Introduction

An LLC Operating Agreement is fundamental to a Limited Liability Company, outlining its internal operations and governance. This critical document clarifies ownership and management structures while delineating the roles and responsibilities of each member, which significantly mitigates the potential for disputes. Key components of a well-crafted operating agreement include:

- Provisions for decision-making

- Profit distribution

- Member responsibilities

Variations in these agreements reflect the unique needs of different businesses, making it essential for entrepreneurs to understand these elements. Establishing a solid foundation for their LLC is crucial as they navigate the complexities of legal compliance and operational efficiency.

Define LLC Operating Agreement

An LLC Operating Agreement is an essential legal document that explains what an LLC operating agreement looks like by outlining the internal operations of a Limited Liability Company (LLC). This foundational agreement among participants outlines what does an LLC operating agreement look like, specifying the management structure, ownership interests, and operational procedures. While not legally required in every state, having a functioning document is highly advisable, as it clearly defines the roles and responsibilities of each participant, which is what does an LLC operating agreement look like, significantly reducing the likelihood of conflicts.

Typically, what does an LLC operating agreement look like includes details on the distribution of profits and losses, decision-making processes, and the procedures for adding or removing participants. Furthermore, it offers operational ease and tax flexibility, making it an appealing choice for entrepreneurs. Legal experts emphasize that knowing what does an LLC operating agreement look like is vital for maintaining harmony within the LLC and protecting the interests of its members. As business attorney Shawna L. L’Italien notes, “A well-drafted management contract is the single best method to safeguard everyone’s interests and ensure your business operates efficiently.”

Moreover, statistics reveal that a substantial percentage of LLCs across various states possess operating agreements, prompting the inquiry of what does an LLC operating agreement look like, and highlighting their significance in establishing clear governance and operational guidelines.

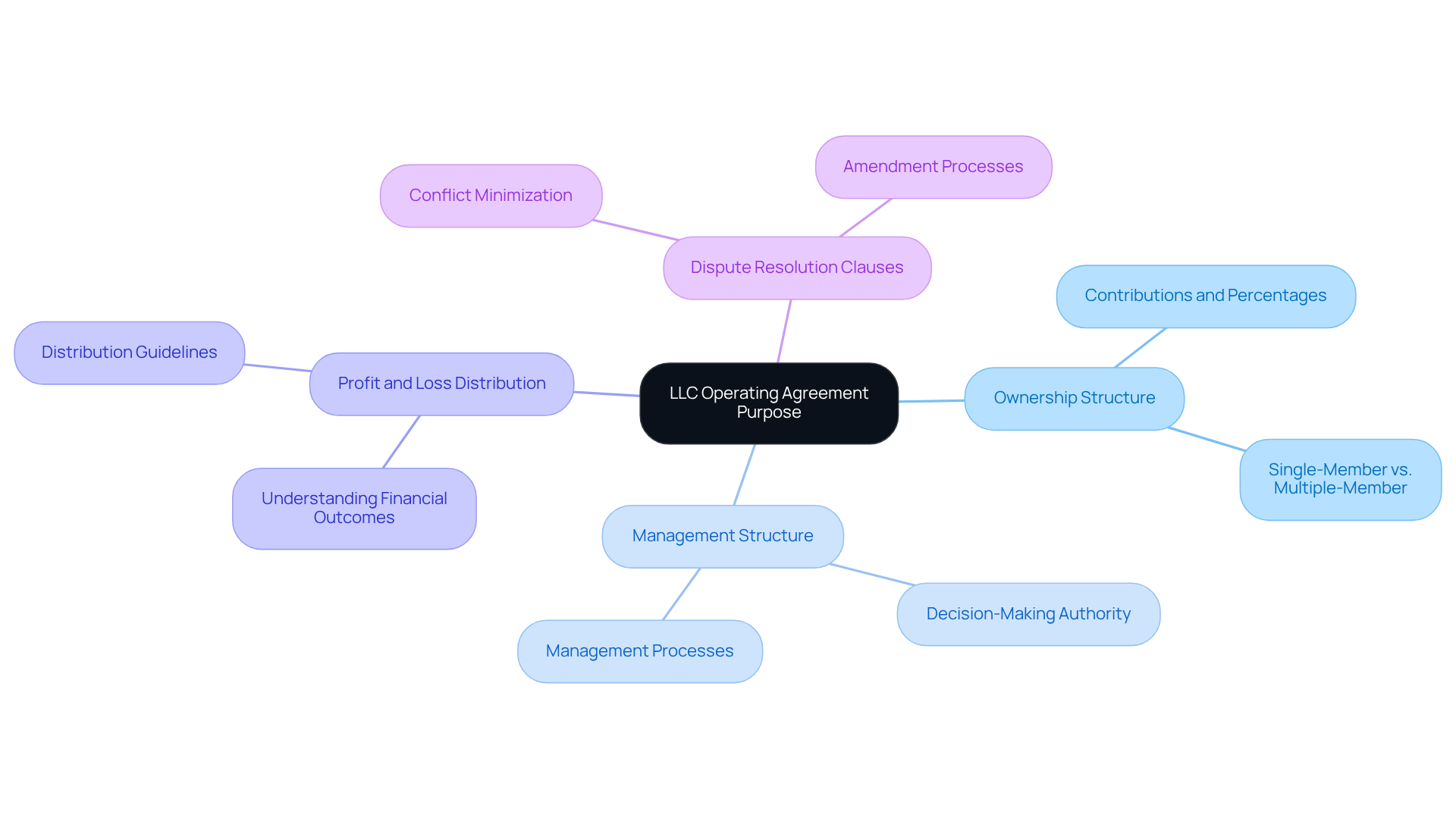

Explain the Purpose of an LLC Operating Agreement

An LLC Operating Agreement is crucial for establishing the operational framework of a Limited Liability Company, which leads to the question: what does an LLC operating agreement look like? It primarily defines the ownership structure, specifying each individual’s contributions and ownership percentages. This clarity is particularly important, considering that approximately 64% of LLCs consist of only one participant, with an average of four participants per LLC.

The agreement also outlines the management structure, detailing decision-making authority and processes, which are vital for effective governance. Additionally, it provides guidelines for profit and loss distribution, ensuring that all participants understand how financial outcomes will be shared.

Moreover, the management contract can include clauses for dispute resolution, participant departures, and amendment processes, thereby protecting stakeholder interests and minimizing potential conflicts. Legal experts emphasize that clear agreements are essential for effective business operations, leading to the question of what does an LLC operating agreement look like, as a well-crafted operating agreement not only safeguards participants but also enhances the LLC’s credibility.

Outline Key Components of an LLC Operating Agreement

Key components of an LLC Operating Agreement typically include:

-

Company Information: This section outlines the LLC’s name, principal address, and purpose, establishing the foundation of the business.

-

Participant Information: It details each individual’s contributions and ownership percentages, ensuring clarity on financial stakes and responsibilities.

-

Management Structure: This specifies whether the LLC will be member-managed or manager-managed, delineating the powers and responsibilities of each party involved.

-

Profit and Loss Distribution: This component explains how profits and losses will be shared among participants, which is essential for financial transparency.

-

Voting Rights: It details the voting procedure for significant decisions, including what defines a quorum, ensuring that all participants have a voice in governance.

-

Dispute Resolution: This section offers methods for addressing conflicts among participants, such as mediation or arbitration, to preserve harmony within the LLC.

-

Amendment Procedures: It explains how the operational arrangement can be modified in the future, permitting adaptability as the business develops.

-

Dissolution Procedures: This specifies the process for dissolving the LLC if necessary, including triggering events and decision-making authority.

Incorporating these elements guarantees that the contract is thorough and meets its intended function efficiently, safeguarding the interests of all participants and promoting seamless operations, which leads to the question of what does an LLC operating agreement look like.

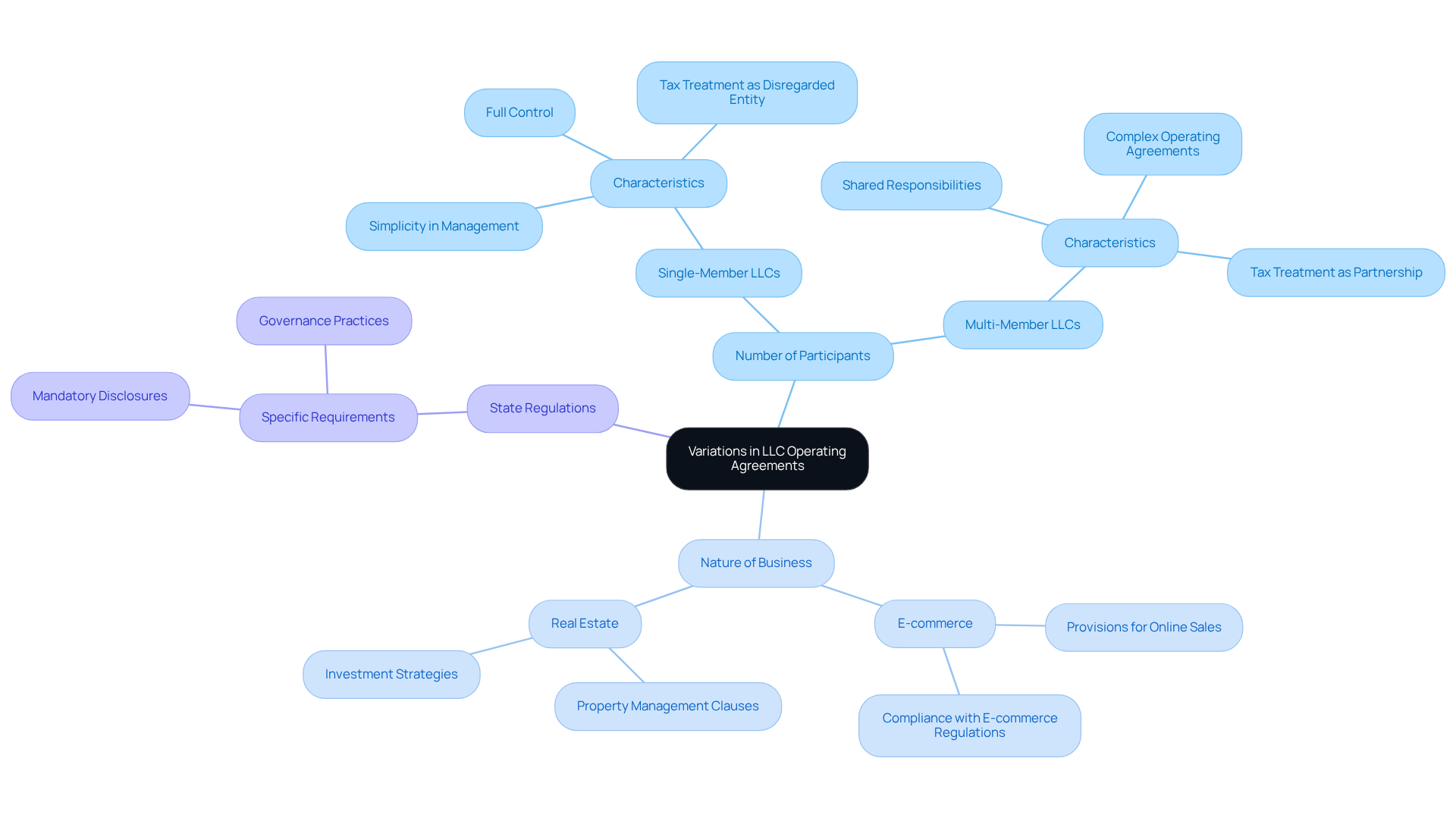

Discuss Variations in LLC Operating Agreements

The various differences in LLC operating contracts highlight what does an LLC operating agreement look like, as they are influenced by several key factors, including the number of participants, the nature of the business, and specific state regulations.

Single-member LLCs generally feature simpler arrangements that primarily address ownership and management, facilitating streamlined decision-making. In contrast, multi-member LLCs require more comprehensive provisions to address the complexities associated with shared ownership and responsibilities. For example, a multi-member LLC may include clauses that delineate voting rights, profit distribution, and member exit procedures, thereby ensuring clarity and accountability among members.

Industry-specific factors also significantly shape operational contracts. An LLC operating in the e-commerce sector might incorporate provisions related to online sales, digital transactions, and compliance with e-commerce regulations. Conversely, a real estate LLC may emphasize clauses that pertain to property management, investment strategies, and tenant relations.

Moreover, state regulations can impose specific requirements on management contracts, influencing their structure and content. For instance, certain states may mandate particular disclosures or governance practices that must be reflected in the operating agreement. This adaptability enables LLCs to customize their documents, which raises the question of what does an LLC operating agreement look like, to meet both operational needs and legal obligations, ensuring compliance while effectively managing their unique business challenges.

Conclusion

An LLC Operating Agreement is a foundational document that delineates the internal workings of a Limited Liability Company. It details essential elements such as management structure, ownership interests, and operational procedures. By clearly defining the roles and responsibilities of each member, this agreement minimizes potential conflicts and ensures smooth operations within the company.

Key components of an LLC Operating Agreement include:

- Company information

- Participant contributions

- Management structures

- Profit distribution

- Dispute resolution procedures

Variations in these agreements, influenced by factors like the number of members and specific industry needs, underscore the importance of tailoring the document to meet both operational and legal requirements.

Understanding the intricacies of an LLC Operating Agreement is vital for anyone looking to establish or manage an LLC. By dedicating time to create a comprehensive and well-structured agreement, entrepreneurs can safeguard their interests, promote transparency, and enhance their business’s credibility. This essential document not only lays a solid foundation for effective governance but also paves the way for long-term success in the competitive business landscape.

Frequently Asked Questions

What is an LLC Operating Agreement?

An LLC Operating Agreement is a legal document that outlines the internal operations of a Limited Liability Company (LLC), specifying the management structure, ownership interests, and operational procedures.

Is an LLC Operating Agreement legally required in all states?

No, an LLC Operating Agreement is not legally required in every state, but it is highly advisable to have one.

Why is having an LLC Operating Agreement important?

It clearly defines the roles and responsibilities of each participant, significantly reducing the likelihood of conflicts and protecting the interests of the members.

What details are typically included in an LLC Operating Agreement?

An LLC Operating Agreement typically includes details on the distribution of profits and losses, decision-making processes, and procedures for adding or removing participants.

How does an LLC Operating Agreement benefit entrepreneurs?

It offers operational ease and tax flexibility, making it an appealing choice for entrepreneurs.

What do legal experts say about the importance of an LLC Operating Agreement?

Legal experts emphasize that a well-drafted management contract is vital for maintaining harmony within the LLC and ensuring efficient business operations.

What do statistics indicate about LLCs and Operating Agreements?

A substantial percentage of LLCs across various states possess operating agreements, highlighting their significance in establishing clear governance and operational guidelines.