Introduction

Understanding the Employer Identification Number (EIN) is essential for international entrepreneurs aiming to establish a presence in the U.S. market. This unique nine-digit identifier streamlines tax compliance and enhances a business’s credibility, making it a crucial asset for operations such as hiring employees and opening bank accounts. However, the process of obtaining an EIN can be complex, presenting significant challenges. This raises an important question: how can foreign entrepreneurs effectively navigate these hurdles to achieve success in the competitive landscape of American business?

Define EIN: Understanding Employer Identification Numbers

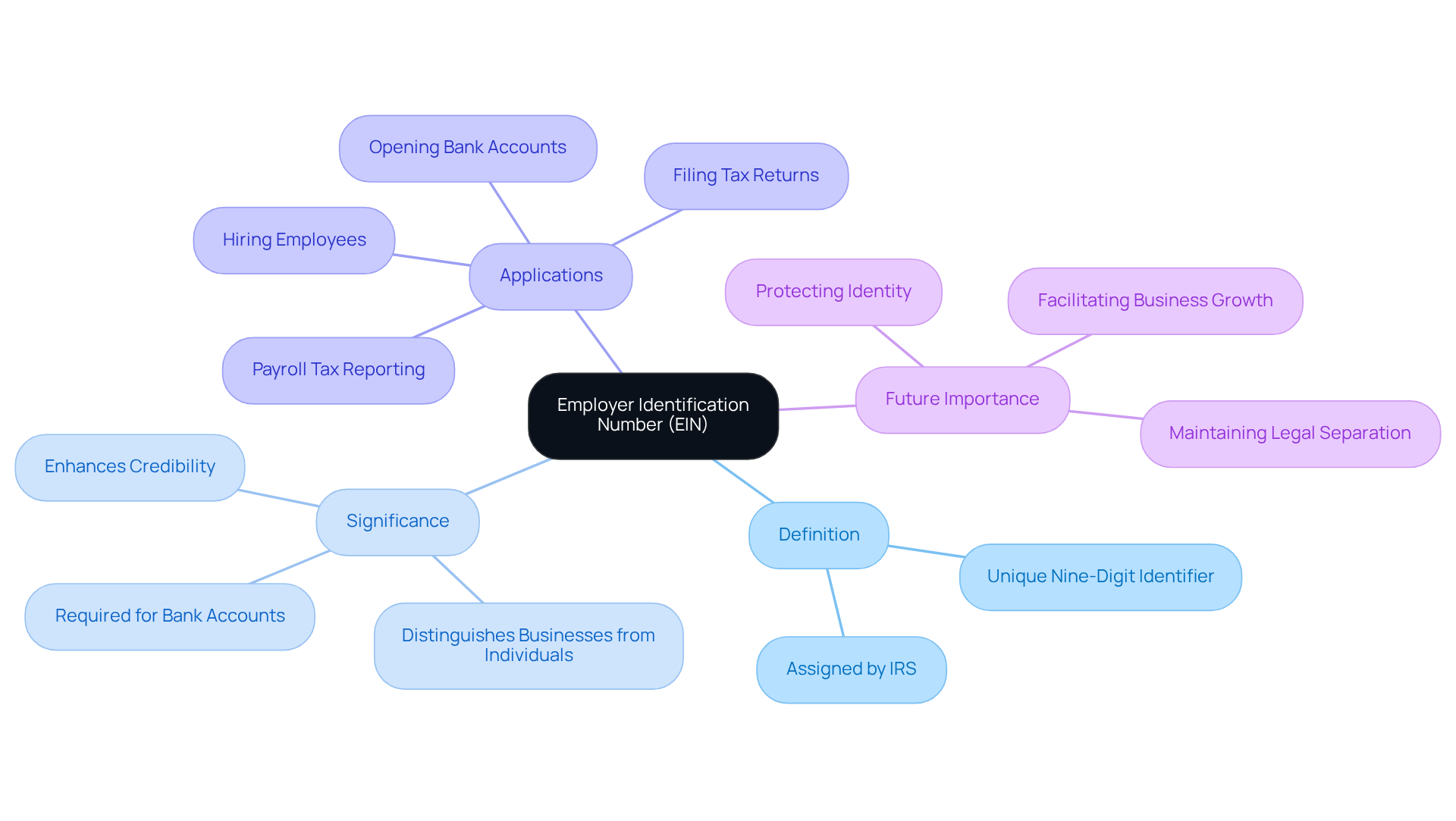

The term EIN meaning refers to a unique nine-digit identifier assigned by the Internal Revenue Service (IRS) to companies and other entities for tax purposes, formatted as XX-XXXXXXX. This federal tax ID number is essential for various operations, including filing tax returns, hiring employees, and opening bank accounts. Essentially, the EIN meaning serves as a Social Security Number (SSN) for enterprises, distinguishing them from individuals in the eyes of the IRS and other governmental entities.

The significance of an EIN is underscored by the fact that nearly every bank requires it to open a commercial account, highlighting its role in establishing a legitimate business presence. For international entrepreneurs aiming to enter the U.S. market, knowing the EIN meaning is a vital step. It not only facilitates compliance with tax regulations but also enhances credibility with partners and customers.

Moreover, companies intending to recruit staff must understand the EIN meaning for payroll tax reporting and distributing W-2 forms, making it essential for growth and operational efficiency. As of 2026, the importance of an EIN continues to expand, with many enterprises recognizing it as a key component in protecting their identity and maintaining a legal separation between personal and corporate assets.

Contextualize EIN: Importance for International Entrepreneurs

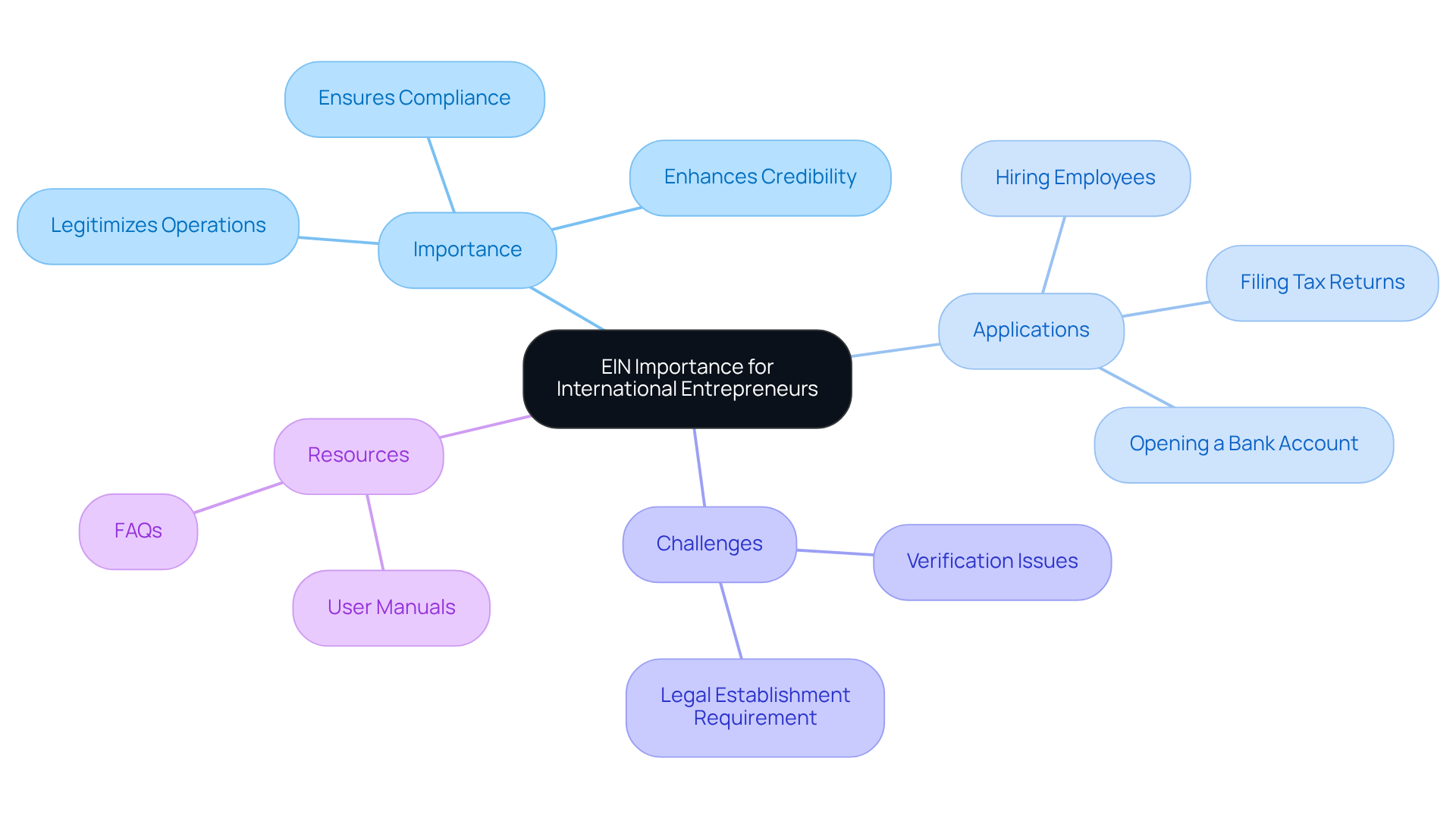

For international entrepreneurs, knowing the EIN meaning is crucial for securing an Employer Identification Number and establishing a commercial presence in the United States. This unique nine-digit identifier legitimizes operations and ensures compliance with U.S. tax regulations. An EIN is necessary for various commercial activities, including:

- Hiring employees

- Filing tax returns

- Opening a bank account

Without it, foreign entrepreneurs face significant obstacles, such as difficulties in obtaining financing, building credit, and navigating the complex landscape of U.S. regulations.

Moreover, possessing an EIN enhances a company’s credibility, facilitating smoother interactions with suppliers, customers, and financial institutions. It serves as a vital connection to the IRS, verifying the entity’s legitimacy and operational status. Additionally, U.S. banks require an EIN to comply with KYC and AML regulations, making it essential for opening bank accounts.

However, international entrepreneurs may encounter challenges when applying for an EIN, including common verification issues related to address and the requirement for the entity to be legally established at the state level before applying. Many non-residents do not qualify for an SSN or ITIN, complicating the application process further. The EIN application necessitates a completed Form SS-4, which is a critical step in obtaining this essential identifier. To navigate the EIN application process successfully, it is advisable for entrepreneurs to consult user manuals that outline specific steps and requirements.

In essence, the EIN meaning serves as a gateway for international entrepreneurs, enabling them to effectively engage in the U.S. market and overcome the complexities associated with starting and managing an enterprise in a foreign environment. Understanding the various types of entities, such as Limited Liability Companies (LLCs) and Corporations, is also essential for entrepreneurs aiming to navigate the U.S. commercial landscape successfully. For additional insights, entrepreneurs may refer to FAQs that address common concerns related to EIN and company formation.

Trace the Origins: The Evolution of EINs in U.S. Business

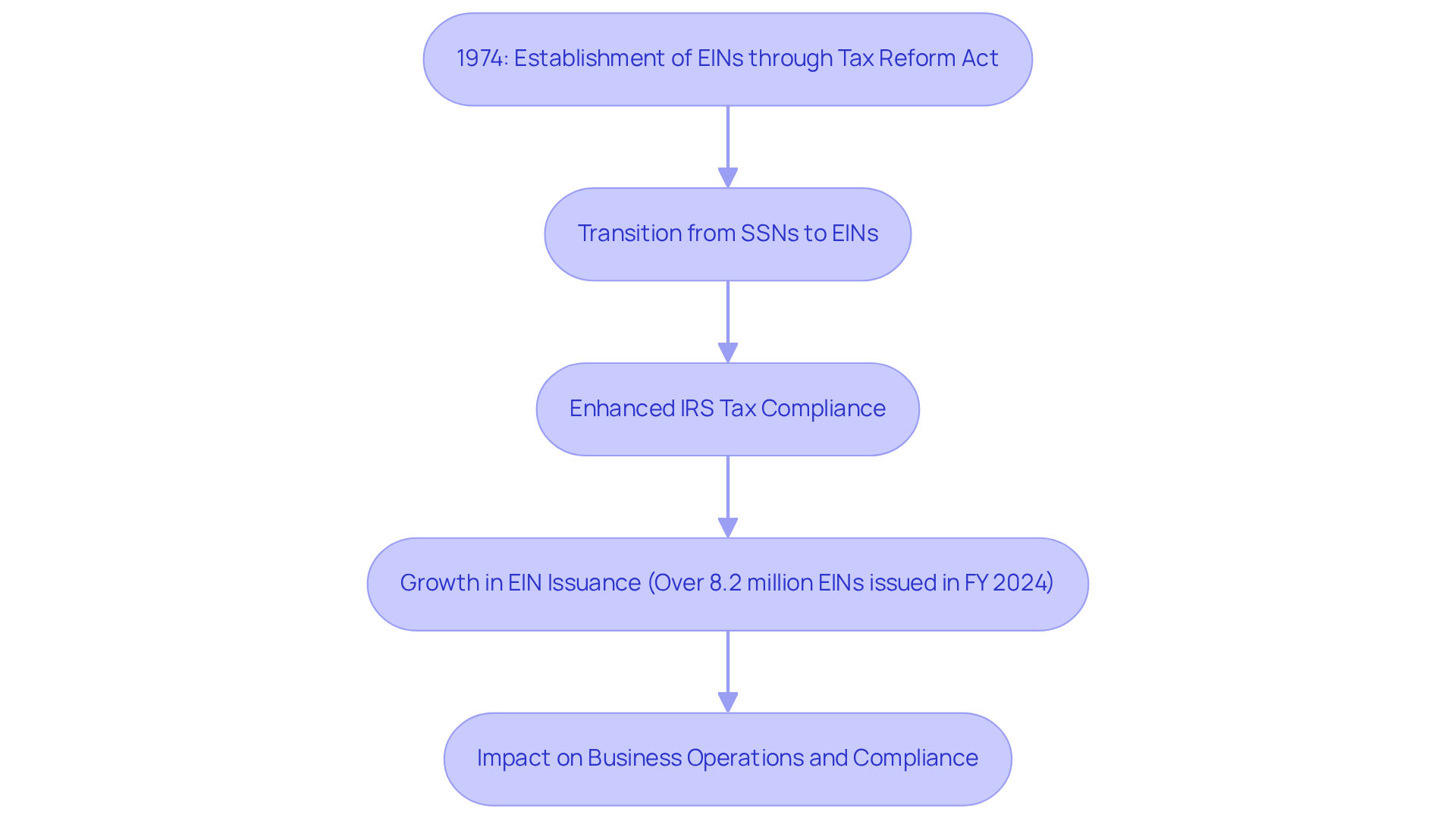

The Employer Identification Number (EIN) was established in 1974 through the Tax Reform Act to streamline the identification of businesses for tax purposes. Prior to the EIN, companies depended on Social Security Numbers for tax identification, which often resulted in confusion and inefficiencies. The introduction of EINs enabled the IRS to enhance tax compliance and reporting across various business structures, including corporations, partnerships, and sole proprietorships.

Since its inception, the utilization of EINs has grown significantly, becoming a crucial requirement for businesses operating within the United States. Today, EINs are essential not only for tax reporting but also for facilitating key transactions, such as banking and regulatory compliance. In Fiscal Year 2024 alone, the IRS issued over 8.2 million EINs, underscoring the increasing dependence on this identification system.

Furthermore, professional assessments highlight that the establishment of EINs has greatly impacted tax compliance, simplifying processes and reducing errors in business identification. As companies navigate complex regulatory environments, the EIN remains a vital tool for ensuring compliance and enhancing operational efficiency.

Identify Key Characteristics: Components and Uses of EINs

The Employer Identification Number (EIN) has an EIN meaning as a nine-digit identifier formatted as XX-XXXXXXX, primarily used for tax identification. The EIN meaning encompasses several essential roles, including:

- Identifying entities for federal tax reporting

- Facilitating payroll processing

- Ensuring compliance with various regulatory requirements

Businesses with employees, specifically those structured as corporations or partnerships, and entities filing specific tax returns, must obtain an EIN, which is an EIN meaning.

Moreover, understanding EIN meaning is vital for:

- Opening commercial bank accounts

- Applying for permits

- Establishing credit for enterprises

For global entrepreneurs, particularly in the e-commerce and gaming sectors, understanding EIN meaning is often a prerequisite for engaging in activities within the U.S., underscoring its significance in their operational strategy. Understanding the company establishment procedures and tax implications specific to e-commerce and gaming enterprises is crucial for compliance and operational effectiveness.

For instance, understanding EIN meaning can help businesses utilizing EINs for payroll processing to streamline their employee compensation and tax obligations, thereby enhancing operational efficiency and compliance. Approximately 80% of enterprises require an EIN meaning for regulatory adherence, highlighting its importance in maintaining compliance with U.S. tax laws. Tax advisors stress that understanding the EIN meaning and the regulatory requirements associated with it is essential for avoiding potential penalties and ensuring smooth business operations.

Conclusion

In conclusion, the Employer Identification Number (EIN) is not merely a tax identification number; it serves as a crucial gateway for international entrepreneurs aiming to engage effectively in the U.S. market. Understanding the meaning and applications of an EIN empowers entrepreneurs to navigate regulatory landscapes, overcome barriers, and position themselves for growth. This knowledge not only aids in compliance with tax regulations but also fosters trust and credibility within the business community. Ultimately, embracing the significance of the EIN paves the way for successful international ventures.

Frequently Asked Questions

What does EIN stand for?

EIN stands for Employer Identification Number, which is a unique nine-digit identifier assigned by the Internal Revenue Service (IRS) for tax purposes.

How is an EIN formatted?

An EIN is formatted as XX-XXXXXXX.

Why is an EIN important for businesses?

An EIN is essential for various operations, including filing tax returns, hiring employees, and opening bank accounts. It serves as a federal tax ID number that distinguishes businesses from individuals.

Do banks require an EIN to open a commercial account?

Yes, nearly every bank requires an EIN to open a commercial account, highlighting its role in establishing a legitimate business presence.

How does an EIN benefit international entrepreneurs?

For international entrepreneurs, understanding the EIN is vital for entering the U.S. market, as it facilitates compliance with tax regulations and enhances credibility with partners and customers.

What role does an EIN play in payroll tax reporting?

Companies that intend to recruit staff must use the EIN for payroll tax reporting and for distributing W-2 forms, making it essential for growth and operational efficiency.

Is the importance of an EIN expected to change in the future?

Yes, as of 2026, the importance of an EIN continues to expand, with many enterprises recognizing it as a key component in protecting their identity and maintaining a legal separation between personal and corporate assets.