Introduction

Mastering the art of bookkeeping is a critical yet often overlooked aspect of running a successful e-commerce business. As online entrepreneurs navigate the complexities of financial management, understanding core principles and adopting effective learning strategies can significantly impact their bottom line. With numerous learning formats available, determining the best approach to mastering bookkeeping skills becomes essential. This article explores four best practices that not only enhance bookkeeping knowledge but also equip e-commerce businesses to thrive in a competitive landscape.

Master Core Bookkeeping Principles

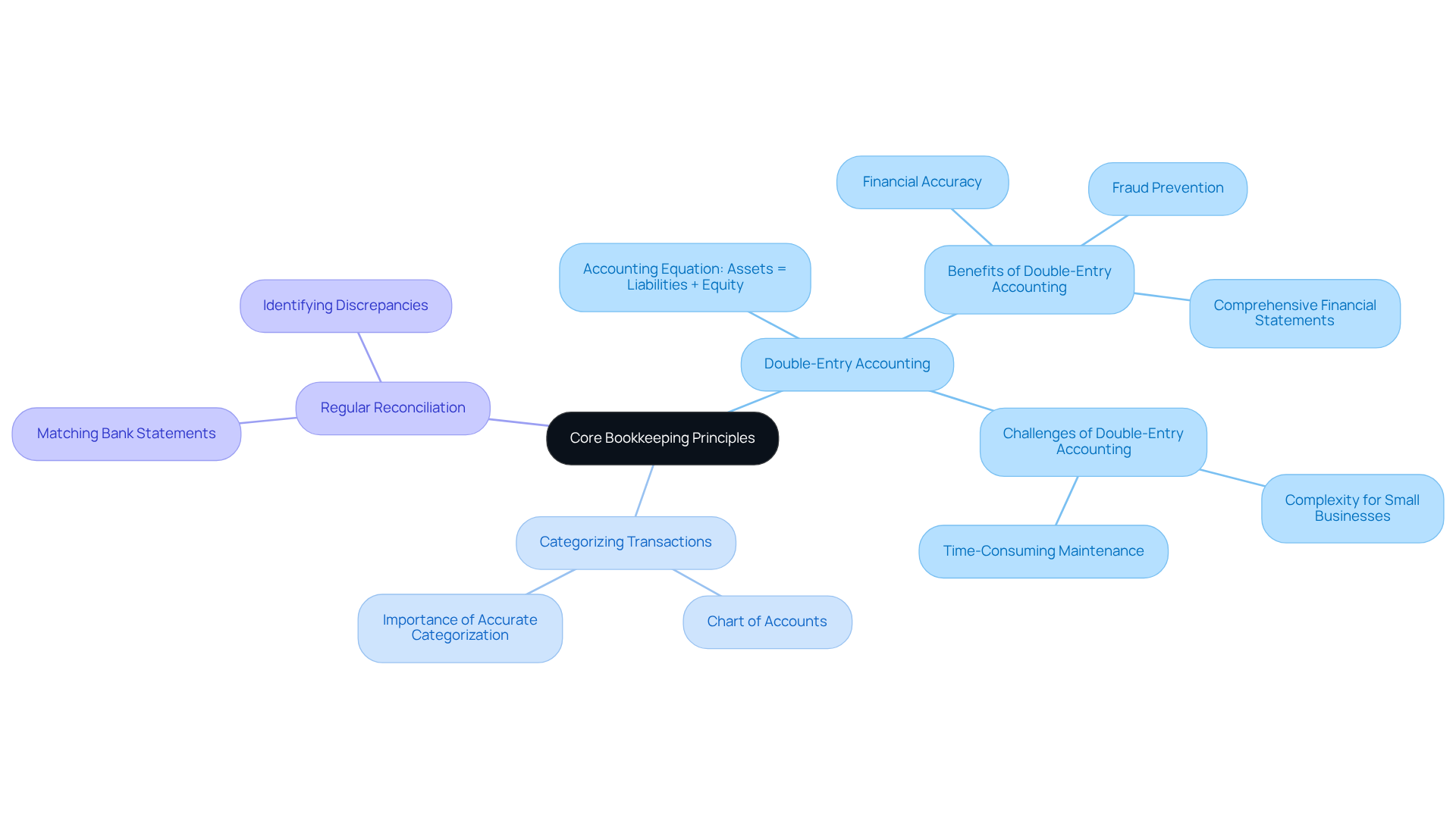

To effectively manage your online business finances, it is essential to master core bookkeeping principles. Begin by familiarizing yourself with the double-entry accounting system, which mandates that every financial transaction is recorded in at least two accounts. This practice upholds the accounting equation: Assets = Liabilities + Equity. A solid understanding of this principle not only helps prevent errors but also provides a clear overview of your financial health.

Furthermore, it is crucial to accurately categorize transactions. Develop a chart of accounts tailored to your specific needs, which will facilitate effective tracking of income, expenses, assets, and liabilities. Regular reconciliation of your accounts with bank statements is also vital to ensure accuracy and to identify discrepancies at an early stage. By establishing these foundational practices, you lay the groundwork for bookkeeping learning that supports effective financial management in your online venture.

Choose the Right Learning Format

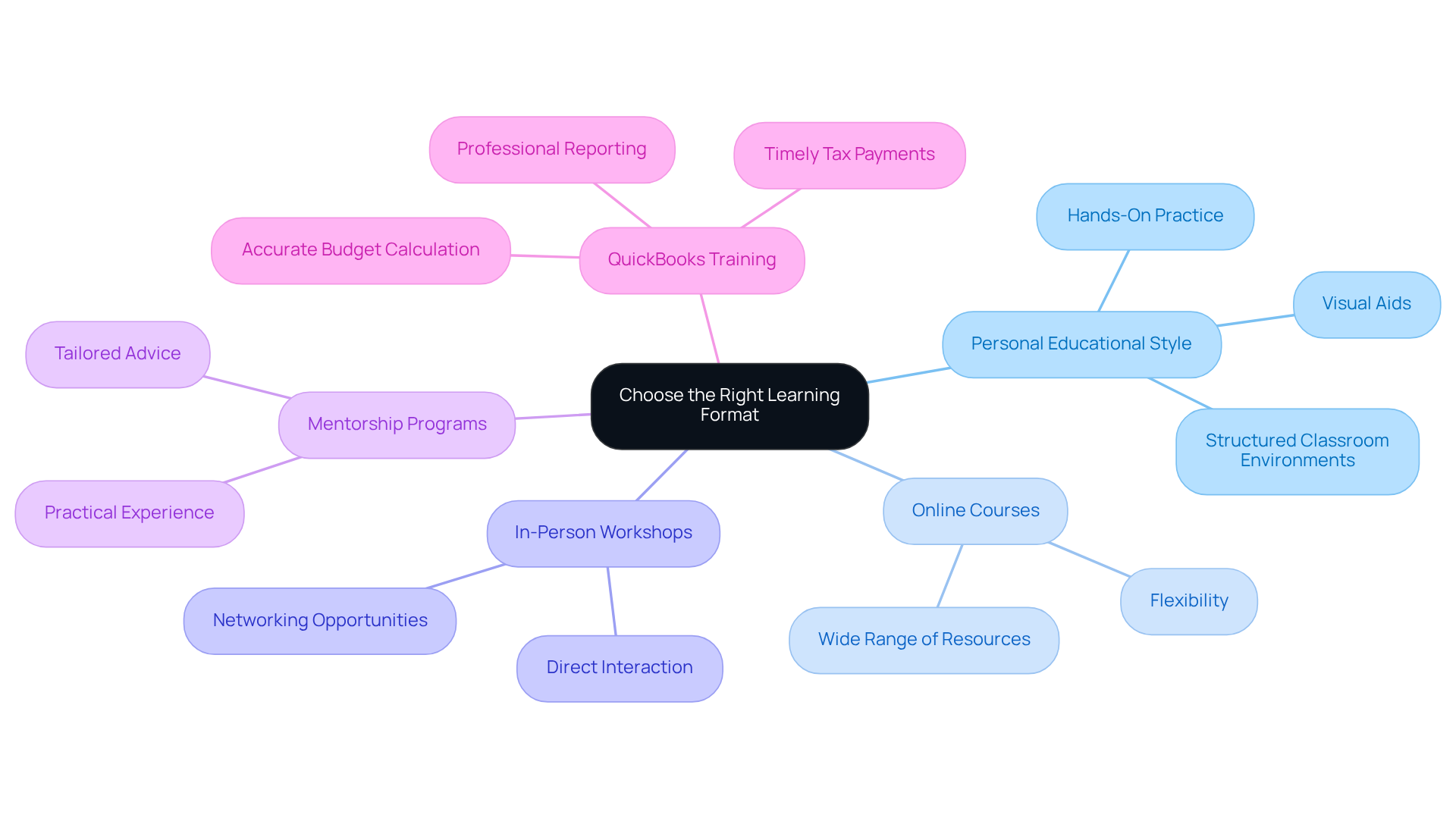

Selecting the appropriate educational format for bookkeeping learning in your e-commerce business is essential for effective comprehension and implementation. It is important to consider your personal educational style: do you thrive with visual aids, prefer hands-on practice, or excel in structured classroom environments? Online courses offer flexibility and a wide range of resources, making them an appealing choice for many. Conversely, in-person workshops provide opportunities for direct interaction and valuable networking.

For individuals who benefit from practical experience, mentorship programs or internships can be particularly beneficial. Collaborating with a skilled accountant offers practical insights and tailored advice, enhancing your understanding of financial record-keeping principles. Furthermore, QuickBooks training provided by Social Enterprises serves as a valuable resource, enabling you to accurately calculate your budget, pay taxes and bills punctually, and professionally report your income and expenses on a monthly basis. This training reduces the margin of error and allows for effective monitoring of your company’s growth.

However, it is crucial to be aware of common pitfalls when selecting an educational format. Ensure that the option you choose for bookkeeping learning aligns with your schedule and learning preferences, as this alignment will enhance your education in finance. Thoughtfully assess your options and select a format that not only meets your requirements but also deepens your understanding of financial principles.

Apply Knowledge Through Real-World Scenarios

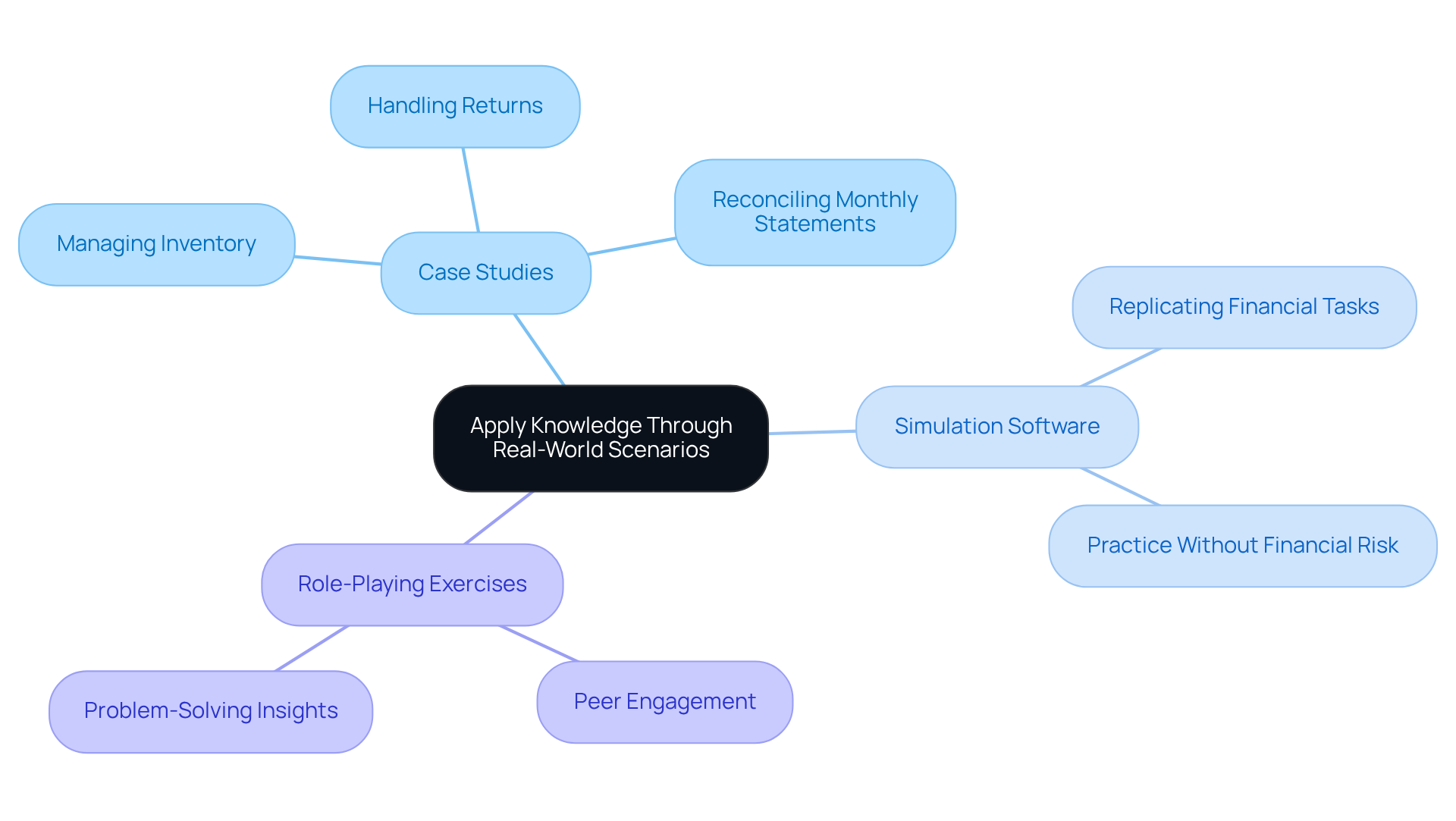

To effectively engage in bookkeeping learning, applying your knowledge in real-world scenarios is essential. Develop case studies based on common e-commerce situations, such as:

- Managing inventory

- Handling returns

- Reconciling monthly statements

This practice not only reinforces your understanding but also equips you for the challenges you may encounter in your business.

Consider utilizing simulation software that replicates real financial tasks, enabling you to practice without the risk of financial loss. Engaging in role-playing exercises with peers can also yield valuable insights into problem-solving and decision-making processes. By immersing yourself in practical applications of bookkeeping learning, you improve your readiness to tackle real-life accounting challenges.

Efficient record-keeping serves as the foundation of any thriving enterprise, particularly for small companies navigating the complex landscape of the US market. For instance, an online retail company that optimized its accounting procedures experienced a 40% increase in sales. Additionally, be mindful of common pitfalls, such as neglecting to track carrying costs for inventory, which can represent up to 50% of annual operating expenses for certain brands. By addressing these challenges, you can further strengthen your accounting skills and ensure the financial health of your business.

Commit to Continuous Learning and Improvement

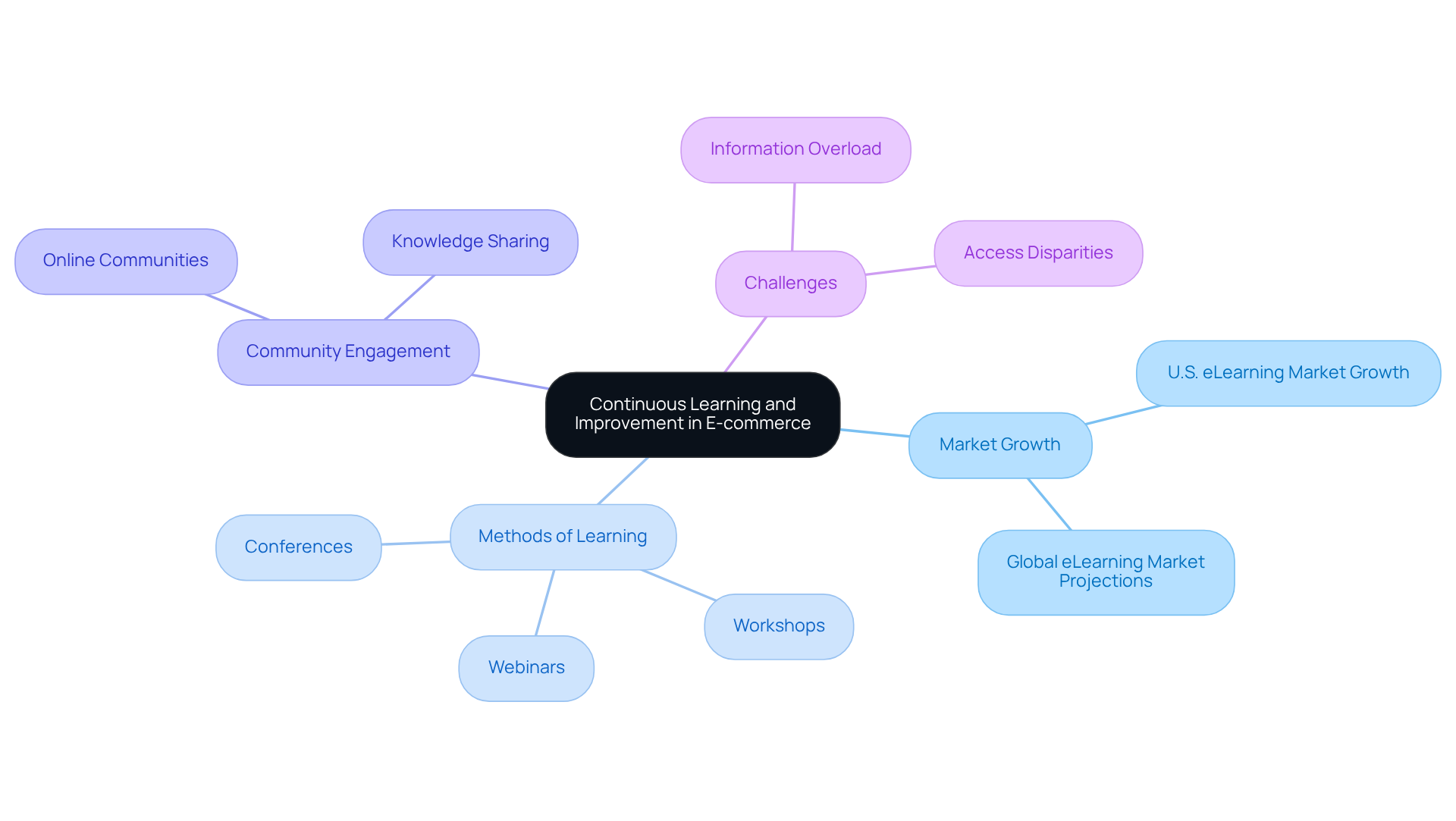

In the dynamic realm of e-commerce, a commitment to continuous learning and improvement is essential. The U.S. eLearning market is projected to grow by $21.64 billion from 2020 to 2024, underscoring the increasing significance of ongoing education in this sector. By actively participating in workshops, webinars, and industry conferences, you can significantly enhance your bookkeeping learning and accounting skills. As industry leader Devlin Peck notes, “The eLearning sector has expanded by 900% in the past twenty years,” which emphasizes the necessity of staying informed about the latest trends and best practices in financial record-keeping.

It is advisable to allocate time each month to explore new accounting software or tools that can enhance your bookkeeping learning processes. Engaging with online communities or forums can also facilitate knowledge sharing and provide support from fellow e-commerce entrepreneurs. Many successful entrepreneurs have attributed their improved financial management skills and overall business performance to their participation in workshops.

However, it is crucial to be aware of common pitfalls associated with continuous education, such as the risk of information overload. By prioritizing relevant educational resources and concentrating on practical applications, you can mitigate these challenges. By emphasizing continuous learning, you not only enhance your skills but also strategically position your business for sustained success.

Conclusion

Mastering effective bookkeeping practices is essential for the success of any e-commerce business. By concentrating on fundamental principles, selecting appropriate learning formats, applying knowledge through real-world scenarios, and committing to continuous improvement, entrepreneurs can significantly enhance their financial management capabilities. These strategies not only establish a solid foundation for bookkeeping but also empower business owners to navigate the complexities of their financial landscape with confidence.

Key insights from the article underscore the importance of grasping core bookkeeping principles, such as the double-entry accounting system, and the necessity for a tailored chart of accounts. Furthermore, choosing an educational format that aligns with individual learning styles – whether through online courses, mentorship, or hands-on workshops – can greatly enhance comprehension and application. Engaging in practical exercises and staying informed about industry trends further solidifies one’s bookkeeping skills, ensuring that e-commerce businesses remain competitive and financially sound.

Ultimately, the journey of mastering bookkeeping is ongoing. As the e-commerce landscape evolves, so too must the strategies for financial management. By prioritizing continuous learning and actively seeking out resources, entrepreneurs can not only refine their bookkeeping skills but also position their businesses for long-term success. Embracing these best practices will lead to more informed decision-making and a stronger financial foundation, paving the way for sustainable growth in the dynamic world of online commerce.

Frequently Asked Questions

What are the core bookkeeping principles one should master for managing online business finances?

The core bookkeeping principles include understanding the double-entry accounting system, accurately categorizing transactions, developing a tailored chart of accounts, and regularly reconciling accounts with bank statements.

What is the double-entry accounting system?

The double-entry accounting system requires that every financial transaction is recorded in at least two accounts, which upholds the accounting equation: Assets = Liabilities + Equity.

Why is understanding the accounting equation important?

A solid understanding of the accounting equation helps prevent errors and provides a clear overview of your financial health.

How can one effectively categorize transactions?

To effectively categorize transactions, you should develop a chart of accounts tailored to your specific business needs, which will help in tracking income, expenses, assets, and liabilities.

Why is regular reconciliation of accounts necessary?

Regular reconciliation of accounts with bank statements is vital to ensure accuracy and to identify discrepancies at an early stage.

How do these bookkeeping practices support financial management in an online business?

Establishing these foundational bookkeeping practices lays the groundwork for effective financial management, allowing for better tracking and oversight of your business finances.