Introduction

Navigating the business landscape necessitates a solid understanding of various legal and financial obligations, with the Tax ID Certificate, or Employer Identification Number (EIN), being one of the most critical. This essential identifier not only ensures tax compliance but also plays a vital role in banking, hiring employees, and obtaining necessary licenses. Despite its importance, many entrepreneurs encounter challenges in securing this crucial document.

This raises an important question: what are the steps to successfully apply for a Tax ID Certificate, and how can potential pitfalls be avoided?

This guide provides a comprehensive roadmap, enabling businesses to confidently pursue compliance and operational success.

Understand the Importance of a Tax ID Certificate

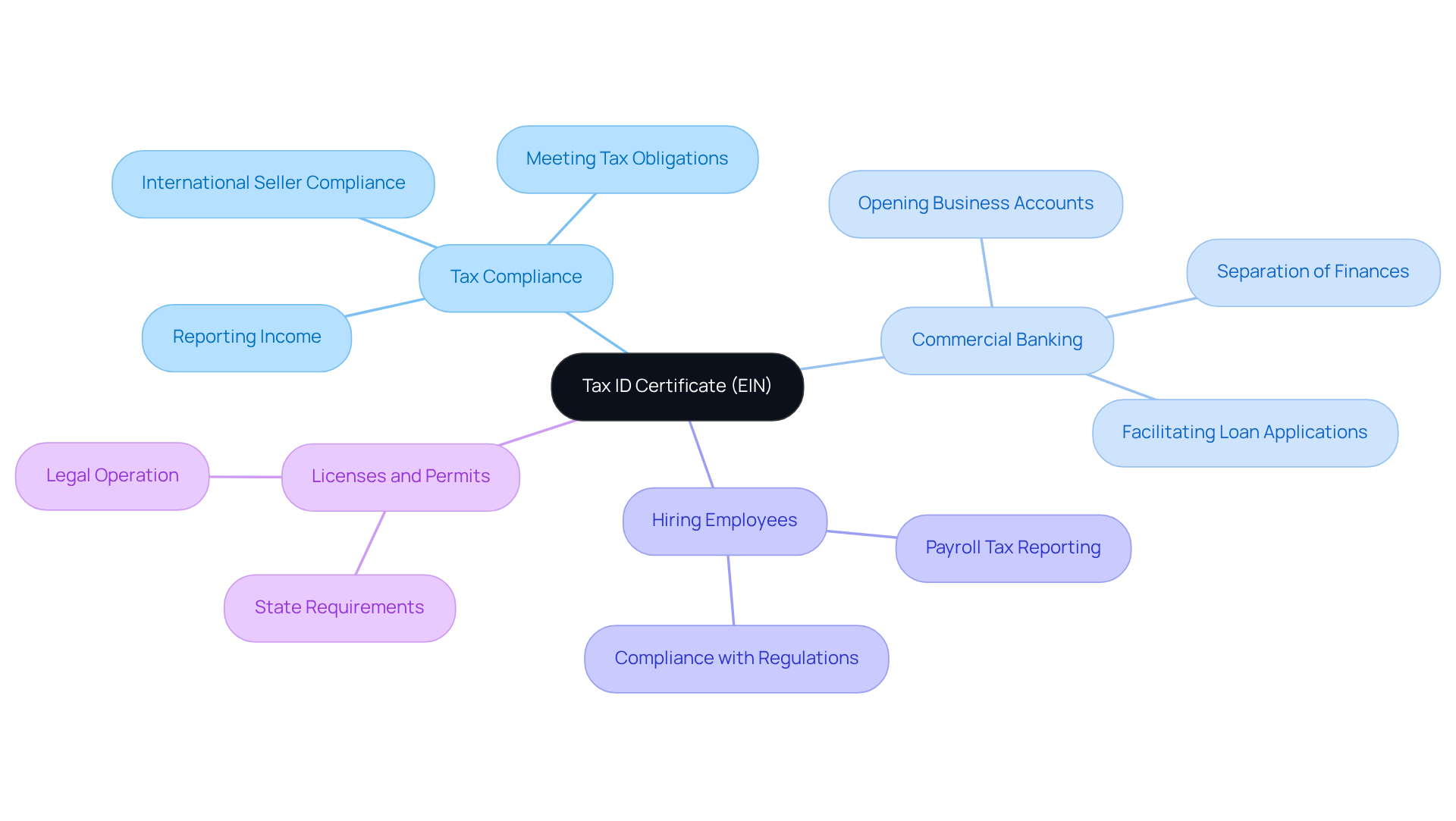

A Tax ID Certificate, often known as an Employer Identification Number (EIN), serves as a unique identifier assigned by the IRS to businesses for tax purposes. Its importance is significant, serving multiple essential functions:

-

Tax Compliance: An EIN is vital for businesses to report income and meet tax obligations. Approximately 90% of enterprises require an EIN for tax compliance, highlighting its necessity in the financial landscape. International Amazon sellers must be aware of their U.S. tax obligations to ensure compliance and avoid penalties.

-

Commercial Banking: Most banks mandate an EIN to open a commercial bank account, which is crucial for maintaining a clear distinction between personal and business finances. This separation is essential for effective financial management and accountability.

-

Hiring Employees: For organizations intending to hire employees, an EIN is required to accurately report payroll taxes. This requirement ensures adherence to federal and state tax regulations.

-

Licenses and Permits: Many states require a Tax ID to obtain necessary licenses and permits, making it a prerequisite for legal operation.

Real-world examples underscore the importance of an EIN. For instance, companies seeking loans often find that having an EIN facilitates the application process, improving their chances of securing favorable terms. Furthermore, businesses that have successfully navigated the complexities of U.S. tax compliance highlight the EIN’s role in establishing credibility and operational legitimacy.

In conclusion, acquiring a Tax ID Certificate is a fundamental step in setting up your business in the U.S. It enables compliance with tax regulations, facilitates banking operations, and supports employee management.

Gather Required Documentation for Application

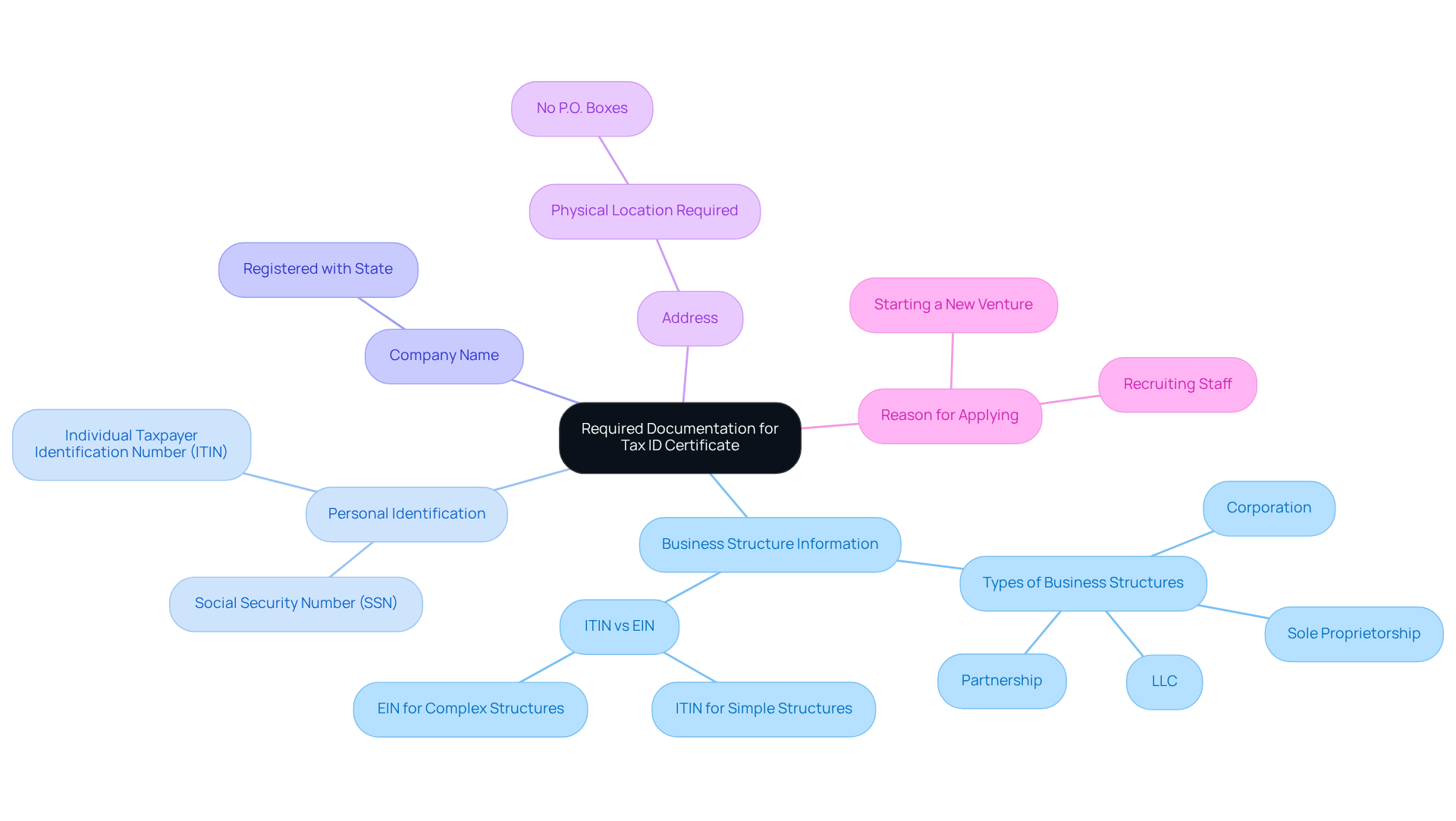

To successfully apply for your Tax ID Certificate, it is essential to gather the following documentation:

-

Business Structure Information: Clearly identify your business type, whether it is a sole proprietorship, partnership, corporation, or LLC. For simpler structures like single-member LLCs or sole proprietorships, an ITIN may suffice. However, an EIN is necessary for more complex structures or if you plan to hire employees.

-

Personal Identification: Include your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). A valid tax id certificate is crucial for eligibility when applying for an EIN.

-

Company Name: If relevant, confirm that your company name is registered with the state.

-

Address: Provide a physical location for your enterprise; note that P.O. Boxes are not acceptable.

-

Reason for Applying: Be prepared to express the aim of your submission, such as starting a new venture or recruiting staff.

Having these documents ready can significantly simplify the submission process. It is noteworthy that approximately 30% of enterprises encounter difficulties when collecting the required paperwork for their EIN requests. For instance, John and Kelly’s Auto Repair Shop successfully navigated this process by ensuring all required documents were in order before applying. By being organized and proactive, you can avoid common pitfalls and ensure compliance with federal requirements. Additionally, remember to inform the IRS of any changes made to your company details to avoid future issues.

Apply for Your Tax ID Certificate: Step-by-Step Process

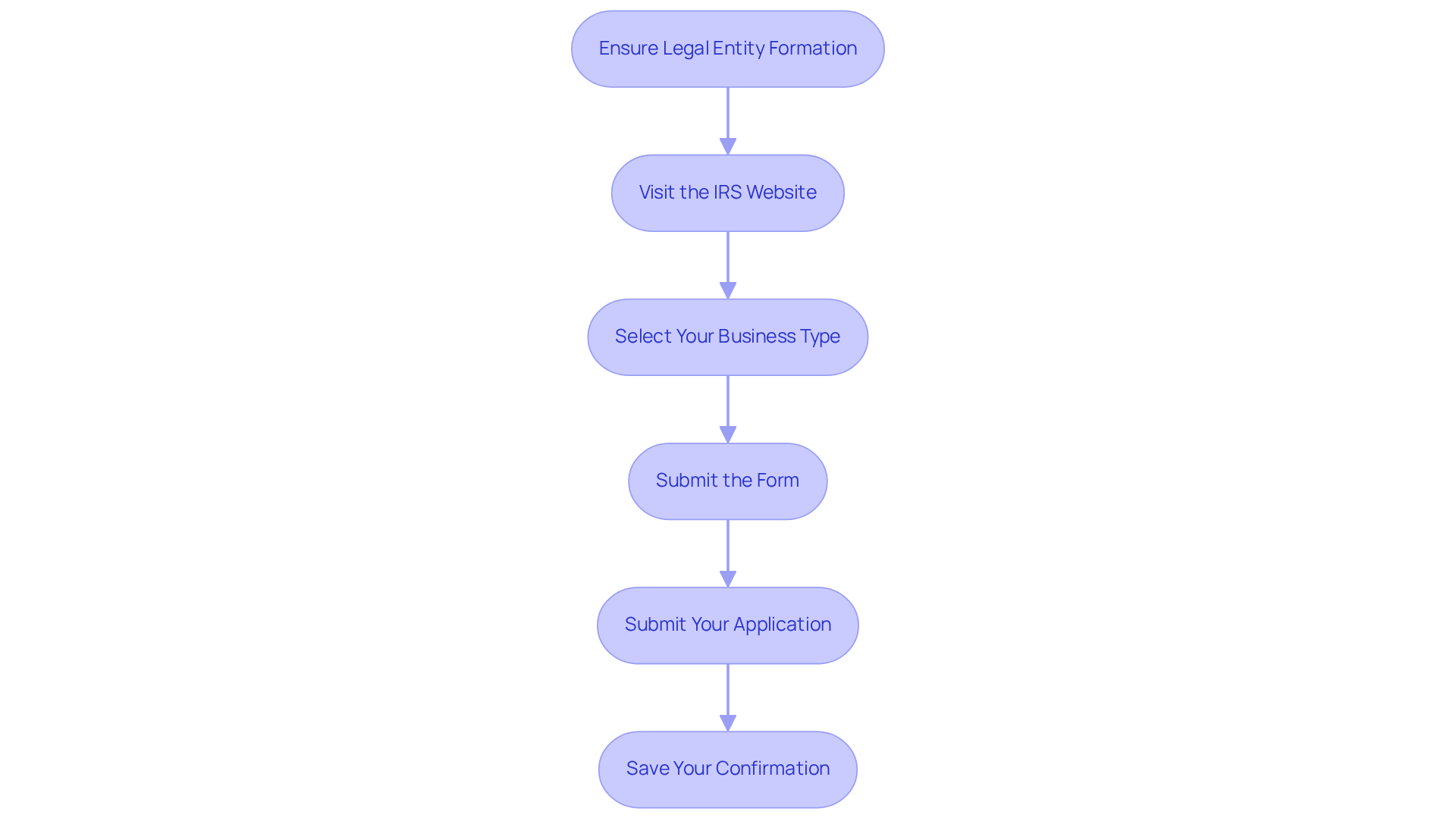

To apply for your Tax ID Certificate, follow these steps:

-

Ensure Legal Entity Formation: Before applying for your Tax ID, confirm that your enterprise is legally formed as an LLC, partnership, corporation, or tax-exempt organization. For game companies in the U.S., choosing between an LLC and a Corporation is crucial. An LLC is straightforward to establish, offers a flexible management structure, and provides tax advantages, while a Corporation may be more suitable for larger-scale projects and investments.

-

Visit the IRS Website: Navigate to the IRS EIN request page.

-

Select Your Business Type: Choose the appropriate business structure from the available options.

-

Submit the Form: Fill out the online form with necessary details, including your company name, address, and reason for requesting. Note that the form must be completed in one session and cannot be saved.

-

Submit Your Application: Carefully review your information for accuracy before submitting. Upon completion, your Tax ID will be issued immediately.

-

Save Your Confirmation: Print or save the confirmation page, as it serves as proof of your Tax ID.

Important Note: If you are considering tax-exempt status, be aware that failing to file required returns for three consecutive years can lead to automatic revocation of that status. Additionally, if you plan to use a third party to apply for your EIN, ensure they have signed authorization to do so.

By following these steps, you will effectively obtain your tax id certificate, allowing you to advance your operations without delay. Consulting with an expert advisor can further enhance your understanding of the best company structure for your needs. Schedule a free 15-minute consultation with our expert team at Social Enterprises to discuss your company formation and taxation questions. We also offer specialized services for U.S. company formation, including assistance with PayPal accounts and DUNS numbers.

Troubleshoot Common Application Issues

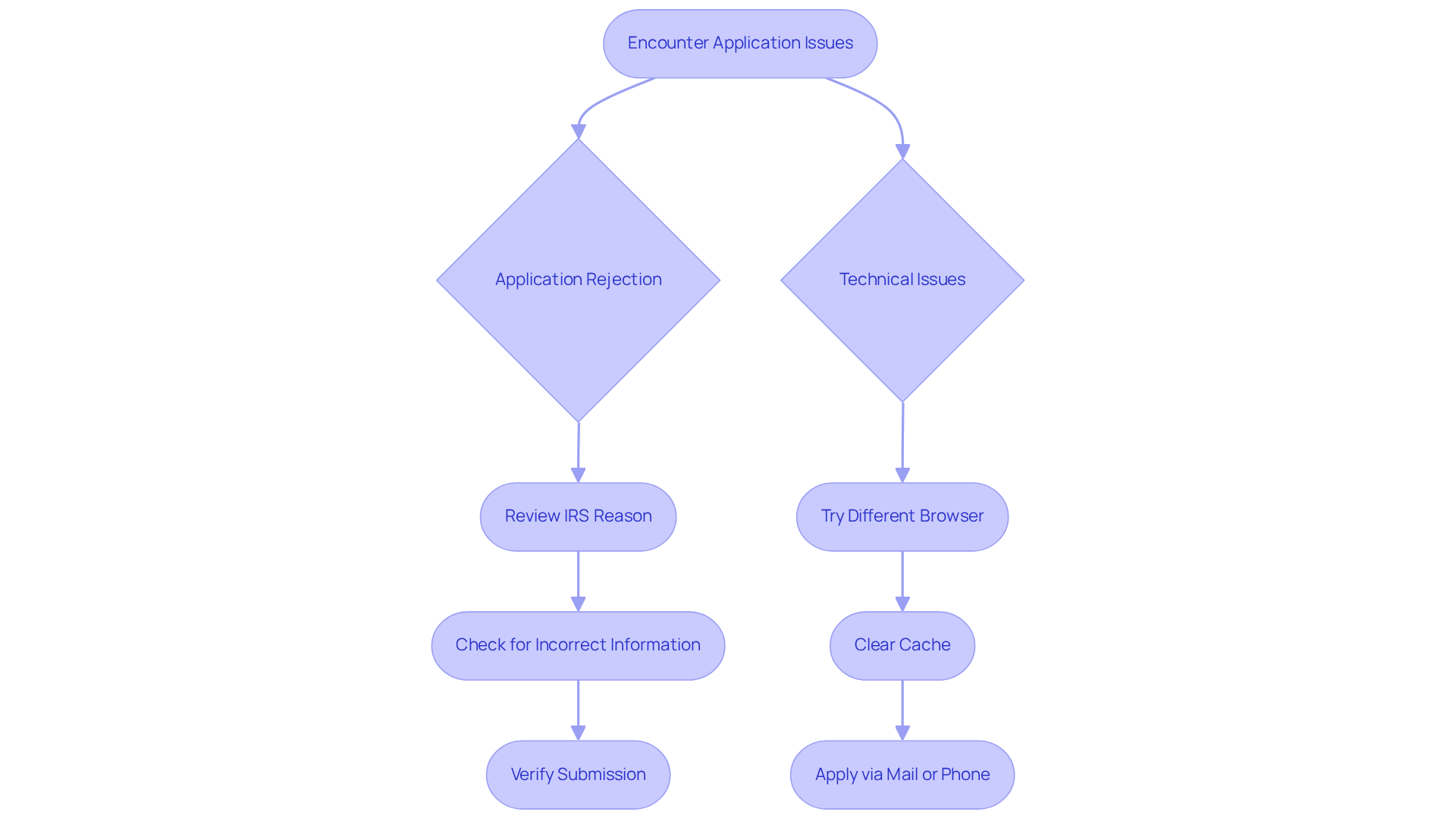

If you encounter issues while applying for your Tax ID Certificate, particularly as a Turkish-speaking entrepreneur navigating the U.S. business landscape, consider the following troubleshooting tips:

- Application Rejection: Should your application be rejected, it is crucial to review the reason provided by the IRS. Common causes include incorrect information or missing documentation. Tax advisors emphasize that ensuring all details are accurate and complete can significantly reduce the likelihood of rejection. For instance, errors in the EIN form can delay processing by several weeks, making it essential to verify your submission.

If you do not receive your tax id certificate within the expected timeframe, check the IRS website for updates or contact their support for assistance. Processing times can vary; for example, obtaining an EIN by mail typically takes approximately four to six weeks. Being aware of these timelines can aid in planning, especially if you have year-end transactions.

- Technical Issues: In the event of technical difficulties while completing the online form, consider using a different browser or clearing your cache. If these steps do not resolve the issue, you may apply via mail using Form SS-4. Alternatively, international applicants can apply for an EIN by phone by calling the IRS at 267-941-1099, which may provide a quicker option.

By being proactive and aware of these common issues and their solutions, you can navigate the application process more effectively and avoid unnecessary delays. Additionally, providing a return fax number when applying via fax can expedite the receipt of your EIN.

Conclusion

Acquiring a Tax ID Certificate is essential for establishing and operating a business in the U.S. This critical identifier not only facilitates tax compliance but also streamlines banking processes, supports employee management, and is necessary for obtaining required licenses. Recognizing its significance empowers entrepreneurs to navigate the complexities of business formation with confidence.

This guide has highlighted key points, including:

- The importance of gathering necessary documentation

- Following a clear step-by-step application process

- Troubleshooting common issues that may arise during the application

By being well-prepared and informed, businesses can avoid potential pitfalls and ensure they meet their legal obligations effectively.

Ultimately, securing a Tax ID Certificate transcends mere compliance; it is a pivotal step that establishes the foundation for business legitimacy and success. Entrepreneurs are encouraged to take proactive measures, seek assistance when needed, and remain vigilant about maintaining compliance with tax regulations. Embracing these practices will foster sustainable growth and operational efficiency in the competitive business landscape.

Frequently Asked Questions

What is a Tax ID Certificate?

A Tax ID Certificate, also known as an Employer Identification Number (EIN), is a unique identifier assigned by the IRS to businesses for tax purposes.

Why is a Tax ID Certificate important for businesses?

A Tax ID Certificate is essential for tax compliance, opening commercial bank accounts, hiring employees, and obtaining necessary licenses and permits.

How does a Tax ID Certificate aid in tax compliance?

An EIN is vital for businesses to report income and meet tax obligations, with approximately 90% of enterprises requiring it for tax compliance.

What role does a Tax ID Certificate play in commercial banking?

Most banks require an EIN to open a commercial bank account, which helps maintain a clear distinction between personal and business finances.

Is a Tax ID Certificate necessary for hiring employees?

Yes, an EIN is required for organizations intending to hire employees to accurately report payroll taxes and adhere to federal and state tax regulations.

Can a Tax ID Certificate impact the ability to obtain licenses and permits?

Many states require a Tax ID to obtain necessary licenses and permits, making it a prerequisite for legal operation.

How does having a Tax ID Certificate benefit businesses in securing loans?

Companies seeking loans often find that having an EIN facilitates the application process, improving their chances of securing favorable terms.

What is the overall significance of acquiring a Tax ID Certificate?

Acquiring a Tax ID Certificate is fundamental for setting up a business in the U.S., enabling compliance with tax regulations, facilitating banking operations, and supporting employee management.