Introduction

In the digital age, establishing a business presents both exciting opportunities and significant challenges, particularly for e-commerce entrepreneurs who must navigate a landscape rich with potential risks and rewards. The formation of a Limited Liability Company (LLC) provides a distinctive combination of protection and flexibility, empowering these innovators to succeed. However, with numerous advantages, including liability protection and tax benefits, a crucial question emerges: what are the true implications of selecting an LLC structure, and how can it profoundly impact the success of an online venture?

Define LLC: Core Characteristics and Structure

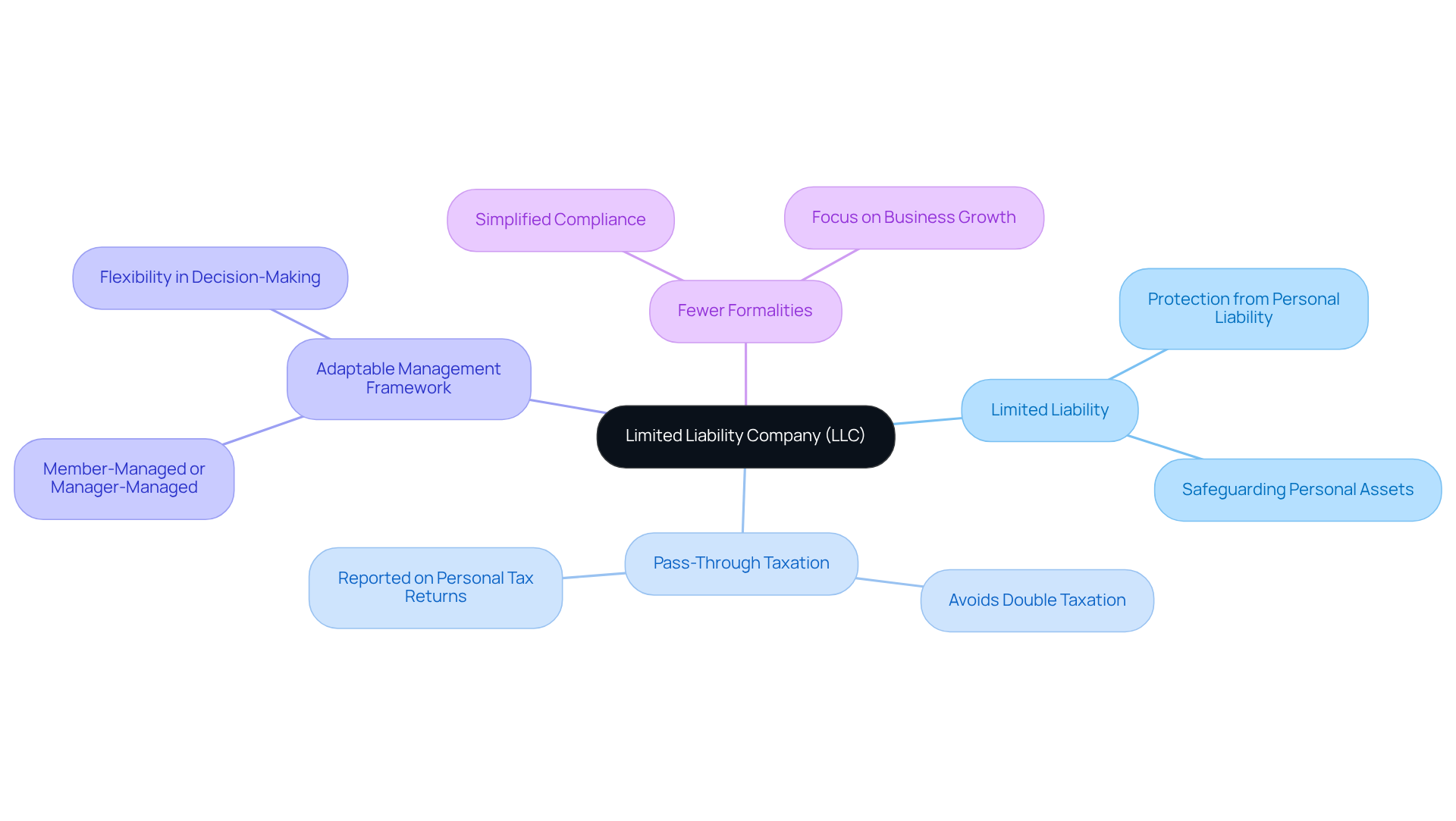

A Limited Liability Company (LLC) represents a flexible business structure that combines the operational adaptability of a partnership with the liability protection typically associated with corporations. The primary characteristics of an LLC include:

- Limited Liability: Members of an LLC are protected from personal liability concerning the company’s debts and obligations, thereby safeguarding their personal assets from business-related risks. This protection is particularly vital for e-commerce entrepreneurs who often encounter various operational uncertainties.

- Pass-Through Taxation: LLCs generally benefit from pass-through taxation, which allows profits and losses to be reported on the members’ personal tax returns. This structure helps to avoid the double taxation that corporations face, making it financially advantageous for owners.

- Adaptable Management Framework: Limited liability companies can be managed by their members or by appointed managers, providing the flexibility to choose a management style that best suits the organization’s needs. This adaptability is especially beneficial for e-commerce ventures that may require swift decision-making.

- Fewer Formalities: Compared to corporations, LLCs have fewer regulatory requirements, simplifying compliance and maintenance. This operational simplicity is appealing to individuals who prefer to focus on growing their businesses rather than navigating complex legal frameworks.

These characteristics raise the question of why create an LLC, as they make it an attractive option for e-commerce innovators, particularly in 2026, when over 80% of small enterprises in the U.S. are opting for this structure. The LLC model not only mitigates personal risk but also enhances operational efficiency, allowing individuals to concentrate on expanding their online ventures.

Explore Benefits: Liability Protection and Tax Advantages

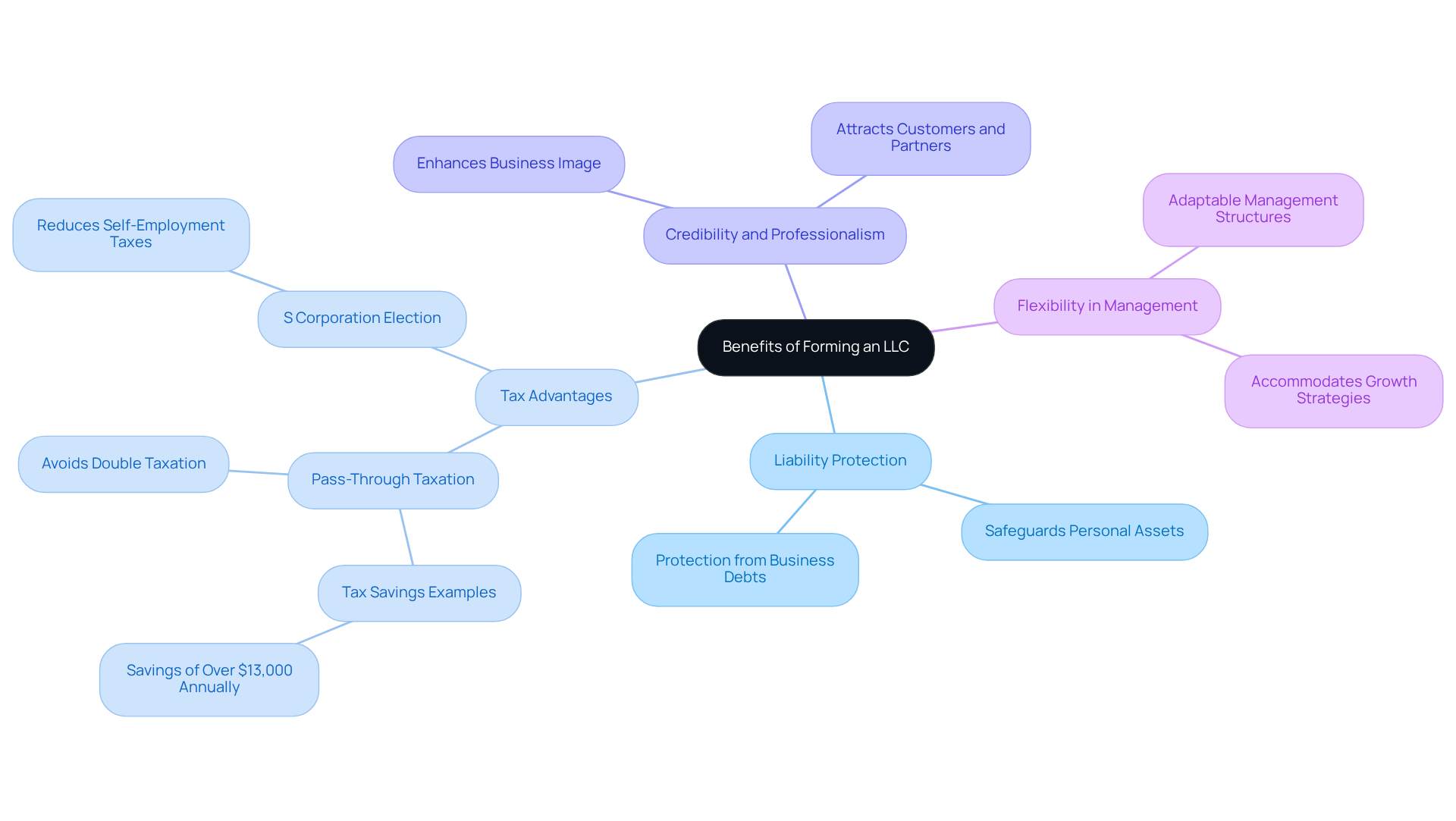

Forming an LLC provides several significant advantages for e-commerce entrepreneurs.

A primary reason for explaining why create an LLC is the liability protection it offers against personal liability. This structure safeguards members’ personal assets, such as homes and savings, from business debts and lawsuits, ensuring personal financial security is preserved even in challenging circumstances.

-

Tax Advantages: Limited liability companies benefit from pass-through taxation, meaning profits are taxed only at the individual level, thus avoiding the double taxation that corporations encounter. Additionally, LLCs can elect to be taxed as an S corporation, which can substantially reduce self-employment taxes. For example, many e-commerce entrepreneurs have reported significant tax savings by utilizing this structure, with some saving over $13,000 annually through effective payroll management and distributions.

-

Credibility and Professionalism: Establishing an LLC enhances the credibility of an e-commerce operation, making it more attractive to customers, suppliers, and payment processors. This credibility is essential in a competitive market, as it can influence purchasing decisions and foster trust among potential clients.

-

Flexibility in Management and Ownership: LLCs provide adaptable management frameworks and ownership structures, accommodating various enterprise models and growth strategies. This flexibility allows business owners to adjust their operations as their company evolves, ensuring they can respond effectively to market demands.

Together, these benefits highlight why create an LLC is important for e-commerce business owners, enabling them to operate securely and effectively while maximizing their potential for growth.

Understand Implications: Compliance and Operational Responsibilities

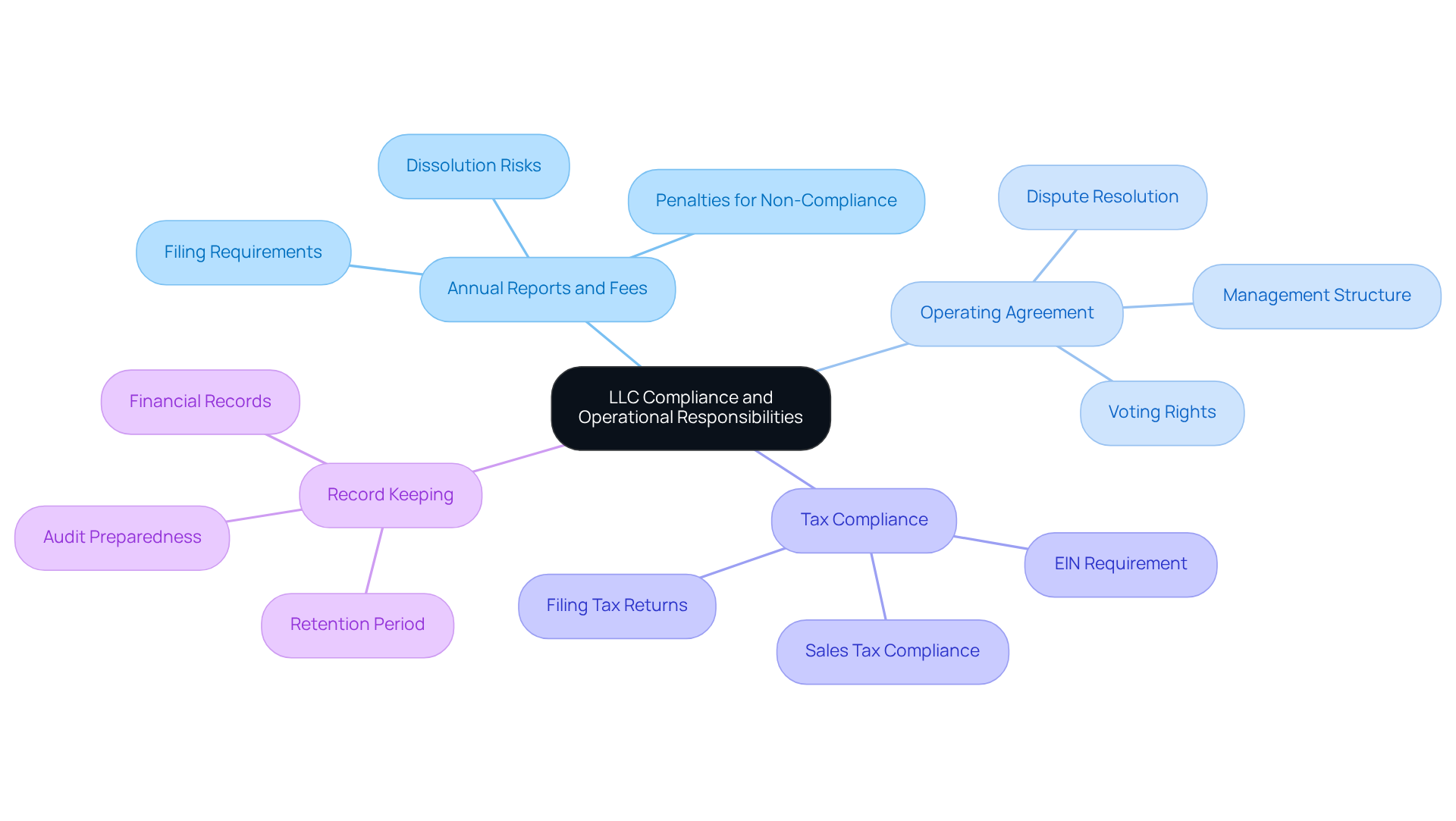

Entrepreneurs must understand why create an LLC, as it presents significant advantages, but also involves specific compliance and operational responsibilities that they must navigate effectively.

Annual Reports and Fees: Most states require LLCs to file annual reports and pay associated fees to maintain good standing. Failure to comply can result in penalties or even dissolution of the LLC, highlighting the necessity of staying current with these obligations.

Operating Agreement: Although not always legally required, an operating agreement is crucial for limited liability companies. This document outlines the management structure, member responsibilities, and operational procedures, promoting clarity and reducing the potential for disputes. For example, a well-crafted operating agreement can avert conflicts by clearly defining voting rights and decision-making processes among members.

Tax Compliance: Limited Liability Companies must comply with federal, state, and local tax regulations, which include obtaining an Employer Identification Number (EIN) and filing necessary tax returns. Understanding these obligations is essential to avoid legal complications. E-commerce LLCs, particularly in sectors such as gaming or real estate, encounter complex tax requirements, including sales tax compliance that varies by jurisdiction.

Record Keeping: Accurate financial record-keeping is vital for compliance and tax purposes. This encompasses tracking income, expenses, and all business-related transactions. E-commerce companies should retain these records for a minimum of seven years to ensure readiness for audits and to validate their financial activities.

By thoroughly understanding these implications and seeking expert counsel from Social Enterprises, e-commerce founders can effectively prepare for the responsibilities that accompany operating an LLC, which leads to the question of why create an LLC, ensuring their venture remains compliant and positioned for growth.

Assess Strategic Advantages: Choosing the Right State for Your LLC

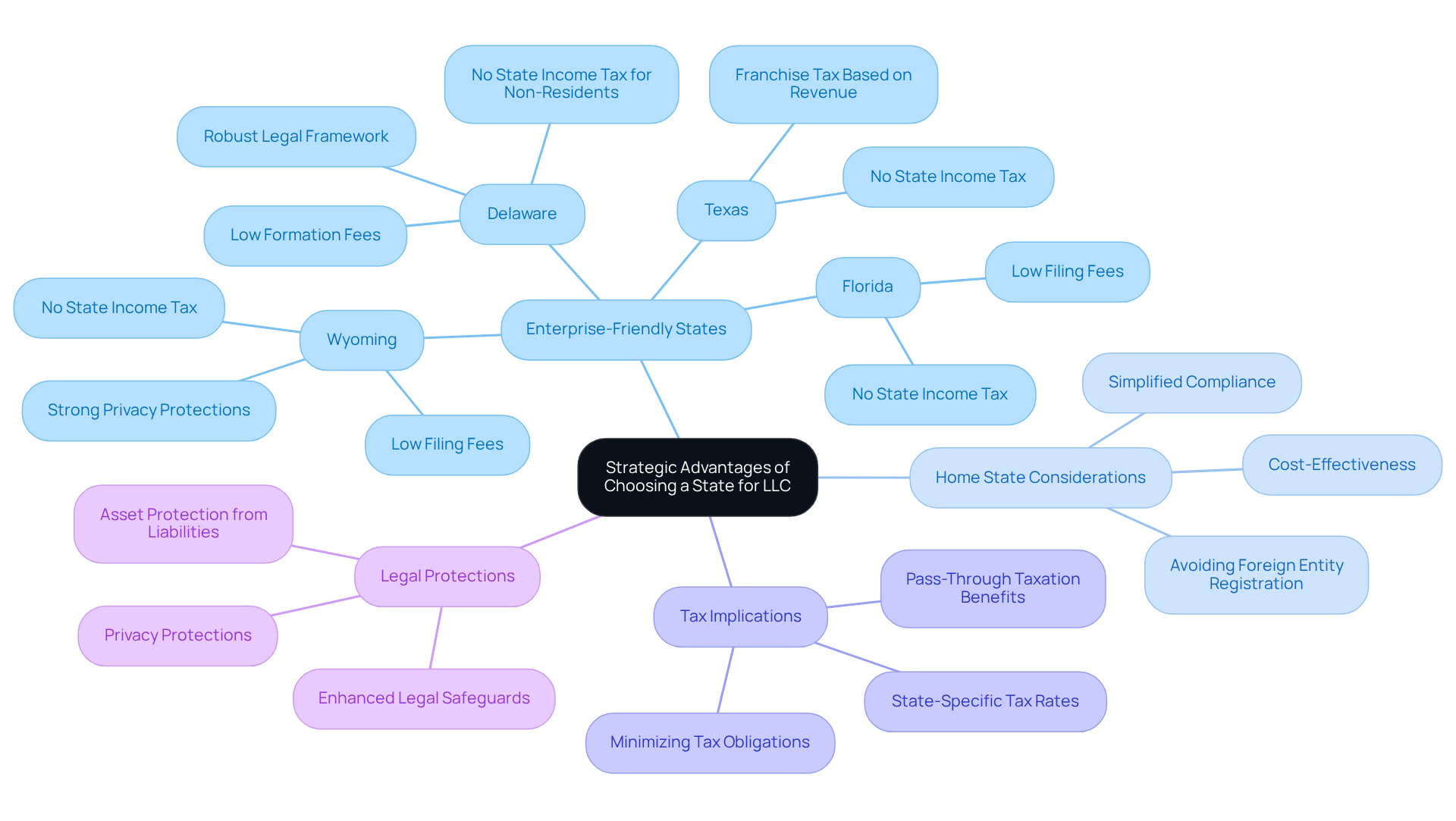

E-commerce entrepreneurs must consider why create an LLC when choosing the appropriate state for establishing one, as it significantly impacts their operations and financial outcomes.

-

Enterprise-Friendly States: Delaware and Wyoming are notable for their favorable regulations, including low formation fees and advantageous tax structures. Delaware, in particular, is recognized for its robust legal framework, attracting numerous businesses seeking a reliable environment for growth.

-

Home State Considerations: For many business owners, forming an LLC in their home state often proves to be the most practical choice. This strategy simplifies compliance and eliminates the complexities associated with foreign entity registration, facilitating a more streamlined operational process.

-

Tax Implications: Each state presents distinct tax rates and regulations that can influence overall profitability. By understanding these variations, business owners can strategically select a state that minimizes their tax obligations while enhancing operational efficiency.

-

Legal Protections: Certain states provide enhanced legal safeguards for LLCs, which can be vital in protecting interests and assets from potential liabilities.

By thoroughly assessing these strategic advantages, e-commerce entrepreneurs can understand why create an LLC to make informed decisions that align with their business objectives and operational needs.

Conclusion

Establishing a Limited Liability Company (LLC) represents a strategic decision for e-commerce entrepreneurs, combining the flexibility of a partnership with the protective benefits of a corporation. This structure not only safeguards personal assets from business liabilities but also enhances tax efficiency and operational management, making it an attractive option for those aiming to succeed in the competitive online marketplace.

The article outlines several compelling reasons to form an LLC, notably the critical liability protection it provides, which shields personal finances from business-related risks. Furthermore, the tax benefits associated with pass-through taxation and the possibility of electing S corporation status can result in significant savings. The credibility and professionalism gained from forming an LLC further bolster an e-commerce business’s reputation, while the adaptable management framework allows for timely adjustments to evolving market conditions.

In conclusion, comprehending the implications of compliance and operational responsibilities is vital for e-commerce entrepreneurs contemplating an LLC. By thoroughly evaluating the strategic advantages of selecting the appropriate state for formation, business owners can align their LLC structure with their objectives and operational requirements. This proactive strategy not only positions them for growth but also equips them to navigate the complexities of managing a successful e-commerce venture. Forming an LLC transcends mere legal formalities; it serves as a foundational step toward establishing a resilient and prosperous online business.

Frequently Asked Questions

What is an LLC?

A Limited Liability Company (LLC) is a flexible business structure that combines the operational adaptability of a partnership with the liability protection typically associated with corporations.

What are the core characteristics of an LLC?

The core characteristics of an LLC include limited liability for its members, pass-through taxation, an adaptable management framework, and fewer formalities compared to corporations.

How does limited liability benefit LLC members?

Limited liability protects members from personal liability concerning the company’s debts and obligations, safeguarding their personal assets from business-related risks.

What is pass-through taxation in an LLC?

Pass-through taxation allows profits and losses of the LLC to be reported on the members’ personal tax returns, helping to avoid double taxation that corporations face.

How can an LLC be managed?

An LLC can be managed by its members or by appointed managers, providing flexibility in choosing a management style that suits the organization’s needs.

Why are LLCs considered to have fewer formalities?

LLCs have fewer regulatory requirements compared to corporations, simplifying compliance and maintenance, which is appealing for individuals focusing on business growth.

Why are LLCs particularly attractive for e-commerce entrepreneurs?

LLCs mitigate personal risk and enhance operational efficiency, allowing e-commerce entrepreneurs to concentrate on expanding their online ventures, especially as more small enterprises in the U.S. are opting for this structure.