Introduction

An Employer Identification Number (EIN) is a crucial element for businesses navigating federal regulations and enhancing operational efficiency. This unique nine-digit identifier is more than just a bureaucratic necessity; it provides essential benefits, including:

- Tax compliance

- Banking capabilities

- The ability to hire employees

However, obtaining an EIN can present challenges, such as:

- Understanding eligibility criteria

- Addressing common application issues

Entrepreneurs must consider how to streamline this process while fully leveraging the advantages associated with securing their EIN.

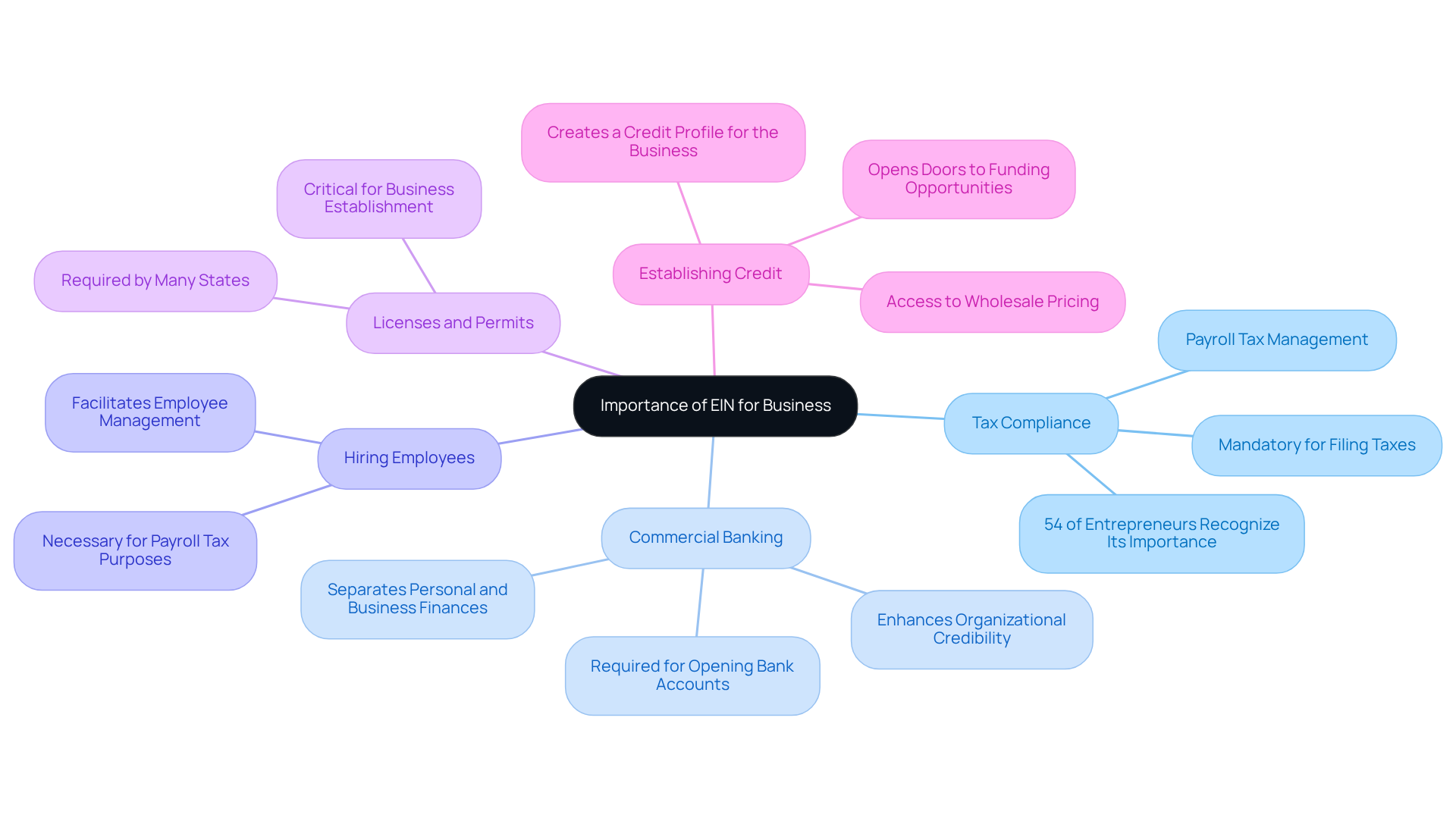

Understand the Importance of an EIN for Your Business

An Employer Identification Number (EIN) is a nine-digit identifier assigned by the IRS, crucial for various commercial operations. Obtaining an EIN is essential for several key reasons:

- Tax Compliance: An EIN is mandatory for filing business taxes, ensuring adherence to federal regulations. Approximately 54% of entrepreneurs recognize the importance of an EIN number federal tax id for tax compliance, especially when managing payroll and other tax obligations.

- Commercial Banking: Most banks require an EIN to open a commercial bank account, which is vital for separating personal and business finances. This separation not only protects personal assets but also enhances organizational credibility, facilitating smoother transactions with suppliers and partners.

- If you plan to hire employees, you will need an EIN number federal tax id for payroll tax purposes. Without it, companies may face challenges in managing employee-related taxes and compliance.

- Licenses and Permits: Many states and localities require an ein number federal tax id for issuing licenses and permits, making it a critical step in the establishment process.

- Establishing Credit for Enterprises: An EIN is instrumental in creating a credit profile for a company, essential for securing loans and credit lines. Businesses with an EIN can access wholesale pricing and funding opportunities, significantly enhancing their growth potential.

Real-world examples underscore the significance of an EIN: enterprises that have effectively managed banking and credit processes often cite their EIN as a crucial element in operational efficiency. Financial specialists emphasize that possessing an EIN not only streamlines tax payments but also fosters improved management and growth opportunities. Understanding these points highlights the essential role of an EIN in operations and compliance.

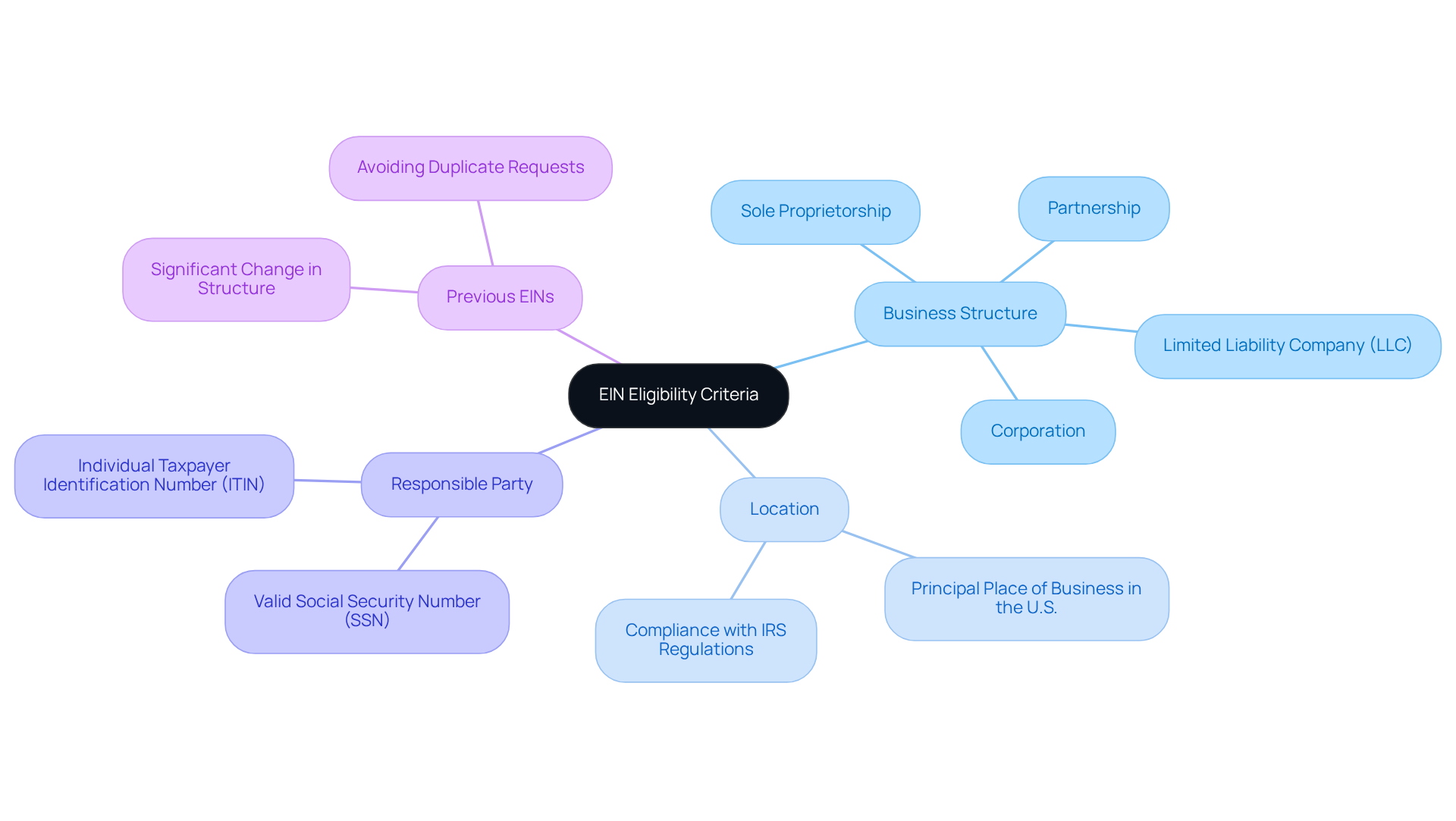

Determine Your Eligibility for an EIN

Before applying for an Employer Identification Number (EIN), it is crucial to confirm your eligibility based on the following criteria:

-

Business Structure: Your business must have a recognized legal structure, such as a sole proprietorship, partnership, corporation, or Limited Liability Company (LLC). LLCs are particularly popular among game companies in the U.S. due to their ease of establishment, flexible management structure, and tax advantages. Corporations may be more suitable for larger-scale projects and investments. Consulting with experts, such as Social Enterprises, can assist you in selecting the appropriate framework for your organizational needs.

-

Location: The principal place of business must be situated within the United States or its territories, ensuring compliance with IRS regulations.

-

Responsible Party: The form must be submitted by a responsible party who possesses a valid Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). This requirement is essential for establishing accountability in the procedure.

-

Previous EINs: If you have previously requested an EIN, it is important to refrain from submitting a new request unless there has been a significant change in your company’s structure. This helps prevent complications and ensures that your operation remains compliant with IRS guidelines.

Comprehending these eligibility criteria will facilitate a smoother submission process and reduce potential delays, enabling you to concentrate on establishing your business effectively. Additionally, it is important to note that the EIN number federal tax ID is distinct from a state tax ID number, which is used for state-level taxes and may be required by many states.

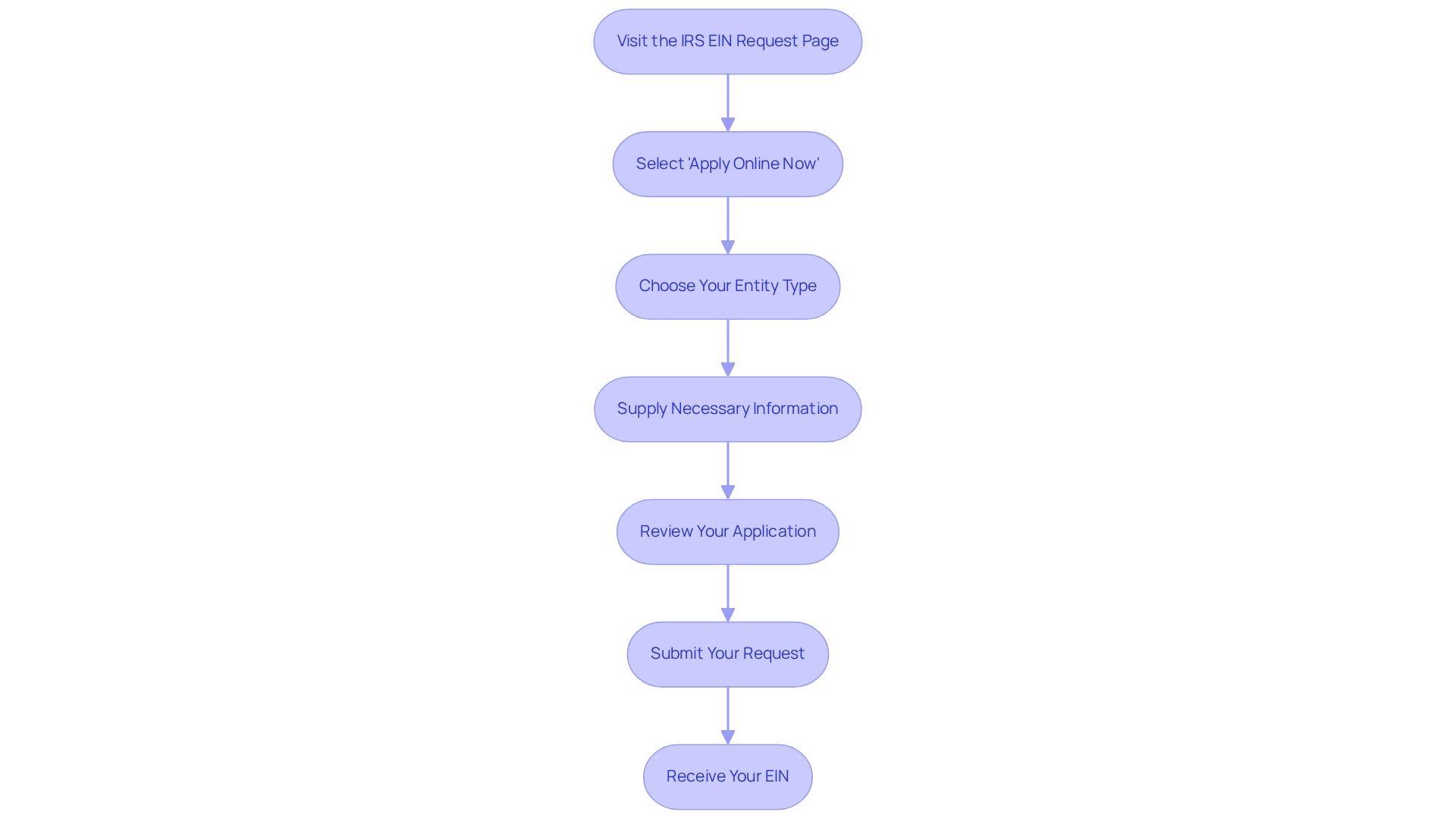

Follow the Step-by-Step Application Process for Your EIN

To apply for your EIN, follow these steps:

- Visit the IRS EIN Request Page: Navigate to the IRS website and locate the EIN request section.

- Select ‘Apply Online Now’: Click on the ‘Apply Online Now’ button to initiate the process.

- Choose Your Entity Type: Indicate the type of entity you are applying for, such as an LLC, C Corporation, or S Corporation. Understanding the distinctions between these entities is crucial for your organizational structure.

- Supply Necessary Information: Complete the form with essential company details, including the legal name, mailing address, and information about the responsible party.

- Review Your Application: Thoroughly check all entries for accuracy to avoid errors that could delay processing.

- Submit Your Request: After confirming that all information is correct, submit your request.

- Receive Your EIN: If approved, your EIN will be issued immediately online. Retain this EIN number federal tax ID for your records, as it is essential for various business operations, including opening bank accounts and filing taxes.

Typically, if you apply online, you can expect to receive your EIN within minutes. However, if you opt to apply via mail, it may take approximately four weeks to receive your EIN. This efficiency is particularly beneficial for companies aiming to commence operations swiftly, as the process can often be completed in one sitting, which is set to expire after 15 minutes of inactivity. Additionally, note that only one EIN request can be submitted per responsible party per day. By adhering to these steps, you can ensure a smooth process for obtaining an EIN and avoid common pitfalls that may arise during the request.

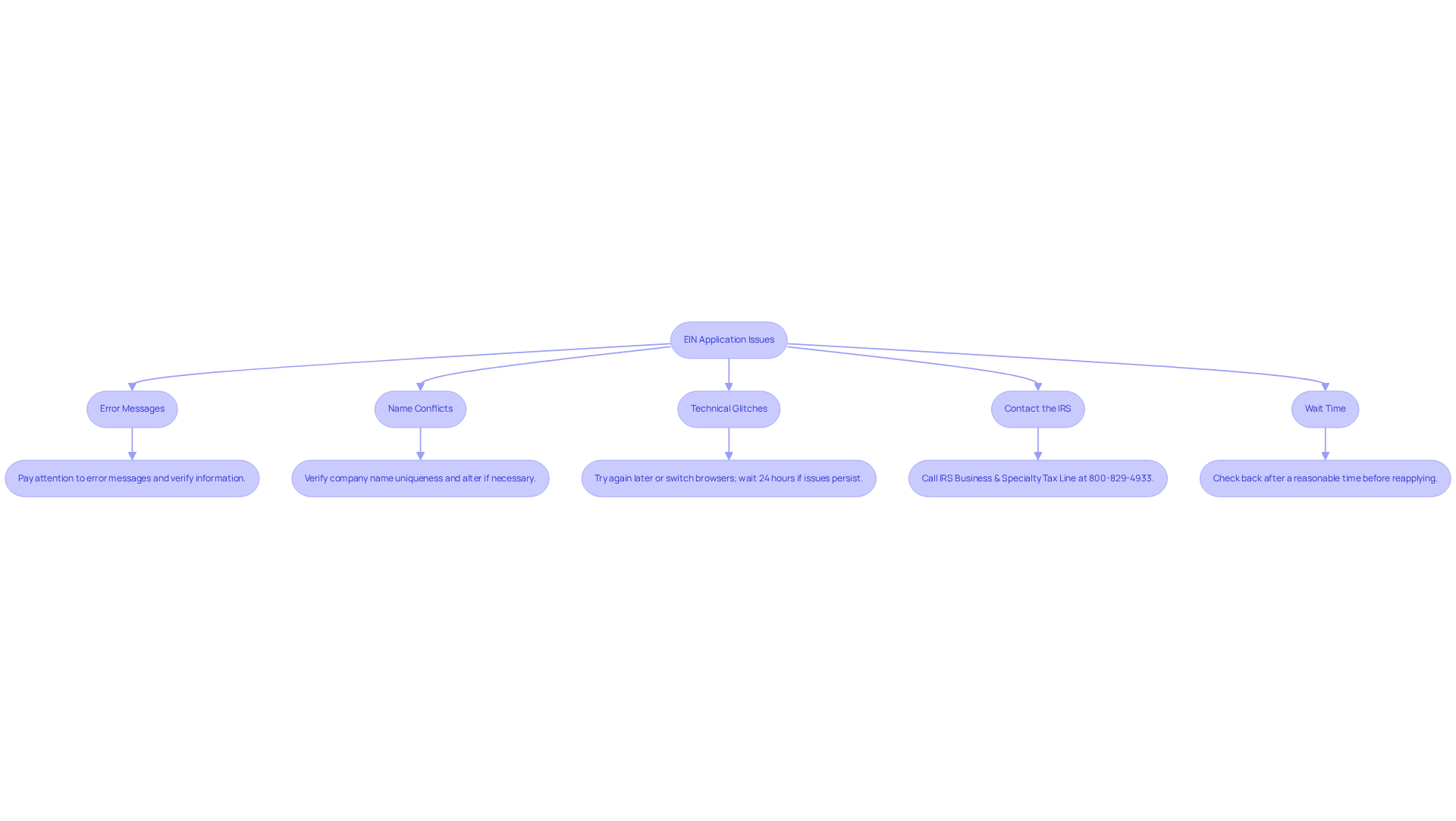

Troubleshoot Common Issues When Applying for an EIN

When applying for your EIN number federal tax ID, it can be frustrating to encounter issues. However, there are effective troubleshooting tips to help you navigate common problems:

- Error Messages: Pay close attention to any error messages during the application process. Common issues include mismatched information, such as incorrect Social Security numbers or misspelled names, which can lead to significant delays. In fact, nearly 25% of delays in processing are linked to clerical errors rather than complex tax law issues.

- Name Conflicts: If you encounter a name conflict error, it is essential to verify that your company name is unique and not already registered. For instance, a startup faced a name conflict when attempting to register an EIN for an enterprise with a similar name already in use. They addressed this by slightly altering their business name, enabling them to move forward with the submission successfully.

- Technical Glitches: Technical issues can occur, particularly during peak usage times. If the IRS website is down or you experience glitches, try again later or switch to a different browser. If problems persist, waiting 24 hours before retrying can often resolve the issue.

- Contact the IRS: If you continue to face challenges, do not hesitate to reach out to the IRS Business & Specialty Tax Line at 800-829-4933. They can provide guidance on specific error messages and help you troubleshoot effectively.

- Wait Time: After submitting your application, allow some time for processing. If you have not received your EIN within a reasonable timeframe, it is advisable to check back rather than reapplying immediately, as this can lead to further complications.

By following these troubleshooting steps, you can effectively address common issues and successfully obtain your EIN number federal tax ID, which will ensure a smoother start for your business.

Conclusion

Obtaining an Employer Identification Number (EIN) is a crucial step for any business aiming to operate legally and efficiently. This unique identifier not only ensures compliance with tax regulations but also facilitates banking relationships, employee management, and access to credit. The importance of an EIN cannot be overstated, as it serves as the backbone for various essential business operations.

The process for acquiring an EIN has been clearly outlined, starting with determining eligibility based on business structure and location, followed by a straightforward application process. Key insights include:

- The necessity of having a valid Social Security Number for the responsible party

- The importance of avoiding common pitfalls that could delay your application

By understanding the significance of an EIN and the steps involved in obtaining one, entrepreneurs can lay a solid foundation for their business ventures.

Securing an EIN is not merely a bureaucratic formality; it is a vital component of establishing a successful business. Entrepreneurs are encouraged to prioritize this step to ensure compliance, enhance credibility, and unlock growth opportunities. By taking action now, businesses can position themselves for long-term success and stability in their respective markets.

Frequently Asked Questions

What is an Employer Identification Number (EIN)?

An Employer Identification Number (EIN) is a nine-digit identifier assigned by the IRS, essential for various business operations.

Why is obtaining an EIN important for tax compliance?

An EIN is mandatory for filing business taxes and ensures adherence to federal regulations, particularly for managing payroll and other tax obligations.

How does an EIN facilitate commercial banking?

Most banks require an EIN to open a commercial bank account, which helps separate personal and business finances, protecting personal assets and enhancing organizational credibility.

Is an EIN necessary if I plan to hire employees?

Yes, an EIN is required for payroll tax purposes when hiring employees, as it helps manage employee-related taxes and compliance.

What role does an EIN play in obtaining licenses and permits?

Many states and localities require an EIN for issuing licenses and permits, making it a critical step in the business establishment process.

How does an EIN help in establishing credit for a business?

An EIN is instrumental in creating a credit profile for a company, which is essential for securing loans and credit lines, and can lead to access to wholesale pricing and funding opportunities.

What are some real-world benefits of having an EIN?

Enterprises that effectively manage banking and credit processes often cite their EIN as crucial for operational efficiency, streamlined tax payments, and enhanced growth opportunities.