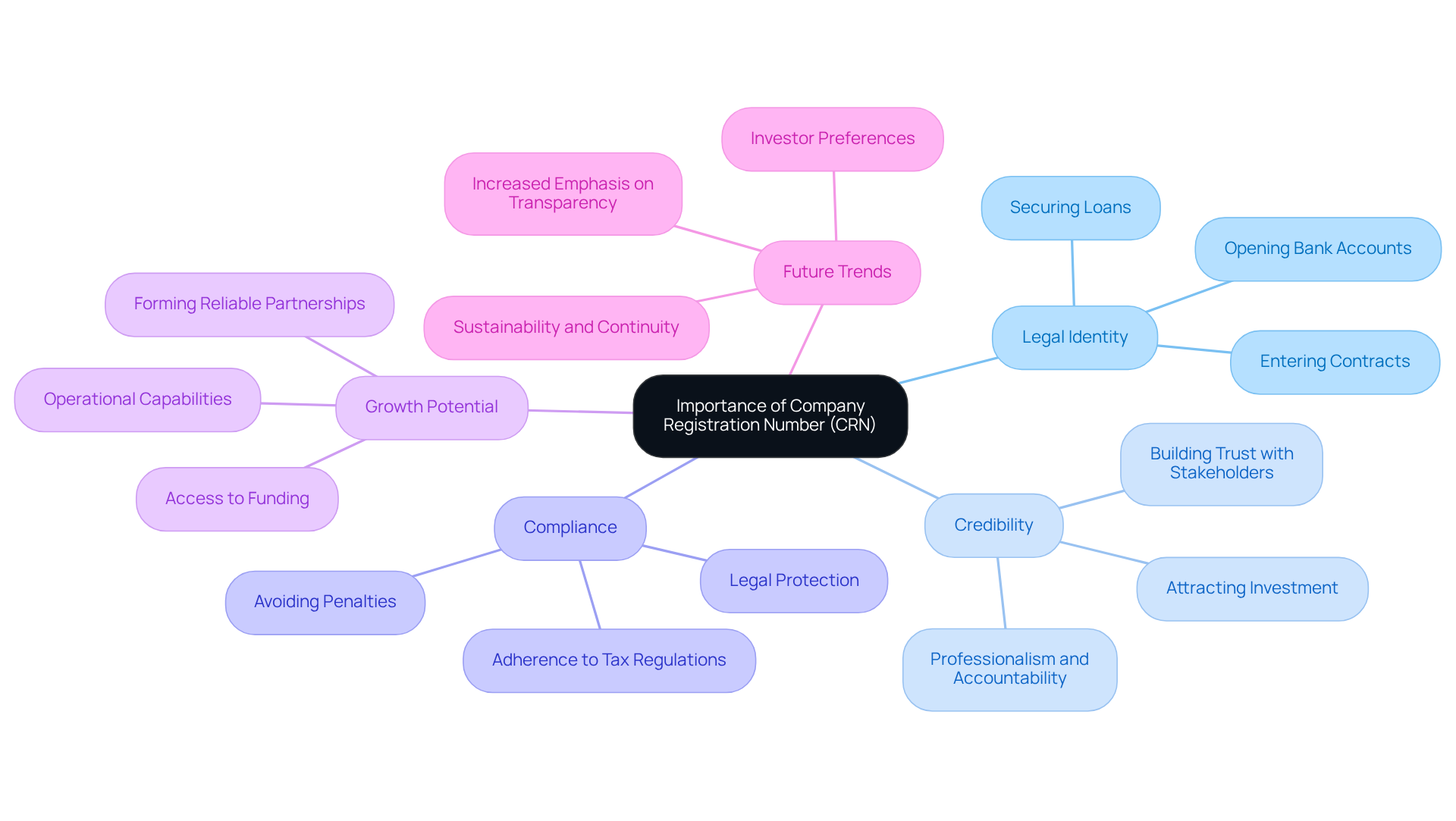

Explain the Importance of a Company Registration Number

The significance of what is my company registration number (CRN) is critical in the current commercial landscape. It acts as the legal identity of a business, enabling essential functions such as opening bank accounts, securing loans, and entering contracts. Organizations often face challenges in establishing credibility with clients, suppliers, and financial institutions when they do not know what is my company registration number, which can significantly hinder their growth potential. Research shows that unregistered businesses encounter considerable obstacles, including difficulties in obtaining funding and forming reliable partnerships, which can restrict their operational capabilities.

Furthermore, knowing what is my company registration number is vital for compliance with tax regulations, allowing government authorities to oversee financial activities and ensure adherence to tax obligations. This compliance is not merely a legal requirement; it also conveys professionalism and accountability to stakeholders. Registered businesses are perceived as more stable and credible, increasing their chances of attracting investment and securing favorable terms from banks. They gain access to corporate bank accounts, company credit, and loans, which are viewed positively by investors.

As we look ahead to 2026, the importance of a CRN continues to escalate, with investors placing greater emphasis on transparency and accountability in their transactions. A well-registered business fosters trust among stakeholders, leading to improved relationships and opportunities. To navigate the complexities of business registration and ensure compliance, consider scheduling a complimentary 15-minute consultation with Social Enterprises, where our experts can assist you through the registration process and clarify your obligations. Ultimately, knowing what is my company registration number serves as a foundational element of an organization’s operational framework, facilitating legal and financial interactions while reinforcing its commitment to responsible practices.

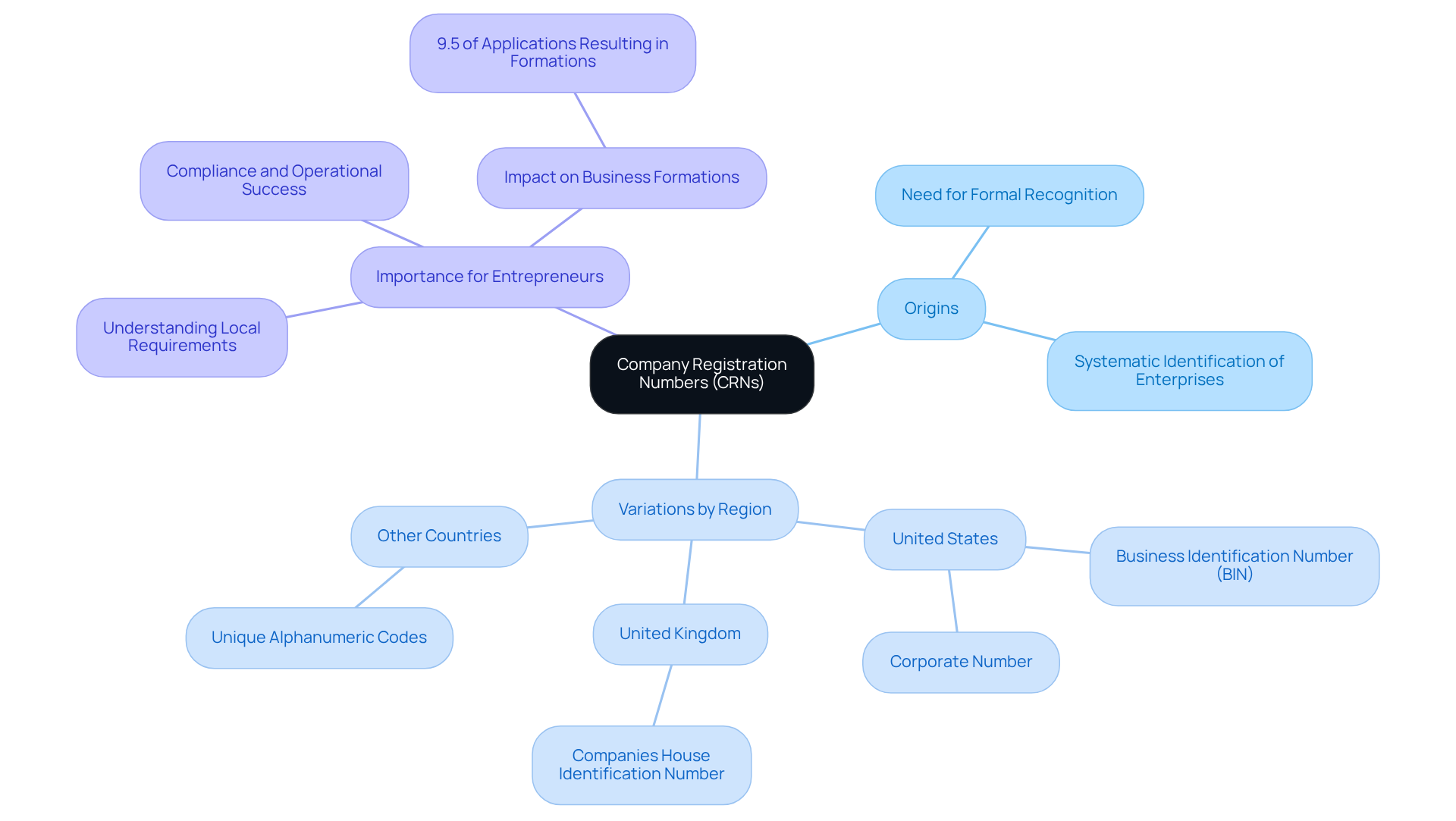

Discuss Origins and Variations of Company Registration Numbers

The concept of a company registration number (CRN) arose from the necessity for businesses to receive formal recognition from governmental authorities. As commerce evolved, the demand for a systematic method to identify and regulate enterprises became increasingly evident.

In the United States, each state has established its own framework for issuing CRNs, leading to significant variations in format and terminology. For example, while some states refer to it as a business identification number (BIN) or corporate number, others may adopt entirely different terms. Conversely, countries like the United Kingdom assign a Companies House identification number, which is a unique alphanumeric code given to companies upon incorporation.

This variation in naming conventions and formats underscores the differing regulatory environments and practices across jurisdictions. For entrepreneurs, particularly in 2026, understanding these local requirements is vital as the landscape continues to shift with new regulations and standards.

Statistics indicate that approximately 9.5% of enterprise applications from 2016 to 2019 resulted in actual company formations, highlighting the importance of precise enrollment processes. As businesses navigate these complexities, understanding what is my company registration number and the specific requirements in their respective regions is essential for compliance and operational success.

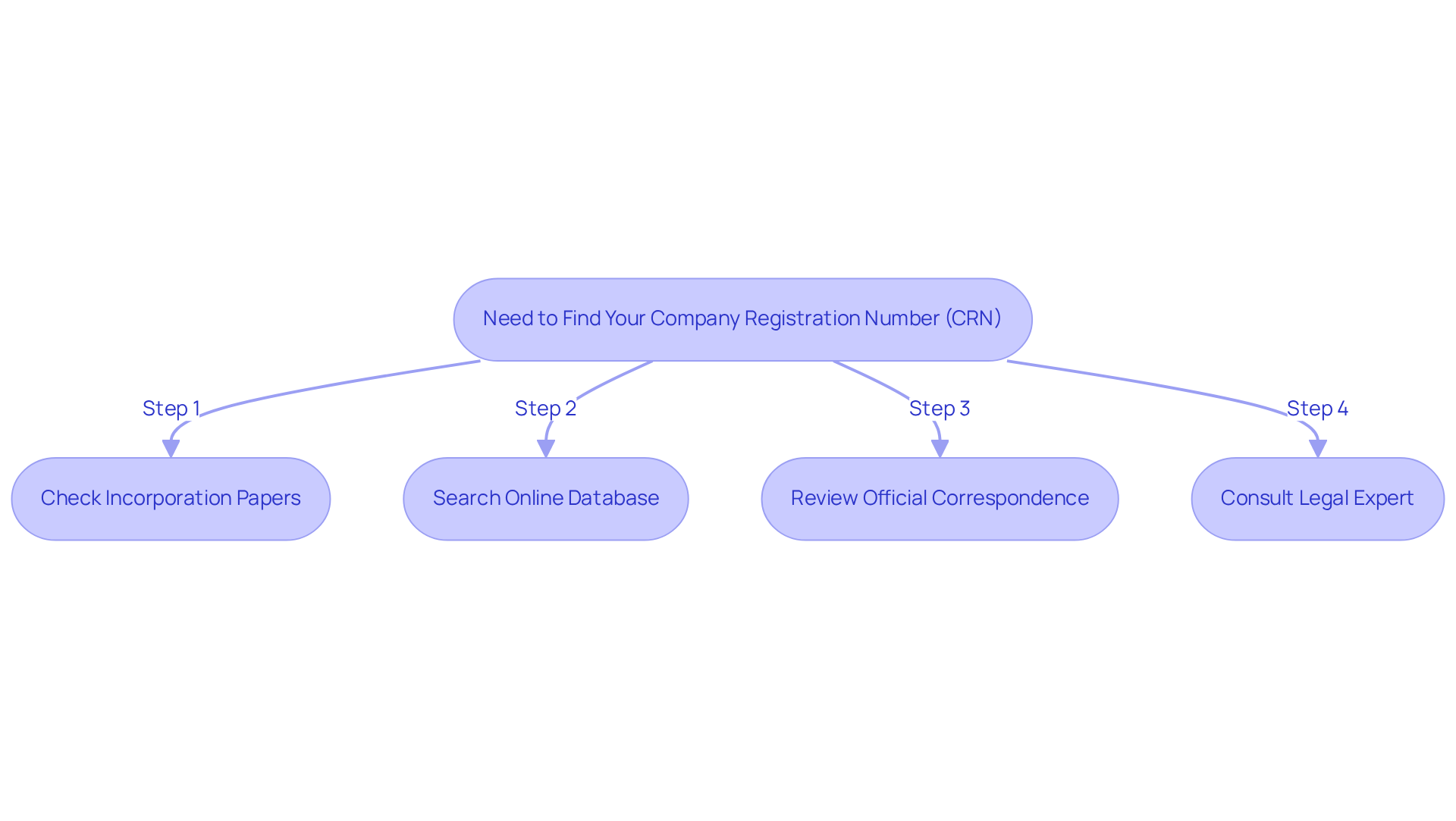

Outline How to Find or Obtain Your Company Registration Number

To find out what is my company registration number (CRN), follow these essential steps. If you are establishing your enterprise, you may wonder what is my company registration number, which will be provided upon successful filing with your region’s Secretary of State or a comparable authority, typically included in your incorporation papers or certificate of formation. For those who have already registered but cannot locate what is my company registration number, many regions provide online searchable databases. By entering your company name, you can easily retrieve your registration details. Additionally, any official correspondence from the state regarding your enterprise will likely include information on what is my company registration number. If you encounter challenges, consulting a legal expert can provide further assistance in acquiring the necessary information.

In 2023, approximately 20.4 million applications were filed in the U.S., with an estimated 1.9 million expected to result in actual business formations. This underscores the importance of having a CRN, as knowing what is my company registration number is essential for legal recognition, tax compliance, and operational expansion. For instance, businesses that successfully obtained their CRN from government registries have reported smoother operations and enhanced credibility, facilitating activities such as opening bank accounts and applying for an Employer Identification Number (EIN). Maintaining accurate records and ensuring your CRN is up to date is vital to avoid penalties and ensure compliance with state regulations. If your certificate of enrollment is lost, you can obtain a duplicate from the Secretary of State by submitting a request or online application.

Furthermore, with the Corporate Transparency Act (CTA) set to impact small enterprises starting January 1, 2024, it is crucial to stay informed about registration and compliance requirements. For expert support in navigating these processes, consider scheduling a consultation with Social Enterprises LLC, which specializes in U.S. business formation and compliance.

Conclusion

A company registration number (CRN) is more than just a numeric code; it is the cornerstone of a business’s legal identity. This unique identifier is vital for establishing credibility, ensuring compliance, and facilitating various operational processes. Understanding the significance of a CRN is essential for any enterprise aiming to succeed in a competitive market.

The importance of a CRN is evident in several key areas:

- It serves as proof of a company’s existence.

- It is crucial for tax compliance.

- It plays a significant role in securing loans and contracts.

Unregistered businesses face challenges such as difficulties in accessing funding and forming partnerships, which further underscores the necessity of having a CRN. Moreover, the variations in CRN formats across different regions highlight the need for entrepreneurs to be aware of local regulations to ensure compliance and operational success.

In summary, a company registration number is a foundational element that supports not only the legality of a business but also its growth and credibility in the eyes of stakeholders. As regulations evolve and the business landscape becomes increasingly complex, staying informed about CRNs and the registration process is imperative. Entrepreneurs should prioritize obtaining and maintaining their CRN, as it is a critical step toward building a reputable and sustainable enterprise.

Frequently Asked Questions

What is a Company Registration Number (CRN)?

A Company Registration Number (CRN) is a unique identifier assigned to a business upon registration with a governmental authority, typically the Secretary of State or a similar regulatory body, and it varies by state.

Why is a CRN important?

A CRN serves as official proof of a company’s existence and is vital for various legal and administrative processes, including tax purposes, official documents, licenses, and contracts.

How does a CRN relate to tax purposes?

In the United States, the CRN is crucial for tax purposes as it enables the government to oversee enterprises for tax collection and compliance.

What challenges might a company face without a CRN?

Without a CRN, companies may encounter difficulties in opening bank accounts, securing loans, or establishing credibility with clients and suppliers.

What is the significance of proper documentation for new enterprises?

Proper documentation, including having a CRN, is essential for fostering entrepreneurial activity, as highlighted by the Census Bureau’s estimate of around 30,438 new enterprises with payroll tax responsibilities in 2025.

How does a CRN enhance an enterprise’s legitimacy?

A CRN enhances an enterprise’s legitimacy by ensuring that it is legally recognized and can operate within the regulatory framework, which also helps protect personal assets and facilitate growth opportunities.