Introduction

Establishing a subsidiary within a Limited Liability Company (LLC) offers a strategic opportunity for business growth and effective risk management. This structure not only facilitates operational independence but also bolsters the parent company’s credibility and market presence. However, the complexities of legal compliance, tax obligations, and management oversight can present significant challenges.

How can business owners effectively navigate these benefits and hurdles to ensure successful subsidiary formation?

Define a Subsidiary and Its Role in an LLC

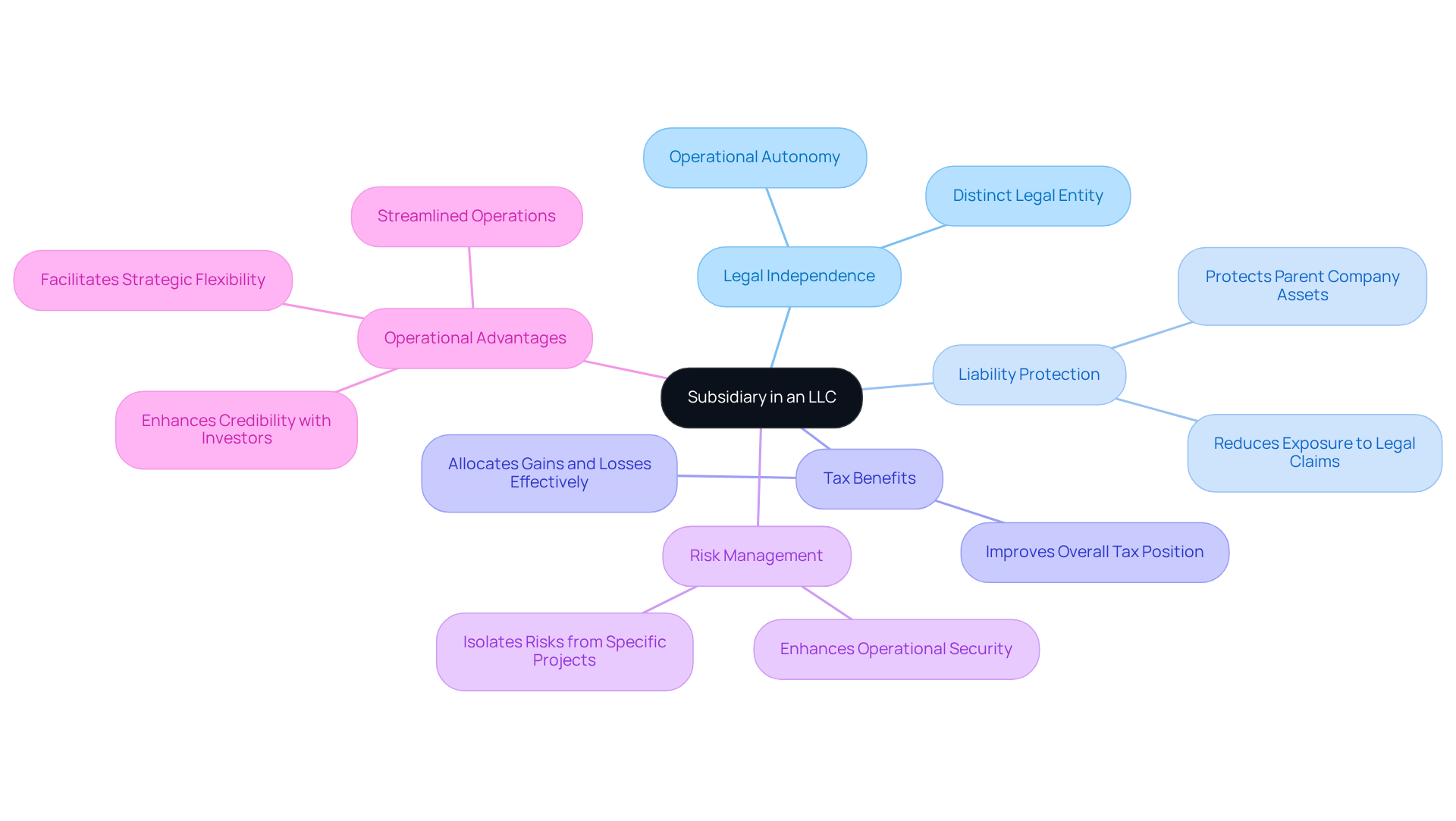

A branch represents a business entity that is either wholly or partially owned by another organization, referred to as the controlling company. Within the framework of a Limited Liability Company (LLC), a division operates as a distinct legal entity, enabling it to function independently while remaining under the oversight of the main LLC. This structure offers several advantages, including limited liability protection for the parent company, which shields its assets from the liabilities associated with the branch. Furthermore, it facilitates the management of diverse business lines under a single corporate umbrella, promoting streamlined operations and strategic flexibility.

Establishing a branch can also yield significant tax benefits, as gains and losses can be allocated in ways that improve the overall tax position of the main LLC. Research indicates that companies utilizing affiliates for liability protection experience a marked reduction in exposure to legal claims, thereby enhancing their operational security. For instance, numerous LLCs have successfully employed branches to isolate risks tied to specific projects or markets, effectively protecting the parent company from potential financial repercussions.

Understanding the role of a branch is crucial for business owners aiming to expand their operations while adeptly managing risks related to liability and compliance. By creating a branch, LLCs can not only bolster their market presence but also enhance credibility with investors and partners, signaling a commitment to sustainable growth and stability.

Outline Steps to Create a Subsidiary Under an LLC

-

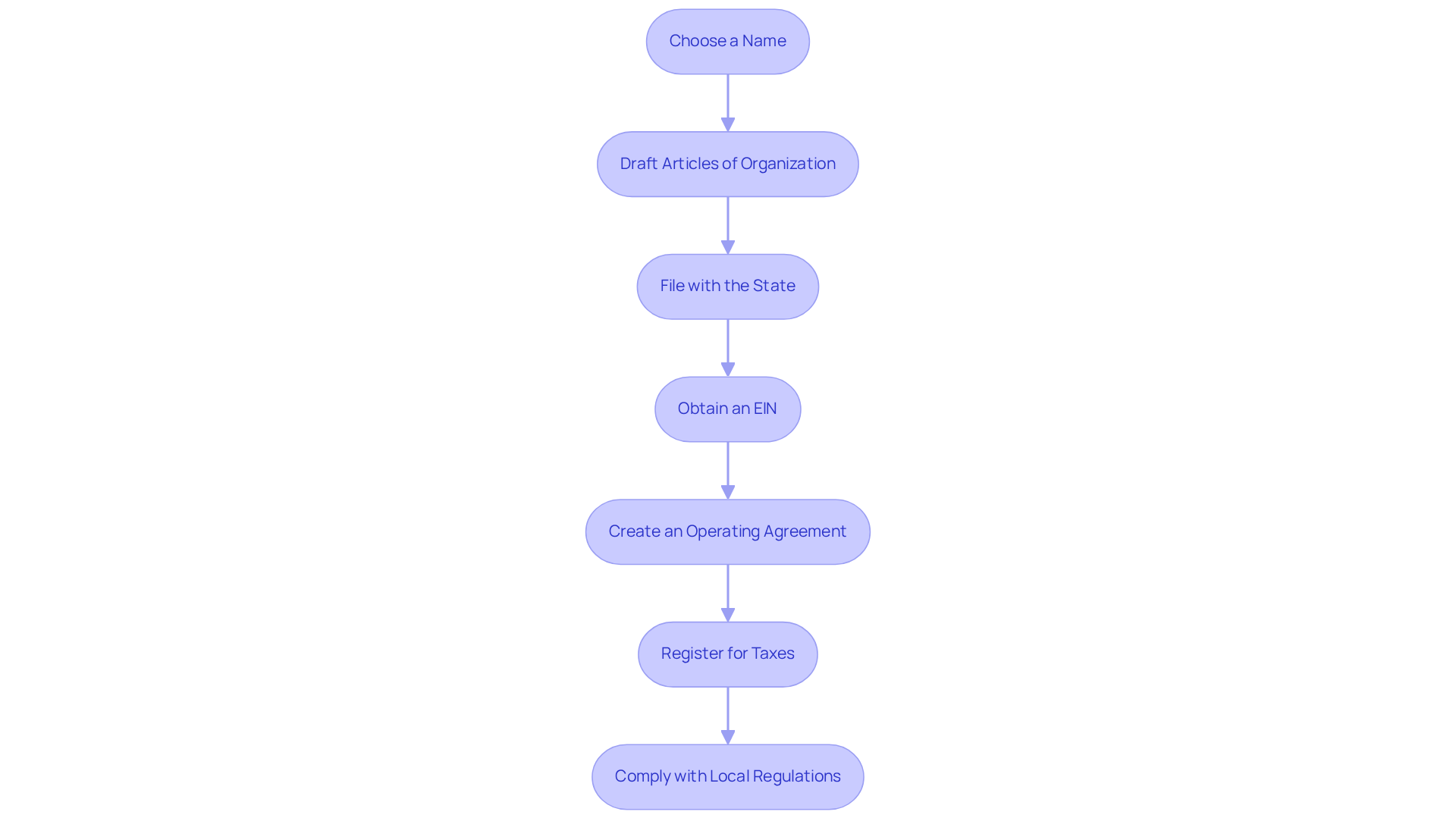

Choose a Name: Select a unique name for your branch that complies with state naming regulations. It is essential to verify that the name is not already in use by another entity in your state to prevent potential conflicts.

-

Draft Articles of Organization: Prepare the Articles of Organization, the official document that establishes your branch. This document must include the subsidiary’s name, address, and the name of the registered agent to understand how to add a subsidiary to an llc. Ensuring that the content aligns with state-specific requirements is crucial, as these can vary significantly.

-

File with the State: Submit the Articles of Organization to the appropriate state agency, typically the Secretary of State, along with the required filing fee. For instance, establishing in Delaware is both swift and affordable, starting at only $89 for corporations, making it a favored option for numerous enterprises.

-

Obtain an EIN: Apply for an Employer Identification Number (EIN) from the IRS, which is essential for tax purposes. This number is necessary for opening a commercial bank account and hiring employees, ensuring compliance with federal regulations.

-

Create an Operating Agreement: Draft an operating agreement that outlines the management structure and operational procedures of the branch. This document is vital for internal governance and clarifies the roles and responsibilities of stakeholders.

-

Register for Taxes: Depending on your enterprise activities, you may need to register for state and local taxes, including sales tax and employment tax. Understanding the tax obligations in your state is critical for maintaining compliance and avoiding penalties.

-

Comply with Local Regulations: Ensure that your branch adheres to any local business licenses or permits required to operate legally in your area. Understanding how to add a subsidiary to an llc is essential for ongoing compliance to preserve legal standing and protect the parent company from potential liabilities.

Identify Legal and Compliance Requirements for Subsidiaries

-

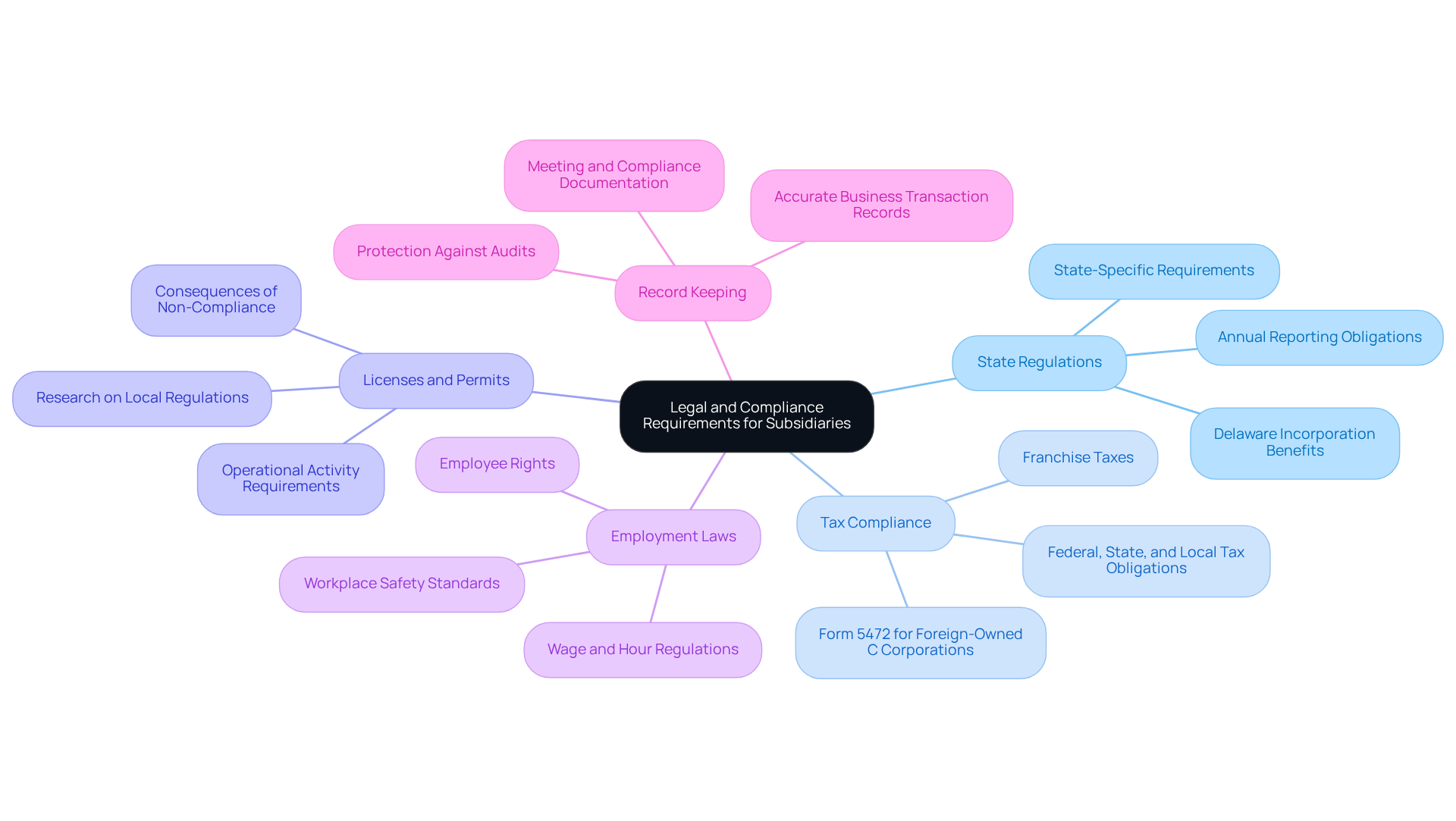

State Regulations: Each state has specific regulations that govern the formation and operation of LLCs and their branches. It is essential to understand the particular requirements in your chosen state, including annual reporting obligations and associated fees. For example, Delaware is often favored for incorporation due to its business-friendly laws and streamlined processes.

-

Tax Compliance: Subsidiaries must comply with federal, state, and local tax obligations, which encompass filing annual tax returns and paying applicable franchise taxes. Importantly, if a C Corporation is more than 25% foreign-owned, it is mandated to file Form 5472 to report inter-company transactions. This underscores the necessity of meticulous tax planning to avoid potential penalties.

-

Licenses and Permits: Depending on your branch’s operational activities, specific licenses or permits may be required for lawful operation. Conducting thorough research on local regulations is crucial to ensure compliance, as failing to obtain the necessary licenses can result in operational disruptions.

-

Employment Laws: If your subsidiary intends to employ staff, it is vital to comprehend employment laws, including wage and hour regulations, workplace safety standards, and employee rights. Compliance with these regulations not only protects your enterprise but also fosters a positive work environment.

-

Record Keeping: Maintaining accurate records of all business transactions, meetings, and compliance documents is critical for legal protection and tax purposes. Effective record-keeping practices can safeguard your branch against potential audits and legal challenges, ensuring smooth operations.

Evaluate Benefits and Challenges of Forming a Subsidiary

Benefits:

-

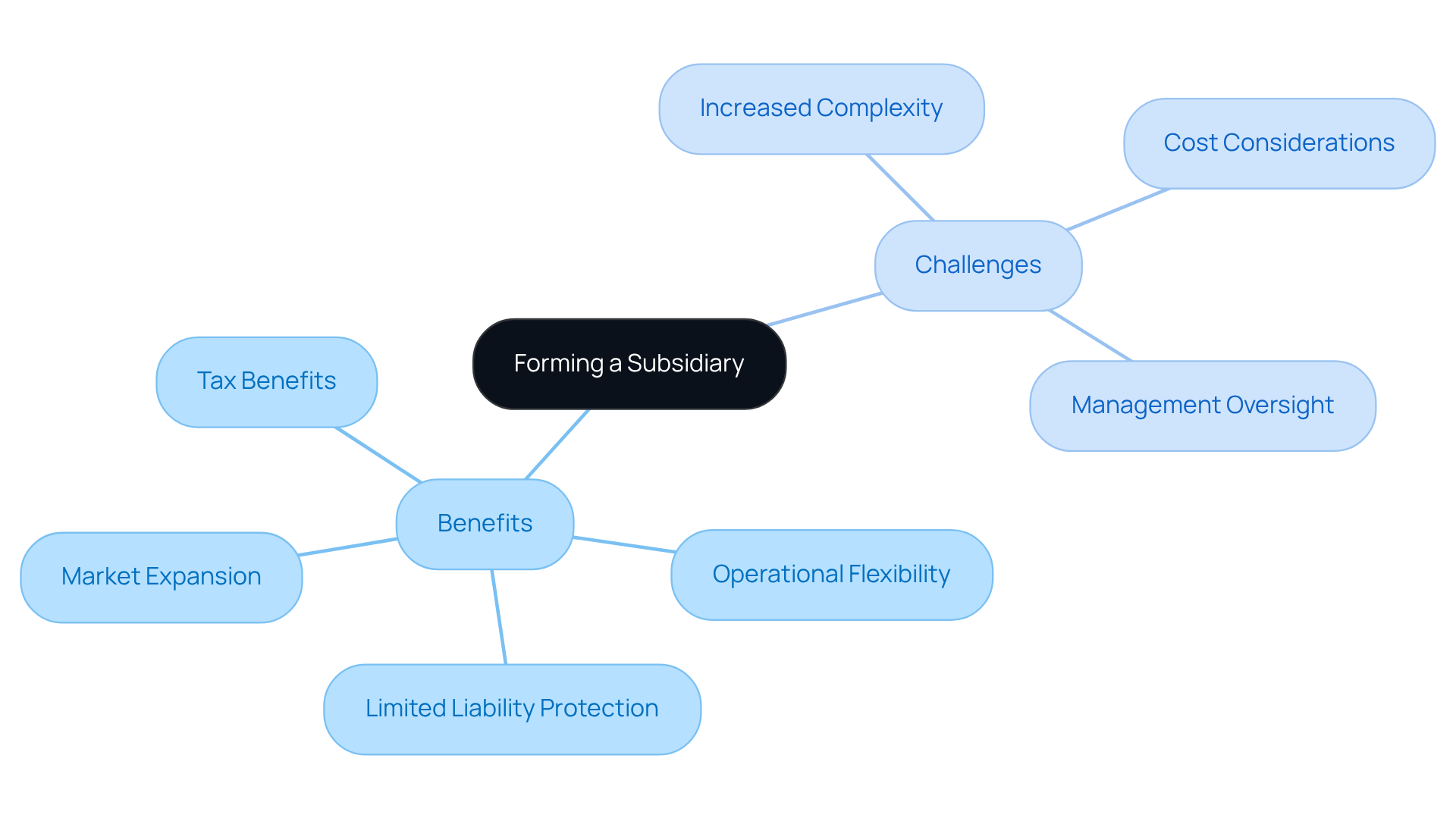

Limited Liability Protection: A branch operates as a distinct legal entity, providing a shield for the main LLC against liabilities associated with the branch’s debts and obligations. This separation is essential for protecting both personal and corporate assets.

-

I need to learn how to add a subsidiary to an LLC. Understanding how to add a subsidiary to an LLC allows for operational flexibility, as subsidiaries can operate independently and enable management strategies tailored to specific markets or product lines. This flexibility enables companies to respond swiftly to local demands and operational challenges.

-

I am looking for information on how to add a subsidiary to an LLC. Understanding how to add a subsidiary to an LLC can reveal significant tax benefits, including the ability to offset losses against the main company’s income, thereby enhancing overall financial efficiency.

-

To understand how to add a subsidiary to an LLC, one must follow specific legal procedures. Market expansion through understanding how to add a subsidiary to an LLC can facilitate entry into new markets, allowing businesses to test new products or services while minimizing risk to the parent company’s assets.

Challenges:

-

Increased Complexity: Managing a branch introduces additional layers of complexity, including increased compliance and reporting obligations that must be navigated carefully to uphold legal protections.

-

I need to learn how to add a subsidiary to an LLC. Cost Considerations: The establishment and ongoing maintenance of a branch can incur substantial costs, including legal fees, filing expenses, and continuous compliance requirements that may strain resources.

-

I am looking for information on how to add a subsidiary to an LLC. Management Oversight: Effective governance of the subsidiary can pose challenges, particularly if it operates in a different industry or market. Ensuring alignment with the parent company’s strategic goals necessitates diligent oversight and communication.

Conclusion

Establishing a subsidiary under a Limited Liability Company (LLC) is a strategic move that significantly enhances operational flexibility and risk management. Understanding the unique characteristics of subsidiaries and their role within an LLC allows businesses to leverage this structure to protect their assets while pursuing growth opportunities. The advantages of forming a subsidiary, including limited liability protection and potential tax benefits, underscore the importance of this decision for companies aiming to expand their market presence.

Key steps for creating a subsidiary have been outlined, including:

- Choosing a name

- Drafting Articles of Organization

- Ensuring compliance with state regulations

The discussion on legal and compliance requirements highlights the necessity of adhering to local laws, maintaining accurate records, and understanding tax obligations. Additionally, the benefits and challenges of forming a subsidiary are crucial considerations, as they can significantly impact the long-term success of the business.

The process of adding a subsidiary to an LLC is not merely a structural change; it represents a vital strategy for managing risk and enhancing business operations. By taking informed steps and being mindful of compliance requirements, business owners can effectively navigate this journey. Embracing the potential of subsidiaries can pave the way for sustainable growth and a robust market position, making it an essential consideration for any ambitious enterprise.

Frequently Asked Questions

What is a subsidiary in the context of an LLC?

A subsidiary, or branch, is a business entity that is either wholly or partially owned by another organization, known as the controlling company. In an LLC, a branch operates as a distinct legal entity, functioning independently while remaining under the oversight of the main LLC.

What are the advantages of having a branch in an LLC?

The advantages include limited liability protection for the parent company, which safeguards its assets from the liabilities of the branch. It also allows for the management of diverse business lines under one corporate umbrella, promoting streamlined operations and strategic flexibility.

How can establishing a branch benefit the tax position of an LLC?

Establishing a branch can yield significant tax benefits as gains and losses can be allocated in ways that improve the overall tax position of the main LLC.

How do branches help reduce exposure to legal claims?

Research indicates that companies using branches for liability protection experience a marked reduction in exposure to legal claims, enhancing their operational security. This structure allows LLCs to isolate risks tied to specific projects or markets, protecting the parent company from potential financial repercussions.

Why is understanding the role of a branch important for business owners?

Understanding the role of a branch is crucial for business owners seeking to expand operations while managing risks related to liability and compliance. It can bolster market presence and enhance credibility with investors and partners, signaling a commitment to sustainable growth and stability.