Introduction

Understanding the costs associated with forming an LLC is essential for international entrepreneurs navigating the complexities of U.S. business regulations. The state filing fees can vary significantly, ranging from as low as $35 to over $500, which can greatly influence financial decision-making. Entrepreneurs must not only identify the most affordable states but also consider the ongoing expenses that may accumulate over time. Strategic advantages can be leveraged by selecting the right state for LLC formation, aligning these choices with long-term business goals.

Overview of LLC Formation Costs: Key Fees and Expenses

When forming an LLC, entrepreneurs must consider several key costs:

-

The LLC state filing fees represent the primary expenses associated with submitting the Articles of Organization to the government. As of 2026, the LLC state filing fees will range from $35 to $500, depending on the region. For example, Kentucky has one of the lowest LLC state filing fees at $40, while Massachusetts’ LLC state filing fees can go up to $520, making it the highest in the nation.

-

Registered Agent Fees: Most jurisdictions require LLCs to appoint a registered agent, typically costing between $100 and $300 annually. This service is crucial for receiving legal documents and ensuring compliance with regional regulations. Social Enterprises offers a comprehensive company formation kit that includes registered agent services, ensuring adherence to local requirements.

-

Operating Agreement: While not mandatory in all states, having an operating agreement is highly advisable. Legal fees for drafting this document can range from $200 to $1,000, depending on the complexity of the business structure. Social Enterprises can assist in drafting this document as part of their service offerings.

-

EIN Application: Obtaining an Employer Identification Number (EIN) from the IRS is free if done directly. However, some business owners opt to pay a service fee for assistance, which can simplify the process. Social Enterprises provides guidance on this process, ensuring business owners understand the requirements.

-

State-Specific Fees: Certain states impose additional costs, such as publication requirements or franchise taxes. For instance, New York mandates publication in two newspapers, which can significantly increase the overall formation cost. By choosing Social Enterprises, global innovators can benefit from transparent pricing and tailored packages that encompass all essential services for U.S. company establishment.

Understanding these costs is vital for international business owners, particularly those from Turkey, as they navigate the complexities of U.S. business regulations. With Social Enterprises, you can access affordable company formation packages tailored to your specific needs, ensuring a smooth and compliant setup process.

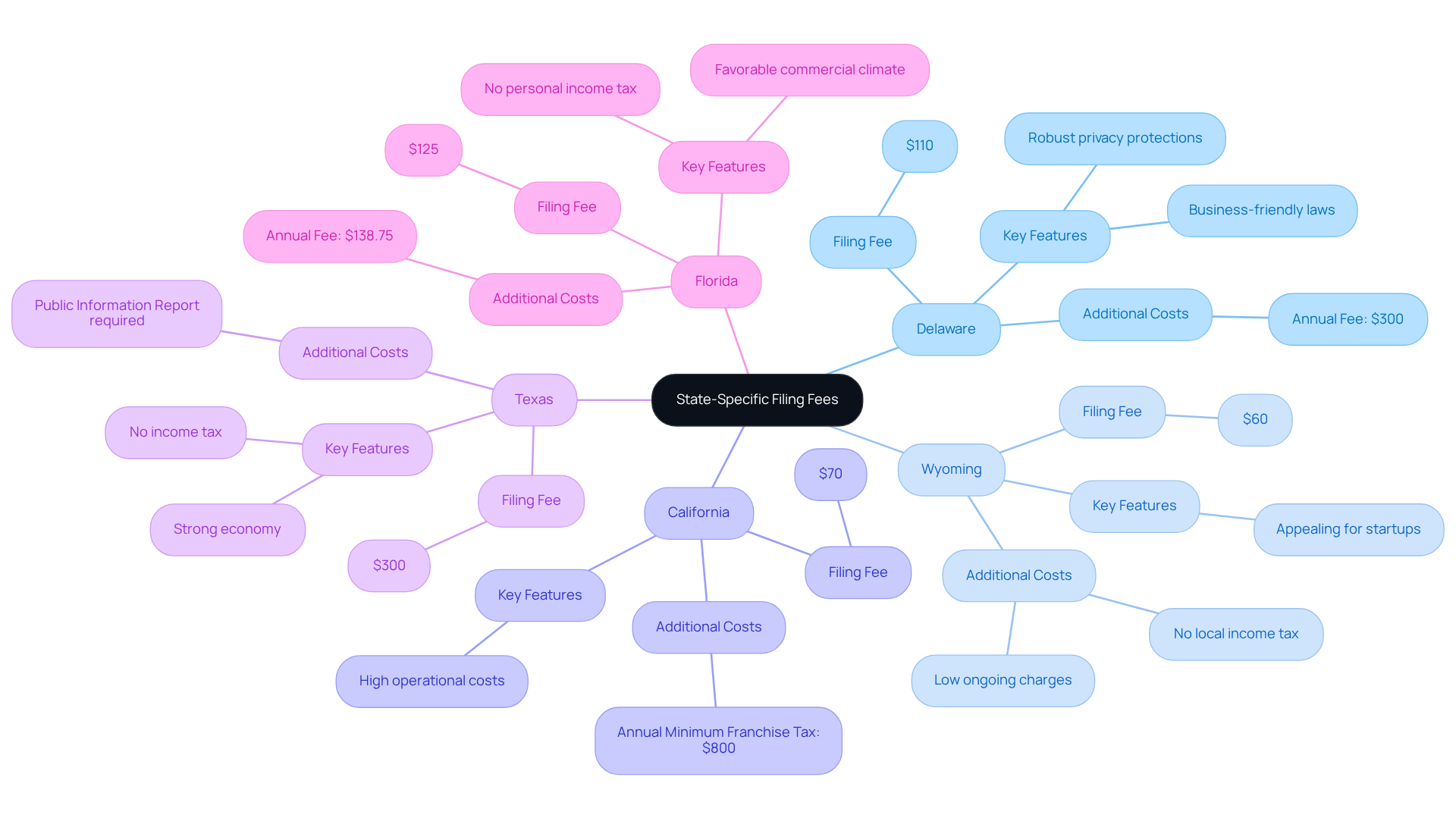

State-Specific Filing Fees: A Comparative Analysis

The variation in LLC state filing fees across regions can greatly influence the decision-making process for global business owners. A comparative analysis of key states as of 2026 reveals the following insights:

- Delaware: With a filing fee of $110, Delaware is renowned for its business-friendly laws and robust privacy protections, making it a preferred choice for many foreign entrepreneurs.

- Wyoming: The $60 LLC state filing fees in Wyoming, combined with low ongoing charges and the absence of local income tax, position Wyoming as an appealing option for startups seeking economical solutions.

- California: Although the LLC state filing fees are $70, California imposes an annual minimum franchise tax of $800, which may deter many from establishing their LLC in this state.

- Texas: Texas has LLC state filing fees of $300 and boasts a strong economy with no income tax, attracting a diverse group of entrepreneurs.

- Florida: The $125 LLC state filing fees, along with a favorable commercial climate and the absence of personal income tax, enhance Florida’s appeal for international enterprises.

This analysis illustrates that while some states may present lower initial registration costs, the ongoing expenses, such as LLC state filing fees and tax liabilities, can vary significantly, impacting the total expenditure of maintaining an LLC. For example, Delaware’s reputation for facilitating business operations has proven particularly beneficial for Turkish entrepreneurs, who often seek its favorable legal environment and streamlined processes for company formation.

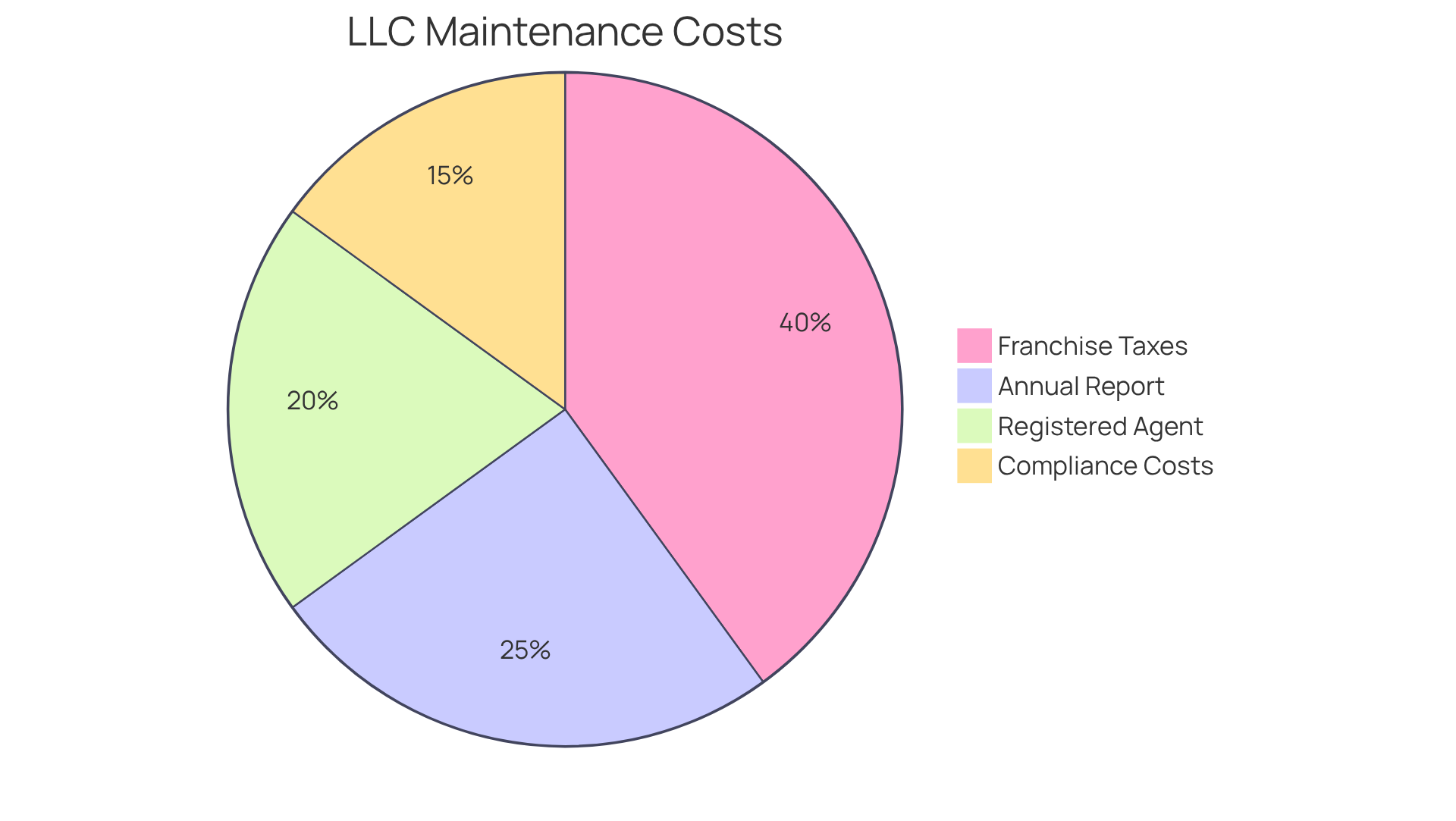

Ongoing LLC Maintenance Costs: Comparing Annual Fees and Taxes

Once an LLC is formed, ongoing maintenance costs become a crucial factor in its sustainability. Understanding LLC state filing fees and other related costs is essential for entrepreneurs, particularly those from Turkey, as they plan for the financial health of their LLC in the U.S. The estimated average cost of maintaining an LLC in 2025 was between $300 and $1,000. Accurate budgeting for LLC state filing fees can help avoid penalties and ensure smooth operations.

-

Annual Report Charges: Most regions require LLCs to submit yearly reports, with costs varying from $10 to $300. For example, Florida’s LLC state filing fees are $138.75, while Delaware does not impose an annual report fee but requires a minimum franchise tax of $300.

-

Franchise Taxes: Certain states, such as California, mandate an annual minimum franchise tax of $800, which can significantly impact cash flow. This tax is a recurring expense that LLC owners must budget for, along with the LLC state filing fees, to maintain compliance.

-

Registered Agent Charges: These expenses occur yearly and usually vary from $100 to $300, adding to the total maintenance costs. Hiring a registered agent ensures that legal documents are managed properly, which is essential for compliance.

-

Compliance Costs: Depending on the industry, additional compliance costs may arise, including licensing fees or specific regulatory requirements. For instance, businesses in regulated sectors may face higher costs due to the need for specialized permits.

Consulting with experts like Social Enterprises can provide valuable guidance on navigating these fees and ensuring compliance.

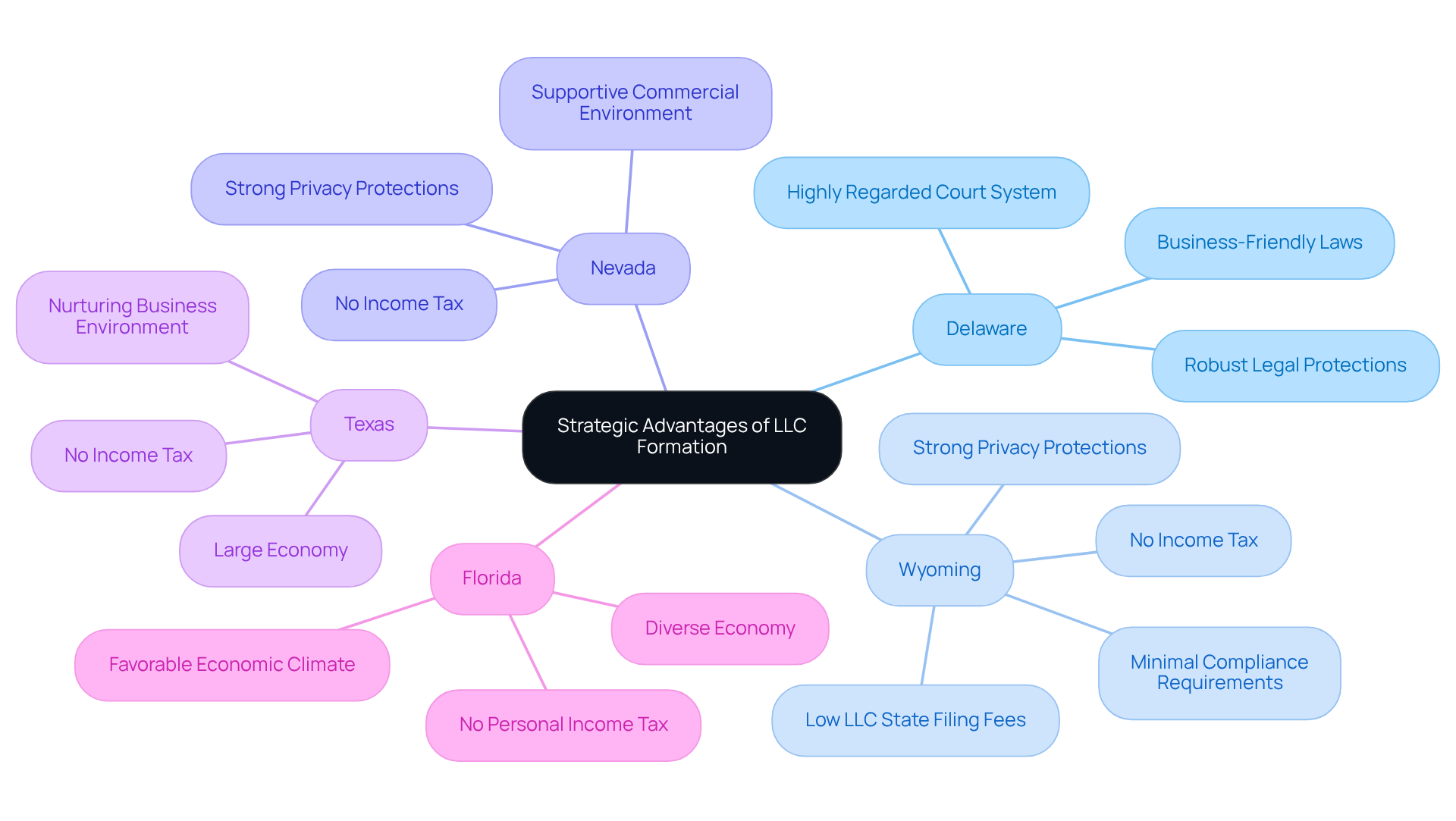

Strategic Advantages of LLC Formation: Evaluating Key States

Choosing the appropriate region for LLC establishment can significantly influence success by aligning with strategic objectives. Below are key states and their respective advantages:

-

Delaware: Esteemed for its business-friendly laws, Delaware offers robust legal protections and a highly regarded court system for resolving business disputes. This makes it a preferred option for many business owners, particularly those seeking investment.

-

Wyoming: With its low LLC state filing fees and absence of income tax, Wyoming is particularly appealing for startups aiming to reduce costs while maintaining privacy. The region’s minimal compliance requirements further enhance its attractiveness for budget-conscious business owners.

-

Nevada: Recognized for its lack of income tax and strong privacy protections, Nevada is ideal for entrepreneurs seeking to safeguard their identities. The region’s supportive commercial environment fosters growth and innovation.

-

Texas: As one of the largest economies in the U.S., Texas provides a vibrant marketplace for enterprises. The absence of income tax, combined with a nurturing environment for businesses, makes it an attractive choice for growth-oriented entrepreneurs.

-

Florida: Known for its favorable economic climate and absence of personal income tax, Florida is a sought-after location for e-commerce enterprises targeting both domestic and international markets. The region’s diverse economy offers ample opportunities for growth.

By evaluating these strategic advantages, entrepreneurs, particularly those from Turkey, can select a state that not only meets their budgetary needs but also takes into account the LLC state filing fees to support their long-term business aspirations.

Conclusion

Understanding the costs associated with forming and maintaining an LLC is essential for international entrepreneurs aiming to establish their businesses in the U.S. The significant variation in LLC state filing fees across different states can greatly influence decisions for global business owners. By examining these fees and related expenses, entrepreneurs can make informed choices that align with their financial goals and operational needs.

Key points discussed include the range of LLC state filing fees, which can vary from as low as $35 to as high as $500, depending on the state. Additionally, the necessity of registered agent fees, operating agreements, and ongoing maintenance costs such as annual report charges and franchise taxes are emphasized. States like Delaware, Wyoming, and Florida are noted for their strategic advantages, offering favorable conditions for startups and established businesses alike.

In conclusion, navigating the complexities of LLC formation and maintenance requires careful consideration of various costs and state-specific advantages. For international entrepreneurs, particularly those from Turkey, leveraging resources like Social Enterprises can provide valuable support in simplifying the registration process and ensuring compliance. By taking proactive steps to understand and manage these expenses, entrepreneurs can enhance their chances of success in the competitive U.S. market.

Frequently Asked Questions

What are the main costs associated with forming an LLC?

The main costs include LLC state filing fees, registered agent fees, legal fees for an operating agreement, and potentially state-specific fees.

What are the state filing fees for LLCs?

As of 2026, LLC state filing fees range from $35 to $500, varying by region. For example, Kentucky’s fee is $40, while Massachusetts charges up to $520, the highest in the nation.

What are registered agent fees?

Registered agent fees typically range from $100 to $300 annually. This service is essential for receiving legal documents and ensuring compliance with regulations.

Is an operating agreement mandatory for LLCs?

An operating agreement is not mandatory in all states, but it is highly advisable. Legal fees for drafting this document can range from $200 to $1,000, depending on the business structure’s complexity.

How can I obtain an Employer Identification Number (EIN)?

Obtaining an EIN from the IRS is free if done directly. However, some business owners may choose to pay a service fee for assistance, which can simplify the process.

Are there any additional state-specific fees for LLC formation?

Yes, certain states may impose additional costs, such as publication requirements or franchise taxes. For example, New York requires publication in two newspapers, which can increase overall formation costs.

How can Social Enterprises assist with LLC formation?

Social Enterprises offers a comprehensive company formation kit that includes registered agent services, assistance with drafting operating agreements, and guidance on obtaining an EIN, along with tailored packages for U.S. company establishment.