Introduction

Starting a business involves navigating a complex landscape of administrative tasks that are essential for establishing a solid foundation for success. Among these tasks, obtaining an Employer Identification Number (EIN) stands out as a critical step for entrepreneurs. This key identifier not only facilitates tax compliance but also plays a vital role in banking and employee management.

However, the process of requesting an EIN letter can present significant challenges, which may discourage even the most determined business owners. Therefore, it is imperative for entrepreneurs to identify effective strategies to overcome these obstacles, ensuring that their business operations can proceed smoothly.

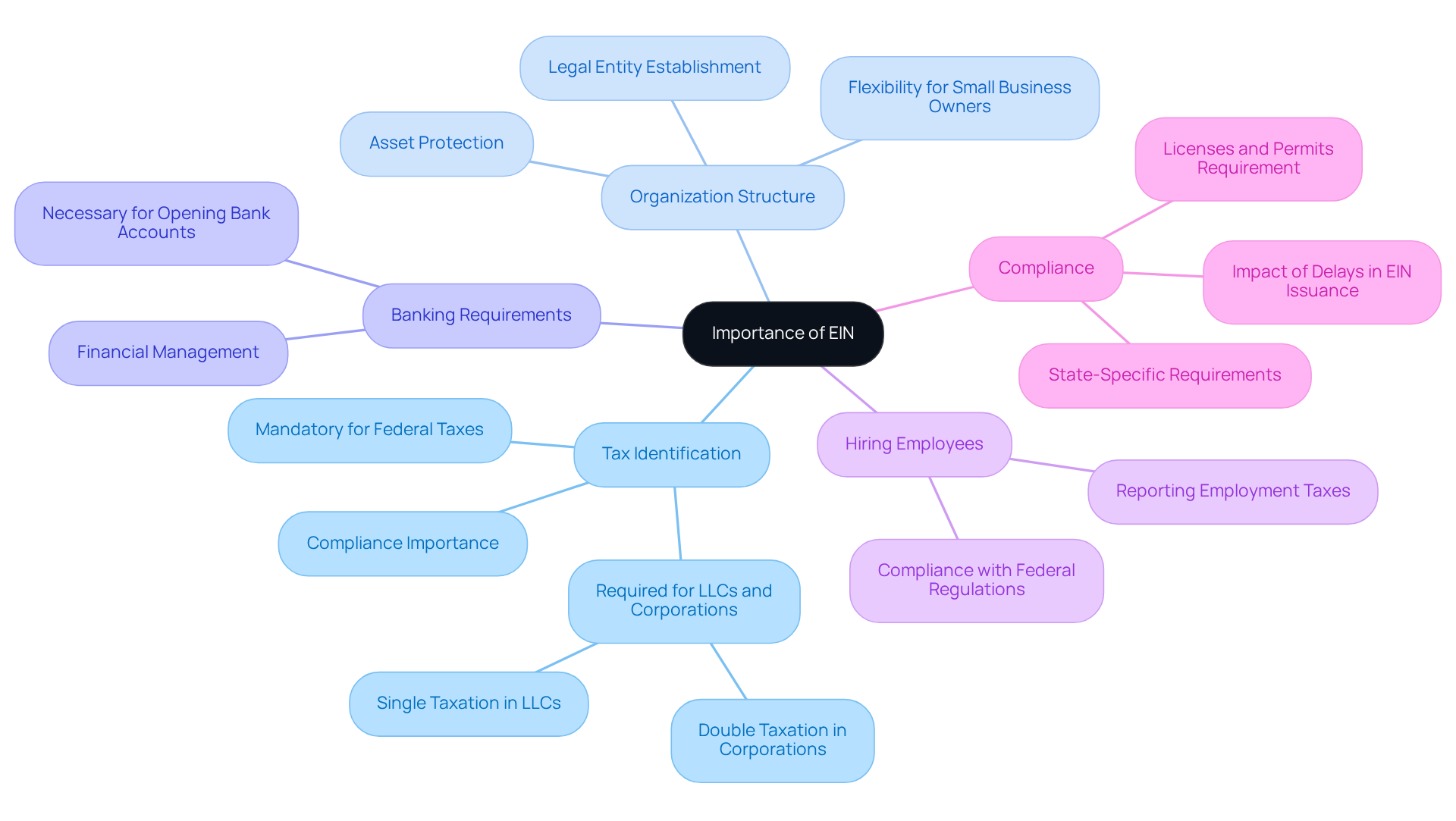

Understand the Importance of an EIN

An Employer Identification Number (EIN) is a nine-digit identifier assigned by the IRS, essential for various commercial operations. Obtaining an EIN is crucial for several key reasons:

- Tax Identification: An EIN is mandatory for filing federal taxes, including income and payroll taxes. Approximately 90% of enterprises require an EIN for tax purposes, underscoring its importance in compliance. This requirement is particularly relevant for different company types, such as LLCs and Corporations, which have distinct tax implications, including the potential for double taxation in Corporations compared to single taxation in LLCs.

- Organization Structure: The EIN establishes your enterprise as a distinct legal entity, which is vital for safeguarding personal assets from commercial liabilities. For instance, LLCs are frequently preferred by small enterprise owners for this reason, as they offer flexibility and protection.

- Banking Requirements: Most banks require an EIN to open a commercial bank account, a fundamental step for effective financial management. This is crucial for entrepreneurs aiming to manage their finances efficiently.

- Hiring Employees: If you intend to hire employees, an EIN is essential for reporting employment taxes, ensuring compliance with federal regulations. This requirement is consistent across various organizational structures.

- Compliance: Various licenses and permits necessitate an EIN, making it a critical component of organizational compliance. Understanding the specific requirements for your state can further streamline this process.

As the IRS states, “One of the most important steps taxpayers can take is to access their IRS Individual Online Account,” highlighting the significance of EINs in operational activities.

Real-world examples illustrate the benefits of having an EIN. Companies that have secured their EINs report smoother operations, particularly in tax filing and banking processes. Furthermore, the American Institute of CPAs (AICPA) has expressed concerns regarding delays in EIN issuance, which can obstruct commercial activities. Grasping these points will prepare you for the subsequent stages in the EIN registration process, especially in understanding how to request ein letter, particularly considering the new Beneficial Ownership Information (BOI) reporting obligations under the Corporate Transparency Act, which require including an EIN in initial reports submitted to the Treasury Department. Additionally, it is essential for Turkish-speaking entrepreneurs to recognize that obtaining an EIN is a foundational step in establishing an enterprise in the U.S., as it directly impacts compliance and operational efficiency.

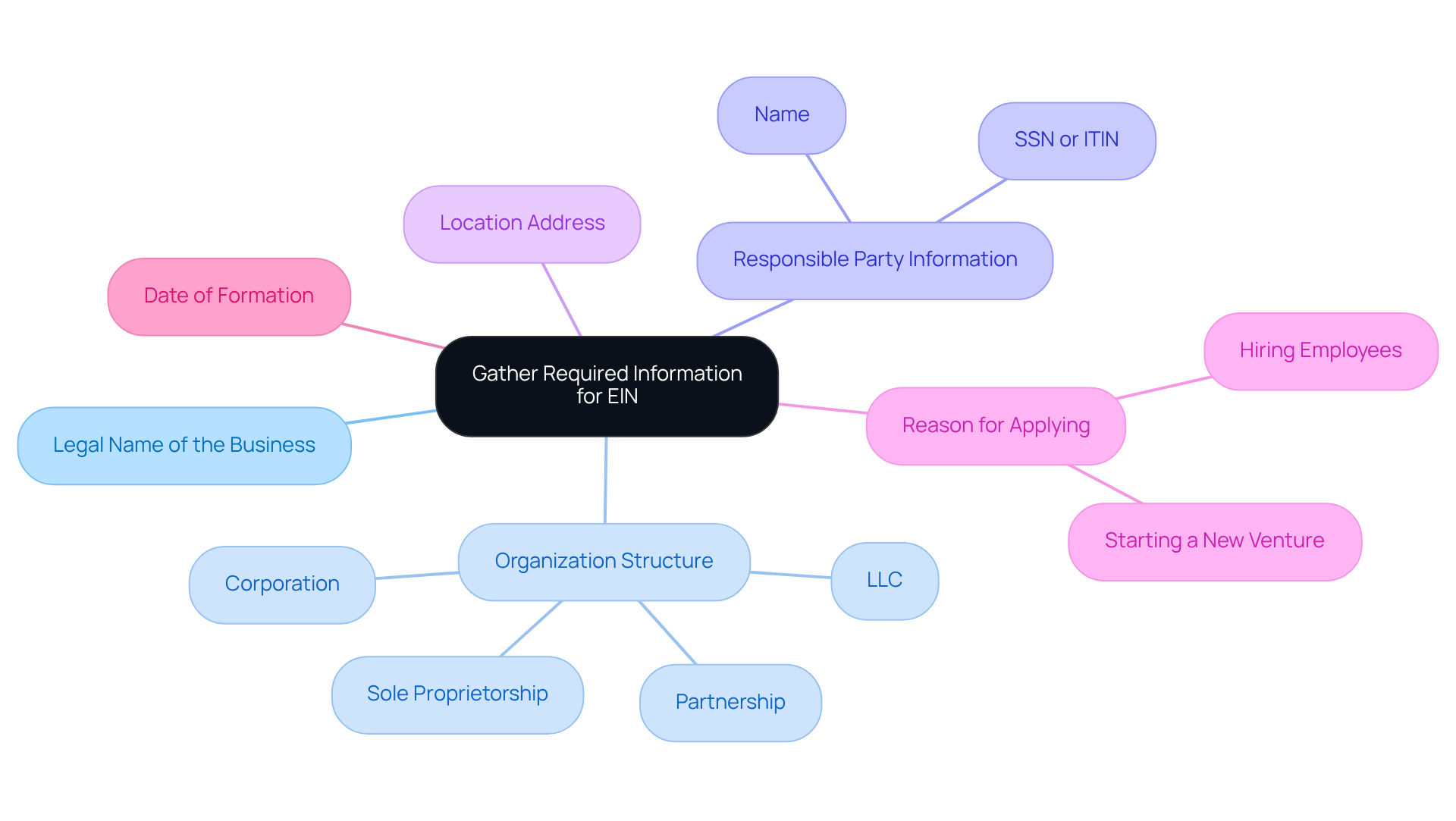

Gather Required Information and Documents

Before applying for your EIN, it is essential to gather the following information and documents to ensure a smooth application process:

- Legal Name of the Business: This is the official name under which your business operates, as registered with the state.

- Organization Structure: Clearly specify your type of enterprise, such as sole proprietorship, partnership, corporation, or LLC. For simpler structures like single-member LLCs or sole proprietorships, an ITIN may suffice, while an EIN is necessary for more complex structures or if you plan to hire employees.

- Responsible Party Information: Provide the name and Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) of the individual accountable for the entity.

- Location Address: Include the physical address where your company is situated, which must be within the U.S. or its territories.

- Reason for Applying: Be prepared to explain why you are applying for an EIN, such as starting a new venture or hiring employees.

- Date of Formation: Indicate the date when your enterprise was legally established.

Having this information readily available can significantly simplify the EIN registration process. Notably, approximately 30% of entrepreneurs encounter challenges due to incomplete documentation when applying for their EIN. Ensuring that all required details are accurate and complete can help avoid delays and complications, allowing you to focus on launching and growing your business effectively. Additionally, remember to inform the IRS of any changes to your company details to maintain compliance.

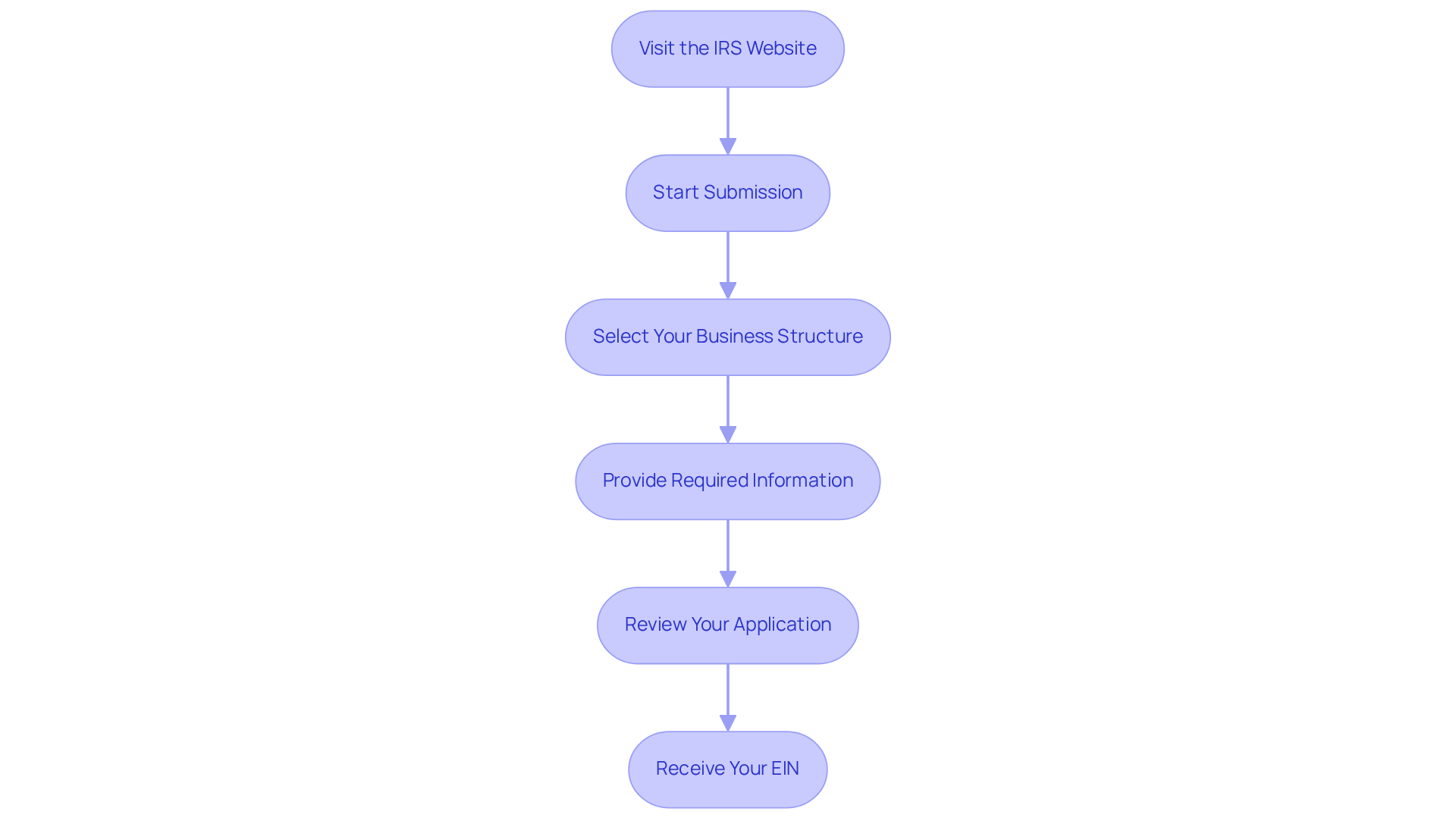

Request Your EIN: Step-by-Step Process

To request your Employer Identification Number (EIN), follow these streamlined steps:

- Visit the IRS Website: Navigate to the IRS EIN registration page.

- Start Submission: Click on the ‘Apply Online Now’ button to initiate the submission process.

- Select Your Business Structure: Choose the appropriate entity type, such as LLC or corporation.

- Provide Required Information: Enter essential details, including your company name, address, and information about the responsible party.

- Review Your Application: Carefully check all information for accuracy to prevent any delays in processing.

- Receive Your EIN: If approved, your EIN will be issued immediately online. Ensure you save this number for your records.

By adhering to these steps, you can efficiently secure your EIN and proceed with your business operations without unnecessary delays.

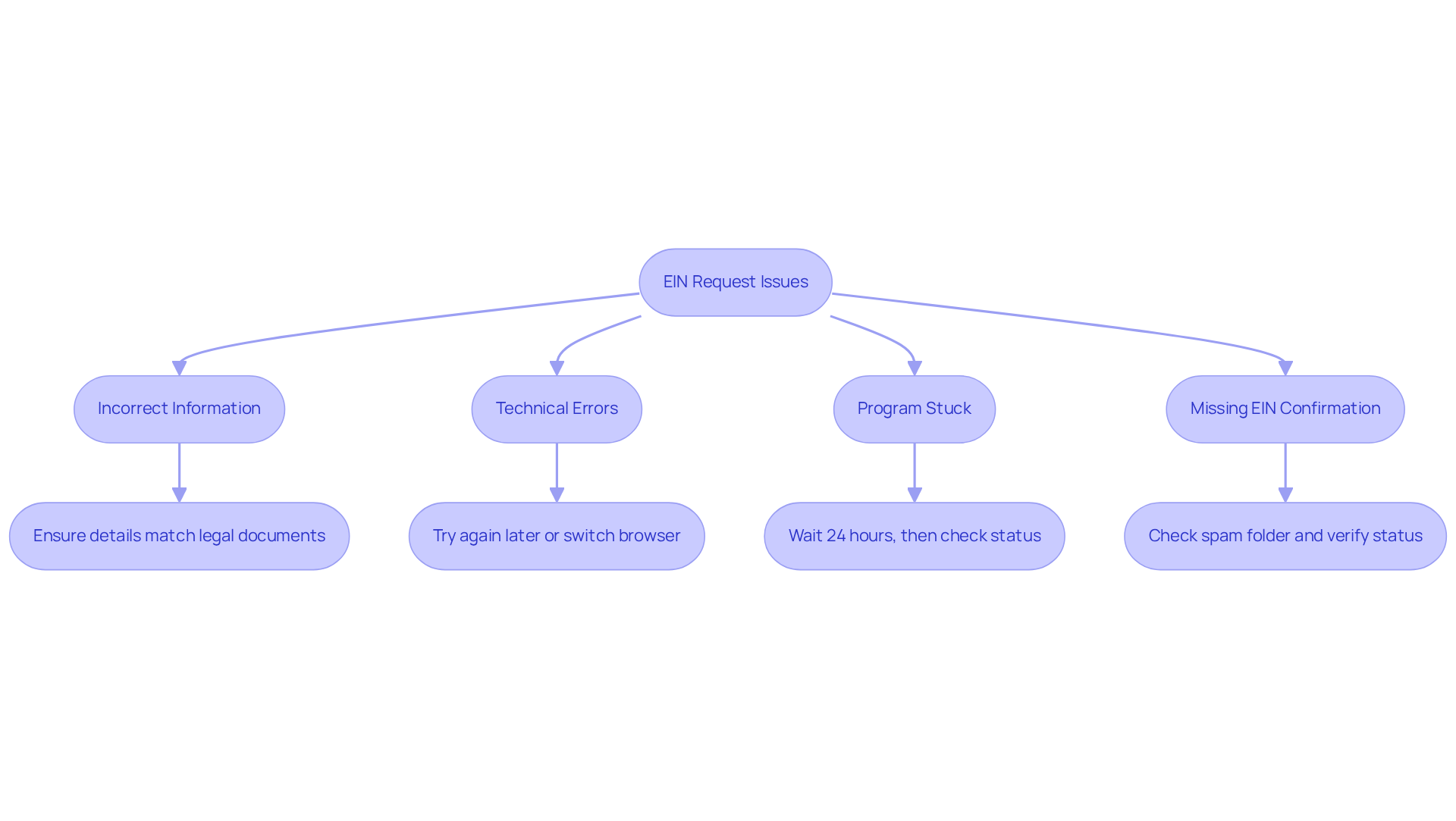

Troubleshoot Common EIN Request Issues

When you learn how to request ein letter, several common issues may arise. Understanding these challenges can help you navigate the process more effectively:

- Incorrect Information: It is crucial to ensure that all details provided match your legal documents. Mismatched names or numbers are a primary reason for rejection, with a significant percentage of EIN submissions denied due to inaccuracies.

- Technical Errors: Should the IRS website be down or if you encounter technical difficulties, consider trying again later or switching to a different browser. System overloads can lead to error codes, prompting applicants to retry their submissions.

- Program Stuck: If your application appears to be stuck, wait 24 hours before checking the status. If the issue persists, contact the IRS Business & Specialty Tax Line at 1-800-829-4933 for assistance.

- Missing EIN Confirmation: If you do not receive your EIN immediately, check your spam folder for emails from the IRS. Additionally, verify your status online to ensure it was processed correctly.

By being aware of these common issues and their solutions, you can better understand how to request ein letter, allowing you to navigate the EIN application process more effectively and minimizing delays that could hinder your business operations.

Conclusion

Obtaining an Employer Identification Number (EIN) is a crucial step for entrepreneurs embarking on their business journey. This unique identifier not only ensures compliance with tax regulations but also establishes your business as a separate legal entity. This separation protects personal assets and enables efficient financial management. Understanding the significance of an EIN and the process to acquire one is essential for any business owner.

The importance of an EIN cannot be overstated. It plays a vital role in:

- Tax identification

- Organizational structure

- Banking requirements

- Employee hiring

- Overall compliance

This article provides a comprehensive step-by-step guide on how to request your EIN, emphasizing the necessity of gathering the required information and documents beforehand. Additionally, common issues encountered during the EIN request process are addressed, equipping entrepreneurs with the tools to navigate potential pitfalls effectively.

In conclusion, securing your EIN is not merely a bureaucratic formality; it is a pivotal step that can significantly influence the success of your business operations. Entrepreneurs are encouraged to approach this process with diligence, ensuring that all required information is accurate and complete. By taking these proactive measures, business owners can streamline their operations and focus on what truly matters-growing their enterprises.

Frequently Asked Questions

What is an Employer Identification Number (EIN)?

An EIN is a nine-digit identifier assigned by the IRS that is essential for various commercial operations, including tax identification and compliance.

Why is obtaining an EIN important for businesses?

An EIN is crucial for tax identification, establishing legal entity status, opening commercial bank accounts, hiring employees, and ensuring compliance with various licenses and permits.

How does an EIN affect tax obligations?

An EIN is mandatory for filing federal taxes, including income and payroll taxes. Approximately 90% of enterprises require an EIN for tax purposes, which is particularly relevant for LLCs and Corporations due to their distinct tax implications.

What role does an EIN play in protecting personal assets?

The EIN establishes a business as a distinct legal entity, which is vital for safeguarding personal assets from commercial liabilities, especially for small enterprise owners using structures like LLCs.

Do banks require an EIN to open a business account?

Yes, most banks require an EIN to open a commercial bank account, which is a fundamental step for effective financial management for entrepreneurs.

Is an EIN necessary for hiring employees?

Yes, an EIN is essential for reporting employment taxes and ensuring compliance with federal regulations when hiring employees.

How does an EIN relate to compliance with licenses and permits?

Various licenses and permits require an EIN, making it a critical component of organizational compliance. Understanding state-specific requirements can help streamline this process.

What are the potential consequences of delays in EIN issuance?

Delays in EIN issuance can obstruct commercial activities, as companies report smoother operations when they have secured their EINs, particularly in tax filing and banking processes.

What should Turkish-speaking entrepreneurs know about obtaining an EIN?

For Turkish-speaking entrepreneurs, obtaining an EIN is a foundational step in establishing a business in the U.S., as it directly impacts compliance and operational efficiency.

What new reporting obligations are associated with EINs under the Corporate Transparency Act?

The Corporate Transparency Act requires including an EIN in initial reports submitted to the Treasury Department, particularly concerning Beneficial Ownership Information (BOI) reporting obligations.