Introduction

The dynamics of managing members within a Limited Liability Company (LLC) are pivotal in determining its operational success and legal compliance. Understanding the permissible number of managing members in an LLC transcends mere legal formality; it significantly influences decision-making, efficiency, and the overall governance structure of the business. Entrepreneurs, especially in the fintech sector, must navigate the complexities of LLC formation while balancing flexibility and control in their management structures. To achieve this, they must ensure that their chosen framework not only adheres to legal requirements but also promotes effective collaboration and growth.

Understand the Role of Managing Members in an LLC

The question of how many managing members can an LLC have pertains to the designated individuals who are responsible for the daily operations and decision-making processes of the company. Their roles are essential for ensuring adherence to legal obligations and the seamless operation of the enterprise, particularly for fintech entrepreneurs forming an LLC in the U.S. The key responsibilities of managing members include:

-

Decision-Making: Managing individuals possess the authority to make significant organizational choices, such as entering contracts, hiring staff, and overseeing financial matters. This level of authority is crucial, as studies indicate that businesses with clear decision-making structures can experience a 30% increase in efficiency.

-

Operational Oversight: They ensure that daily operations run efficiently and align with the company’s objectives, which is particularly important in a member-managed LLC where all participants are involved in operations.

-

Legal Compliance: Managing participants must ensure that the LLC adheres to all applicable laws and regulations, including tax responsibilities and reporting obligations. This compliance is vital for maintaining the LLC’s legal standing and avoiding penalties, especially given the varying tax regulations across states that fintech entrepreneurs must navigate.

-

Financial Management: Often, overseeing individuals are tasked with budgeting, accounting, and financial reporting, ensuring the LLC’s financial health. This responsibility is critical, particularly since 40% of LLCs generate less than $50,000 in annual revenue, underscoring the need for careful financial oversight. The tax flexibility offered by LLCs can significantly benefit founders, allowing for pass-through taxation and avoiding double taxation on company income.

-

Representation: They represent the LLC in legal matters and have the authority to bind the company to contracts, making their role pivotal in external dealings.

Furthermore, having a clear operating agreement is crucial for outlining the roles and responsibilities of governing individuals, ensuring organized leadership and cooperation within the LLC. It is essential to understand how many managing members an LLC can have, especially when distinguishing between member-managed and manager-managed structures, as nearly 80% of small enterprises choose member-managed setups where managing members take a direct role in operations. As noted by consultants, ‘A well-defined operating agreement can significantly enhance the efficiency and clarity of decision-making within an LLC.’

For fintech entrepreneurs looking to form an LLC, grasping these roles is vital, as it clarifies the distribution of responsibilities within the organization. To navigate the complexities of LLC formation and compliance, consider scheduling a free consultation with Social Enterprises, where expert guidance can help you establish a solid foundation for your venture.

Identify Legal Requirements for Managing Members

When establishing an LLC, understanding the legal obligations regarding overseeing participants is crucial. Here are the key points to consider:

- No maximum limit exists, as most states do not impose a cap on how many managing members an LLC can have. This flexibility allows for various management frameworks that can adapt to business needs, including considerations of how many managing members can an LLC have.

- Minimum Requirement: An LLC must have at least one overseeing individual, who may also be the sole owner in a single-owner LLC. This provision is particularly advantageous for solo entrepreneurs.

- Eligibility: Typically, governing participants must be at least 18 years old and can be individuals or organizations, such as corporations. This broad eligibility accommodates various business models.

- State-Specific Regulations: Each state has specific rules regarding the qualifications and duties of overseeing individuals. For example, some states may require individuals to maintain certain records or adhere to specific fiduciary duties. Consulting state laws or a legal expert is essential for compliance.

- Operating Agreement: The operating agreement should clearly outline the roles and responsibilities of overseeing participants, including any specific qualifications or requirements. This document serves as a foundational element for governance and can help prevent internal disputes.

Understanding these legal obligations ensures that your LLC is established correctly and remains compliant with state regulations, ultimately supporting your enterprise’s growth and stability.

Draft an Operating Agreement to Define Managing Members

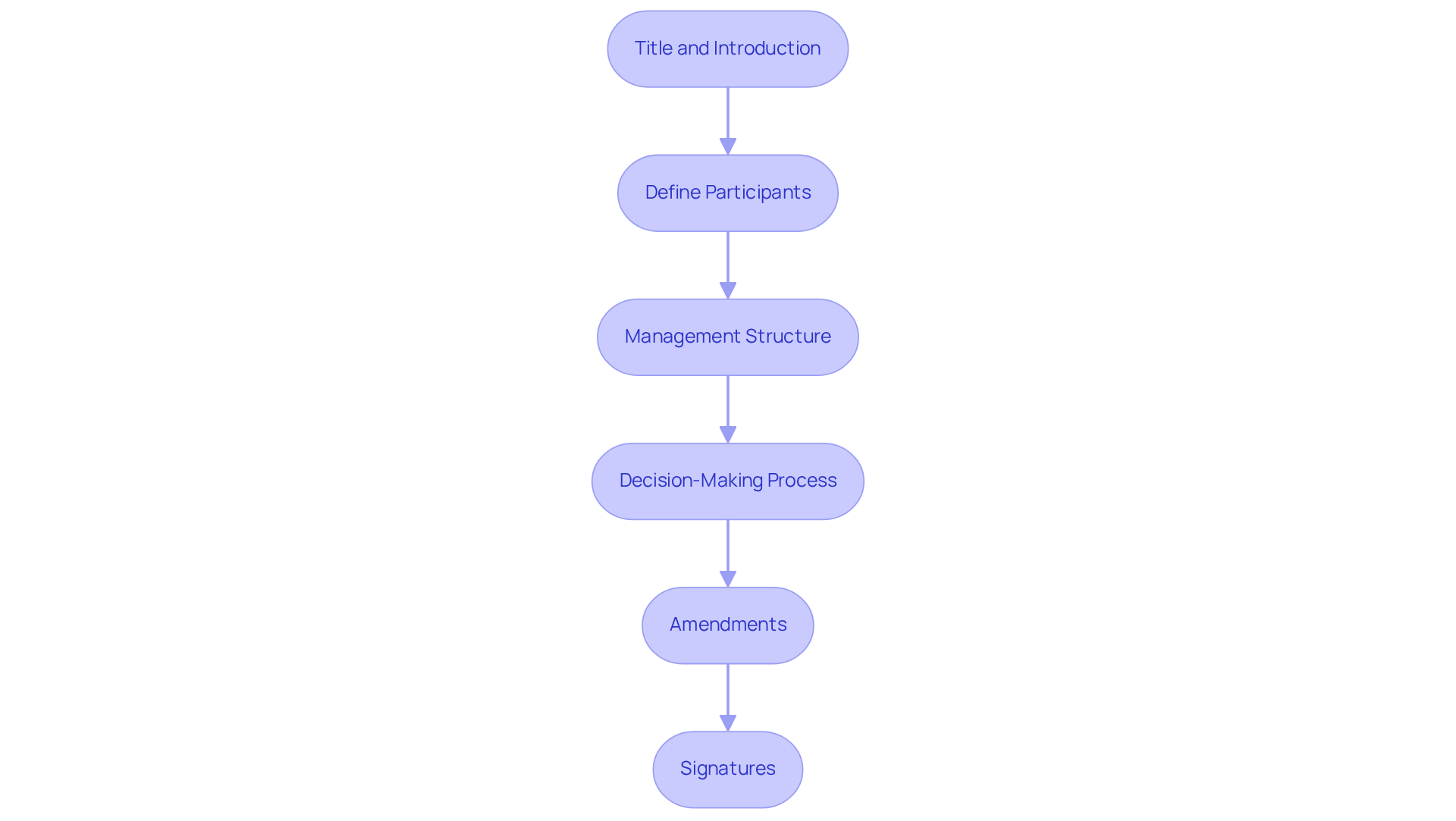

An operating agreement is an essential document for any LLC, forming the foundation for its management framework and defining the roles of leadership individuals. With Social Enterprises, you can establish your LLC and commence operations in as little as 1-3 working days, making it imperative to have an effective operating agreement in place. Here’s how to draft one:

- Title and Introduction: Start with a clear title that indicates it is an operating agreement for the LLC. The introduction should outline the purpose and significance of the agreement.

- Define Participants: List all administrative participants along with their respective roles within the LLC. Clearly specify their rights and responsibilities to mitigate future disputes.

- Management Structure: Indicate whether the LLC will be member-managed or manager-managed. If it is manager-managed, detail the powers and duties assigned to the managers to ensure clarity in authority.

- Decision-Making Process: Outline how decisions will be made within the LLC, including voting rights, quorum requirements, and procedures for significant decisions. This structure is vital to prevent misunderstandings and ensure smooth operations.

- Amendments: Include a section detailing how the operating agreement can be amended in the future, allowing for flexibility as the business evolves and circumstances change.

- Signatures: Ensure that all overseeing participants sign the agreement to validate it legally, reinforcing their commitment to the outlined terms.

By creating a comprehensive operating agreement with the assistance of Social Enterprises, which also oversees post-incorporation compliance, you can establish clear guidelines for overseeing participants. This approach helps prevent misunderstandings and disputes in the future. Legal specialists emphasize that viewing the operating agreement as a dynamic document, open to revisions as the enterprise grows, is crucial for long-term success. By clearly defining ownership, management roles, financial responsibilities, and decision-making processes, the operating agreement enhances the LLC’s credibility and operational integrity.

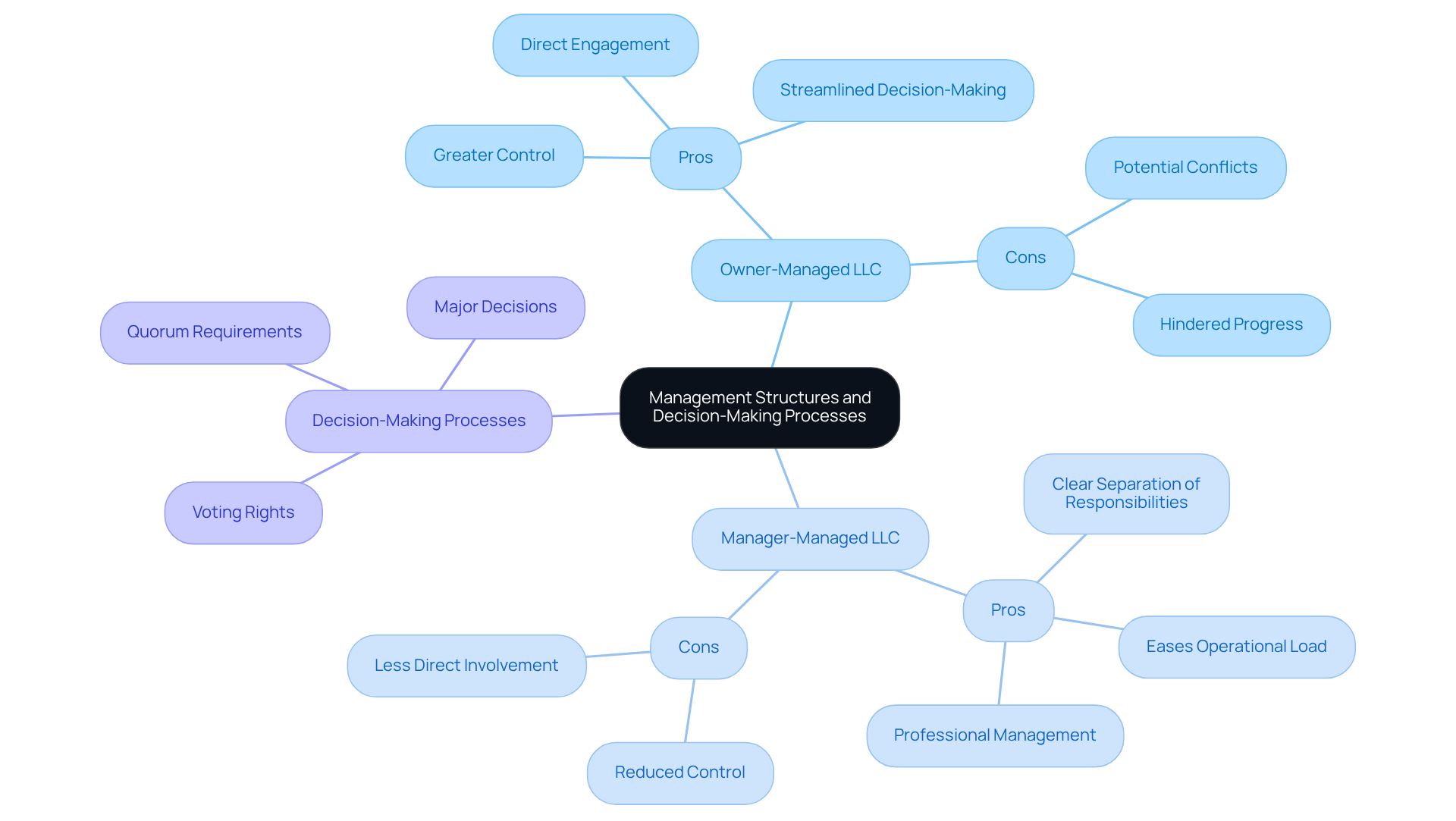

Evaluate Management Structures and Decision-Making Processes

Selecting the appropriate management structure for your LLC is vital for its operational success. The two primary structures to consider are:

-

Owner-Managed LLC: In this model, all owners are actively engaged in managing the LLC, making it a popular choice for small businesses where hands-on participation is desired.

- Pros: Members enjoy greater control, direct engagement in daily operations, and streamlined decision-making processes.

- Cons: This structure can lead to conflicts among participants if disagreements arise, potentially hindering progress.

-

Manager-Managed LLC: In this case, participants appoint one or more managers to supervise daily operations, which is frequently preferred by larger LLCs or those with passive investors.

- Pros: This model offers a clear separation of responsibilities, eases the operational load on individuals, and permits professional management.

- Cons: Members may experience reduced control over daily decisions, which can be a drawback for those who prefer direct involvement.

-

Decision-Making Processes: Regardless of the chosen management structure, establishing clear decision-making protocols is crucial. Key components include:

- Voting Rights: Clearly define how votes are cast and what constitutes a majority.

- Quorum Requirements: Specify the minimum number of individuals needed for decisions to be valid.

- Major Decisions: Distinguish which decisions necessitate member approval versus those that can be made by managers.

By carefully evaluating these management structures and decision-making processes, you can select the most effective approach for your LLC, ensuring efficient and effective operations.

Conclusion

Understanding the management structure of an LLC is essential for ensuring its success and compliance with legal requirements. The flexibility in the number of managing members enables businesses to tailor their governance to meet operational needs. Whether choosing a member-managed or manager-managed structure, clarity in roles and responsibilities is vital for effective decision-making and operational efficiency.

Key insights emphasize the necessity of:

- Defining the roles of managing members

- Comprehending state-specific regulations

- Drafting a comprehensive operating agreement

Each of these components significantly contributes to the LLC’s stability and growth. By establishing clear guidelines for management and decision-making, entrepreneurs can mitigate potential conflicts and enhance organizational effectiveness.

Ultimately, the selection of a management structure and the clarity provided by an operating agreement are foundational to the success of an LLC. Entrepreneurs should take deliberate steps to define their governance framework, ensuring that their business can thrive in a competitive landscape. Adopting these best practices not only fosters a robust operational foundation but also positions the LLC for sustainable growth and compliance in an ever-evolving business environment.

Frequently Asked Questions

What is the role of managing members in an LLC?

Managing members are responsible for the daily operations and decision-making processes of the LLC, ensuring legal compliance and efficient operation.

How many managing members can an LLC have?

An LLC can have multiple managing members, particularly in member-managed structures where all participants are involved in operations.

What are the key responsibilities of managing members?

Key responsibilities include decision-making, operational oversight, legal compliance, financial management, and representation of the LLC in legal matters.

Why is decision-making important for managing members?

Decision-making is crucial as managing members have the authority to make significant organizational choices, which can lead to a 30% increase in efficiency for businesses with clear decision-making structures.

How do managing members ensure legal compliance?

They ensure the LLC adheres to applicable laws and regulations, including tax responsibilities and reporting obligations, which is vital for maintaining the LLC’s legal standing.

What financial responsibilities do managing members have?

They oversee budgeting, accounting, and financial reporting to ensure the LLC’s financial health, which is critical since many LLCs generate less than $50,000 in annual revenue.

What is the importance of having a clear operating agreement?

A clear operating agreement outlines the roles and responsibilities of managing members, ensuring organized leadership and cooperation within the LLC.

What is the difference between member-managed and manager-managed LLCs?

In member-managed LLCs, all members take a direct role in operations, while in manager-managed LLCs, specific individuals are designated to handle management responsibilities.

Why should fintech entrepreneurs understand the roles of managing members?

Understanding these roles clarifies the distribution of responsibilities within the organization, which is essential for effective operation and compliance.

How can fintech entrepreneurs get assistance with LLC formation?

They can schedule a free consultation with Social Enterprises for expert guidance in establishing a solid foundation for their venture.