Introduction

Understanding the complexities of nonprofit organizations is crucial in a landscape where charitable contributions and community support significantly influence societal development. The 501(c)(3) designation not only provides tax-exempt status but also creates access to funding opportunities that can profoundly affect an organization’s mission. However, the journey to obtaining this status involves navigating various complexities and regulatory requirements, which can pose challenges even for the most committed founders.

What are the essential factors that contribute to the success of a 501(c)(3) organization, and how can businesses utilize this status to amplify their impact?

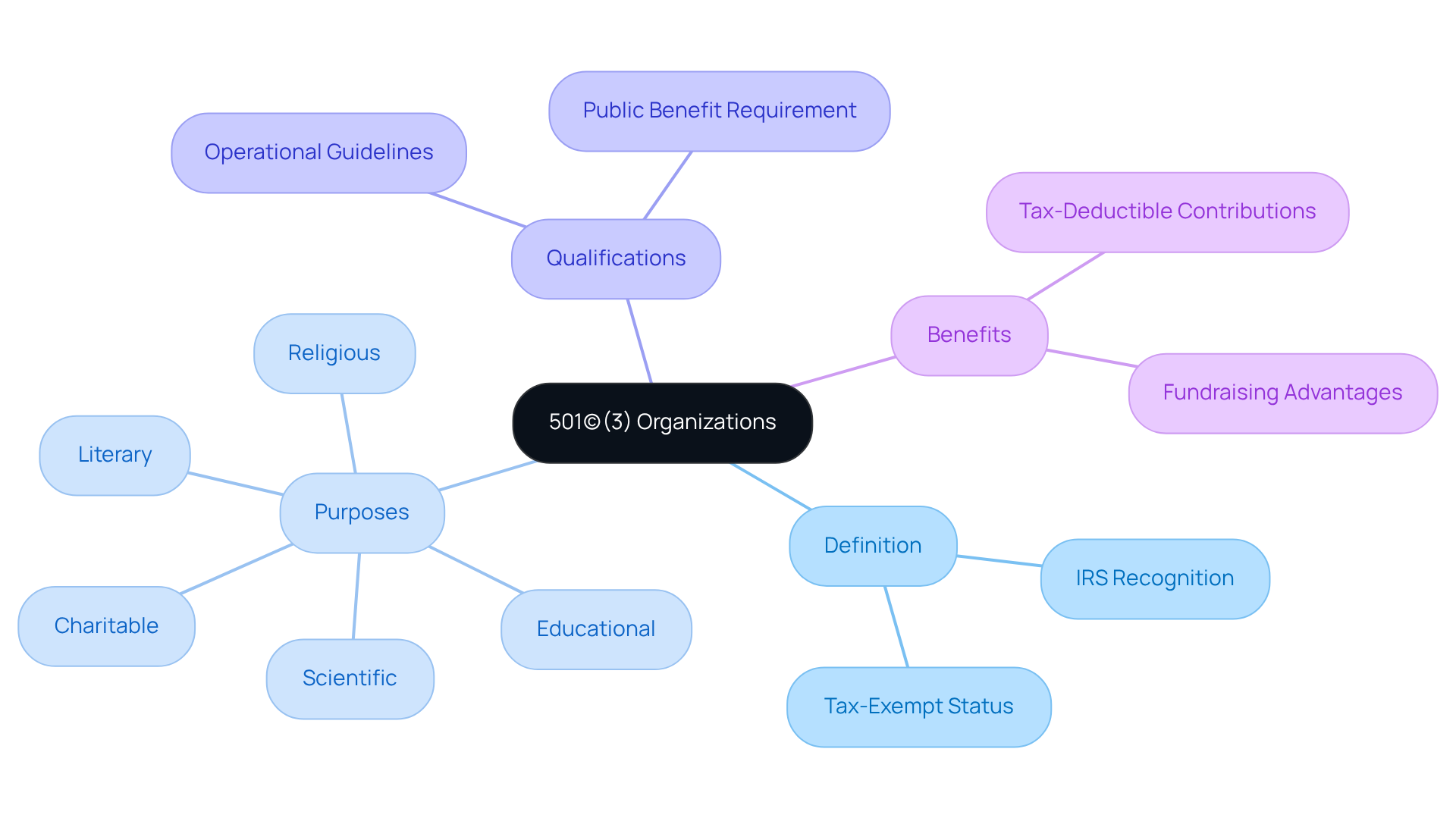

Define 501(c)(3) Organizations

What is a 501 c3? It refers to a nonprofit organization that is recognized by the Internal Revenue Service (IRS) as tax-exempt under Section 501(c)(3) of the Internal Revenue Code. Organizations that operate exclusively for charitable, religious, educational, scientific, or literary purposes are often recognized under the designation of what is a 501 c3. To qualify for this status, these organizations must adhere to specific operational guidelines, ensuring that their activities primarily benefit the public rather than private interests.

The tax-exempt status conferred upon 501(c)(3) entities enables them to receive tax-deductible contributions, which not only makes them appealing to potential donors but also plays a crucial role in their fundraising efforts. This financial advantage is essential for sustaining their operations and advancing their missions.

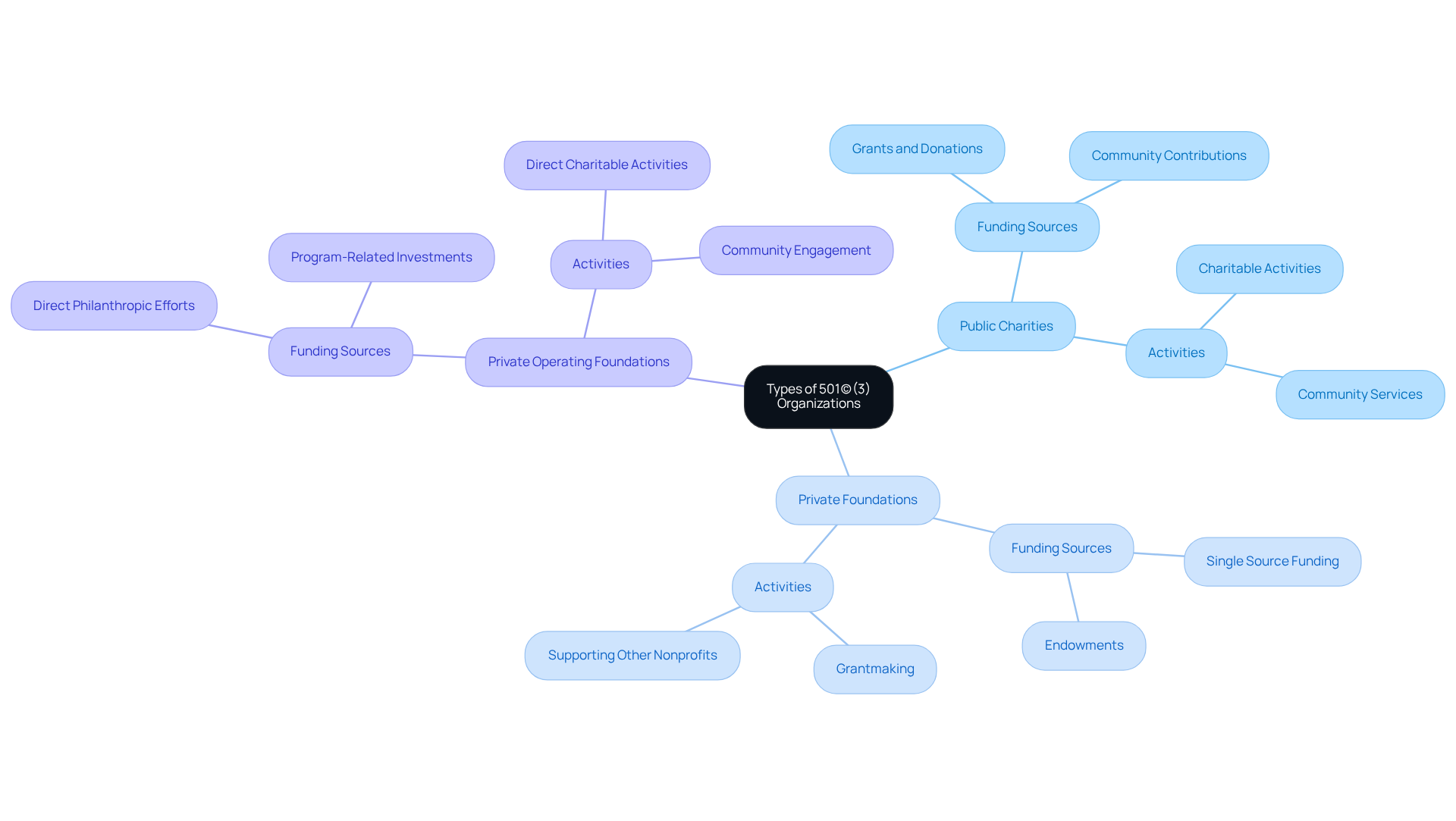

Explore Types of 501(c)(3) Organizations

What is a 501 c3? It refers to entities that can be categorized into three primary types:

- Public charities

- Private foundations

- Private operating foundations

Public charities, such as food banks and educational institutions, typically derive a significant portion of their funding from community contributions and are actively involved in charitable activities. In contrast, private foundations are generally funded by a single source, such as an individual or family, and primarily focus on providing grants to other nonprofit organizations. Private operating foundations engage directly in philanthropic efforts rather than merely funding other nonprofits. Understanding these distinctions is essential for prospective founders to effectively align their missions with what is a 501 c3 and the appropriate organizational structure.

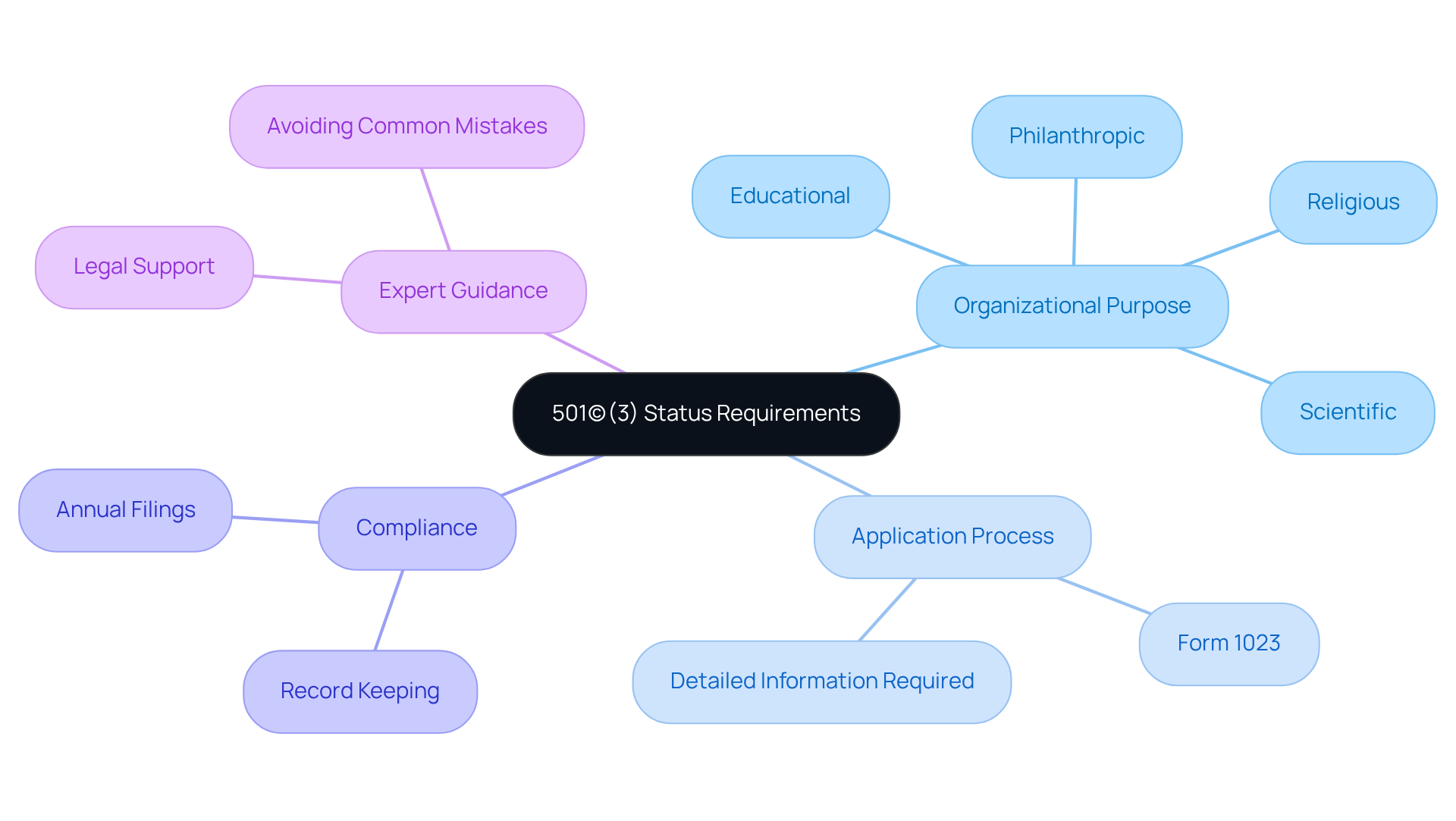

Outline Requirements for 501(c)(3) Status

To secure 501(c)(3) status, a group must understand what is a 501 c3 and adhere to several essential requirements. Primarily, it must be organized and operated solely for exempt purposes as defined by the IRS, which include philanthropic, religious, educational, and scientific missions. The application procedure involves submitting an extensive Form 1023, which spans nearly 30 pages and requires detailed information regarding the entity’s structure and governance. This form is critical, as many private foundations require what is a 501 c3 before considering funding proposals.

Organizations must also maintain accurate records and comply with ongoing reporting obligations, including annual filings with the IRS. Significantly, they are prohibited from engaging in political campaigning or substantial lobbying efforts, ensuring their focus remains on charitable objectives. Delays or errors in the application process can result in significant setbacks, including funding losses and IRS penalties, making legal guidance invaluable. Experts emphasize that the cost of rectifying mistakes often surpasses the expense of obtaining professional support upfront, underscoring the importance of thorough preparation.

For international e-commerce entrepreneurs, understanding these requirements is crucial. By leveraging expert advice, organizations can enhance their credibility and access vital funding opportunities, ensuring they navigate the complexities of establishing their nonprofit effectively.

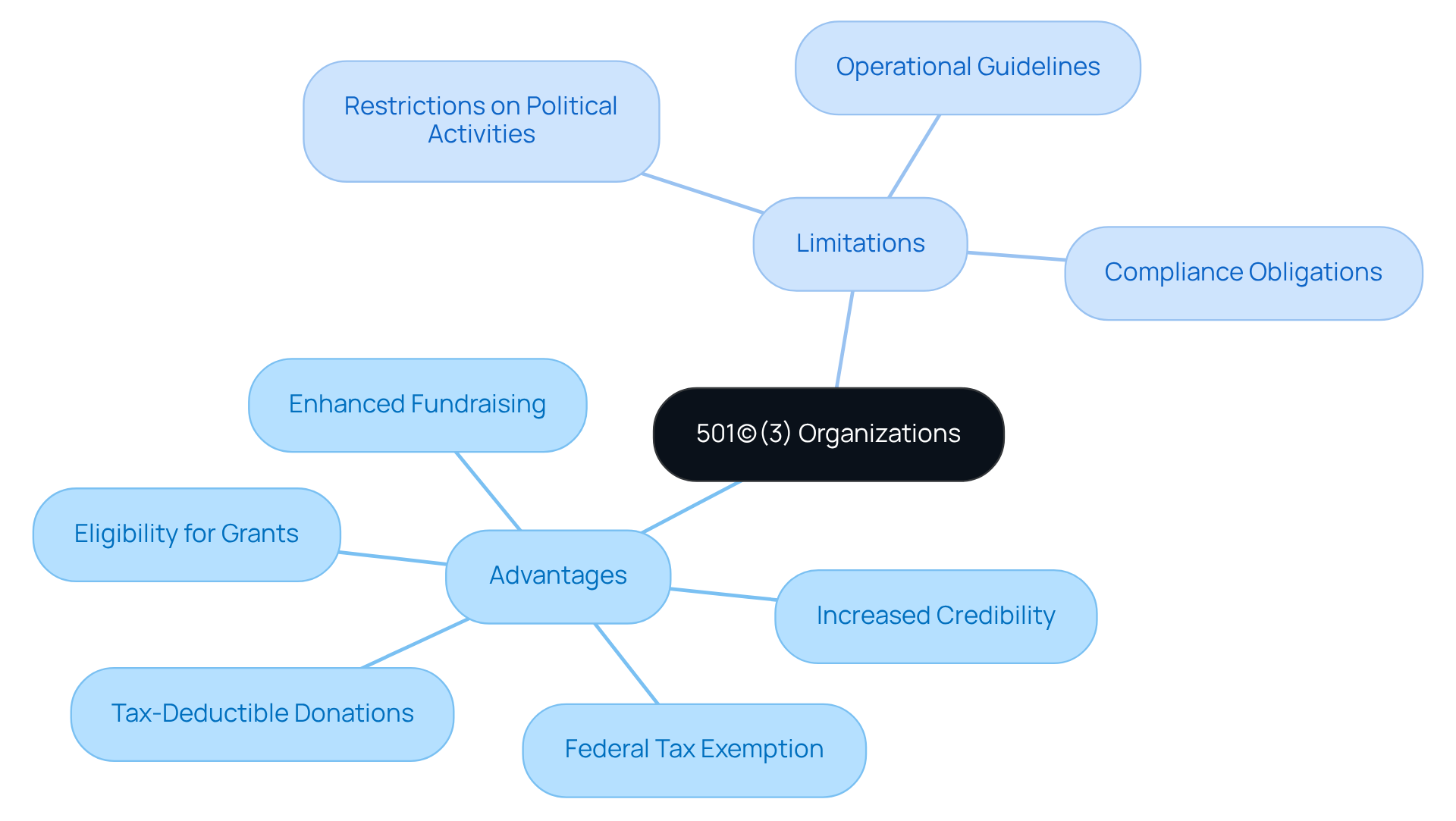

Assess Advantages and Limitations of 501(c)(3) Organizations

Understanding what is a 501 c3 status offers several significant advantages. Primarily, it provides federal tax exemption, eligibility for grants, and the capacity to receive tax-deductible donations. These benefits can greatly enhance an organization’s fundraising efforts. Furthermore, this status can bolster credibility and public trust, thereby attracting a larger base of supporters.

However, organizations must also be aware of certain limitations associated with this designation. Notably, there are restrictions on political activities, and organizations are required to adhere to strict operational guidelines. Additionally, ongoing compliance and reporting obligations can be resource-intensive, necessitating careful management and planning.

Understanding these factors is crucial for any organization contemplating what is a 501 c3 designation, as it ensures informed decision-making and aligns strategically with their mission.

Conclusion

Understanding the complexities of 501(c)(3) organizations is crucial for any business or individual exploring the nonprofit sector. These entities, recognized by the IRS as tax-exempt, primarily operate for charitable, educational, or scientific purposes. They offer significant advantages, including tax-deductible donations and eligibility for grants. However, this status entails specific operational guidelines and compliance requirements that must be meticulously adhered to in order to maintain tax-exempt status.

This article examines the various types of 501(c)(3) organizations, such as:

- Public charities

- Private foundations

- Private operating foundations

Each category serves distinct functions and funding mechanisms, underscoring the importance of aligning an organization’s mission with the appropriate structure. Additionally, it details the rigorous application process, which requires comprehensive documentation and strict adherence to IRS regulations, highlighting the necessity for careful planning and expert guidance.

The significance of 501(c)(3) status is profound. It not only enhances an organization’s credibility and fundraising potential but also cultivates public trust. For those considering the establishment of a nonprofit, grasping the advantages and limitations associated with this designation is essential. Collaborating with legal and financial experts can streamline the process and ensure compliance, paving the way for impactful charitable initiatives that resonate within the community.

Frequently Asked Questions

What is a 501(c)(3) organization?

A 501(c)(3) organization is a nonprofit entity recognized by the Internal Revenue Service (IRS) as tax-exempt under Section 501(c)(3) of the Internal Revenue Code. These organizations operate exclusively for charitable, religious, educational, scientific, or literary purposes.

What are the requirements for an organization to qualify as a 501(c)(3)?

To qualify as a 501(c)(3), organizations must adhere to specific operational guidelines, ensuring that their activities primarily benefit the public rather than private interests.

What benefits do 501(c)(3) organizations receive?

501(c)(3) organizations receive tax-exempt status, which allows them to obtain tax-deductible contributions. This makes them more appealing to potential donors and plays a crucial role in their fundraising efforts.

Why is tax-exempt status important for 501(c)(3) organizations?

Tax-exempt status is important because it helps sustain the operations of 501(c)(3) organizations and advances their missions by making it easier for them to attract donations.