Introduction

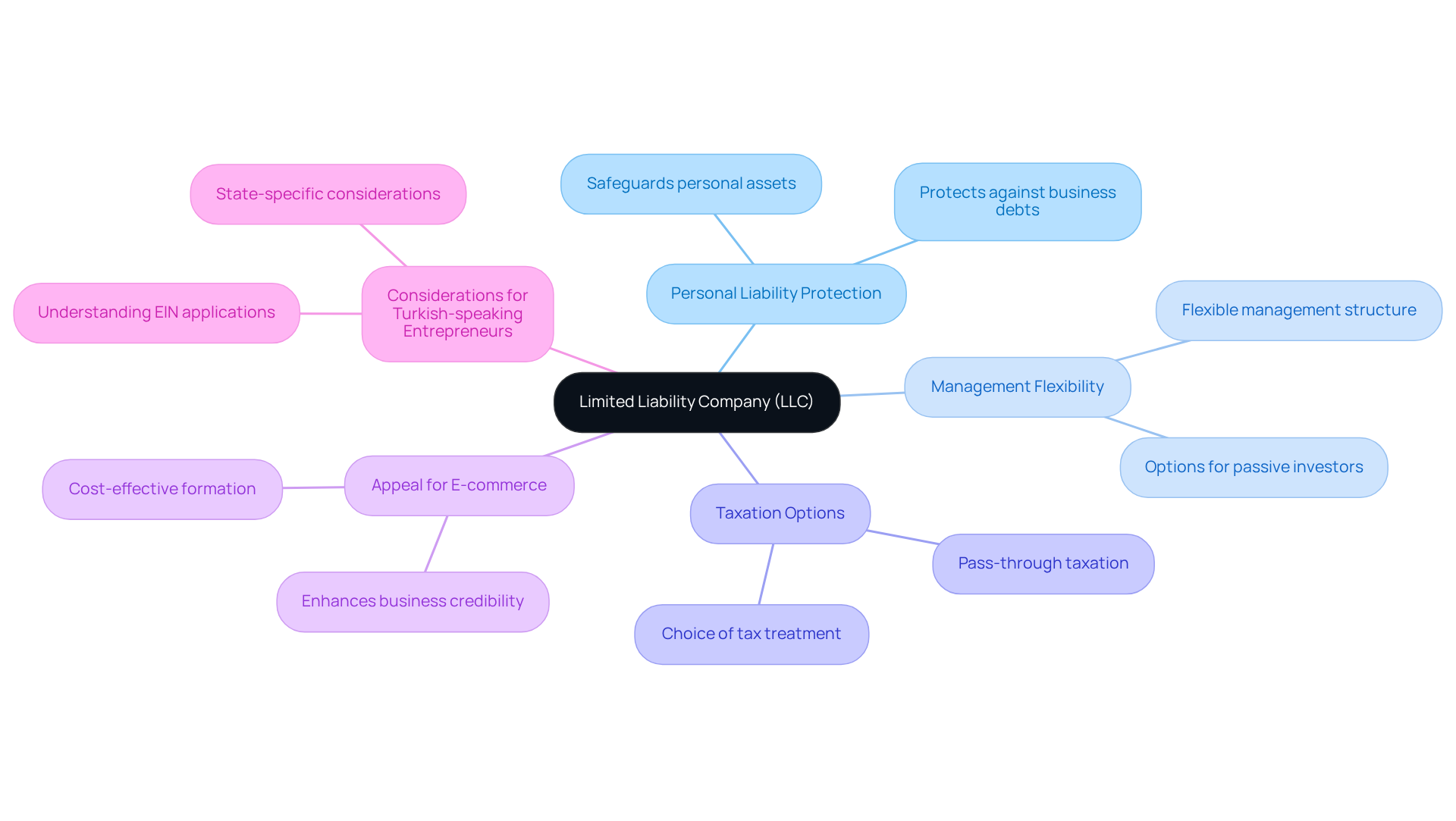

Limited Liability Companies (LLCs) represent a crucial framework for e-commerce entrepreneurs aiming to protect their personal assets amidst the complexities of online business. By combining liability protection, tax flexibility, and operational simplicity, LLCs enable entrepreneurs to concentrate on growth without the persistent concern of personal financial risk.

However, as the e-commerce landscape continues to evolve, challenges emerge. How can entrepreneurs effectively harness the benefits of an LLC while addressing its potential drawbacks?

This article explores the fundamental steps for establishing an LLC in the U.S., outlines the associated financial responsibilities, and examines the key advantages and disadvantages that every online business owner should consider.

Define Limited Liability Company (LLC) and Its Importance for E-commerce Entrepreneurs

A liability company limited (LLC) represents a flexible organizational structure that merges the advantages of both corporations and partnerships. A primary benefit of a liability company limited is personal liability protection, which safeguards owners’ personal assets from debts and legal claims. This protection is particularly vital for e-commerce entrepreneurs, who frequently face risks such as customer disputes and product liability issues.

Moreover, liability company limited structures provide significant flexibility in management and taxation. Owners have the option to be taxed as either a sole proprietorship or a corporation, enabling tailored financial strategies that can result in considerable tax savings. For instance, LLCs benefit from pass-through taxation, meaning that income is taxed only at the individual level, thereby avoiding the double taxation that corporations typically encounter. This feature renders LLCs especially appealing for e-commerce businesses striving to improve their financial performance.

Numerous successful online retailers have chosen the liability company limited structure to bolster their credibility and protect their personal assets, allowing them to concentrate on growth without the persistent concern of personal financial risk. Additionally, establishing an LLC can be as affordable as $49 plus fees in certain states, making it a financially viable choice for many entrepreneurs.

For Turkish-speaking entrepreneurs, understanding the intricacies of forming an LLC in the U.S., including EIN applications, state-specific considerations, and investment processes, is crucial for effectively navigating the commercial landscape.

Outline Steps to Form an LLC in the U.S. for E-commerce Businesses

-

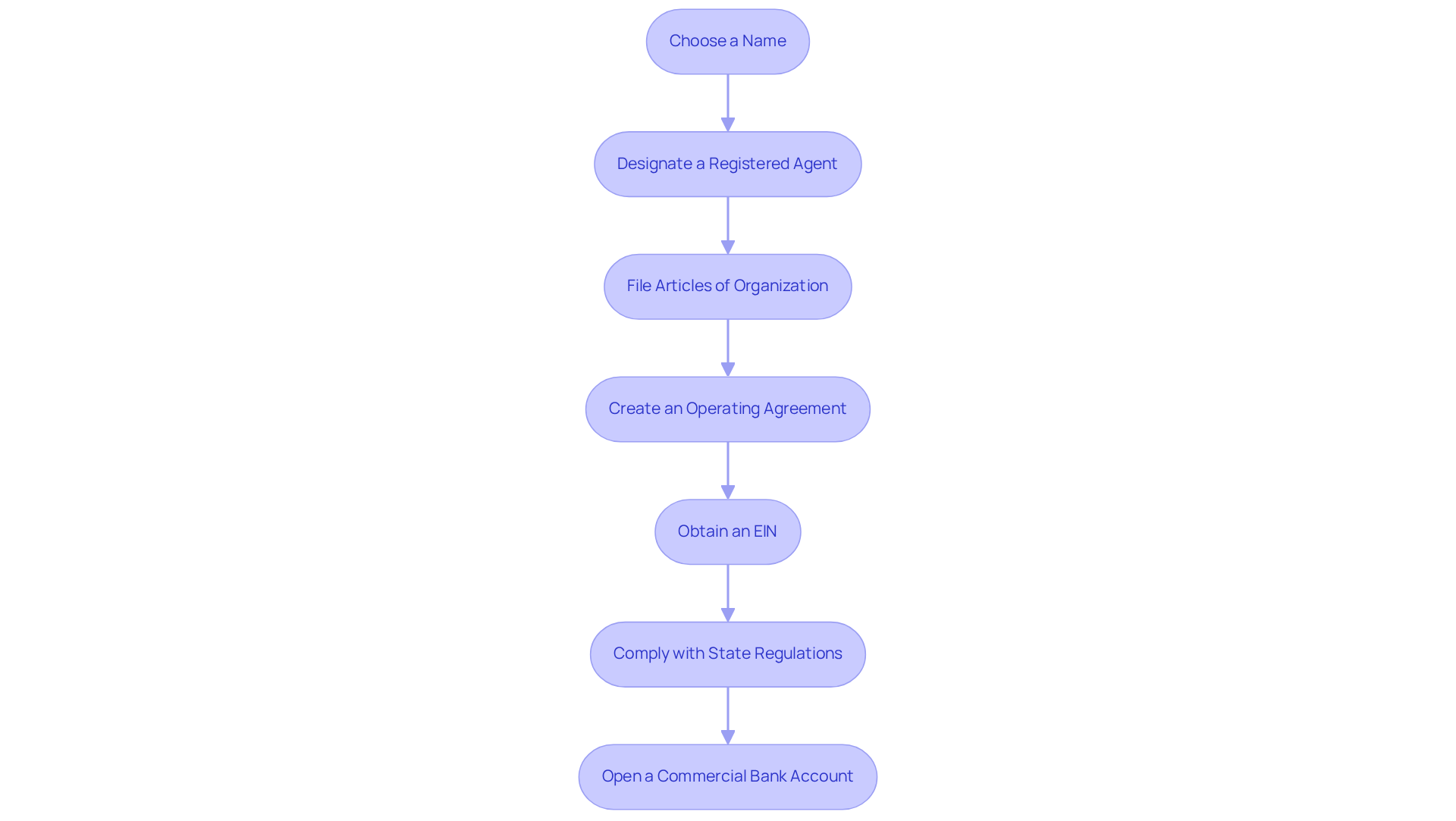

Choose a Name for Your Limited Liability Company: Select a unique name that complies with state regulations, ensuring it includes ‘Limited Liability Company’ or ‘LLC.’ Most states require that your company name be distinguishable from existing entities to avoid confusion.

-

Designate a Registered Agent: Appoint a registered agent who will receive legal documents on behalf of your LLC. This can be an individual or an organization authorized to operate in your state.

-

File Articles of Organization: Submit the Articles of Organization to your state’s Secretary of State office. This document officially establishes your liability company limited and typically requires a filing fee ranging from $50 to $200. Processing times for online submissions generally vary from 3 to 10 working days, with some states offering expedited options.

-

Create an Operating Agreement: While not always mandatory, an operating agreement is highly recommended. This document outlines the management structure and operational procedures of your liability company limited, helping to prevent misunderstandings among members.

-

Obtain an EIN: An Employer Identification Number (EIN) is essential for tax purposes and is often required to open a business bank account. This nine-digit number is crucial for hiring employees and submitting financial statements.

-

Comply with State Regulations: Ensure compliance with any additional state-specific requirements, which may include filing annual reports or paying franchise taxes to maintain your LLC’s good standing.

-

Open a Commercial Bank Account: To safeguard your personal assets, it is essential to maintain a distinction between your liability company limited and personal finances. Opening a dedicated business bank account is a key step in maintaining liability protection and effectively managing your LLC’s finances.

Explain Tax Compliance and Financial Responsibilities of LLCs

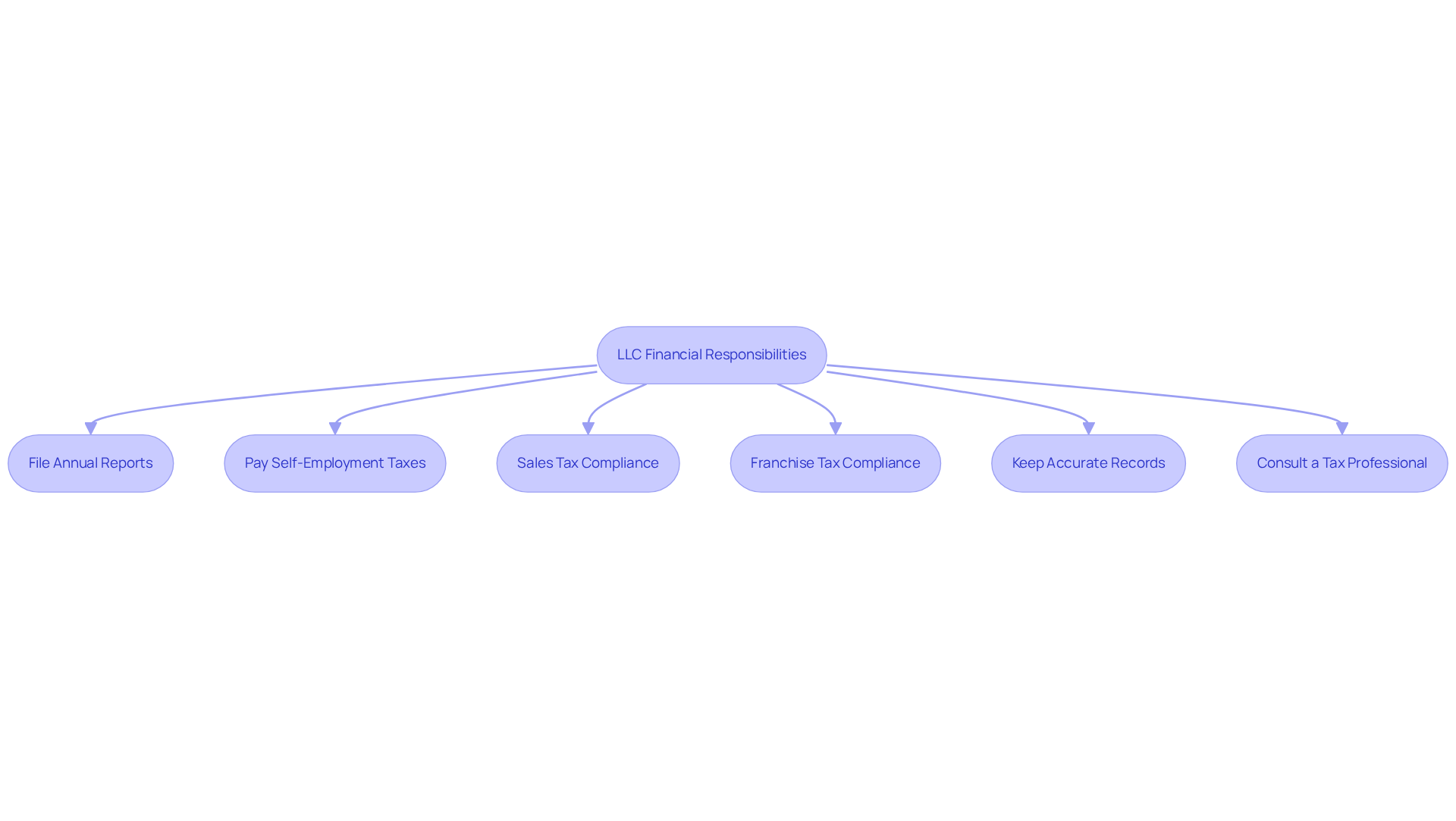

Limited Liability Companies (LLCs) are classified as ‘pass-through’ entities for tax purposes, meaning they do not pay federal income taxes directly. Instead, profits and losses are reported on the owners’ personal tax returns. Understanding the financial responsibilities of a liability company limited is essential for e-commerce entrepreneurs. The key obligations include:

-

File Annual Reports: Most states require LLCs to file annual reports and pay associated fees to maintain good standing. This requirement promotes transparency and accountability in operations; failure to comply can result in the loss of corporate designations and associated tax benefits.

-

Pay Self-Employment Taxes: LLC owners must pay self-employment taxes on their share of profits, currently set at 15.3%. This rate encompasses 12.4% for Social Security and 2.9% for Medicare, reflecting the same obligations as wage earners.

-

Sales Tax Compliance: E-commerce businesses are obligated to collect and remit sales tax in states where they establish a tax nexus. This nexus can be influenced by sales volume and location, making it crucial for owners to stay informed about varying state regulations.

-

Franchise Tax Compliance: LLCs may also be subject to Franchise Tax, which varies by state and is based on the company’s revenue or other criteria. Understanding these obligations is vital for maintaining compliance and avoiding penalties.

-

Keep Accurate Records: Maintaining detailed financial records is essential for supporting tax filings and ensuring compliance with both state and federal regulations. This practice not only aids in tax preparation but also enhances overall management.

-

Consult a Tax Professional: Given the complexities of tax laws, seeking advice from a tax professional can assist LLC owners in navigating compliance issues and optimizing their tax strategies. Expert guidance can be invaluable in minimizing liabilities and maximizing deductions, particularly concerning Franchise Tax and Annual Report obligations.

By adhering to these financial responsibilities, owners of a liability company limited can ensure their enterprises operate smoothly and remain compliant with U.S. tax laws, ultimately contributing to their long-term success in the e-commerce landscape.

Evaluate Advantages and Disadvantages of Operating as an LLC

Advantages:

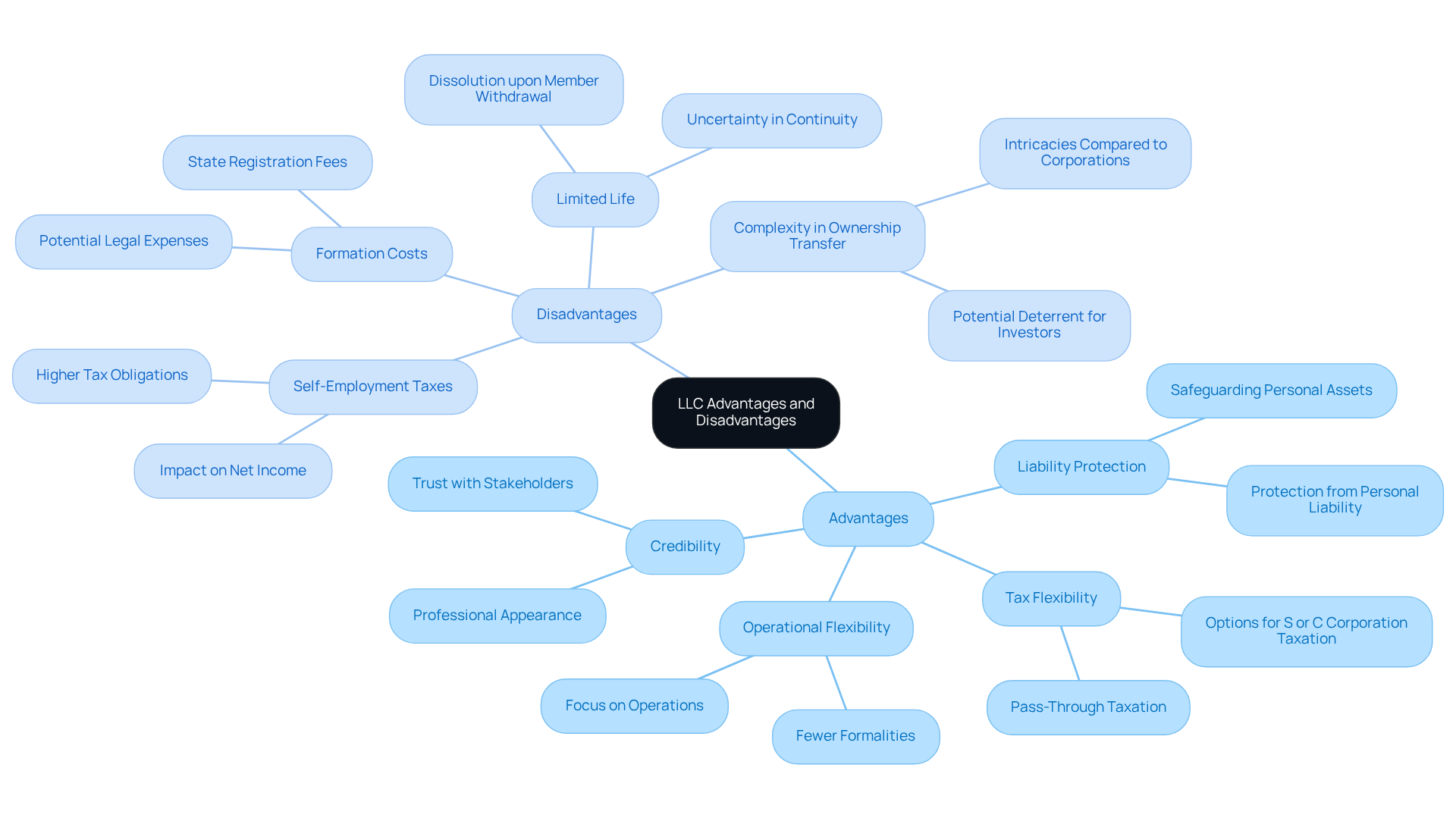

- A primary benefit of forming a liability company limited is the protection it offers owners from personal liability for business debts. This legal separation safeguards personal assets from creditors, making it a prudent choice for entrepreneurs. For instance, the case study titled ‘Limited Liability Protection’ demonstrates how a liability company limited effectively shields personal assets from business-related lawsuits.

- Tax Flexibility: Limited liability companies enjoy pass-through taxation, meaning profits are reported on the owners’ personal tax returns, thus avoiding double taxation at the corporate level. Furthermore, single-owner limited liability companies are classified as disregarded entities by the IRS, which means they do not incur taxes at the entity level; instead, owners report income on Form 1040-NR. This status simplifies tax compliance but necessitates careful planning to meet all obligations. Additionally, limited liability companies can opt to be taxed as an S Corporation or C Corporation, providing further tax-saving opportunities.

- Operational Flexibility: Compared to corporations, limited liability companies face fewer formalities and ongoing compliance requirements. This simplicity allows owners to focus more on operations rather than administrative tasks. Notably, liability company limited entities constitute approximately 42.9% of all small enterprises in the U.S., underscoring their significance in the business landscape.

- Credibility: Establishing an LLC can bolster an enterprise’s credibility with customers, suppliers, and investors. The designation of ‘LLC’ in a business name conveys professionalism and commitment, which can be vital in competitive markets.

Disadvantages:

- Self-Employment Taxes: Owners of limited liability companies may encounter higher tax obligations due to self-employment taxes on profits. This can substantially impact net income, particularly for smaller enterprises. In fact, 40% of limited liability companies generate less than $50,000 in annual revenue, highlighting the financial challenges some of these entities face.

- Formation Costs: While the process of forming an LLC is generally straightforward, there are associated costs, including state registration fees and potential legal expenses. These costs can vary significantly by state, ranging from $50 to $500.

- Limited Life: In certain states, an LLC may dissolve upon the death or withdrawal of a member unless the operating agreement specifies otherwise. This can introduce uncertainty regarding operational continuity.

- Complexity in Ownership Transfer: Transferring ownership of an LLC can be more intricate than with a corporation, which can easily issue shares. This complexity may deter potential investors or complicate succession planning. Additionally, it is noteworthy that 85% of limited liability companies have no employees aside from the owner, which may limit growth potential for entrepreneurs seeking to expand their businesses.

In summary, while a liability company limited (LLC) offers significant advantages such as liability protection and tax flexibility, it also presents challenges that entrepreneurs must carefully consider, particularly in the evolving e-commerce landscape.

Conclusion

Forming a Limited Liability Company (LLC) represents a strategic decision for e-commerce entrepreneurs who aim to protect their personal assets while benefiting from flexible management and taxation options. The LLC structure not only offers essential liability protection but also empowers business owners to navigate the complexities of the e-commerce landscape with increased ease and confidence.

This tutorial has examined key aspects of LLC formation, including:

- The steps necessary to establish an LLC

- The significance of tax compliance

- The financial responsibilities associated with this business structure

Furthermore, we have evaluated the advantages and disadvantages of operating as an LLC, emphasizing substantial benefits such as:

- Personal liability protection

- Tax flexibility

Alongside potential challenges like:

- Self-employment taxes

- Formation costs

Ultimately, grasping the nuances of forming and maintaining an LLC is vital for entrepreneurs striving for long-term success in the e-commerce sector. By undertaking the necessary steps to establish an LLC, business owners can concentrate on growth and innovation, assured that they are shielded from personal financial risks. Adopting this organizational structure not only enhances credibility but also positions e-commerce businesses for sustainable success in an increasingly competitive market.

Frequently Asked Questions

What is a Limited Liability Company (LLC)?

A Limited Liability Company (LLC) is a flexible organizational structure that combines the benefits of both corporations and partnerships, providing personal liability protection for its owners.

Why is an LLC important for e-commerce entrepreneurs?

An LLC is important for e-commerce entrepreneurs because it protects their personal assets from debts and legal claims, which is crucial given the risks associated with customer disputes and product liability issues.

What are the tax benefits of forming an LLC?

LLCs offer significant tax benefits, including the option for owners to be taxed as either a sole proprietorship or a corporation. They benefit from pass-through taxation, meaning income is taxed only at the individual level, avoiding the double taxation that corporations face.

How does forming an LLC affect the financial performance of e-commerce businesses?

Forming an LLC can lead to considerable tax savings and improved financial performance, making it an appealing choice for e-commerce businesses.

What is the cost of establishing an LLC?

Establishing an LLC can be as affordable as $49 plus fees in certain states, making it a financially viable option for many entrepreneurs.

What should Turkish-speaking entrepreneurs know about forming an LLC in the U.S.?

Turkish-speaking entrepreneurs should understand the intricacies of forming an LLC in the U.S., including EIN applications, state-specific considerations, and investment processes to effectively navigate the commercial landscape.